Market Size

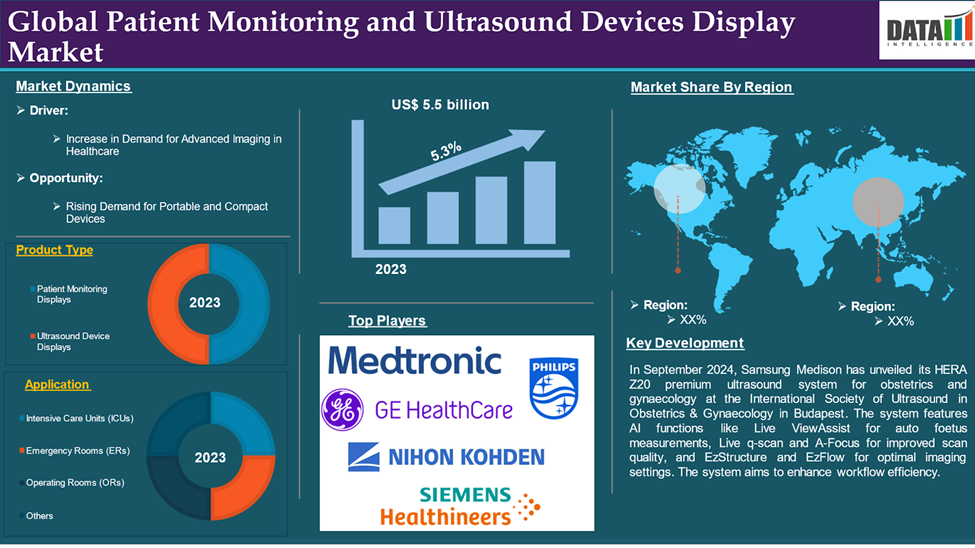

The Global Patient Monitoring and Ultrasound Devices Display Market reached US$ 5.50 billion in 2023 and is expected to reach US$ 9.33 billion by 2033, growing at a CAGR of 5.3% during the forecast period 2025-2033, according to DataM Intelligence report.

Patient monitoring and ultrasound devices display technologies are essential in modern healthcare, providing real-time visualization of patients vital signs and internal conditions. These devices use advanced display systems to present detailed images and data, enabling healthcare professionals to make informed decisions quickly. Patient monitoring displays track vital parameters like heart rate, blood pressure, respiratory rate, and oxygen saturation, while ultrasound displays visualize internal organs, tissues, and blood flow. The market for these devices continues to expand due to technological innovation, patient-centered care, novel product launches and other various factors.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Increase in Demand for Advanced Imaging in Healthcare

The global patient monitoring and ultrasound device display market is growing due to the growing demand for advanced imaging technologies in healthcare. These technologies offer visualization capabilities, precise diagnosis, and treatment planning. The integration of high-resolution displays and real-time monitoring enhances clinical decision-making, particularly in critical care and emergency settings. The increasing prevalence of chronic diseases and emphasis on minimally invasive procedures further fuel the adoption of these advanced systems. As healthcare providers strive to improve patient outcomes and operational efficiency, the role of advanced imaging continues to expand.

For instance, in December 2024, Mindray, a global healthcare technology developer, has expanded its Resona-Series radiology portfolio with the introduction of the Resona I8 Ultrasound Machine. This versatile shared service imaging solution is designed to help sonographers excel in challenging ultrasound environments. This addition, along with future Digital Radiography offerings, demonstrates Mindray's commitment to innovation and medical imaging excellence.

High Cost Associated with the Devices

The global patient monitoring and ultrasound device display market is hindered by the high cost of advanced technologies. These devices, with high-resolution displays, real-time monitoring capabilities, and enhanced imaging features, often exceed the budgets of smaller healthcare facilities, especially in developing economies. The financial burden extends beyond the initial purchase, including maintenance, software upgrades, and medical staff training. This discourages widespread adoption and creates a barrier for market penetration, especially in cost-sensitive regions.

For instance, Low-range ultrasound machines are ideal for private or small clinics or practices, with new machines costing $5,000 to $30,000 and used machines between $5,000 and $15,000. Refurbishing these machines is not economically viable due to the high cost.

Market Segment Analysis

The global patient monitoring and ultrasound devices display market is segmented based on product type, display technology, application, end user and region.

Product Type:

Portable Patient Monitoring Displays segment under Patient Monitoring Displays is expected to dominate the Patient Monitoring and Ultrasound Devices Display market share

The portable patient monitoring displays segment holds a major portion of the patient monitoring and ultrasound devices display market share and is expected to continue to hold a significant portion of the Patient Monitoring and Ultrasound Devices Display market share during the forecast period.

Portable patient monitoring displays are revolutionizing the healthcare industry by providing real-time monitoring of vital signs, such as heart rate, blood pressure, and oxygen saturation, outside traditional settings. This is particularly useful in home healthcare, ambulances, and field hospitals. The integration of wireless connectivity and cloud-based data storage further enhances their utility, enabling remote monitoring and telemedicine applications. The growing preference for patient-centric care and the prevalence of chronic diseases are driving the adoption of these displays, which support early diagnosis and continuous patient management without geographical constraints. Advancements in battery life, miniaturization, and user-friendly interfaces further contribute to their increased demand.

For instance, in October 2023, Dozee has introduced its ambulatory connected patient monitoring system, 'Dozee Pro Ex', which uses wireless wearable sensors to continuously monitor patient vitals like ECG rhythm, blood pressure, heart rate, oxygen saturation, respiration rate, and temperature. The system also features an AI-powered early warning system that provides timely alerts for possible clinical deterioration.

Application:

Intensive Care Units (ICUs) segment is the fastest-growing segment in Patient Monitoring and Ultrasound Devices Display market share

The intensive care units (ICUs) segment is the fastest-growing segment in the patient monitoring and ultrasound devices display market share and is expected to hold the market share over the forecast period.

Intensive Care Units (ICUs) are driving the global demand for advanced patient monitoring and ultrasound device displays due to the significant product launches, need for accurate, real-time solutions for managing critically ill patients. Advanced displays provide healthcare professionals with comprehensive visualizations of multiple parameters, ensuring timely and informed decision-making. High-resolution and touchscreen displays enhance operational efficiency by allowing intuitive access to data trends, alarms, and system settings. The increasing incidence of life-threatening conditions like sepsis, respiratory failure, and cardiac arrests underscores the need for advanced monitoring solutions in ICUs.

For instance, in April 2024, Drager, a global medical and safety technology company, has launched Vista 300 in India, a patient monitoring system designed to improve information flow across hospital departments. The system allows continuous data transfer from the patient's bed to the Hospital Information System, enabling medical professionals to access critical clinical care information throughout the patient's journey.

Market Geographical Share

North America is expected to hold a significant position in the Patient Monitoring and Ultrasound Devices Display market share

North America holds a substantial position in the patient monitoring and ultrasound devices display market and is expected to hold most of the market share due to high adoption of medical technologies. The region's focus on early diagnosis and preventive care has increased demand for advanced monitoring and imaging solutions. The growing prevalence of chronic diseases like diabetes and cardiovascular disorders has also heightened the need for real-time patient monitoring devices. Government initiatives and favorable reimbursement policies further boost the market.

For instance, in October 2024, GE Healthcare has launched the Versana Premier, the latest addition to its ultrasound system family. The system is designed to cater to healthcare professionals across various clinical specialities, including general practice, obstetrics and gynaecology, musculoskeletal, and cardiology. The new version of Versana Premier features automation and AI-enabled productivity tools, enhancing workflows, clinical efficiency, and accuracy.

Moreover, in June 2023, Exo, a leading medical imaging software company, is partnering with Sana Kliniken AG to provide its high-performance handheld ultrasound platform and artificial intelligence to over 120 German-speaking healthcare facilities. This partnership aims to improve patient outcomes, streamline workflow inefficiencies, and lower costs through real-time decision-making.

Asia-Pacific is growing at the fastest pace in the Patient Monitoring and Ultrasound Devices Display market

Asia-Pacific holds the fastest pace in the patient monitoring and ultrasound devices display market and is expected to hold most of the market share due factors such as the aging population, rising chronic diseases, urbanization, and improved healthcare infrastructure. Government initiatives, increased investments in digital health technologies, and rising awareness of preventive healthcare are driving market growth. The affordability of portable devices and the presence of global and regional market players investing in R&D further contribute to the market expansion. The region's increasing healthcare expenditure and the presence of global and regional market players further contribute to the global market expansion.

For instance, in February 2024, FUJIFILM India has launched the ALOKA ARIETTA 850 Diagnostic Ultrasound System at Fortis Hospital in Bengaluru, Karnataka. This high-tech ultrasound system aims to improve diagnostic precision and image clarity for gastrointestinal diseases in the region, marking a significant advancement in endoscopic technologies.

Major Global Players

The major global players in the patient monitoring and ultrasound devices display market include Philips Healthcare, GE HealthCare, Nihon Kohden Corporation, Medtronic Plc, Mindray Medical International Limited, Siemens Healthineers, Canon Medical Systems Corporation, Samsung Medison Co., Ltd., FUJIFILM Holdings Corporation, Esaote SpA and among others.

Key Developments

- In September 2024, Samsung Medison has unveiled its HERA Z20 premium ultrasound system for obstetrics and gynaecology at the International Society of Ultrasound in Obstetrics & Gynaecology in Budapest. The system features AI functions like Live ViewAssist for auto foetus measurements, Live q-scan and A-Focus for improved scan quality, and EzStructure and EzFlow for optimal imaging settings. The system aims to enhance workflow efficiency.

- In September 2023, Mindray, a global leader in healthcare solutions, has launched the TE Air Wireless Handheld Ultrasound, a compact, wireless imaging solution that enhances ultrasound accessibility. This compact device allows healthcare professionals to carry comprehensive scanning capabilities in their pockets, adapting to various clinical scenarios. The TE Air is the first handheld ultrasound device to connect to mobile devices or touch-based TE X Ultrasound System.

- In March 2023, El Camino Health has become the first global health system to implement FloPatch, a wireless, wearable Doppler ultra-sound system developed by Flosonics Medical, which monitors real-time blood flow, aiding clinicians in managing intravenous fluid therapy earlier in the sepsis care pathway.

| Metrics | Details | |

| CAGR | 5.3% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Product Type | Patient Monitoring Displays, Ultrasound Device Displays |

| Display Technology | LCD (Liquid Crystal Display), LED (Light Emitting Diode), OLED (Organic Light Emitting Diode) | |

| Application | Intensive Care Units (ICUs), Emergency Rooms (ERs), Operating Rooms (ORs), Others | |

| End User | Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Diagnostic Imaging Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global patient monitoring and ultrasound devices display market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.