Peptide Synthesis Market Size and Trends

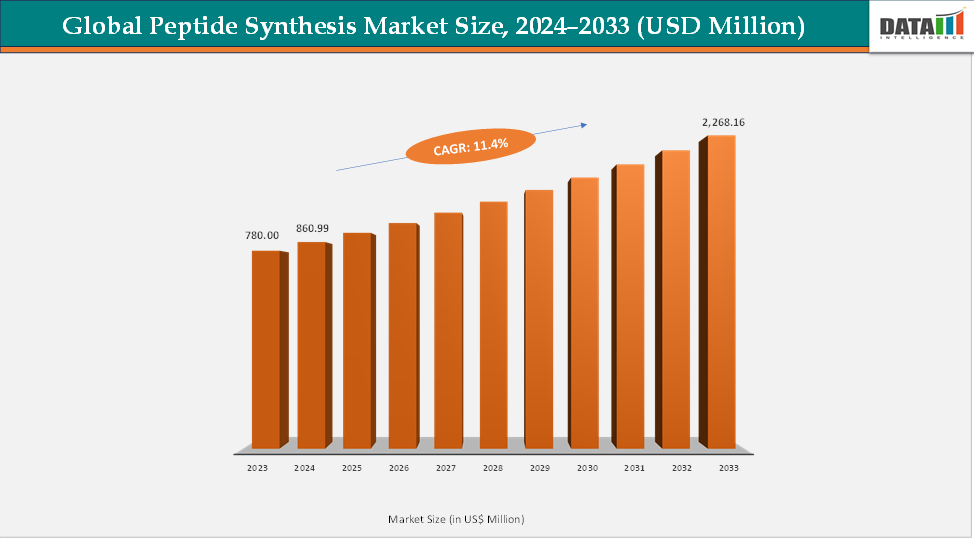

The global peptide synthesis market reached US$ 780.00 million in 2023, with a rise to US$ 860.99 million in 2024, and is expected to reach US$ 2,268.16 million by 2033, growing at a CAGR of 11.4% during the forecast period 2025–2033. The global peptide synthesis market is witnessing significant growth, driven by the rising demand for therapeutic peptides, peptide-based vaccines, and specialized biologics across oncology, metabolic, and infectious disease applications. Increasing investment in research and development, coupled with the growing complexity of peptide therapeutics, is accelerating the adoption of both solid-phase and solution-phase synthesis technologies. Innovations in automated synthesizers, high-throughput purification systems, and continuous-flow solution-phase processes are enhancing production efficiency, yield, and scalability, while reducing costs and resource consumption. Furthermore, strategic investments by key players, such as CordenPharma’s €1 billion expansion in SPPS capacity and Cambrex’s development of advanced LPPS technology, are reinforcing market growth and enabling broader access to high-quality peptides. The convergence of technological advancements, rising prevalence of chronic diseases, and expanding therapeutic pipelines is positioning the peptide synthesis market as a critical and rapidly expanding segment of the global biopharmaceutical industry.

Key Market highlights

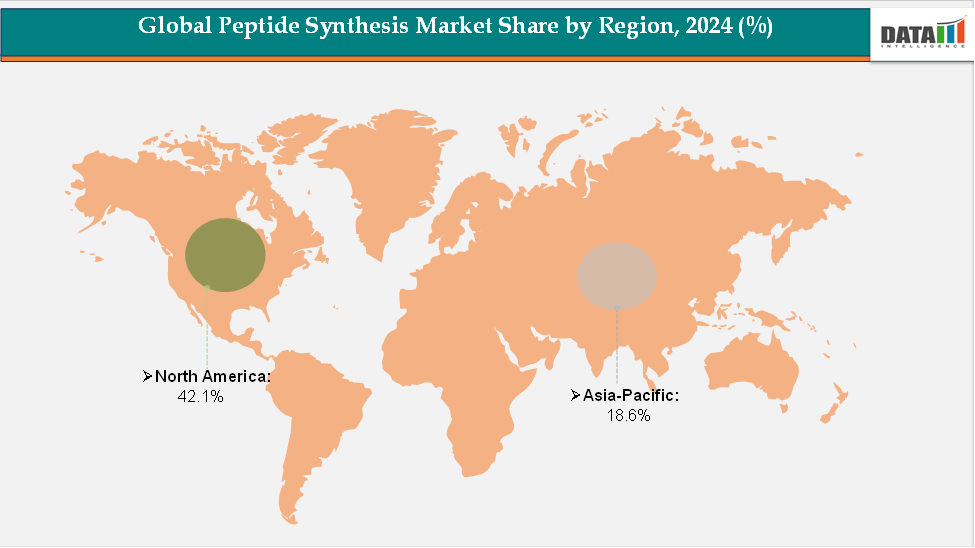

- North America dominates the global peptide synthesis market, accounting for approximately 42.1% of total revenue. The region’s leadership is supported by its strong pharmaceutical and biotechnology base, high R&D expenditure, and the widespread presence of peptide-focused drug developers and CDMOs in the United States and Canada.

- Asia–Pacific represents the fastest-growing market, contributing around 18.6% of the global share. Growth in the region is fueled by the rapid expansion of pharmaceutical manufacturing in China, India, and South Korea, coupled with increasing investments in biotechnology and peptide-based drug discovery. Rising academic–industry collaborations, lower production costs, and government initiatives promoting domestic API and peptide synthesis capabilities are driving local and international contract manufacturing demand.

- By technology, solid-phase peptide synthesis (SPPS) remains the dominant segment, accounting for approximately 39.7% of the market. SPPS continues to lead due to its efficiency in producing long and complex peptide chains with high purity and reproducibility.

Market Size & Forecast

- 2024 Market Size: US$860.99 million

- 2033 Projected Market Size: US$2,268.16 million

- CAGR (2025–2033): 11.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

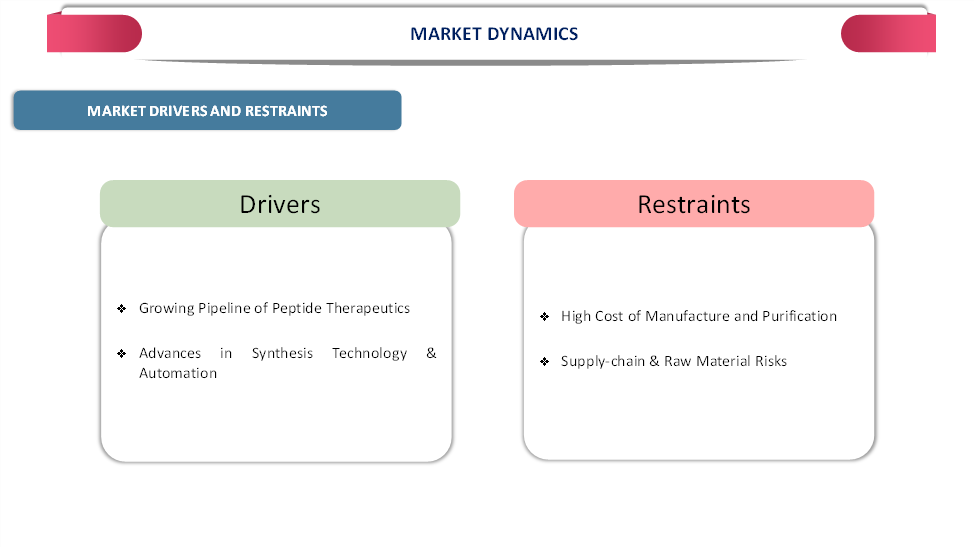

Driver: Growing Pipeline of Peptide Therapeutics

The peptide synthesis market is witnessing significant growth due to the expanding pipeline of peptide therapeutics, which is reshaping the pharmaceutical landscape. Peptides are increasingly being explored for a wide range of therapeutic areas, including oncology, metabolic disorders, infectious diseases, and autoimmune conditions, owing to their high specificity, efficacy, and reduced off-target effects compared to traditional small molecules.

Recent approvals and clinical trials have demonstrated the versatility of peptides, such as the development of peptide-based vaccines and novel oncology agents that target previously “undruggable” pathways. For instance, companies like Amgen and Novo Nordisk have advanced their peptide therapeutics pipelines with several candidates in late-stage clinical trials, highlighting the growing demand for reliable and scalable peptide synthesis techniques. This expansion necessitates high-throughput, precise, and cost-effective peptide production, thereby directly driving the adoption of advanced synthesis technologies across research and commercial settings.

Moreover, collaborations between biotech startups and contract development and manufacturing organizations (CDMOs) are accelerating the availability of peptides, further stimulating market growth and creating opportunities for innovation in synthesis methods.

Restraint: High Cost of Manufacture and Purification

the peptide synthesis market faces considerable challenges due to the high costs associated with manufacturing and purification. Peptides, especially long-chain or modified sequences, require complex synthesis protocols that involve multiple protection and deprotection steps, highly controlled reaction conditions, and stringent quality testing. Purification processes such as high-performance liquid chromatography (HPLC) add substantial cost and time, making large-scale production expensive.

For more details on this report, Request for Sample

Global Peptide Synthesis Market Segment Analysis

The global peptide synthesis market is segmented by technique, product type, process type, application, end-user and region.

Technique: The solid phase synthesis segment is estimated to have 39.7% of the peptide synthesis market share.

Solid-phase peptide synthesis (SPPS) continues to dominate the peptide synthesis market, driven by its efficiency, scalability, and ability to produce high-purity peptides for both research and commercial applications. SPPS allows for the stepwise assembly of peptides on a solid support, which simplifies purification, improves yields, and enables the synthesis of complex sequences with high fidelity. Its adaptability to automation and high-throughput systems makes it the preferred method for pharmaceutical and biotechnology companies engaged in therapeutic peptide development.

In 16 July 2024, CordenPharma announced a strategic investment of over €1 billion in peptide development and manufacturing, aiming to expand its Peptide Platform business beyond €1 billion in sales by 2028. The investment includes more than €500 million allocated to establishing multiple manufacturing lines equipped with small- to large-scale SPPS reactors, totaling over 5,000 L capacity, to support both GLP-1 and non-GLP-1 peptide projects. This initiative highlights the continuing dominance of SPPS in the market and reflects the growing demand for scalable, high-quality peptide production across therapeutic applications.

The solution phase synthesis segment is estimated to have 29.8% of the peptide synthesis market share.

Solution-phase peptide synthesis (SPPS), also referred to as liquid-phase peptide synthesis (LPPS), is emerging as the fastest-growing segment in the peptide synthesis market due to its flexibility in producing longer, more complex, and highly modified peptides that are challenging to synthesize using traditional solid-phase methods. Unlike SPPS, solution-phase techniques allow for greater control over reaction conditions, enabling higher yields and more efficient incorporation of non-standard amino acids or post-translational modifications.

In September 2024, Cambrex, through its subsidiary Snapdragon Chemistry, announced the successful development of a novel LPPS technology that leverages conventional API batch reactors and continuous flow systems, eliminating reliance on specialized solid-phase reactors. This innovation significantly reduces solvent consumption and minimizes the use of excess reagents compared to standard solid-phase synthesis, enhancing cost-effectiveness and sustainability. The adoption of such advanced solution-phase technologies is being increasingly driven by pharmaceutical and biotechnology companies seeking scalable, high-quality peptide production for therapeutic applications, positioning solution-phase synthesis as the fastest-growing and most strategically important segment in the market.

Global Peptide Synthesis Market, Geographical Analysis

The North America peptide synthesis market was valued at 42.1% market share in 2024

North America continues to dominate the peptide synthesis market. The region’s leadership is driven by its well-established pharmaceutical and biotechnology industries, robust research and development infrastructure, and favorable regulatory environment. The U.S. has several leading peptide manufacturing companies and research institutions actively engaged in therapeutic peptide development. The FDA’s regulatory guidance and approvals, such as for AVITA Medical’s RECELL system, have encouraged the adoption of innovative peptide-based therapies.

Moreover, high patient awareness, widespread access to advanced healthcare, and significant venture capital investment in biotech startups create a conducive environment for the growth of peptide synthesis. North America also benefits from strong collaborations between academic institutions and pharmaceutical companies, fostering innovation in peptide design, synthesis, and delivery technologies, which reinforces its position as the largest regional market.

The Europe peptide synthesis market was valued at 22.8% market share in 2024

Europe holds a significant position in the peptide synthesis market. The region’s market strength is underpinned by its mature pharmaceutical and biotechnology sectors, strong emphasis on research and development, and high adoption of advanced peptide therapeutics. Countries like Germany, the United Kingdom, and France lead the European market, supported by established manufacturing capabilities and regulatory systems that encourage innovation in peptide-based drugs. European companies are also investing in cutting-edge synthesis technologies, including automated SPPS systems and advanced solution-phase methodologies, to meet the growing demand for therapeutic peptides.

The Asia-Pacific peptide synthesis market was valued at 18.6% market share in 2024

Asia-Pacific is poised to be the fastest-growing region in the peptide synthesis market. This growth is driven by increasing government and private investments in biotechnology research, a growing number of peptide-based clinical trials, and expanding healthcare infrastructure in emerging economies such as China, India, Japan, and Southeast Asian nations. Rising disposable incomes, improved healthcare access, and growing awareness of peptide therapeutics are contributing to higher demand in these markets.

Additionally, several contract research and manufacturing organizations (CRDMOs) in the region are establishing state-of-the-art peptide synthesis facilities, catering to both domestic and international pharmaceutical clients. The combination of cost-competitive production, supportive regulatory frameworks, and growing scientific expertise positions Asia-Pacific as the fastest-growing market segment, offering lucrative opportunities for both established players and new entrants.

Peptide Synthesis Market Competitive Landscape

The major players in the peptide synthesis market include Bachem, Thermo Fisher Scientific Inc., Merck, GenScript, PolyPeptide Group, Almac Group, Kaneka Eurogentec S.A., Biosynth, BCNPeptides, CPC Scientific Inc., among others.

Key Developments:

- In July 2024, BioDuro opened a fully automated solid-phase peptide synthesis scale-up laboratory at its Shanghai Zhangjiang High-tech Park campus in China. This new facility further enhances the company’s peptide synthesis capabilities to meet increasing demand from its global partners for efficient and scalable peptide manufacturing.

- In December 2024, Solid Science Plc, a young and innovative Hungarian biotechnology firm, is excited to introduce the RevoPSy instrument.

Market Scope

| Metrics | Details | |

| CAGR | 11.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Technique | Solid Phase Synthesis, Solution Phase Synthesis, Hybrid Approach |

| Product Type | Equipment, Reagents & Consumables, Services | |

| Application | Therapeutic, Diagnostics, Research | |

| End-User | Pharmaceutical and Biotechnology Companies, CDMOs & CROs, Academic and Research Institutes, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global peptide synthesis market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here