Genomics in Cancer Care Market Size& Industry Outlook

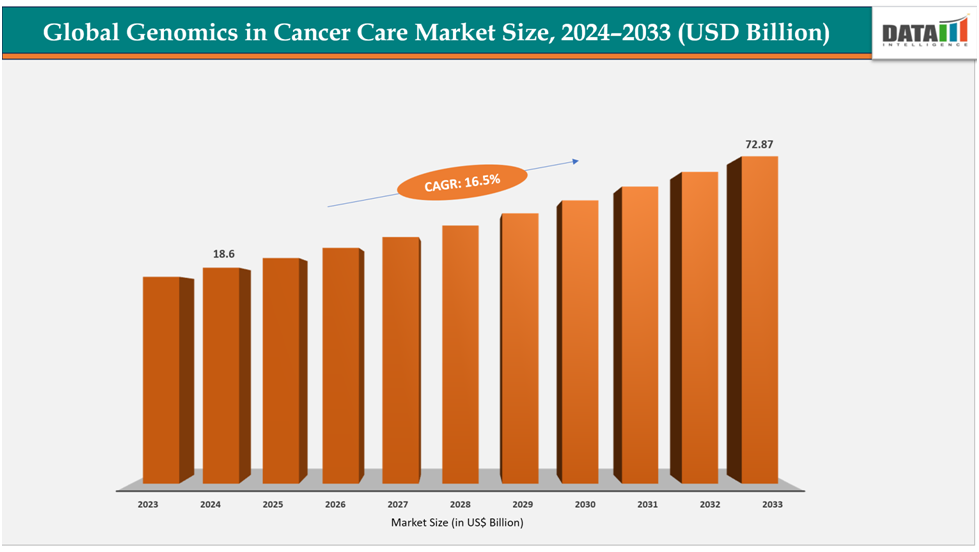

The global genomics in cancer care market size reached US$ 16.14billion with rise of US$18.6billion in 2024 is expected to reach US$ 72.87billion by 2033, growing at a CAGR of 16.8%during the forecast period 2025-2033.

One of the major drivers of the global genomics in cancer care market is the growing integration of liquid biopsy technologies for early cancer detection and monitoring. Liquid biopsies, which analyze circulating tumor DNA (ctDNA) or other biomarkers from a simple blood sample, offer a non-invasive, cost-effective, and rapid alternative to traditional tissue biopsies. For instance, companies like Guardant Health and Foundation Medicine are advancing liquid biopsy platforms that enable early detection of cancers, continuous disease monitoring, and assessment of treatment response. This technology is gaining significant traction in clinical practice as it improves patient outcomes, reduces diagnostic delays, and supports the shift toward minimally invasive approaches in oncology.

Key Highlights

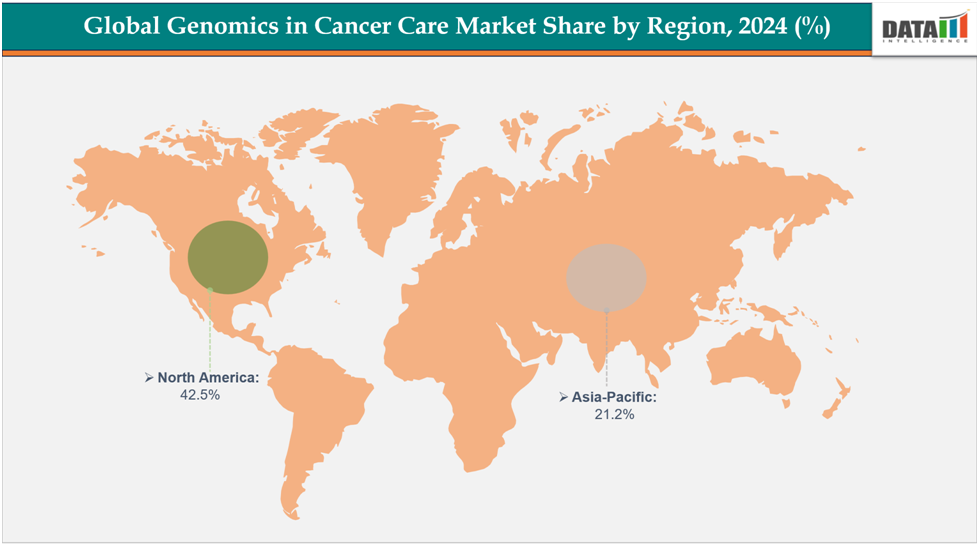

- North America dominates the genomics in cancer care market with the largest revenue share of 42.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.1% over the forecast period.

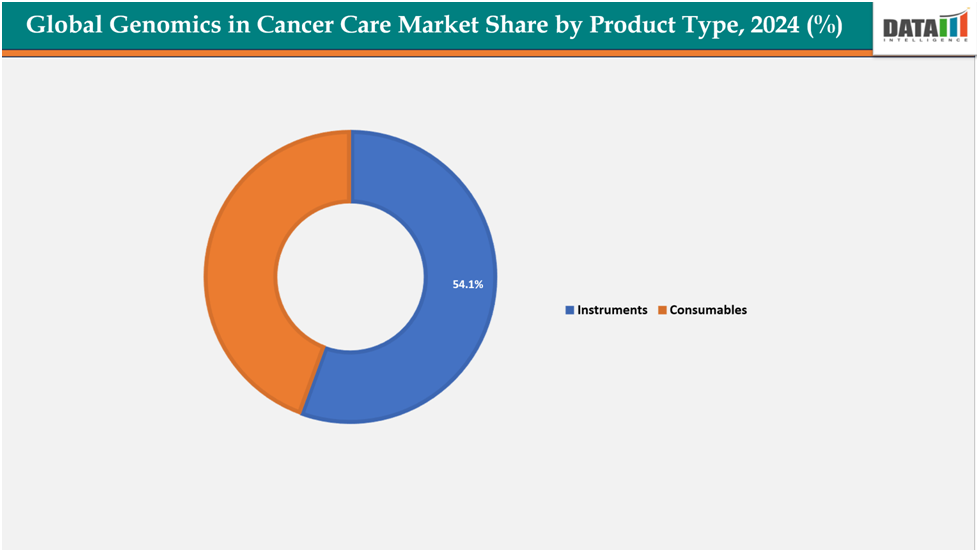

- Based on product type, instruments segmented the market with the largest revenue share of 54.1% in 2024.

- The major market players in the Illumina, Thermo Fisher Scientific, BGI Genomics, QIAGEN, Roche Diagnostics, Guardant Health, Natera, Myriad Geneticsand among others.

Market Dynamics

Drivers: Rising adoption of next-generation sequencing (NGS) in oncology diagnostics is significantly driving the genomics in cancer care market growth

The rising adoption of Next-Generation Sequencing (NGS) in oncology diagnostics is playing a transformative role in driving the global genomics in cancer care market, as it allows for a far deeper and more precise understanding of the genetic underpinnings of cancer. Unlike traditional methods, NGS can analyze hundreds to thousands of genes simultaneously, making it possible to detect a wide spectrum of mutations, including single nucleotide variants, insertions, deletions, copy number alterations, and gene fusions, all in a single test. This comprehensive profiling enables oncologists to identify actionable mutations and design highly targeted treatment strategies, significantly improving patient outcomes

For instance, in July 2025, Illumina Inc. has unveiled the latest version of its flagship cancer research assay, TruSight Oncology 500 v2, designed to deliver comprehensive genomic profiling (CGP). CGP plays a vital role in advancing precision medicine by generating detailed molecular tumor profiles that support research in therapy selection and clinical trial matching. The upgraded TSO 500 v2 provides an enhanced, streamlined sample-to-analysis workflow, underscoring Illumina’s commitment to offering researchers and laboratories high-quality, rigorously validated solutions for oncology research.

Restraints: Limited reimbursement policies and regulatory challenges are hampering the growth of the genomics in cancer care market

The global genomics in cancer care market faces significant barriers due to limited reimbursement policies and regulatory challenges. Despite technological advancements, genomic tests like next-generation sequencing and comprehensive genomic profiling remain expensive and lack standardized reimbursement frameworks. This restricts patient access, especially in emerging markets. The U.S. Centers for Medicare & Medicaid Services has approved coverage for certain FDA-approved NGS-based companion diagnostics, but similar support is inconsistent in European and Asia-Pacific regions. Regulatory complexities also hinder innovation and commercialization, restraining the genomics in cancer care market's growth potential.

For more details on this report – Request for Sample

Segmentation Analysis

The global genomics in cancer care market is segmented based on product type, technology, application, end user, and region.

Product Type:

The instruments from product type segment to dominate the genomics in cancer care market with a 54.1% share in 2024

The instruments segment is driven by the increasing demand for advanced platforms that enable high-throughput genomic analysis and efficient cancer research. Rising investments by hospitals, diagnostic centers, and research institutions in state-of-the-art sequencers, PCR systems, and microarrays are boosting adoption. Continuous innovations, such as automated sample preparation systems and integrated sequencing platforms, are enhancing accuracy, reducing turnaround time, and improving ease of use. Additionally, the growing prevalence of cancer and the need for rapid, precise diagnostics are pushing healthcare providers to adopt robust instruments that support large-scale genomic studies and routine clinical testing.

For instance, in September 2025, MGI Tech Co., Ltd. has launched the DNBSEQ-T7+, a high-throughput sequencer designed for large-scale genomic research. The T7+ delivers over 14 Tb/day of data in 24 hours, offering a smaller footprint, flexible run configurations, and end-to-end automation. Known as a "data mining machine," it redefines high-throughput sequencing by combining daily output with ease of use and multi-omics versatility.

Technology:

The next generation sequencing segment is estimated to have a 41.2% of the genomics in cancer care market share in 2024

The NGS segment is propelled by its ability to provide comprehensive genomic profiling, enabling the detection of multiple genetic alterations simultaneously for precision oncology. Its applications in therapy selection, prognosis, and minimal residual disease monitoring make it indispensable in cancer care.

Increasing clinical adoption of NGS-based companion diagnostics, along with regulatory approvals for tests like Illumina’s TruSight Oncology 500 and Thermo Fisher’s Oncomine Dx, is further accelerating growth. Declining sequencing costs, coupled with rising awareness of the role of genomics in personalized cancer treatment, are also major factors driving adoption. Moreover, government initiatives and funding support for genomics-based cancer research continue to strengthen the NGS segment’s position in the market.

Geographical Analysis

North America dominates the global genomics in cancer care market with a 42.5% in 2024

The market in North America is primarily driven by well-established healthcare infrastructure, widespread adoption of next-generation sequencing (NGS), and high investment levels from biotechnology and pharmaceutical companies. Favorable reimbursement frameworks, particularly for FDA-approved companion diagnostics, along with strong clinical research networks, further accelerate the integration of genomic testing in oncology. The presence of major players like Illumina, Thermo Fisher Scientific, and Guardant Health also strengthens regional growth.

In the U.S., the market is propelled by rising cancer prevalence, regulatory support from agencies like the FDA for genomic-based diagnostics, and strong reimbursement coverage for certain NGS tests under the Centers for Medicare & Medicaid Services (CMS). Additionally, the U.S. leads in clinical trials for targeted therapies and immunotherapies that require genomic profiling, boosting demand for advanced diagnostic assays and instruments.

For instance, in July 2025, NIST and other institutions have released extensive data on the genome of pancreatic cancer cells, enabling researchers, clinical labs, and drug and biotech companies to study cancer genes and develop lifesaving therapies, making this the first cancer cell line developed from an individual's consent.

Europe is the second region after North America which is expected to dominate the global genomics in cancer care market with a 34.5% in 2024

Growth in Europe is supported by government-backed precision medicine initiatives, increasing adoption of comprehensive genomic profiling in oncology, and collaborative efforts between research institutions and healthcare systems. Countries like Germany and France are investing heavily in integrating genomics into cancer care, while the EU’s focus on cross-border research programs is helping build advanced genomic networks.

The UK market benefits from strong government policies, including the NHS Genomic Medicine Service, which provides broad patient access to genomic testing. High cancer incidence rates, coupled with initiatives like the 100,000 Genomes Project, have positioned the UK as a leader in implementing large-scale genomic data for cancer research and patient care. Partnerships between academia, healthcare providers, and diagnostic companies are further fueling adoption.

The Asia Pacific region is the fastest-growing region in the global genomics in cancer care market, with a CAGR of 7.1% in 2024

The Asia-Pacific market is expanding rapidly due to rising cancer burden, improving healthcare infrastructure, and increasing government investments in genomic medicine. Countries such as China, India, and South Korea are driving growth through large-scale genome sequencing projects and partnerships with global players. The growing availability of cost-effective sequencing technologies is also encouraging adoption in clinical oncology settings.

Japan is a frontrunner in the region, driven by government-backed cancer genomic medicine programs and a supportive regulatory framework for NGS-based diagnostics. High awareness among clinicians, integration of genomic profiling in national healthcare guidelines, and early adoption of advanced sequencing platforms have positioned Japan as a key hub for precision oncology.

For instance, in May 2025, Illumina's TruSight Oncology Comprehensive assay has been approved by Japan's Ministry of Health, Labour and Welfare, as a Class III/IV Medical Device in Japan.

Competitive Landscape

Top companies in the genomics in cancer care market include Illumina, Thermos Fisher Scientific, BGI Genomics, QIAGEN, Roche Diagnostics, Guardant Health, Natera, Myriad Genetics and among others.

Illumina: Illumina is a leading provider of next-generation sequencing platforms and comprehensive genomic profiling (CGP) assays, enabling clinicians and researchers to analyze hundreds of cancer-related genes simultaneously. Its sequencing systems, including NovaSeq and NextSeq, are widely used in hospitals, diagnostic labs, and research institutions worldwide. Illumina has secured regulatory approvals in key markets like the U.S., Europe, and Japan, and has formed partnerships with pharmaceutical companies for companion diagnostics. Its continuous innovations in high-throughput sequencing, automation, and bioinformatics drive the growth of the cancer genomics market globally.

Key Developments:

- In September 2025, The Hyundai Motor India Foundation (HMIF) and IIT Madras have launched 'Hyundai Hope for Cancer', a program aimed at improving pediatric cancer care in India. The initiative includes the Hyundai Center for Cancer Genomics at IIT Madras, Chennai.

Market Scope

| Metrics | Details | |

| CAGR | 16.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Instruments, Consumables |

| Technology | Next Generation Sequencing, PCR, Microarrays, Nuclei Acid Extraction and Purification, Others | |

| Application | Diagnostics, Personalized Medicine, Drug Discovery & Development | |

| End User | Hospitals & Oncology Clinics, Diagnostic Labs, Academic & Research Centers, Pharma & CROs | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global genomics in cancer care market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here