Global Organic Infant Formula Market Overview

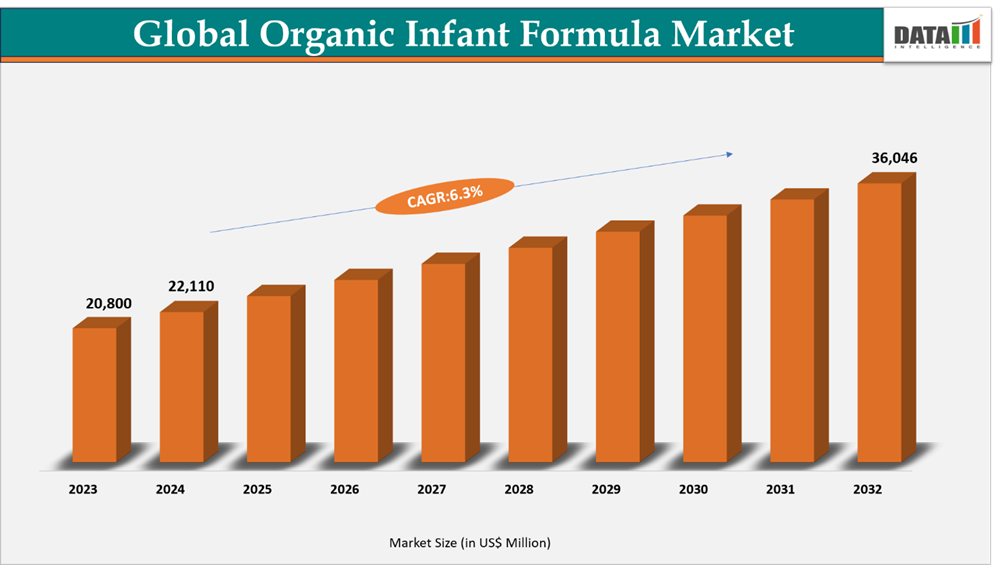

The global organic infant formula market reached US$ 20,800 million in 2023, rising to US$ 22,110 million in 2024 and is expected to reach US$ 36,046 million by 2032, growing at a CAGR of 6.3% from 2025 to 2032.

The organic infant formula market is experiencing steady growth, driven by increasing parental awareness of infant nutrition, rising cases of lactose intolerance and cow’s milk protein allergies, and a growing preference for natural, chemical-free products. These formulas are made from certified organic ingredients, free from synthetic pesticides, antibiotics, and GMOs. Market expansion is further supported by wider distribution channels, including e-commerce and retail, as well as product innovations that enrich formulas with prebiotics, probiotics, vitamins, and minerals to boost nutritional value and differentiation. The demand for safe, sustainable, and high-quality infant nutrition continues to propel the market globally.

Organic Infant Formula Market Industry Trends and Strategic Insights

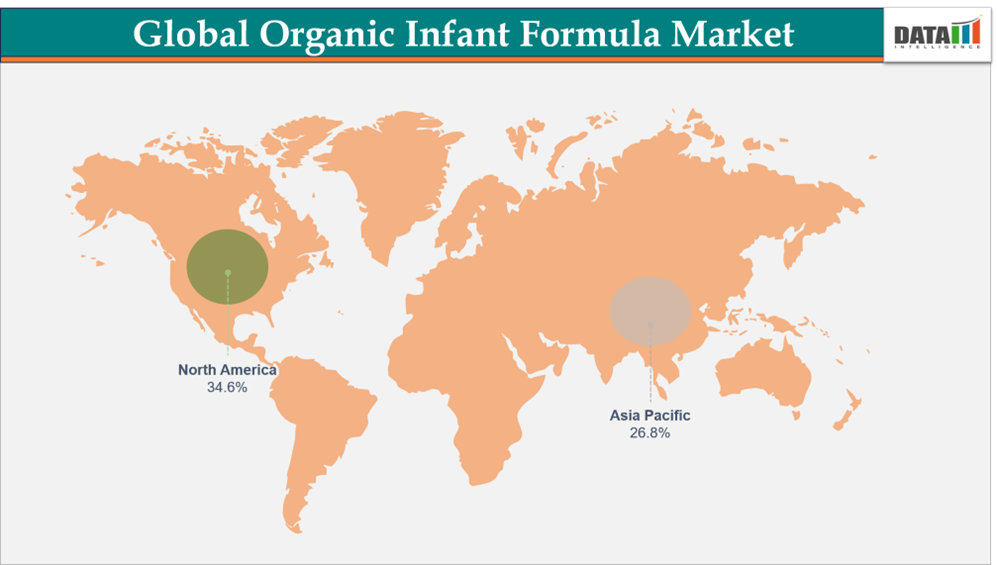

- North America leads the global organic infant formula market, capturing the largest revenue share of 34.6% in 2024.

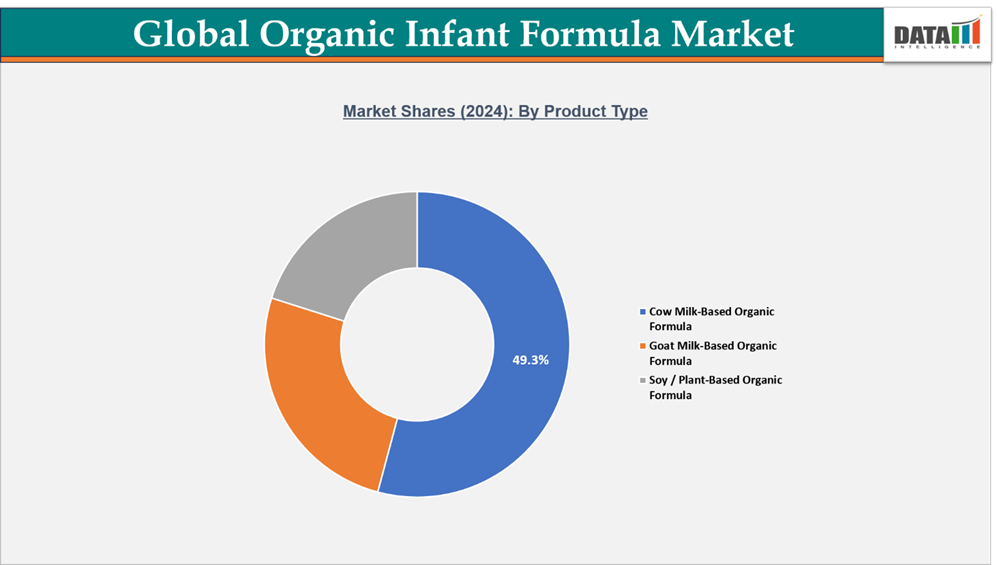

- By product type form segment, Cow milk-based organic formula lead the global organic infant formula market, capturing the largest revenue share of 49.3% in 2024.

Global Organic Infant Formula Market Size and Future Outlook

- 2024 Market Size: US$ 22,110 million

- 2032 Projected Market Size: US$ 36,046 million

- CAGR (2025–2032): 6.3%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Product Type | Cow Milk-Based Organic Formula, Goat Milk-Based Organic Formula, Soy / Plant-Based Organic Formula |

| By Stage | Stage 1 – Infant Formula (0–6 months), Stage 2 – Follow-on Formula (6–12 months) |

| By Form | Powdered Formula, Ready-to-Feed (RTF) Formula, Concentrated Liquid Formula |

| By Distribution Channel | Online, Offline |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report – Request for Sample

Market Dynamics

Rising Parental Health Consciousness

Rising parental health consciousness is a major factor driving the growth of the organic infant formula market. Today’s parents are increasingly focused on promoting healthy growth and strong immunity in their children, which strongly influences their choice of infant nutrition products. In September 2024, A global survey conducted by Arla Foods Ingredients, covering 6,800 women aged 18-45 across 13 countries, revealed that mothers prioritize formulas that support overall growth and immune system development. This shift reflects a broader trend toward natural, safe, and high-quality nutrition, with parents seeking products free from synthetic pesticides, antibiotics, and genetically modified organisms (GMOs).

In response, organic infant formula manufacturers are introducing products enriched with prebiotics, probiotics, vitamins, minerals, and other functional ingredients to meet these expectations. The preference for premium, nutrient-rich formulas is driving market expansion, particularly in regions like North America, Europe, and Asia-Pacific, where awareness and disposable income are higher. Overall, increasing parental focus on infant health is shaping both purchasing behavior and product innovation, establishing organic formulas as the preferred choice for health-conscious families.

Segment Analysis

The global organic infant formula market is segmented based on product type, stage, form, distribution channel and region.

Cow Milk-Based Organic Formula Leads the Market Due to Nutritional Reliability and Wide Acceptance

The cow milk-based organic formula segment holds the largest share in the global organic infant formula market, owing to its nutritional reliability, balanced composition, and strong consumer acceptance. These formulas are designed to closely replicate the nutrient profile of breast milk, providing essential proteins, fats, carbohydrates, vitamins, and minerals necessary for healthy growth and immune system support in infants.

This segment benefits from both regulatory recognition and high parental trust. For instance, in September 2025, Earth’s Best, a leading brand in organic infant nutrition, offers USDA-certified organic cow milk-based formulas made with non-GMO ingredients and milk from grass-fed cows, supplying 30 essential vitamins and minerals to support growth and development. These formulas are easy to digest and enriched with Omega-3 DHA and Omega-6 ARA to promote brain and eye development, highlighting the segment’s focus on premium, nutritionally complete options.

The combination of consumer confidence, nutritional adequacy, and regulatory compliance continues to make cow milk-based organic formulas the dominant choice for health-conscious parents, solidifying this segment’s leadership in the global organic infant formula market.

Goat Milk-Based Organic Formula Experiencing Rapid Growth Due to Digestibility and Specialty Appeal

The goat milk-based organic formula segment is growing rapidly, driven by its easier digestibility, hypoallergenic properties, and positioning as a specialty nutrition option for infants with mild sensitivities to cow milk proteins. Goat milk contains smaller fat globules and a distinct protein structure, making it gentler on the digestive system while providing essential nutrients for healthy growth and immune support.

Product innovation and premium branding are further fueling this segment’s expansion. For instance, in June 2024, Kabrita, a leading global goat milk formula manufacturer, has received top recognition from the Clean Label Project (CLP), earning certifications such as the First 1,000 Day Promise, Pesticide Free, and Purity Awards. Kabrita is the first and only goat milk-based infant formula to achieve these accolades, underscoring the segment’s focus on high-quality, safe, and clean-label nutrition. Manufacturers are also enhancing formulas with prebiotics, probiotics, vitamins, minerals, and functional nutrients to support immunity, cognitive development, and overall infant growth.

The combination of digestive benefits, growing parental health awareness, and strong product differentiation is driving the rapid adoption of goat milk-based organic formulas, particularly in North America, Europe, and Asia-Pacific, making this segment one of the fastest-growing categories in the global organic infant formula market.

Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Organic Infant Formula Market Driven by Health-Conscious Parenting and Specialty Nutrition Demand

The North America organic infant formula market is the largest globally, driven by increasing parental focus on infant health, growing awareness of organic and clean-label nutrition, and the rising demand for specialty formulas such as plant-based and goat milk-based options. Parents are increasingly prioritizing formulas that support healthy growth, immune system development, brain and eye development, and digestive comfort, which is encouraging the adoption of premium organic products over conventional alternatives.

US Organic Infant Formula Market Insights

The United States remains the key contributor to the region’s market growth, supported by high disposable incomes, strong retail penetration, and widespread e-commerce availability. Specialty brands and international entrants are gaining rapid acceptance among US families. For instance, Kabrita, the global goat milk formula manufacturer, launched its Kabrita Goat Milk Infant Formula in the US, now available at Whole Foods Market and Sprouts Farmers Market nationwide. Within less than a year of its US launch, the formula has quickly become a trusted choice for health-conscious parents, also achieving the distinction of being the European infant formula sold on Amazon. This reflects the growing trend of parents seeking gentle, easily digestible, and high-quality goat milk-based options alongside traditional cow milk formulas.

Furthermore, US consumers are increasingly exploring plant-based organic formulas, prompting strategic moves from major players. Danone, for instance, plans to acquire the US based plant-based organic formula maker Kate Farms, demonstrating the rising investment in plant-based nutrition and signaling the strong market potential for non-dairy organic alternatives. The demand for fortified, nutrient-rich formulas—including additions like DHA, ARA, prebiotics, and probiotics is driving product innovation and differentiation in the US market.

Canada Organic Infant Formula Market Industry Growth

In Canada, stringent regulatory frameworks for organic certification and infant nutrition ensure high product quality and consumer confidence. Parents are increasingly seeking natural, safe, and nutrient-complete options for infants, leading to steady adoption of cow milk- and goat milk-based organic formulas. Retail expansion, both in physical stores and online platforms, along with educational campaigns on infant nutrition, further supports market growth.

FASTEST GROWING MARKET:

Asia-Pacific Emerges as the Fastest-Growing Region Driven by Health-Conscious Parenting and Specialty Formula Demand

The Asia-Pacific organic infant formula market is witnessing rapid growth, propelled by increasing health awareness among parents, rising urbanization, and growing demand for organic, plant-based, and specialty formulas that support healthy growth, immunity, and cognitive development. This trend has created a favorable environment for both cow milk- and goat milk-based organic formulas.

India Organic Infant Formula Market Outlook

India is one of the fastest-growing markets in the region, fueled by rising parental focus on infant nutrition, higher disposable incomes, and the expansion of retail and e-commerce channels. Parents are showing strong interest in plant-based and hypoallergenic formulas, reflecting the preference for gentle, safe, and high-quality nutrition suitable for infants with dietary sensitivities.

China Organic Infant Formula Market Trends

China dominates the Asia-Pacific market, supported by a large population and growing adoption of premium and specialty formulas. Companies are increasingly investing in local production and strategic expansions. For instance, in 2025, a2MC recently strengthened its China-label infant formula business through a new plant acquisition, highlighting the rising potential for plant-based and organic products. Stringent regulatory standards and organic certification requirements further ensure product safety and consumer confidence, driving continued market growth.

Sustainability and ESG Analysis

Sustainability is becoming an important factor in the global organic infant formula market, shaping consumer trust, brand reputation, and regulatory compliance. Companies are focusing on organic and traceable ingredients, animal welfare, and eco-friendly packaging to meet growing expectations for responsible products.

Reducing the carbon footprint, water use, and energy consumption in production remains a key challenge. To address this, many manufacturers are adopting renewable energy, partnering with sustainable farms, and using recyclable or biodegradable packaging.

For instance, in July 2023, Prolactal, a leading organic dairy ingredient supplier, has launched a project to cut greenhouse gas emissions at its Hartberg, Austria facility. This effort helps improve the carbon footprint of infant formulas like NAN by Nestlé. Prolactal has been supplying organic dairy ingredients for nearly 20 years and has run its Austrian plant on renewable energy since 1984, showing a long-term commitment to sustainability. By focusing on ethical sourcing, transparent supply chains, and environmentally responsible practices, companies in this market can strengthen brand loyalty, consumer trust, and long-term competitiveness.

Competitive Landscape

- The global organic infant formula market is highly competitive, comprising both multinational corporations and regional players. Leading companies such as Nestlé, Abbott, Danone, HiPP, Mead Johnson, Bellamy's Organic, Holle Baby Food AG, Topfer, and a2 Milk Company Limited hold significant market share, supported by their wide production networks, diverse product offerings, and strong R&D capabilities, especially in premium and specialty infant nutrition.

- International brands have also strengthened their presence through imports and e-commerce channels. For example, HiPP and Holle Baby Food AG products are easily accessible on platforms like Amazon, iHerb, and regional online stores, catering to parents seeking high-quality organic formulas.

- The market remains dynamic, with regulatory compliance, brand credibility, innovation, and effective distribution strategies serving as key drivers of competitive advantage and growth in the global organic infant formula industry.

Key Developments

- On April 2025, Bobbie Introduces the First and Only USDA-Certified Organic Whole Milk Infant Formula Made in the USA

Investment & Funding Landscape

The global organic infant formula market is experiencing significant investments and strategic developments, fueled by growing consumer demand for safe and high-quality infant nutrition. In 2025, Nara Organics launched what it claims to be the first FDA-registered and USDA-certified organic whole milk infant formula designed to meet both U.S. and European safety standards. The company secured $32 million in funding from investors including AlleyCorp, Torch Capital, Corazon Ventures, BBG Ventures, and Gingerbread Capital, with individual investors such as Serena Williams, Mindy Grossman, and Gina Rodriguez, and advisors including Nicky Hilton, Erin and Sara Foster, Keleigh Teller, and Karla Souza. Manufactured in Germany, the formula contains no skim milk, palm oil, soy, corn syrup, maltodextrin, or GMOs, emphasizing clean and safe ingredients.

Additionally, In 2022, Perrigo announced a strategic investment to expand and strengthen U.S. infant formula manufacturing, reflecting the market’s focus on local production, regulatory compliance, and supply chain resilience. These initiatives underscore the growing investor confidence and strategic efforts to meet the rising demand for premium, innovative, and safe organic infant nutrition products.

| Company | Investment/Funding | Year | Details | |

| Nara Organics | Organic Funding | 2025 | Nara Organics launched the first FDA-registered and USDA-certified organic whole milk infant formula meeting both US and European safety standards. The company raised US$32 million from investors including AlleyCorp, Torch Capital, Corazon Ventures, BBG Ventures, and Gingerbread Capital, with individual investors such as Serena Williams, Mindy Grossman, and Gina Rodriguez, and advisors including Nicky Hilton, Erin and Sara Foster, Keleigh Teller, and Karla Souza. Manufactured in Germany, the formula contains no skim milk, palm oil, soy, corn syrup, maltodextrin, or GMOs. | |

| Perrigo | Strategic capital raise | 2022 | Perrigo announced a US$170 million strategic investment to expand US infant formula production, including the acquisition of Nestlé’s Gateway plant and the US and Canadian rights to the Good Start brand. As part of this plan, US$60 million was allocated to increase Gateway’s capacity by 7 million pounds annually, adding a total of 36 million pounds, in addition to Perrigo’s ongoing US$20 million annual investment in its Vermont and Ohio facilities. | |

What Sets This Global Organic Infant Formula Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product type, stage, form, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect organic infant formula commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.