New Crop Protection Generics Market Size

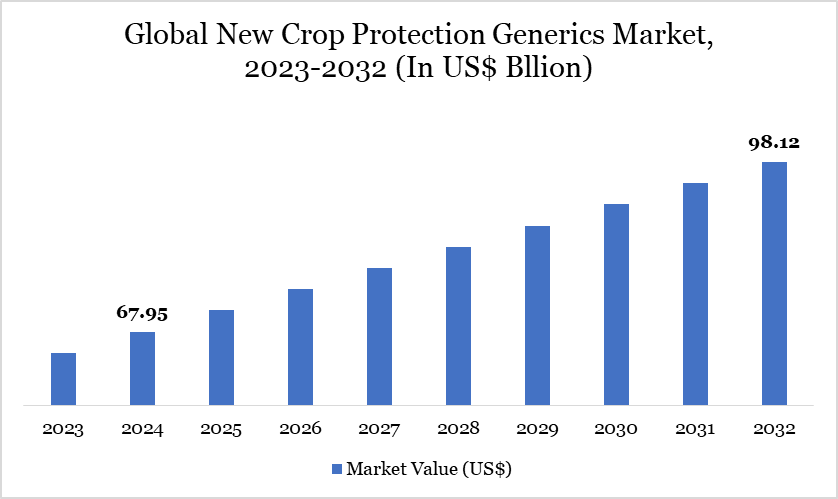

New Crop Protection Generics Market reached US$ 67.95 billion in 2024 and is expected to reach US$ 98.12 billion by 2032, growing at a CAGR of 4.7% during the forecast period 2025-2032.

The demand for new crop protection generics is rising, driven by the need for cost-effective alternatives to patented agrochemicals. As patents for many original crop protection products expire, farmers increasingly turn to generics, which offer comparable efficacy at lower costs. The trend is especially pronounced in regions where agriculture is a key economic activity and cost management is critical for farmers.

As pest and disease resistance grows, generics featuring advanced formulations and new active ingredients are becoming essential in maintaining crop yields. The innovations enhance pest control effectiveness, making generics a critical tool in integrated pest management (IPM) strategies. Regulatory support for generics is driving further adoption, ensuring consistent market growth.

ASCENZA is one of the key players in differentiated generics for crop protection, focusing on off-patent solutions to enhance accessibility and meet regulatory demands. The company invests 9% of its revenue in R&D, combining technical and regulatory expertise to provide high-quality, adaptable solutions. As part of the Rovensa group, ASCENZA’s strategy supports farmers with scalable, sustainable crop protection, contributing to a healthier agricultural system.

New Crop Protection Generics Market Trend

The crop protection industry is undergoing significant transformation driven by global disruptions, such as supply chain instability, geopolitical tensions and rising ESG demands, alongside long-standing trends like consolidation, pest resistance and the rise of precision agriculture.

As highlighted by the Council of Producers & Distributors of Agrotechnology (CPDA) in 2023, generics now dominate over 70% of the crop protection market. The increasing dominance of generics is reshaping distribution strategies, prompting vertically integrated models and driving demand for cost-effective, sustainable solutions aligned with precision agriculture and biological innovations.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

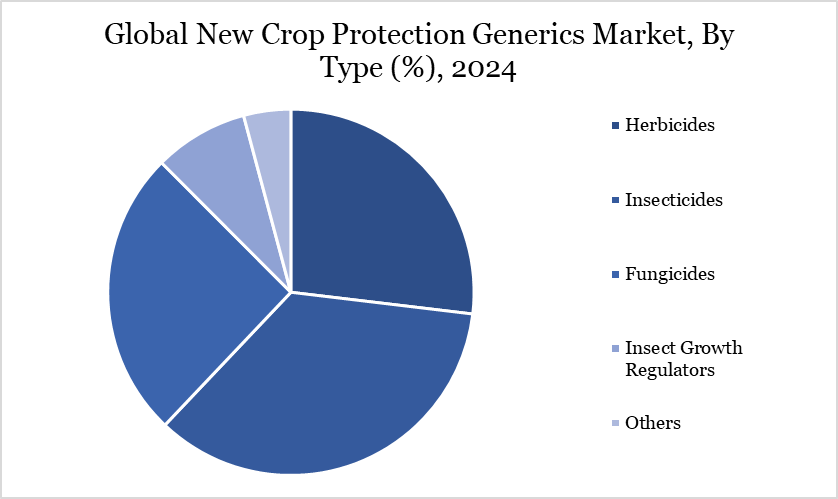

By Type | Herbicides, Insecticides, Fungicides, Insect Growth Regulators and Others |

By Mode of Application | Foliar Spray, Seed Treatment, Soil Treatment, Post-harvest and Others |

By Crop Type | Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Commercial Crops and Others |

Formulation | Liquid, Granular, Powder and Emulsifiable Concentrates |

By Distribution Channel | Retailers, Distributors, E-commerce and Cooperative Societies |

By Region | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

New Crop Protection Generics Market Dynamics

Rising Demand for Food Security

The rising demand for food security in 2024 is set to significantly impact the growth of the crop protection generics market. With initiatives such as the World Bank's US$ 45 billion commitment to combat food insecurity, there will be increased investment in affordable agricultural inputs, including generics. The trend is supported by favorable regulatory frameworks and increased emphasis on sustainability, especially in low-income regions where food insecurity is most pronounced. As a result, the generics market is positioned to expand rapidly, responding to the urgent need for effective crop protection solutions.

Moreover, the shift toward generics will enhance competition and accessibility for farmers, facilitating improved agricultural productivity. The growing focus on environmentally sustainable practices will drive innovation within the market, prompting companies to develop cost-effective solutions that align with evolving consumer and regulatory demands. The dynamic landscape not only presents lucrative opportunities for market participants but also plays a crucial role in strengthening global food security initiatives.

Stringent Regulatory Environment

The regulatory landscape for new crop protection generics is becoming more stringent, requiring extensive safety, environmental and efficacy data, leading to longer development cycles and higher R&D costs. Companies innovate through sustainable practices, such as integrating biological solutions and advanced breeding techniques. It creates both challenges and opportunities for differentiation in a competitive market, pushing firms to align with global environmental standards.

According to Indian Agrochemicals Industry, India’s crop protection industry faces a stringent regulatory environment, particularly for new generics, with complex registration processes and high R&D costs. Most local companies focus on producing generics due to lower investment needs and faster market entry. However, shrinking demand for generics in key global markets such as the US and Europe pressures Indian firms to innovate. With local R&D spending at only 1-2% compared to multinationals’ 12-15%, Indian companies must increase focus on developing new active ingredients to stay competitive.

New Crop Protection Generics Market Segment Analysis

The global new crop protection generics market is segmented based on type, mode of application, crop type, formulation, distribution channel and region.

The Surging Demand for Herbicides Crop Protection Products

The herbicides segment is expected to be the dominant segment, holding an approximate market share of 32% during the forecast period.

The demand for herbicides in the generic crop protection market remains robust, driven by factors such as the increasing need for effective weed management to enhance crop yields and quality, rising concerns over resistant weed species and the push for sustainable agriculture practices further fuel demand. Additionally, the shift towards cost-effective solutions in crop production makes herbicides a vital component, especially in high-value crops like rice and tea, where weed control directly impacts productivity and profitability.

For instance, in May 2023, BASF launched two advanced herbicides, Facet and Duvelon, to help Indian farmers combat weed challenges in rice and tea cultivation. Facet, utilizing Quinclorac, targets grassy weeds in rice, while Duvelon, with Kixor Active, addresses broadleaf weeds in tea plantations. Both solutions enhance weed management efficiency, supporting higher crop yields and reinforcing BASF’s dedication to sustainable agricultural innovation.

New Crop Protection Generics Market Geographical Share

Rising Demand for Generic Crop Protection Products in Asia Pacific

Asia-Pacific is expected to be the dominant region in the global new crop protection generics market, holding an approximate market share of 35% during the forecast period.

The agricultural industry in the Asia-Pacific region is witnessing a significant increase in demand for generic crop protection products. Several factors, including the need for cost-effective solutions among farmers and the rising emphasis on sustainable agricultural practices, primarily drive this trend. As traditional branded products often come with high price tags, generic alternatives are becoming increasingly attractive, allowing growers to maintain competitiveness while managing costs.

Furthermore, the growing awareness of environmental sustainability and regulatory pressures is pushing farmers to explore more diverse crop protection strategies. Generic products often offer similar efficacy as their branded counterparts, enabling farmers to adopt integrated pest management approaches without compromising performance. The shift is particularly relevant in countries where agricultural productivity is essential for food security and economic stability.

For instance, in September 2024, FMC Corporation, a leading player in agricultural sciences, introduced three advanced crop protection solutions, Velzo fungicide, Vayobel herbicide and Ambriva herbicide, into the Indian market, enhancing its existing portfolio. The launch, attended by FMC's senior leadership, signifies the company's dedication to addressing Indian farmers' evolving needs through science-driven solutions.

Sustainability Analysis

The new crop protection generics market is shifting toward sustainability, driven by regulatory pressure, environmental concerns and demand for eco-friendly solutions. Generic manufacturers are increasingly investing in green chemistry, developing low-residue and biodegradable formulations and aligning their portfolios with Integrated Pest Management (IPM) frameworks. Additionally, many companies are adopting circular packaging, sustainable sourcing practices and energy-efficient manufacturing to enhance their environmental footprint and meet the compliance requirements of markets such as the EU and North America.

FMC Corporation’s 2024 sustainability report emphasizes how embedding sustainability into its business strategy enhances efficiency, reduces environmental impact and supports long-term growth. Key achievements include a 27% reduction in Scope 1 and 2 emissions and a 6% cut in waste, generating nearly US$6 million in cost savings. The company’s innovation pipeline featuring advanced fungicides, pheromone- and microbial-based products and sustainable formulations demonstrates its commitment to promoting resilient, environmentally responsible agriculture.

New Crop Protection Generics Market Major Players

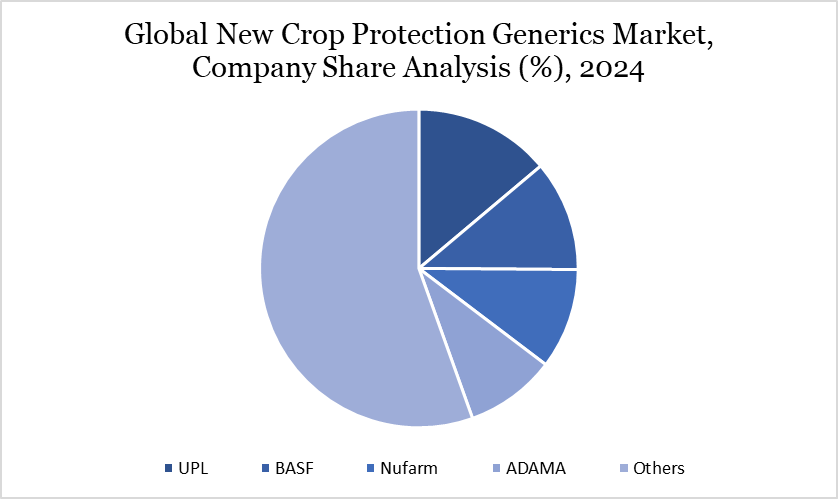

The major global players in the market include UPL, BASF, Nufarm, ADAMA, FMC Corporation, Bayer AG, Albaugh LLC, AMVAC Chemical Corporation, Wynca Group, Sumitomo Chemical Co., Ltd., Coromandel International Limited and Syngenta.

Key Developments

In May 2024, Coromandel International Ltd. launched five new generic formulations, underscoring its commitment to sustainable farming innovation. Notably, the collaboration with ISK Japan led to the introduction of Prachand, a product designed to protect paddy crops from pests, potentially averting yield losses of up to 70%. Additionally, a formulation targeting the fall armyworm enhances the product lineup. The expansion reinforces Coromandel's leadership in providing effective crop protection solutions.

In September 2023, ADAMA Ltd. launched Cosayr and Lapidos, featuring Chlorantraniliprole (CTPR), produced in-house. Targeted at paddy and sugarcane farmers, these products effectively combat key pests, enhancing crop yields and quality. Lapidos offers broad-spectrum protection during early growth stages, while Cosayr addresses critical threats like stem borers and leaf folders in rice cultivation.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies