Overview

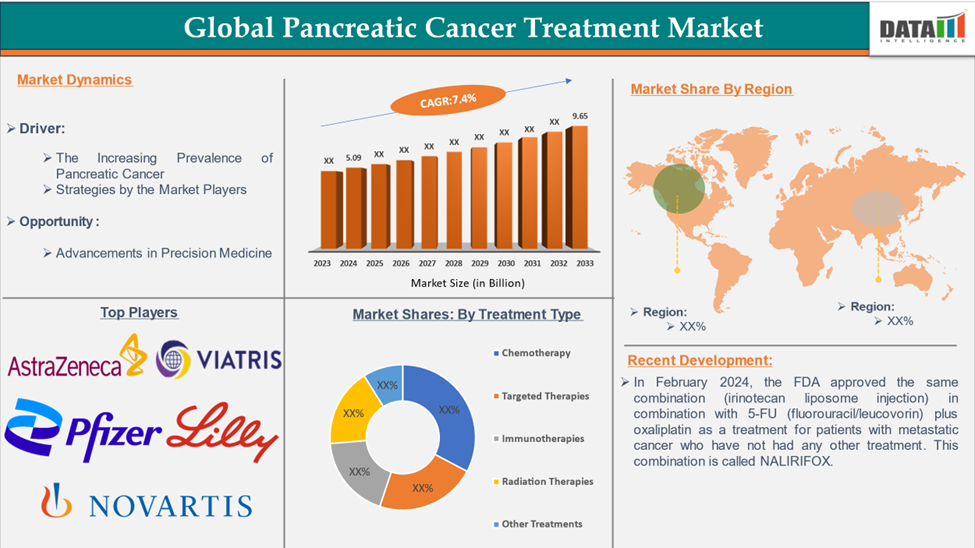

The global pancreatic cancer treatment market size reached US$ 5.09 billion in 2024 and is expected to reach US$ 9.65 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2025-2033.

Pancreatic Cancer is the seventh leading cause of cancer-related deaths. Its early detection is challenging because the disease often progresses without noticeable symptoms. Currently, screening methods are primarily reserved for individuals at high risk. It arises from the uncontrolled growth of abnormal cells, forming malignant tumors. Because symptoms typically appear only in advanced stages, diagnosis is often delayed.

Common signs of advanced pancreatic cancer include jaundice (yellowing of the skin and eyes), abdominal pain, weight loss, loss of appetite, nausea, and changes in stool color. Treatment depends on the cancer’s stage and the patient’s overall health. Treatment options include surgery, chemotherapy, radiation therapy, targeted therapies, and immunotherapy.

Executive Summary

Market Dynamics: Drivers & Restraints

Strategies by the Market Players

Collaborations between pharmaceutical companies, research institutions, and academia can accelerate the pace of research and development for new treatments and therapies. By pooling resources, expertise, and data, these partnerships can lead to breakthroughs in understanding Pancreatic Cancer Treatment biology and identifying potential drug targets.

Partnerships can provide access to complementary resources such as funding, technology platforms, and research tools that may not be readily available to individual organizations. This can facilitate the development of innovative approaches for diagnosing, treating, and monitoring pancreatic cancer. Thus, due to rise of partnerships by companies and organizations helps boost the market growth.

For instance, in 2023, Phanes Therapeutics, Inc had entered into a clinical collaboration agreement with Merck to study PT886, its first-in-class bispecific antibody targeting claudin 18.2 and CD47, in combination with Merck's anti-PD-1 therapy, KEYTRUDA (pembrolizumab), in patients with claudin 18.2 positive gastric or gastroesophageal junction (GEJ) adenocarcinomas. PT886 was assembled using Phanes' proprietary bispecific antibody platforms, PACbody and SPECpair, and was granted orphan drug designation (ODD) for the treatment of pancreatic cancer by the FDA last year.

Additionally, in 2023, ClearNote Health signed an agreement to partner with the Pancreatic Cancer Early Detection (PRECEDE) Consortium. The PRECEDE Consortium is an international, multi-institutional collaborative group of experts working to improve early detection for those with a heritable risk for Pancreatic Cancer Treatment, or those with pancreatic cysts, through a novel model of collaboration and data sharing.

The Limited Treatment Options for Pancreatic Cancer

Existing treatment options for pancreatic cancer, such as surgery, chemotherapy, and radiation therapy, often have limited efficacy, particularly in advanced stages of the disease. For instance, while chemotherapy regimens like FOLFIRINOX and gemcitabine-based therapies may provide some survival benefit, they often only extend life expectancy by a few months. This limited efficacy can deter investment in research and development of new treatments and may discourage patients and healthcare providers from pursuing treatment options that offer marginal benefits.

Unlike some other cancer types, such as breast or lung cancer, pancreatic cancer has fewer targeted therapy options. For example, while drugs targeting specific genetic mutations, such as EGFR inhibitors or ALK inhibitors, have revolutionized the treatment of certain cancers, similar targeted therapies for pancreatic cancer treatment are lacking. This limitation stems from the complex molecular and genetic landscape of pancreatic cancer treatment, which presents challenges in identifying viable targets for therapeutic intervention.

Epidemiology Analysis

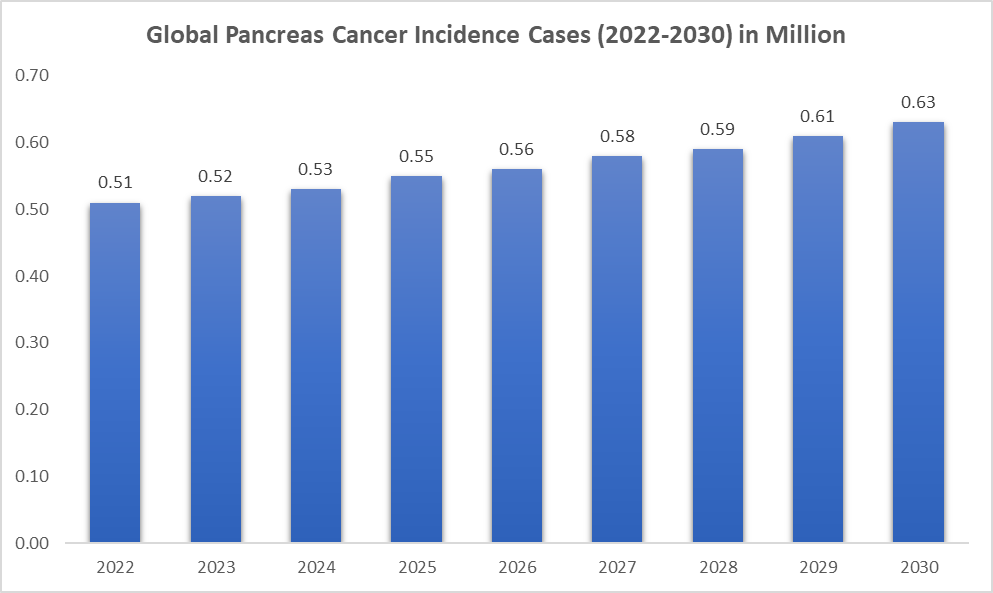

The incidence of pancreatic cancer is rising. As per DataM intelligence estimates, nearly 0.51 million incident cases are estimated worldwide in 2024. However, pancreatic cancer continues to present a major healthcare burden, particularly in developing nations and among high-risk populations.

Epidemiology Analysis (By Region)

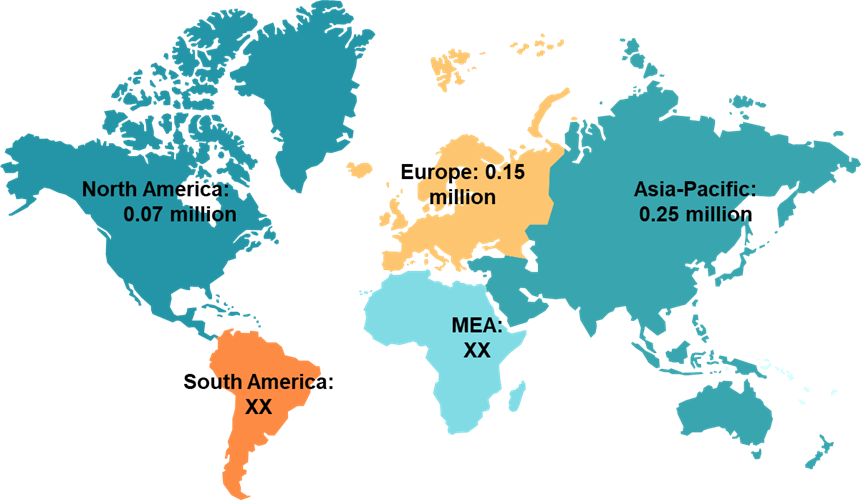

The incidence of pancreatic cancer varies among regions. The region with the highest prevalence of pancreatic cancer is the Asia-Pacific, accounting for 0.25 million cases in 2024.

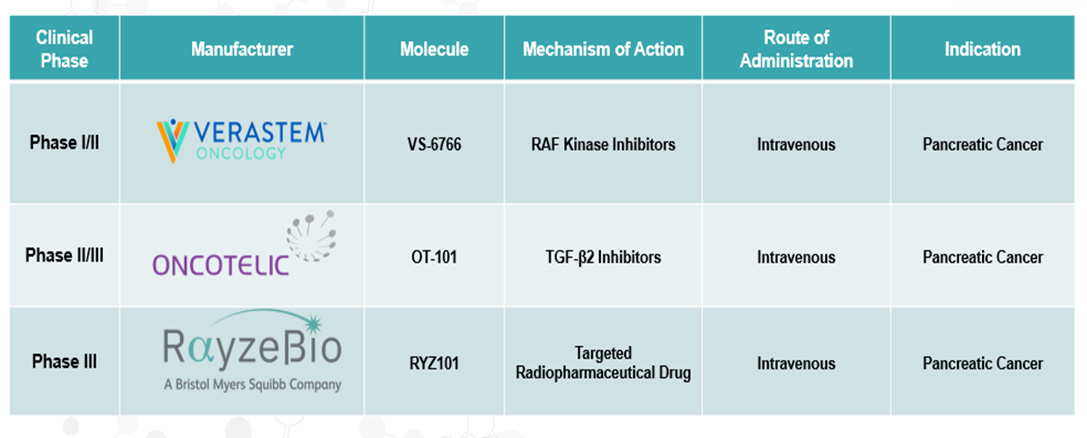

Pipeline Analysis

Pipeline Molecules for Pancreatic Cancer

Segment Analysis

The global pancreatic cancer treatment market is segmented based on cancer type, treatment type, and region.

Treatment Type:

The chemotherapy segment is expected to dominate the pancreatic cancer treatment market with the highest market share.

Chemotherapy is used as the first line of treatment. Many patients suffering from this cancer receive chemotherapy, which provides long-term cancer protection. It eliminates the rapidly dividing abnormal cells and involves the application of chemicals and lasers to eradicate all diseased cells. Chemotherapy is one of the main treatments for pancreatic cancer. It uses anti-cancer (cytotoxic) drugs to destroy cancer cells. The drugs circulate throughout the body in the bloodstream.

There are several drugs approved by the United States Food and Drug Administration (FDA) for the treatment of pancreatic cancer. In February 2024, the FDA approved the same combination (irinotecan liposome injection) in combination with 5-FU (fluorouracil/leucovorin) plus oxaliplatin as a treatment for patients with metastatic cancer who have not had any other treatment. This combination is called NALIRIFOX.

Moreover, in January 2024, BPGBio stated early data indicating that its small-molecule drug BPM 31510 (ubidecarenone) doubled progression-free survival (PFS) when combined with gemcitabine in participants with advanced Pancreatic Cancer Treatment.

Geographical Analysis

North America is expected to hold a significant position in the global pancreatic cancer treatment market, with the highest market share

Owing to the strong presence of major market players, the rising prevalence of pancreatic cancers, increasing research activities, rising awareness about cancer, rising clinical studies, and well-established healthcare infrastructure are the factors expected to drive the Pancreatic Cancer Treatment market in the region.

North America, especially the United States, boasts a robust healthcare industry with many major market players such as Pfizer Inc., Bristol-Myers Squibb Company, Amgen Inc., and others actively engaged in research and development and clinical trials for pancreatic cancer treatments. Their presence fosters competition, innovation, and the availability of advanced therapies in the market.

For instance, in January 2024, FibroGen, Inc. completed the pamrevlumab experimental arm in the Pancreatic Cancer Treatment Action Network's (PanCAN) Precision PromiseSM Phase 2/3 adaptive platform trial, which evaluates pamrevlumab in combination with the chemotherapy treatments gemcitabine and nab-paclitaxel for patients with metastatic pancreatic ductal adenocarcinoma (mPDAC).

Additionally, in June 2023, RenovoRx, Inc., a clinical-stage biopharmaceutical company developing targeted combination therapies, released new positive data on progression-free survival (PFS) from the pivotal Phase III open-label TIGeR-PaC study of RenovoGem (intra-arterial administration of gemcitabine) in locally advanced Pancreatic Cancer Treatment (LAPC)

Major market players in the region, especially in the United States increasing the collaborations and acquisitions to perform clinical activities for the development of advanced innovative therapeutics for the treatment of pancreatic cancer.

For instance, on January 10, 2024, AIM ImmunoTech Inc. released that enrollment is open at Erasmus Medical Center in a Phase 1b/2 clinical trial combining AIM’s Ampligen (rintatolimod) with AstraZeneca’s anti-PD-L1 immune checkpoint inhibitor Imfinzi (durvalumab) for the treatment of pancreatic cancer. Ampligen has shown therapeutic synergies with checkpoint inhibitors, potentially increasing survival rates and efficacy.

Competitive Landscape

Top companies in the pancreatic cancer treatment market include Pfizer Inc., Eli Lilly and Company, Novartis AG, Bristol-Myers Squibb Company, AstraZeneca, Intelicure Lifesciences, Ipsen Pharma, Viatris Inc., Sun Pharmaceutical Industries Ltd, and F. Hoffmann-La Roche Ltd, among others.

Scope

| Metrics | Details | |

| CAGR | 7.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Cancer Type | Exocrine Tumors, Neuroendocrine Tumors |

| Treatment Type | Chemotherapy, Targeted Therapies, Immunotherapies, Radiation Therapies, Other Treatments | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global pancreatic cancer treatment market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.