Global Pet Supplements Market: Industry Outlook

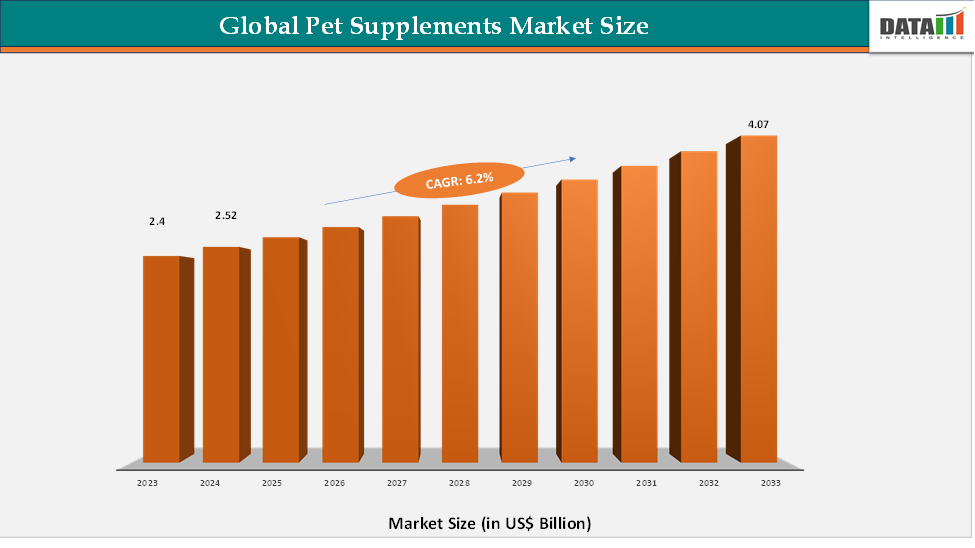

The global pet supplements market reached US$ 2.40 billion in 2023, with a rise to US$ 2.52 billion in 2024, and is expected to reach US$ 4.07 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2025–2033. The pet supplements market is experiencing steady growth, driven by increasing awareness around pet health, advancements in product development, and the growing demand for convenient at-home solutions. Technological innovations have enhanced the bioavailability and absorption of nutrients, making supplements more effective and accessible.

Key Market Trends & Insights

North America continues to dominate the global pet supplements market, accounting for approximately 40.6% of the market share in 2024. This dominance is driven by several key factors. The region boasts a high level of pet ownership, with a significant portion of households having dogs, cats, and other pets, leading to consistent demand for pet-related products.

Asia-Pacific is projected to be the fastest-growing region in the pet supplements market. The anticipated growth is driven by several factors. Rapid urbanization and increasing disposable incomes have led to a surge in pet ownership, particularly among the burgeoning middle class. Consumers are becoming more aware of the importance of pet health, leading to increased spending on pet supplements. The expansion of online retail platforms has facilitated easier access to a variety of pet supplement products.

The probiotics segment has emerged as the leading category in the global pet supplements market, driven by increasing pet health awareness and demand for natural, preventive care products. In 2024, probiotics accounted for approximately 38.4% of the overall market size.

Market Size & Forecast

2024 Market Size: US$ 2.52 Billion

2033 Projected Market Size: US$ 4.07 Billion

CAGR (2025–2033): 6.2%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Pet Ownership & Humanization

The rising trend in pet ownership and the intensifying humanization of pets are key engines powering growth in the pet supplements market. In the United States, pet-owning households rose from around 82 million in 2023 to 94 million in 2025, as reported by the American Pet Products Association. This deep emotional bond is evident: studies show that nearly 97% of U.S. pet owners see their pets as part of the family. Likewise, in Canada, about 58% of households owned a pet by the end of 2024, with 54% of Millennials describing themselves as “pet parents”. As pets increasingly receive the same level of care, attention, and preventive health focus as human family members, owners are more inclined to invest in supplements that support joint health, immunity, digestion, and overall wellness. This emotional and behavioral shift is a powerful driver behind the robust expansion of the pet supplements market.

Restraint: High Cost & Price Sensitivity

High cost and price sensitivity pose significant challenges for the pet supplements market. Premium formulations often come with steep price tags due to high-quality ingredients, advanced delivery systems, and clinical backing, especially during periods of economic strain when discretionary spending is curtailed, and consumers prioritize essentials over supplementary health products. Additionally, price-sensitive buyers gravitate toward lower-cost alternatives or mass-market options lacking robust evidence of efficacy, which can limit the adoption of higher-margin premium products and fragment the market.

For more details on this report, Request for Sample

Segmentation Analysis

The global pet supplements market is segmented by supplement type, product form, pet type, application, distribution channel, and region.

Supplement Type :The probiotics segment is estimated to have 38.4% of the pet supplements market share.

The probiotics segment is poised to become the leading category in the pet supplements market, propelled by surging demand rooted in growing owner awareness that gut health is central to overall pet wellness, as well as rising pet humanization and preventive care trends. Multiple factors are reinforcing this leadership: veterinary endorsements for strain-specific gut health benefits, innovations such as multi‑strain synbiotic blends, microencapsulation for shelf stability, and convenient delivery formats like flavored chewables, powders, and soft chews, expanding distribution via e‑commerce and subscription models offering repeatable convenience, and rising adoption in emerging regions such as the Asia‑Pacific.

Geographical Analysis

The North America pet supplements market was valued at 40.6% market share in 2024

North America continues to lead the global pet supplements market, holding a substantial share. This dominance is driven by several key factors which includes a high level of pet ownership, with a significant portion of households having dogs, cats, and other pets, driving consistent demand for pet-related products; increasing consumer awareness regarding pet health and wellness, leading to a growing demand for specialized supplements; and the presence of well-established pet food companies and a robust e-commerce infrastructure, providing consumers with a wide range of options and convenient access to pet products. For instance, in February 2025, Elanco Animal Health Incorporated introduced Pet Protect, a new line of veterinarian-formulated supplements for dogs and cats, launched. This product line is designed to address the growing demand for proactive pet wellness solutions, offering science-backed supplements tailored to support various health needs, including joint health, digestive function, skin health, and stress management.

Thu, the region’s growth is driven by increased awareness among pet owners regarding the health benefits of supplements, with products addressing specific issues like joint health, skin conditions, and digestive wellness gaining popularity

The Asia-Pacific Pet Supplements market was valued at 17.90% market share in 2024

The Asia-Pacific region is the fastest-growing market for pet supplements, driven by several interconnected factors. Rapid urbanization and rising disposable incomes across countries like China, India, Vietnam, and Thailand fuel increased pet ownership, especially among younger and middle-class populations. As pets are increasingly viewed as family members, there’s a growing demand for health-focused, preventive care, joint support, immunity, and anxiety. At the same time, modern urban lifestyles are causing more pet health issues, which further boosts supplement use.

The explosion of e-commerce platforms has made these products more accessible, especially in emerging markets, while the trend toward premium, natural, and functional pet products continues to reshape consumer behavior. Combined, these factors have led to double-digit growth in several APAC countries, cementing the region’s status as the most dynamic and fastest-growing player in the global pet supplements industry.

Competitive Landscape

The major players in the pet supplements market include Now Foods, Nutramax Laboratories Consumer Care, Inc., H&H Group, NuVet Labs, Tomlyn, Nestlé Purina, Hill's Pet Nutrition, Inc., Virbac, Elanco, and FOODSCIENCE.

Now Foods: NOW Foods, a well-established wellness brand headquartered in Bloomingdale, Illinois, has made significant strides in the pet supplements market through its NOW Pets line. This product line is distinguished by its collaboration with Dr. Barbara Royal, DVM, CVA, a renowned holistic veterinarian, ensuring that the formulations are both scientifically sound and tailored to address common health conditions observed in pets.

Key Developments:

- In May 2024, ADM announced the European launch of seven ready-to-market pet product formulas, designed to meet the growing demand for holistic pet health. Available in soft chew and supplement powder sachet formats, these functional products feature science-backed wellness claims and fully comply with European regulatory standards. With a focus on supporting pets' overall well-being.

In February 2023, Abingdon Health plc announced a new distribution agreement with Salignostics for the launch of Salistick, the UK and Ireland’s first saliva-based pregnancy test.

Market Scope

Metrics | Details | |

CAGR | 6.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Supplement Type | Probiotics, Essential Fatty Acids, Antioxidants, Multivitamins, Enzymes, Others |

Product Form | Soft Gels, Capsules, Powders, Others | |

Pet Type | Dogs, Cats, Others | |

Application | Hip & Joints, Digestive Health, Immune Support, Multifunctional, Skin Support, Liver Health, Behavioral Health, Others | |

| Distribution Channel | Pet Care Stores, E-Commerce Stores, Supermarkets & Hypermarkets, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global pet supplements market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more veterinary health-related reports, please click here