Overview

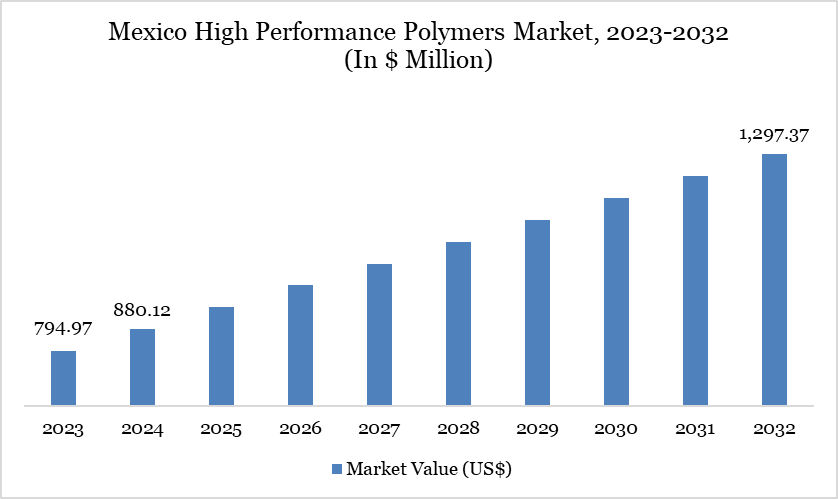

The Mexico high-performance polymers Market reached US$ 880.12 million in 2024 and is expected to reach US$ 1,297.37 million by 2032, growing at a CAGR of 4.97% during the forecast period of 2025-2032.

The market expansion is supported by increasing demand in automotive, aerospace, and electronics manufacturing hubs, particularly in northern and central Mexico. Government-backed industrial corridor projects and free trade agreements are also enhancing the appeal of high-performance materials for export-driven applications. The sector’s development is further accelerated by shifts in global supply chains and domestic investment in specialized materials infrastructure.

High Performance Polymers Market Trend

Liquid Crystal Polymers (LCPs) are gaining momentum in Mexico due to their use in high-frequency electronic components and miniaturized automotive sensors. LCP imports have increased consistently over the past three years, especially through the states of Nuevo León and Jalisco. Local assembly plants producing connectors and sensors for US and Asian markets are driving this shift. The high dimensional stability and processability of LCPs make them a preferred material for precision molding. This trend marks a shift from traditional reliance on polyamides and fluoropolymers toward more specialized polymer classes.

Market Scope

Metrics | Details |

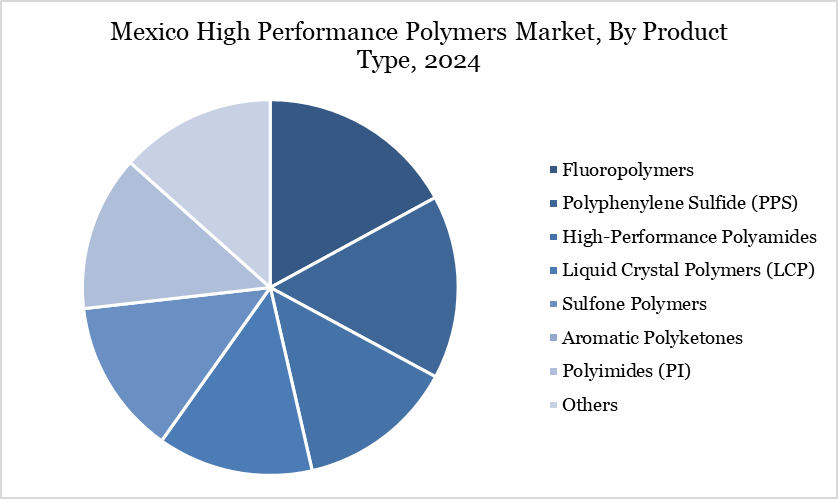

By Product Type | Fluoropolymers, Polyphenylene Sulfide (PPS), High-Performance Polyamides, Liquid Crystal Polymers (LCP) Sulfone, Polymers, Aromatic Polyketones, Polyimides (PI) and Others |

By Processing Technology | Injection Molding, Extrusion, Blow Molding, Compression Molding and Others |

By Application | Automotive & Transportation, Packaging, Medical & Healthcare, Construction, Consumer Goods and Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Nearshoring-Fueled Demand from Mexico’s Advanced Manufacturing Hubs

Between July 2023 and July 2024, 16.9% of companies in Mexico’s northern region reported increased production, sales, or investment due to nearshoring—5 percentage points higher than the national average of 12.9%. Industrial construction activity grew by 20%, supported by the development of 93 new industrial parks across the country. Foreign direct investment in manufacturing rose by 28% in 2023, with the sector accounting for over 50% of total FDI inflows, driven by the relocation of automotive and electronics industries to advanced Mexican hubs.

Limited Domestic Production Capacity for Specialty Monomers and Resins

Mexico’s high‑performance polymers sector is being held back by a shortage of specialty feedstocks—such as caprolactam, engineered monomers, and high‑purity chemical intermediates—due to reduced petrochemical output and underutilized refinery capacities. Feedstock utilization at national petrochemical facilities has fallen below 60%, down from ~70% in 2000, limiting upstream supply for resin production. In addition, Mexico now imports around 28% of its total chemical requirements, signaling major reliance on foreign resins and polymers. This structural deficit constrains domestic manufacturing of advanced polymers like PEEK, PPA, and LCP, hindering local value addition.

Segment Analysis

The Mexico high performance polymers market is segmented based on product type, processing technology, application and country.

Fluoropolymers Segment Driving High Performance Polymers Market

Fluoropolymers accounted for approximately 50.66% of Mexico’s high-performance polymers market value in 2024, making them the dominant segment. The country produced around 14,000 tonnes of fluoropolymers, ranking second in Latin America. Imports reached 5,500 tonnes with an average price of USD 21,778 per tonne, the highest in the region. These polymers are favored for their exceptional heat and chemical resistance in automotive and electronics. Their market leadership reflects strong domestic demand and specialized applications.

Sustainability Analysis

Mexico recycles approximately 1.68 million tonnes of plastic waste annually, with PET container recovery rates reaching 63% nationwide. The country’s installed recycling capacity has grown to over 750,000 tonnes per year, supporting a shift toward circular polymers. In 2023, 177,000 tonnes of post-consumer recycled PET resin were reintroduced into manufacturing streams. Alpek reported a 27% reduction in Scope 1 and 2 emissions from its operations in 2023 compared to 2022. The company also targets a 13.5% cut in Scope 3 emissions by 2030, aligned with science-based climate goals.

Competitive Landscape

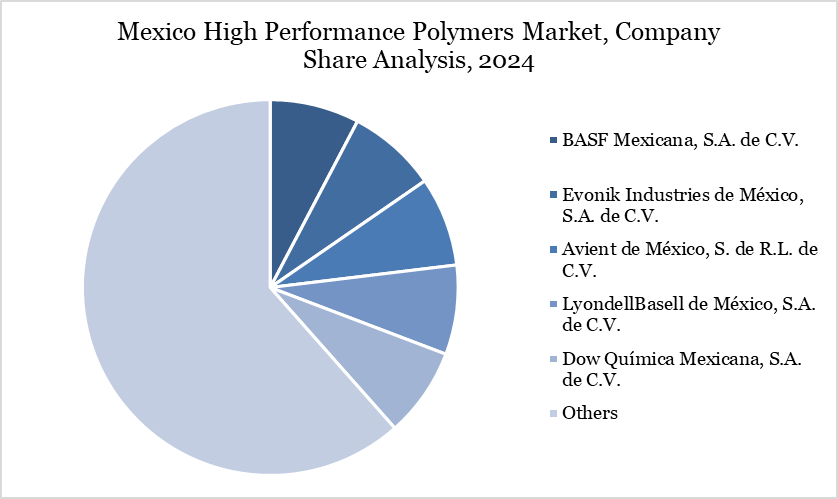

The major Mexico players in the market include BASF Mexicana, S.A. de C.V., Evonik Industries de México, S.A. de C.V., Avient de México, S. de R.L. de C.V., LyondellBasell de México, S.A. de C.V., Dow Química Mexicana, S.A. de C.V., DuPont de Nemours México, S.A. de C.V., Toray Resin Mexico, S.A. de C.V., Alpek, S.A.B. de C.V., and Orbia Advance Corporation, S.A.B. de C.V.

Key Developments

In March 2025, RadiciGroup High Performance Polymers has inaugurated its new production site in Brazil, a strategic step to further strengthen the business area’s presence in the country, where it has been operating successfully for more than 25 years. The new plant, located a short distance away from the previous site, offers a leap in quality in terms of efficiency, safety and environmental sustainability and is ready to serve numerous markets, such as automotive, electrical and electronics, and consumer and industrial goods.

In March 2025, LyondellBasell, a leading player in the global chemical industry, showcased its latest polymer innovations at Plástico Brasil 2025, the leading trade show for the South American plastics industry, which took place from March 24-28 at São Paulo Expo in Brazil. At the event, LYB exhibited solutions designed to drive efficiency, sustainability and performance in plastics manufacturing.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies