Oral Mucositis Market Size & Industry Outlook

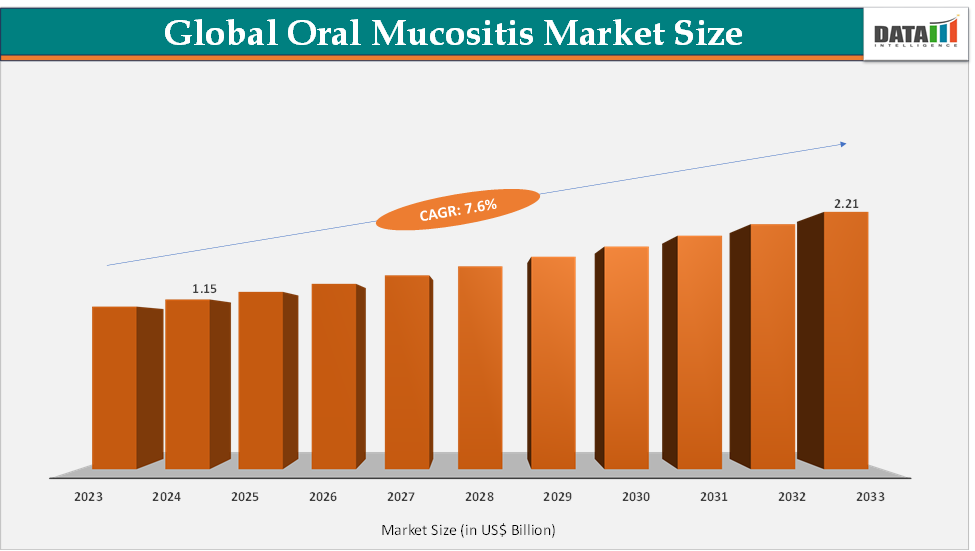

The global oral mucositis market size reached US$ 1.15 Billion in 2024 from US$ 1.07 Billion in 2023 and is expected to reach US$ 2.21 Billion by 2033, growing at a CAGR of 7.6% during the forecast period 2025-2033.

The oral mucositis market is evolving as cancer treatments become more aggressive and survival rates improve, highlighting the urgent need for supportive care. Patients receiving radiotherapy for head and neck cancer or stem cell transplants are especially vulnerable, driving hospitals and oncology centers to adopt specialized options such as palifermin, cryotherapy, and low-level laser therapy. Alongside these advanced interventions, everyday solutions like protective rinses, mucoadhesive gels, and herbal-based products are widely used to ease pain and maintain nutrition. This blend of clinical innovation and patient-driven demand reflects a market focused on improving treatment adherence and overall quality of life for cancer patients.

Key Market Trends & Insights

The key trends in the oral mucositis market are the growing adoption of low-level laser therapy (LLLT), now recommended in several oncology centers to prevent severe mucositis in head and neck cancer patients. The use of growth factors like palifermin remains significant, particularly in stem cell transplant cases where mucositis risk is highest.

At the same time, protective barrier-forming rinses such as Gelclair and Caphosol are widely prescribed to ease discomfort and protect mucosal tissue during chemotherapy and radiotherapy. Another notable trend is the rise of natural and herbal formulations, including honey-based gels and aloe vera rinses, driven by patient demand for gentler alternatives.

Finally, the expansion of home-use products and OTC solutions highlights a shift toward self-management, complementing hospital-based treatments and broadening patient access to supportive care.

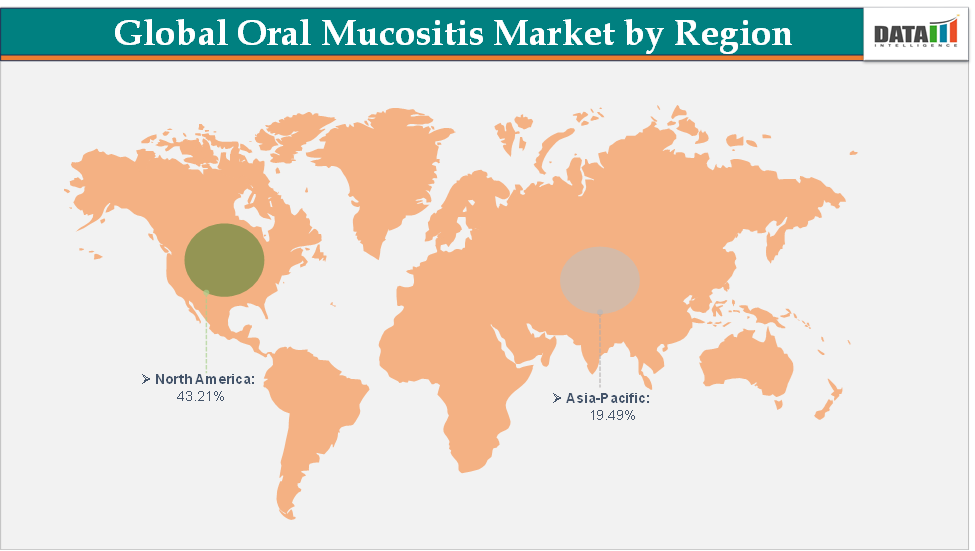

North America dominates the oral mucositis market with the largest revenue share of 43.21% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.1% over the forecast period.

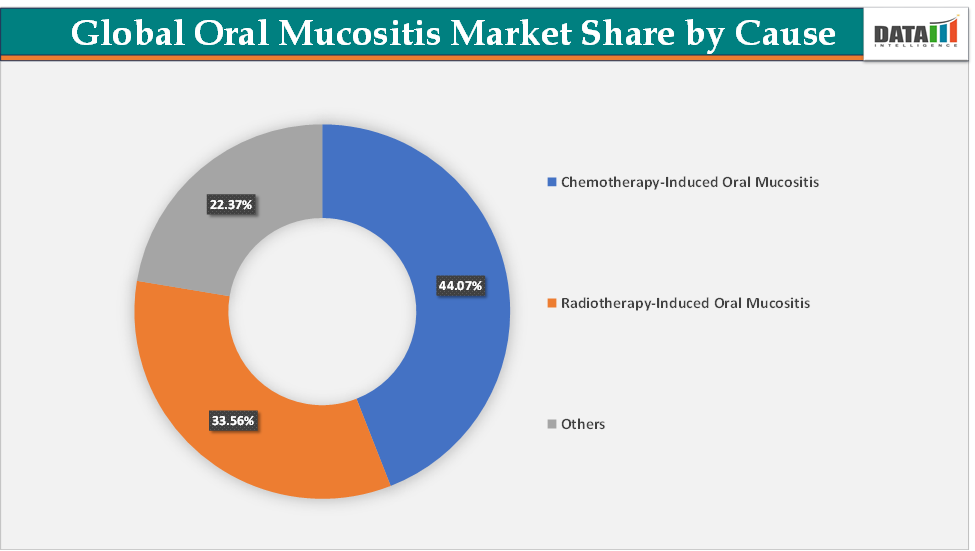

Based on cause, the chemotherapy-induced oral mucositis segment led the market with the largest revenue share of 44.07% in 2024.

The major market players in the oral mucositis market are Amgen Inc., Valerio Therapeutics, Napo Pharmaceuticals, Inc., Enlivity Corporation, MuReva Phototherapy Inc., Innovation Pharmaceuticals, Monopar Therapeutics Inc. and EpicentRx, Inc., among others

Market Size & Forecast

2024 Market Size: US$ 1.15 Billion

2033 Projected Market Size: US$ 2.21 Billion

CAGR (2025–2033): 7.6%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

For more details on this report – Request for Sample

Market Dynamics

Drivers:

Rising cancer incidence and intensive treatment protocols are significantly driving the oral mucositis market growth

Rising cancer incidence and the increasing intensity of treatment protocols are among the most powerful forces driving the growth of the oral mucositis market. Globally, cancer cases continue to rise, particularly in head and neck cancers, leukemias, and hematologic malignancies, where patients are most prone to mucositis due to aggressive chemotherapy and radiotherapy.

For instance, the National Cancer Institute estimates that about 72,680 people in the United States will receive a diagnosis of cancer of the oral cavity, pharynx, or larynx, the major types of head and neck cancer, in 2025. High-dose radiotherapy for head and neck cancer often causes ulcerative mucosal damage, while conditioning regimens for hematopoietic stem cell transplants are almost universally associated with severe oral mucositis. These clinical realities have created a strong need for effective supportive care solutions.

At the same time, low-level laser therapy (LLLT) devices are being adopted in radiotherapy units to prevent oral mucositis by stimulating tissue repair, a practice now recommended by MASCC/ISOO guidelines. In addition to these advanced interventions, widely used products like Caphosol and Gelclair mouth rinses, as well as mucoadhesive barrier gels, provide symptomatic relief for chemotherapy patients. Rising cancer incidence also expands the role of basic protective and soothing agents, including benzydamine rinses for radiotherapy-induced oral mucositis and chlorhexidine-based solutions for preventing secondary infections.

Restraints:

Side effects and limited efficacy of available treatments are hampering the growth of the oral mucositis market

One of the major restraints in the oral mucositis market is the side effects and limited efficacy of currently available treatments, which often discourage widespread adoption and long-term use. For instance, chlorhexidine-based mouth rinses, while widely prescribed for their antimicrobial activity, can cause side effects such as altered taste, tooth staining, and mucosal irritation, leading some patients to discontinue use. Similarly, systemic analgesics and opioids, frequently used for pain management, provide temporary relief but introduce risks of dependency, constipation, and drowsiness, making them far from ideal in a fragile cancer population.

Even more advanced options like palifermin, a recombinant growth factor, though effective in stem cell transplant patients, have limited application due to cost and reports of potential off-target effects such as rash, edema, or taste alteration. Meanwhile, benzydamine rinses, commonly prescribed in radiotherapy-induced mucositis, provide symptom relief but are often insufficient in preventing progression to severe ulcerative stages. Device-based therapies like low-level laser therapy (LLLT) show promise, yet their effectiveness depends heavily on the availability of trained operators, standardized protocols, and repeated sessions, making real-world outcomes variable. Moreover, natural and herbal remedies, including honey-based gels and aloe vera rinses, though well-accepted by patients, often lack robust clinical validation, which limits physician confidence and formal guideline inclusion.

Collectively, these shortcomings create a gap between patient needs and product performance, forcing clinicians to rely on symptomatic management rather than definitive prevention or cure. This inefficiency prolongs patient suffering, increases the risk of treatment interruptions, and adds to healthcare costs, ultimately restraining the growth of the market. Until more consistently effective and safe solutions are introduced, especially those balancing efficacy with minimal side effects, the market will continue to be hampered by skepticism and selective product adoption.

Oral Mucositis Market Segment Analysis

The global oral mucositis market is segmented based on drug class, cause, distribution channel, and region.

Cause:

The chemotherapy-induced oral mucositis segment is dominating the oral mucositis market with a 44.07% share in 2024

Chemotherapy-induced oral mucositis is the dominant segment in the oral mucositis market, holding the largest share due to the widespread use of chemotherapy across multiple cancer types and its well-documented side effects on the oral mucosa. Unlike radiotherapy, which mainly affects patients with localized head and neck cancers, chemotherapy is a systemic treatment administered to patients with leukemia, lymphoma, breast, colorectal, and other solid tumors, making the risk pool much larger. According to the National Institutes of Health, it is estimated that 40% the cases on standard chemotherapy may develop oral mucositis, which translates into a significant patient population requiring supportive care. The demand is further driven by high-intensity regimens like methotrexate, fluorouracil, cisplatin, and melphalan, which are known to cause severe oral lesions and ulcerations.

In more severe chemotherapy settings, particularly hematopoietic stem cell transplantation, biologic agents such as palifermin (a keratinocyte growth factor) are used to reduce mucosal injury and hospitalization rates. In addition, prophylactic methods like cryotherapy are increasingly being integrated into oncology practice as a cost-effective preventive measure. The large patient base, high recurrence with repeated cycles of chemotherapy, and availability of both symptomatic and advanced therapies create a robust and sustained demand in this segment. As cancer incidence continues to rise worldwide, especially in emerging markets, chemotherapy-induced oral mucositis will remain the dominant driver of market revenues, reinforcing its position as the largest contributor to the global oral mucositis market.

The radiotherapy-induced oral mucositis segment is the fastest-growing segment in the oral mucositis market, with a 33.56% share in 2024

Radiotherapy-induced oral mucositis is recognized as the fastest-growing segment in the oral mucositis market, largely due to the increasing global burden of head and neck cancers, where radiotherapy is a primary treatment modality. Unlike chemotherapy, which affects systemic tissues, radiotherapy delivers high-dose localized energy to the oral and pharyngeal regions, directly damaging the mucosal lining and triggering painful ulcerations. According to the National Institutes of Health, patients receiving radiation, especially in the cases of head and neck cancer, have 30%–60% chances of developing mucositis.

The adoption of advanced devices is further driving the segment as the fastest-growing region in the market. For instance, in June 2025, MuReva OM, an innovative intra-oral photobiomodulation (PBM) device, is showing promise in reducing the burden of severe oral mucositis in patients undergoing radiation therapy for head and neck cancer. Presented by Dr. Alessandro Villa (United States) at MASCC 2025, new Phase III trial results highlight the device’s safety, excellent adherence, and significant clinical benefit, positioning MuReva OM as a potential standard of care in supportive oncology.

Patients also turn to natural remedies such as honey, which has shown efficacy in reducing mucositis severity during head and neck radiotherapy. As radiotherapy technology advances, particularly with intensity-modulated radiotherapy (IMRT) and proton therapy, longer treatment durations and higher precision dosing increase mucositis risk, further intensifying the need for effective supportive care. This expanding clinical demand, coupled with the rise of oncology infrastructure in emerging economies, positions radiotherapy-induced oral mucositis as the fastest-growing segment.

Oral Mucositis Market Geographical Analysis

North America is expected to dominate the global oral mucositis market with a 43.21% in 2024

North America has firmly established itself as the leading force in the global oral mucositis market, distinguished by its robust oncology therapy adoption, regulatory agility, and an influx of innovative solutions. The region accounts for approximately 43.21% of global market revenues, supported by a high incidence of head and neck cancers, widespread adoption of supportive care treatments, and well-integrated cancer care systems, especially in the United States, which accounts for an 85.12% share in North America.

The presence of major and emerging players in the region is further accelerating the market growth in the region, with continuous product launches along with FDA approvals. For instance, in October 2024, Jaguar Health, Inc. announced that Jaguar family company Napo Pharmaceuticals has initiated the commercial launch of the FDA-approved oral mucositis prescription product Gelclair in the U.S. Napo's core target audiences for the Gelclair launch are patients with head and neck cancer and oncology-focused health care practitioners. Head and neck cancers account for nearly 4 percent of all cancers in the United States, according to the National Cancer Institute (NCI). Counting cancers of the oral cavity, pharynx, and larynx, the NCI estimates that about 71,110 cases occur in the U.S. in 2024.

The Asia Pacific region is the fastest-growing region in the global oral mucositis market, with a CAGR of 7.1% in 2024

The Asia-Pacific (APAC) region is experiencing the most rapid expansion in the global oral mucositis market, underpinned by surging cancer rates, improving healthcare infrastructure, and enhanced access to supportive therapies. Key contributors include the increasing incidence of cancer in densely populated APAC nations, which raises the demand for managing chemotherapy- and radiotherapy-induced oral mucositis. Concurrently, many governments are ramping up investments in oncology care infrastructure, elevating awareness about mucositis, and expanding access to treatments via hospital systems and public health initiatives.

For instance, in March 2025, GenSci announced the official launch of its flagship product, Episil, now available in China for oral mucositis. Through a strategic partnership, Solasia Pharma K.K. granted GenSci exclusive commercialization rights for Episil in China. As the only clinically validated mucosal protectant with a registered clinical trial in China, Episil brings new hope to cancer patients battling treatment-related oral complications.

Oral Mucositis Market Top Companies

Top companies in the oral mucositis market include Amgen Inc., Valerio Therapeutics, Napo Pharmaceuticals, Inc., Enlivity Corporation, MuReva Phototherapy Inc., Innovation Pharmaceuticals, Monopar Therapeutics Inc., and EpicentRx, Inc., among others.

Oral Mucositis Market Scope

Metrics | Details | |

CAGR | 7.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | Antibiotics, Anti-Fungal Drugs, Anti-Viral Drugs, Anti-Inflammatory Drugs, Anti-Neoplastic Drugs, and Others |

Cause | Chemotherapy-Induced Oral Mucositis, Radiotherapy-Induced Oral Mucositis, and Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global oral mucositis market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.