Infusion Pumps Market Size

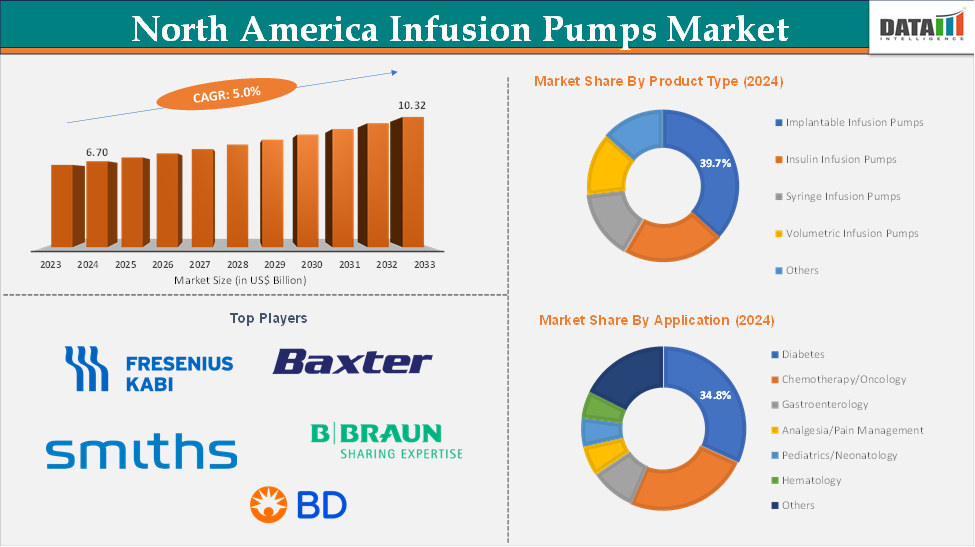

The North America infusion pumps market size reached US$ 6.70 Billion in 2024 and is expected to reach US$ 10.32 Billion by 2033, growing at a CAGR of 5.0% during the forecast period 2025-2033.

Infusion Pumps Market Overview

The North America infusion pumps market is expanding steadily, largely due to the growing incidence of chronic diseases such as diabetes, cancer, and heart conditions, which require precise and reliable medication delivery. Technological advancements, especially the rise of smart infusion pumps, are enhancing patient safety by minimizing errors and improving efficiency. Additionally, regulatory support for advanced infusion technologies is driving innovation and widespread adoption in healthcare settings. With increasing demand for automated and seamlessly integrated IV pumps, the market is set for significant growth in the coming years.

Infusion Pumps Market Executive Summary

Infusion Pumps Market Dynamics: Drivers & Restraints

Rising technological advancements is significantly driving the infusion pumps market growth

Advancements in technology are playing a key role in the growth of the infusion pumps market, improving efficiency, safety, and connectivity in healthcare. The rise of smart infusion pumps equipped with advanced software integration is enhancing medication accuracy, reducing errors, and optimizing clinical workflows. Features like wireless connectivity, automation, and AI-driven monitoring are making infusion systems more reliable and adaptable across different medical settings.

For instance, in April 2024, Baxter International Inc. has secured FDA 510(k) clearance for its Novum IQ large volume infusion pump (LVP) with Dose IQ Safety Software, expanding its Novum IQ Infusion Platform to provide integrated medication delivery in diverse care environments.

Similarly, in April 2025, ICU Medical has reached new regulatory milestones, introducing a new category of infusion devices designed to improve precision and efficiency in therapy. These advancements underscore how cutting-edge technology is transforming the infusion pumps market, making treatments safer, more effective, and aligned with modern healthcare demands.

The high costs of advanced infusion pumps hampering the growth of the infusion pumps market

The high price of advanced infusion pumps is a major obstacle to market growth, making it difficult for many healthcare providers and patients to access these cutting-edge devices. While they come equipped with smart technology, wireless connectivity, and automated safety features, their cost remains a major limitation, especially for smaller hospitals, clinics, and home healthcare setups that struggle to afford them.

For more details on this report – Request for Sample

Infusion Pumps Market, Segment Analysis

The North America infusion pumps market is segmented based on product type, application, and end-user.

The insulin infusion pumps from the device type segment are expected to hold 51.2% of the market share in 2024 in the infusion pumps market

The insulin infusion pumps segment is expected to lead the North America infusion pumps market, driven by the rising prevalence of diabetes and the increasing adoption of advanced insulin delivery systems. With a growing diabetic population, particularly in the United States and Canada, there is a heightened demand for continuous insulin infusion therapy, which offers better glucose control compared to traditional injection methods.

Technological advancements, including smart insulin pumps with automated dosing and connectivity features, are further fueling market expansion. For instance, in March 2025, Tandem Diabetes Care, Inc. officially launched Control-IQ+ technology in the United States. This latest advancement features an enhanced hybrid closed-loop algorithm, designed to optimize automated insulin dosing and improve diabetes management for users.

Additionally, the convenience of wearable and patch-based insulin pumps is attracting more users, especially those seeking improved lifestyle management. As healthcare providers and patients prioritize precision and ease of use, the Insulin Infusion Pumps segment is set to maintain its dominance in the market.

Infusion Pumps Market Competitive Landscape

Top companies in the North America infusion pumps market include JMS North America Corporation, Micrel Medical Devices SA, Biomedix Medical, Inc., Moog Inc., BD, Medtronic, Smiths Group plc, Fresenius Kabi USA, LLC, Baxter, and B. Braun SE, among others.

Infusion Pumps Market, Key Developments

In May 2024, Moog Inc. announced that its Industrial segment has received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the CURLIN 8000 Ambulatory Infusion System. This advanced infusion platform is designed specifically to meet the needs of home infusion therapy.

Infusion Pumps Market Scope

Metrics | Details | |

CAGR | 5.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Implantable Infusion Pumps, Insulin Infusion Pumps, Syringe Infusion Pumps, Volumetric Infusion Pumps, Others |

Application | Diabetes, Chemotherapy/Oncology, Gastroenterology, Analgesia/Pain Management, Pediatrics/Neonatology, Hematology, Others | |

End-User | Hospitals & Clinics, Ambulatory Care Settings, Home Care Settings, Academic & Research Institutes, Others | |

The North America infusion pumps market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.