Overview

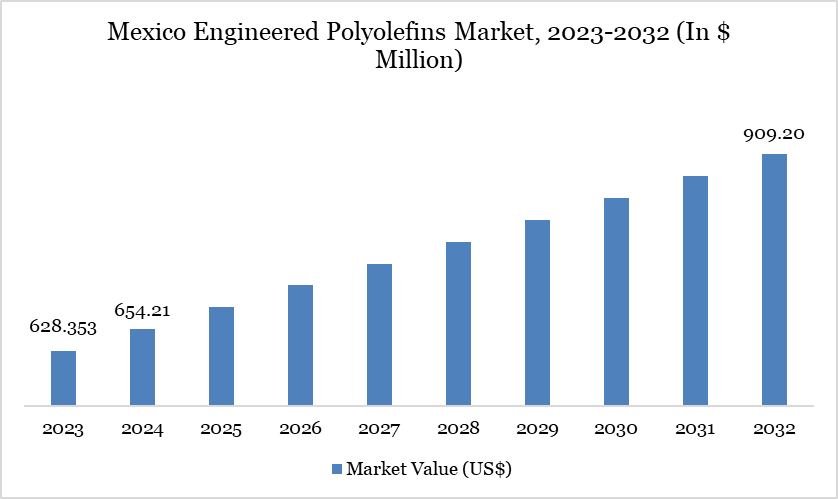

The Mexico Engineered Polyolefins market reached US$654.21 million in 2024 and is expected to reach US$909.20 million by 2032, growing at a CAGR of 4.20% during the forecast period 2025-2032.

The Mexico Engineered Polyolefins market is witnessing steady growth driven by rising demand from the automotive, packaging, and consumer goods sectors. Increasing industrialization and Mexico’s role as a manufacturing hub for North America are fueling the need for high-performance, lightweight, and durable polymer solutions.

In November 2024, Geon Performance Solutions LLC inaugurated a new thermoplastic elastomer (TPE) production line at its Ramos Arizpe facility, marking a strategic step to enhance regional manufacturing. This expansion highlights the growing demand for engineered materials, particularly in automotive applications. Supportive trade agreements and nearshoring trends are also attracting global players to invest in local production. As a result, the market is evolving with more advanced and customized polyolefin solutions.

Engineered Polyolefins Market Trend

Advances in recycling technology are transforming the Mexico Engineered Polyolefins Market by enabling the use of high-quality recycled resins in automotive, packaging, and industrial applications. Both mechanical and chemical recycling methods are being adopted to enhance circularity and reduce reliance on virgin materials. Companies are investing in closed-loop systems and feedstock recovery to meet environmental regulations and sustainability goals. These innovations are improving the performance and consistency of recycled polyolefins, making them viable for demanding engineered uses. As a result, recycling technology is emerging as a strategic enabler of growth and green compliance in the market.

Market Scope

Metrics | Details |

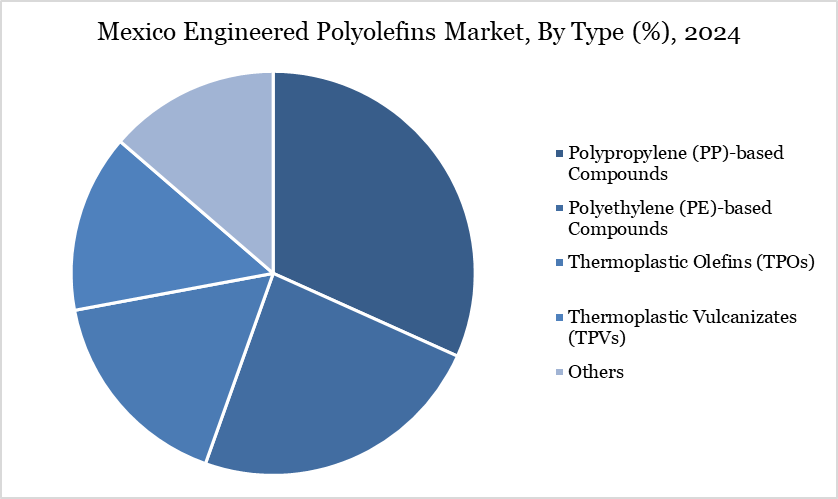

By Type | Polypropylene (PP)-based Compounds, Polyethylene (PE)-based Compounds, Thermoplastic Olefins (TPOs), Thermoplastic Vulcanizates (TPVs), Others |

By Processing Technology | Injection Molding, Blow Molding, Extrusion, Compounding, Others |

By End-User | Automotive, Electrical & Electronics, Packaging, Building & Construction, Consumer Goods, Industrial, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand in Automotive Application

The rising demand in automotive applications is a key driver of the Mexico Engineered Polyolefins Market. Engineered polyolefins, particularly thermoplastic olefins (TPOs) and thermoplastic vulcanizates (TPVs), are widely used in automotive parts due to their lightweight, durability, and design flexibility. With Mexico being the world’s seventh-largest passenger vehicle manufacturer, producing 3.5 million vehicles annually as per IEA, the demand for such materials is surging. A large share, 88% of these vehicles are exported, with 76% going to the US, underscoring the country's role in global automotive supply chains.

Automakers are increasingly adopting engineered polyolefins to meet stringent fuel efficiency and emission norms through lightweighting. Additionally, the demand for improved interior and exterior aesthetics is pushing OEMs to rely on high-performance polyolefin compounds. This growth in automotive production is creating sustained demand for locally produced advanced materials. As a result, manufacturers are expanding capacity and localization of polyolefin compounding to serve OEMs more efficiently.

Raw Material Limitations & Supply Chain Constraints

Raw material limitations and supply chain constraints are significantly restraining the Mexico Engineered Polyolefins Market. The country depends heavily on imports for key feedstocks like ethane and propane, as domestic production by Pemex has declined sharply in recent years. This dependency exposes manufacturers to global price volatility and supply disruptions. Additionally, inadequate petrochemical infrastructure and logistics inefficiencies further escalate production costs and delay delivery timelines, hampering market competitiveness and growth.

Segment Analysis

The Mexico engineered polyolefins market is segmented by type, processing technology, end-user.

Polypropylene (PP)-based Compounds Dominate Mexico's Engineered Polyolefins Market Due to Their Versatile Performance and Cost-Effectiveness

Polypropylene (PP)-based compounds hold a significant share in the Mexico Engineered Polyolefins Market due to their excellent mechanical properties, cost-efficiency, and versatility across applications such as automotive, packaging, and consumer goods. Their dominance is further supported by Mexico's strong reliance on imported plastics—totaling USD 41.52 billion in 2022—with 61% (US$ 22.6 billion) coming from the US, a major supplier of PP compounds. This robust trade relationship ensures a steady supply of high-quality PP materials, reinforcing their widespread use in local manufacturing and export-driven industries.

Sustainability Analysis

The sustainability outlook for the Mexico Engineered Polyolefins Market is evolving as manufacturers increasingly adopt eco-friendly practices. With growing environmental regulations and global pressure to reduce plastic waste, companies are focusing on recyclable and lightweight polyolefin-based materials. Polypropylene and polyethylene compounds are favored for their lower environmental impact and energy-efficient processing. The use of advanced recycling technologies is gradually gaining momentum in Mexico, aligning with circular economy goals. Automotive and packaging sectors are especially driving demand for sustainable polyolefin solutions. Moreover, local production initiatives aim to minimize carbon footprints by reducing dependence on imports. Overall, sustainability is becoming a key competitive factor for market players in Mexico.

Competitive Landscape

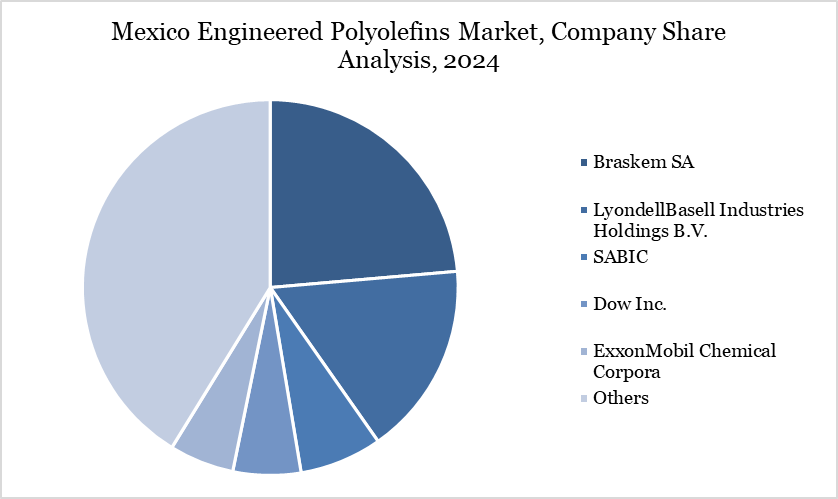

The major players in the market include Braskem SA, LyondellBasell Industries Holdings B.V., SABIC, Dow Inc., ExxonMobil Chemical Corpora, Celanese Corporation, INEOS, TotalEnergies, Borealis AG, Avient Corporation.

Key Developments

In October 2024, ExxonMobil launched Signature Polymers, a unified brand for its polyolefin products, aimed at simplifying product selection and enhancing customer experience. This initiative reflects ExxonMobil’s commitment to deeper collaboration, helping customers address complex industry challenges more efficiently. By consolidating its offerings under a single portfolio, the company streamlines access to its advanced materials and strengthens its service and partnership approach.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies