Global Modular Construction Market: Industry Outlook

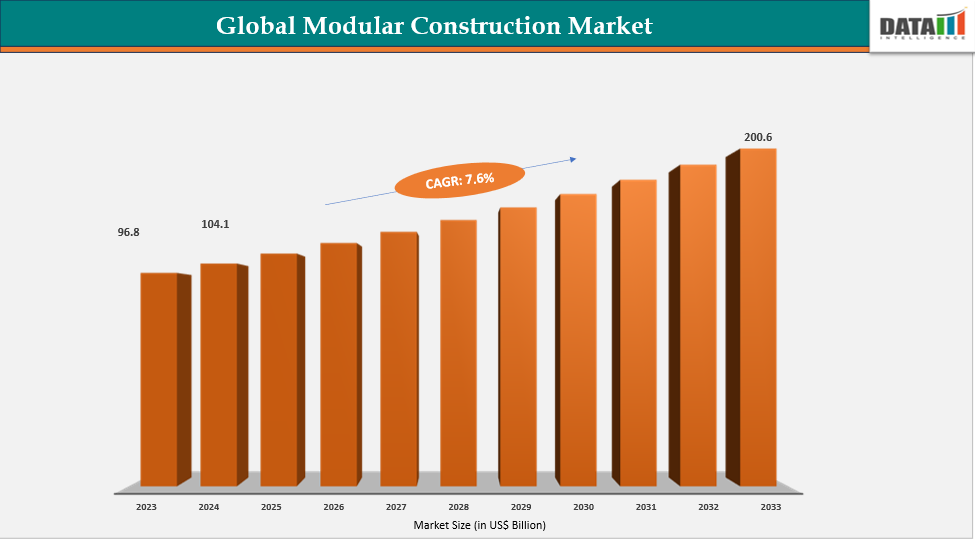

The global modular construction market reached US$ 96.8 billion in 2023, with a rise to US$ 104.1 billion in 2024, and is expected to reach US$ 200.6 billion by 2033, growing at a CAGR of 7.6% during the forecast period 2025–2033. The global modular construction market is experiencing robust growth, driven by its ability to address critical industry challenges such as skilled labor shortages, tight project schedules, and the demand for more sustainable building practices. This off-site manufacturing method offers significant advantages in speed, cost predictability, quality control, and waste reduction. The market's expansion is fueled by demand across sectors, including residential, commercial, education, and healthcare. Key drivers include rapid urbanization, the need for affordable housing, and increased investment in public infrastructure. This growth is further supported by technological advancements in Building Information Modeling (BIM) and manufacturing, which enhance the efficiency and complexity of modular projects.

This market growth is substantiated by tangible performance metrics that underscore the rising demand. Modular construction cuts material waste by up to 90% compared to traditional site-based methods. These efficiencies are critical for meeting ambitious development goals, as seen in regions such as the Asia-Pacific, where government mandates are accelerating adoption. In the United States, the market is also gaining considerable traction, with the number of authorized modular single-family homes growing by over 6% annually.

Key Market Trends & Insights

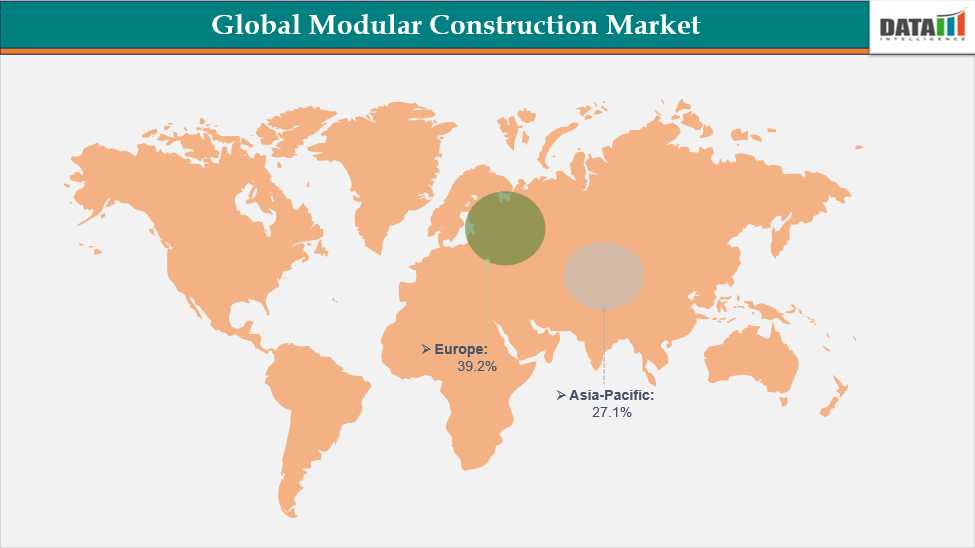

Europe is the largest market with sustainability regulations being the key trend, pushing the adoption of modular methods for their inherent material efficiency and reduced waste. The EU's Construction Products Regulation and energy performance directives are incentivizing off-site construction, which can reduce material waste by up to 90% compared to traditional sites.

Asia Pacific is the fastest growing market with government-led initiatives being the primary driver, with countries such as Singapore and India using modular construction to rapidly address massive housing and infrastructure deficits. For instance, Singapore’s Building and Construction Authority aims to triple its prefabrication volume by 2025 to enhance productivity.

North America focuses on high-volume, permanent modular construction for the institutional sector, particularly for healthcare and education facilities. Advancements in design and manufacturing now allow for high-rise, architecturally complex permanent modular construction (PMC) that rivals traditional builds in quality and aesthetics, while offering superior schedule certainty and reduced on-site disruption.

Market Size & Forecast

2024 Market Size: US$ 104.1 billion

2033 Projected Market Size: US$ 200.6 billion

CAGR (2025–2033): 7.6%

Europe : Largest market in 2024

Asia-Pacific : Fastest-growing market

Market Dynamics

Driver: Intensifying Pressure to Achieve Unparalleled Project Speed and Schedule Certainty

A critical driver propelling the global modular construction market is the intensifying pressure to achieve unparalleled project speed and schedule certainty. In an industry plagued by delays and cost overruns, the off-site fabrication of building components concurrently with on-site foundation work can dramatically compress overall project timelines. This accelerated delivery is paramount for sectors such as healthcare, hospitality, and multi-family housing, where time directly equates to revenue and addressing urgent needs. Studies consistently show that modular construction can reduce project schedules by 30 to 50% compared to traditional methods, offering a significant competitive advantage.

This is powerfully illustrated by the case study of the CitizenM Bowery Hotel in New York City. Facing a constrained urban site and a demanding schedule, the developer utilized 210 fully-finished modular units manufactured in Poland. These modules were then shipped across the Atlantic and stacked into place on the prepared foundation. This innovative approach allowed the 21-story hotel to be completed in a mere 18 months, a project that would have taken an estimated three years using conventional construction, effectively cutting the build time in half and ensuring a faster return on investment.

The demand for such efficiency is quantifiable in market growth projections linked to speed and risk mitigation. The market expansion is heavily attributed to the method's ability to de-risk projects from weather delays and labor variability, ensuring on-time and on-budget completion. This proven capability to guarantee schedule adherence makes modular construction an increasingly indispensable solution for developers and investors worldwide.

Restraint: Persistent Challenge of High Initial Capital Investment and Financing

A primary restraint on the modular construction market is the persistent challenge of high initial capital investment and financing. Establishing or contracting manufacturing facilities requires significant upfront capital for land, factory setup, and specialized equipment, creating a substantial barrier to entry. Furthermore, traditional lenders and appraisers often remain unfamiliar with the modular process, perceiving it as higher risk, which can complicate securing favorable project financing. This financial hesitation slows widespread adoption, as developers may default to familiar, though less efficient, traditional methods despite modular's long-term cost and schedule benefits.

For more details on this report, Request for Sample

Segmentation Analysis

The global modular construction market is segmented based on construction type, category, material, end-use, and region.

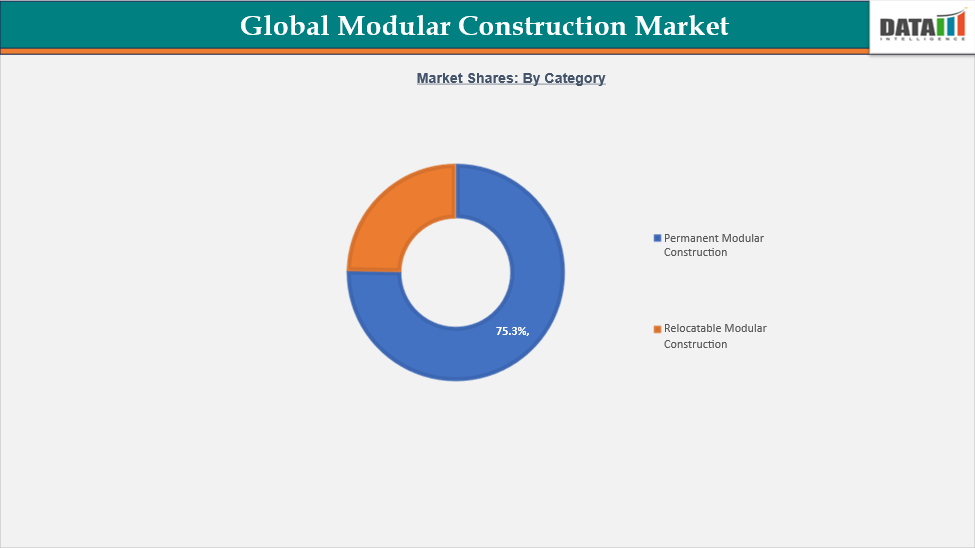

Category: the permanent modular construction segment is estimated to have 75.3% of the modular construction market share.

Permanent modular construction (PMC) is the dominant and innovation-driven segment of the off-site industry, focused on producing high-quality, code-compliant buildings designed for a full lifespan on a fixed foundation. It has evolved far beyond basic structures to encompass sophisticated multi-story apartments, hospitals, hotels, and university campuses. This segment's growth is propelled by its ability to deliver superior project certainty, enhanced quality control in a factory environment, and a more sustainable approach with significantly reduced material waste. PMC is redefining modern construction by merging manufacturing efficiency with architectural design flexibility.

The financial and temporal advantages are substantiated by robust data. A McGraw Hill Construction report states that out of over 800 architecture, engineering and contracting (AEC) professionals surveyed, 66% report improved project schedules, 65% report decreased project costs, and 77% report reduced construction site waste, a key component in the rising adoption of green building. Furthermore, the factory environment allows for precision that reduces construction waste. This efficiency is crucial for meeting the demands of urban densification and acute housing shortages, making PMC a strategic solution for developers and governments alike.

Geographical Analysis

The Europe modular construction market was valued at 39.2% market share in 2024

Europe represents a mature and highly innovative modular construction market, distinguished by its stringent regulatory environment and leading commitment to sustainability. The drive is heavily influenced by the European Green Deal and ambitious carbon neutrality targets, making the material efficiency and reduced waste of off-site manufacturing a strategically vital construction method. This regulatory push is complemented by a strong cultural appreciation for high-quality design and engineering precision, particularly in nations such as Sweden, Germany, and the United Kingdom. The European approach often focuses on permanent, high-performance buildings that meet rigorous energy standards.

Market growth is firmly anchored in this sustainability mandate. The EU’s Construction Products Regulation and Energy Performance of Buildings Directive (EPBD) are powerful drivers, incentivizing methods that can drastically lower a building's embodied carbon. This is evidenced by the fact that modular construction in Europe can reduce CO2 emissions by up to 45% compared to traditional methods. Furthermore, the region is a leader in the circular economy for buildings, with modular designs increasingly prioritizing demountability and the reuse of components, thus minimizing lifecycle environmental impact.

The Asia-Pacific modular construction market was valued at 27.1% market share in 2024

The Asia-Pacific region is the epicenter of the global modular construction market, driven by an unprecedented pace of urbanization and massive governmental infrastructure initiatives. Nations such as China, Japan, and India are leveraging off-site manufacturing to rapidly address the housing needs of their vast urban populations and close critical infrastructure gaps. This state-backed drive is a primary differentiator from other regions, where market forces are a bigger catalyst. The region's established manufacturing prowess and supply chain expertise provide a natural advantage for factory-based production, seamlessly integrating construction into its industrial ecosystem.

In China, the prefabricated buildings now account for over 20% of all new urban construction, with a government mandate targeting 30% by 2026. This policy-driven adoption is unmatched in scale elsewhere, fueling demand for millions of modular units to fulfill ambitious public and private development plans across the region. Cities like Beijing, Shanghai, and Shenzhen are hubs where modular housing and office projects are increasingly mainstream. Moreover, China is investing heavily in smart building integration, combining modular approaches with Building Information Modelling (BIM) and digital twin technologies for efficiency.

Competitive Landscape

The global modular construction market features several prominent players, including Laing O'Rourke, Bouygues Construction, Skanska, ATCO Structures, Red Sea International, Katerra KSA, Lendlease, Guerdon Modular Buildings, Clayco Compute, Algeco, among others.

Bouygues Construction: Bouygues Construction is a major global player in the modular construction market, leveraging its extensive building expertise through dedicated subsidiaries such as Bouygues Bâtiment International and Bouygues Energies & Services. The group is one of the leaders in Europe, focusing on high-quality and innovative off-site solutions for sectors such as healthcare, education, and residential housing. Sustainability is central to its strategy. Bouygues is committed to reducing greenhouse gas emissions, using low-carbon materials, and incorporating eco-design, as well as innovating around energy efficiency.

Market Scope

Metrics | Details | |

CAGR | 7.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Construction Type | 2D, 3D and Hybrid |

Category | Permanent Modular Construction and Relocatable Modular Construction | |

Material | Concrete, Steel, Wood and Others | |

End-use | Residential, Retail & Commercial, Healthcare, Education, Hospitality, Commercial Offices and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global modular construction market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 230 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here