Overview

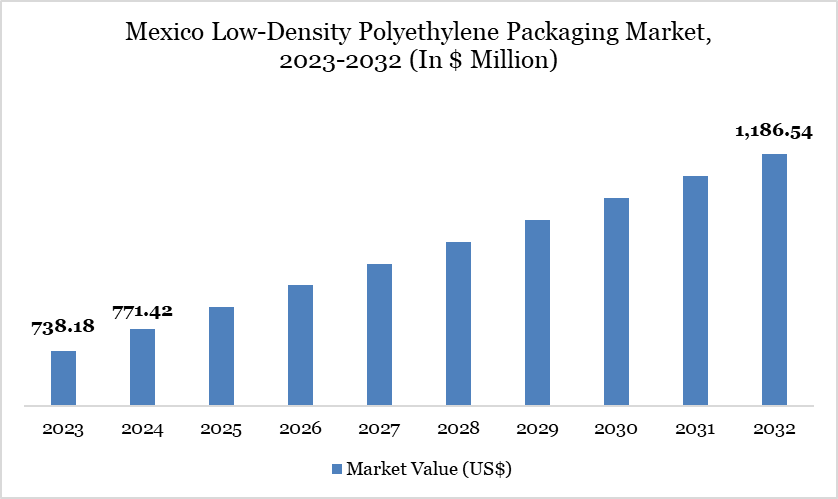

The Mexico low-density polyethylene packaging market reached US$771.42 million in 2024 and is expected to reach US$1,186.54 million by 2032, growing at a CAGR of 5.65% during the forecast period 2025-2032.

The Mexico low-density polyethylene (LDPE) packaging market is experiencing steady growth, driven by rising demand from the food & beverage, personal care, and pharmaceutical sectors. The material’s flexibility, lightweight nature, and excellent moisture barrier properties make it ideal for films, pouches, and containers. The growing e-commerce and retail sectors further boost demand for durable, protective packaging.

According to the IEA, in 2022, Mexico produced 14.6 million tons of packaging containers and packaging materials, with a total estimated value of US$22 billion, reflecting the strong momentum in the industry. Additionally, increased investment in sustainable and recyclable LDPE solutions is supporting market expansion. Technological advancements in extrusion and molding processes are also enhancing product performance. Overall, the market is growing in response to industrial development and shifting consumer preferences for packaging.

Low-Density Polyethylene Packaging Market Trend

Growth in e-commerce packaging is a significant trend shaping the Mexico low-density polyethylene (LDPE) packaging market. The rapid expansion of online retail has increased the need for lightweight, durable, and flexible packaging materials to protect goods during transit. LDPE films and mailer bags are widely used due to their moisture resistance and adaptability. This surge in demand is encouraging local manufacturers to scale up production and adopt advanced extrusion technologies. As e-commerce continues to grow, LDPE packaging is expected to play a vital role in supporting logistics efficiency and product safety.

Market Scope

Metrics | Details |

By Product Type | Films & Sheets, Bags & Pouches, Tubes, Containers and Bottles, Others |

By Manufacturing Process | Blown Film Extrusion, Cast Film Extrusion, Injection Molding, Others |

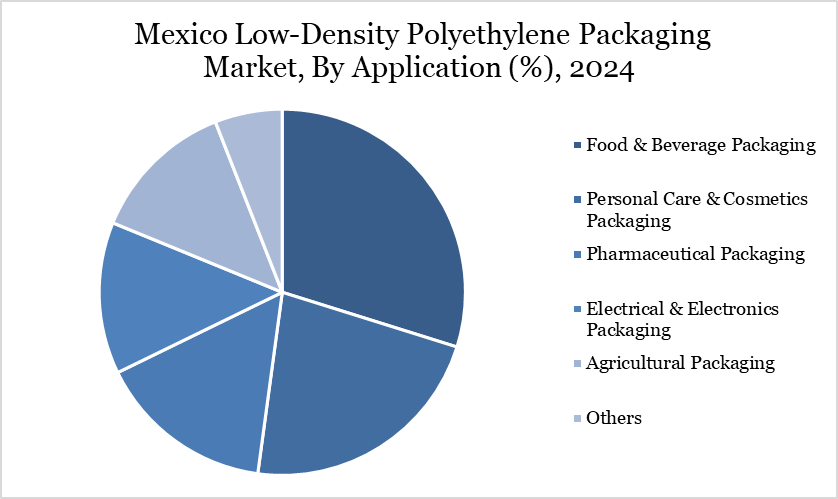

By Application | Food & Beverage Packaging, Personal Care & Cosmetics Packaging, Pharmaceutical Packaging, Electrical & Electronics Packaging, Agricultural Packaging, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing E-commerce Industry

The growing e-commerce industry is a major driver of the low-density polyethylene (LDPE) packaging market in Mexico. With the rise in online shopping, there is increased demand for flexible, lightweight, and durable packaging materials like LDPE for bags, pouches, and protective films. According to the Mexican Online Sales Association, the country's e-commerce market was valued at US$26.2 billion in 2022, up 23% from 2021, highlighting the rapid growth.

Mexico is now among the top five countries globally in terms of e-commerce retail growth, indicating a strong future demand for packaging. The number of e-commerce users reached 63 million in 2022, an increase of 5.5 million from the previous year. This surge is boosting the need for efficient packaging solutions that ensure safe delivery and product integrity. LDPE’s strength, moisture resistance, and printability make it ideal for protective and visually appealing e-commerce packaging. As fulfillment and logistics expand, LDPE packaging is becoming increasingly essential in supporting Mexico’s digital retail infrastructure.

Environmental Concerns and Regulations

Environmental concerns and stringent regulations are significantly restraining the growth of the Low-Density Polyethylene (LDPE) packaging market in Mexico. The government is increasingly adopting policies aimed at reducing plastic waste, including bans on single-use plastics in several states such as Mexico City and Oaxaca. These regulations directly impact the demand for LDPE-based products like plastic bags and flexible packaging. Additionally, public awareness around environmental sustainability is growing, pushing brands to shift toward biodegradable or recyclable alternatives. This shift is being supported by environmental NGOs and consumer pressure, leading to reduced reliance on traditional LDPE. Moreover, Mexico’s alignment with international sustainability goals is encouraging the development of circular economy models, further challenging LDPE’s market growth. As a result, manufacturers are being forced to adapt, invest in recycling infrastructure, or explore alternative materials.

Segment Analysis

The Mexico low-density polyethylene packaging market is segmented by product type, manufacturing process, application.

Food & Beverage Application Holds a Significant Share Due to High Demand for Flexible and Hygienic Packaging Solutions

The food and beverage application holds a significant share in the Mexican low-density Polyethylene (LDPE) packaging market due to rising consumption, urbanization, and the growing demand for flexible and hygienic packaging solutions. LDPE’s lightweight, moisture-resistant, and non-reactive properties make it ideal for food wrapping, pouches, and containers.

As consumers increasingly prefer ready-to-eat and packaged food, demand for LDPE-based packaging continues to surge. According to PMMI, the sales volume of packaging units for food products in Mexico is projected to rise from 62.7 billion units in 2021 to 65 billion units by 2025. This growth directly contributes to the expansion of LDPE packaging. Furthermore, Mexico’s robust food processing industry and increasing supermarket penetration are reinforcing the material’s usage. LDPE's recyclability also aligns with growing sustainability initiatives within the food sector.

Sustainability Analysis

The sustainability analysis of the Mexico Low-Density Polyethylene (LDPE) Packaging market reveals growing environmental and regulatory pressures. LDPE, being non-biodegradable, contributes to plastic waste accumulation, prompting stricter government regulations on single-use plastics. For instance, Mexico City banned plastic bags in 2020, affecting the LDPE packaging industry. However, companies are gradually adopting eco-friendly practices, including recycling and use of bio-based LDPE. The circular economy approach is gaining traction, encouraging investments in plastic recovery infrastructure. Major players are collaborating with recycling firms to improve sustainability metrics. Additionally, consumer awareness about green packaging is influencing demand for sustainable LDPE alternatives. This shift is driving innovation in biodegradable and recyclable LDPE packaging solutions.

Competitive Landscape

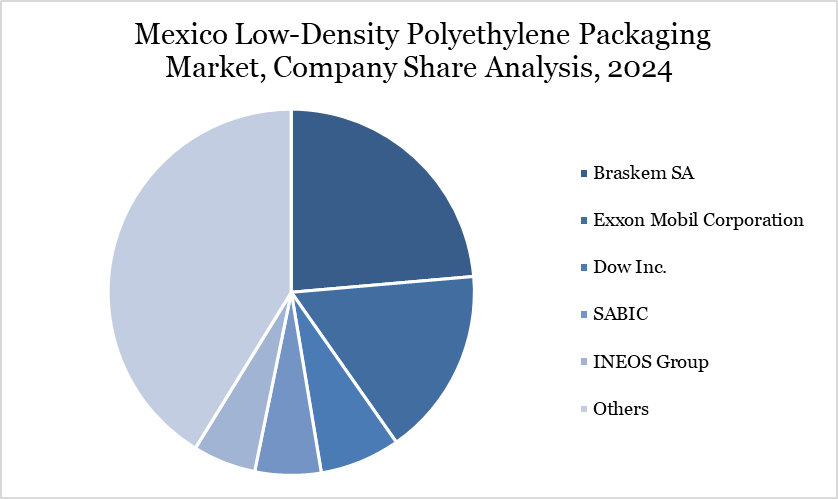

The major players in the market include Braskem SA, Exxon Mobil Corporation, Dow Inc., SABIC, INEOS Group, TotalEnergies SE, Borealis AG, Mitsui Chemicals, Inc., Neelgiri Polymers, NOVA Chemicals

Key Developments

In May 2025, Braskem-Idesa launched its ethane import terminal, Terminal Quimica Puerto Mexico (TQPM), in Coatzacoalcos, Mexico. The facility enables the import of 80,000 barrels/day of ethane, allowing the company to run its Ethylene XXI complex at full capacity. This includes 300,000 tonnes/year of Low-Density Polyethylene (LDPE) production, strengthening domestic LDPE supply and reducing import dependency.

In September 2024, Poly Bajío announced a US$6.7 million investment to expand its polyethylene packaging facilities in San Juan del Río, Querétaro, Mexico. The expansion includes new machinery and solar panel installation, highlighting its commitment to sustainability and circular economy practices.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies