Mental Health Apps Market Size

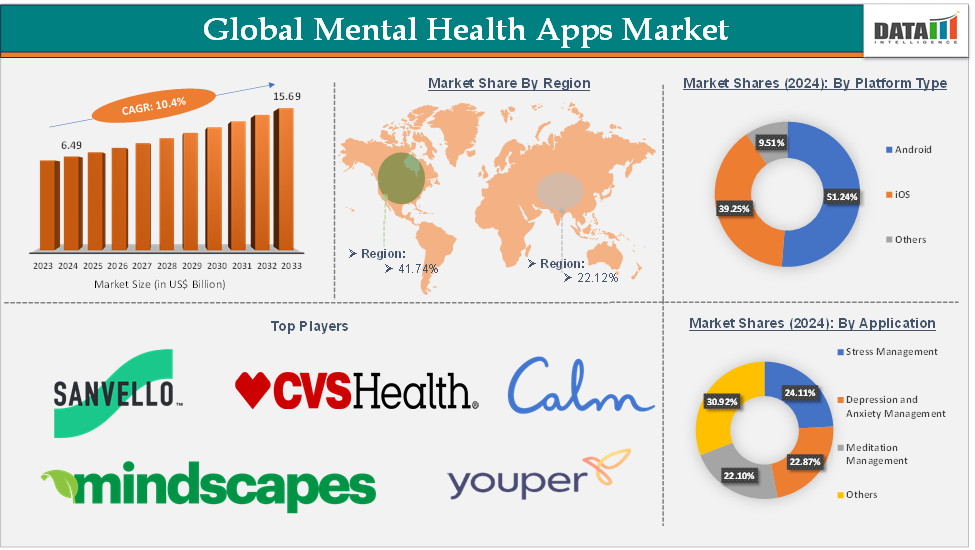

The Global Mental Health Apps Market Size reached US$ 6.49 Billion in 2024 and is expected to reach US$ 15.69 Billion by 2033, growing at a CAGR of 10.4% during the forecast period 2025-2033.

Mental Health Apps Market Overview

The mental health apps market refers to digital solutions designed to support mental well-being through smartphone applications. These apps offer a variety of features ranging from mood tracking, meditation, therapy, and stress management to sleep improvement, cognitive behavioral therapy (CBT), and emotional support through AI-driven chatbots.

Over the last few years, the mental health apps market has gained significant traction, driven by growing awareness of mental health issues, increased smartphone penetration, and a shift towards more accessible, self-paced mental health management tools.

The mental health apps market is expected to continue growing due to the increasing demand for accessible mental health solutions, advancements in AI and telemedicine, and growing awareness of mental health issues. Future developments in AI, augmented reality (AR), and virtual reality (VR) could further enhance the efficacy and engagement of these apps.

Additionally, more partnerships with healthcare providers and insurers could lead to broader adoption of these apps as part of integrated mental healthcare services.

Executive Summary

For more details on this report – Request for Sample

Mental Health Apps Market Dynamics: Drivers & Restraints

Rising awareness of mental health is significantly driving the mental health apps market growth

The rising awareness of mental health is playing a pivotal role in driving the growth of the mental health apps market. As societies globally acknowledge the importance of mental well-being, more people are actively seeking tools and resources to manage mental health issues like anxiety, depression, stress, and insomnia. This growing recognition leads to an increased demand for accessible and effective digital solutions such as mental health apps.

For instance, in May 2025, Clue, the most trusted, data-driven period and reproductive health tracking app, announced its "Connect the Dots" campaign for Mental Health Awareness Month. The campaign highlights the critical, yet often overlooked, connection between menstrual cycles and mental health. Additionally, with 90% of Clue members agreeing that tracking with Clue helps them better understand their body patterns, the campaign will focus on how cycle tracking can better help people understand their bodies and minds. This rising awareness of mental health is fueling demand for easily accessible, cost-effective, and innovative solutions like mental health apps.

As mental health becomes a more prominent topic in media and public discussions, individuals are more likely to seek help. However, traditional therapy or counseling might be costly, stigmatizing, or difficult to access for many. Mental health apps offer an easily accessible and affordable alternative, allowing users to manage their mental health from the comfort of their homes, anytime and anywhere. For example, apps like Headspace and Calm have become extremely popular for stress management and mindfulness, thanks to their user-friendly interfaces and accessibility.

Over-reliance on AI without human oversight is hampering the mental health apps market's growth

Over-reliance on AI without human oversight is a significant restraint in the mental health apps market, as it can compromise the quality of care, safety, and trustworthiness of the services provided. While AI has the potential to enhance personalization and scalability, its limitations, especially when not paired with human oversight, can lead to several problems that hinder market growth.

AI-driven mental health apps often rely on chatbots or automated systems to provide support. While these technologies can offer basic assistance, they are not equipped to recognize or properly respond to high-risk situations like suicidal thoughts or severe mental health crises. Users in acute distress may not get the appropriate level of care, leading to increased risk of harm and loss of trust in the app's effectiveness. This could limit the app's adoption and growth, especially among users who need urgent mental health intervention.

Mental Health Apps Market Segment Analysis

The global mental health apps market is segmented based on platform type, application, end-user, and region.

The Android platform segment is expected to hold 51.24% of the market share in 2024 in the mental health apps market

Android holds a larger share of the global smartphone market compared to iOS, particularly in emerging economies. As of recent reports, Android accounts for around 75% of global smartphone sales. This extensive reach allows mental health app developers to target a larger audience, particularly in developing regions where smartphone penetration is on the rise but iOS devices are less common.

Android devices tend to be more affordable than iOS devices, which makes them the preferred choice for users in regions with lower disposable incomes. Since mental health apps often target users who may not have access to traditional healthcare services, the cost-effectiveness of Android devices provides a vital pathway for individuals to access mental health resources on the go. For instance, Calm and Headspace offer free versions of their apps, and Android’s affordability means more users can download and engage with these apps without worrying about expensive devices.

Android offers a more open app ecosystem compared to iOS, making it easier for developers to distribute their apps and reach a larger number of users via the Google Play Store. This open nature allows for rapid app deployment, testing, and iteration, enabling developers to reach a larger audience faster than on iOS. For instance, the ability for mental health apps to be easily available on the Google Play Store enables apps like Talkspace and BetterHelp to reach millions of users across various global markets without restrictive app store policies.

Mental Health Apps Market Geographical Analysis

North America is expected to dominate the global mental health apps market with a 41.74% share in 2024

North America, particularly the United States, has one of the highest rates of smartphone penetration globally. With nearly every adult owning a smartphone, it provides a massive audience for mental health app developers to target. Apps like Calm, Headspace, and Talkspace are widely used across the U.S., as these apps are optimized for the highly connected population, allowing easy access to mental health tools anytime and anywhere.

The growing awareness and destigmatization of mental health issues in North America have created a favorable environment for mental health solutions. There is a widespread shift towards prioritizing mental health as part of overall well-being, which encourages individuals to seek tools to manage their mental health more effectively. As the awareness increases, the market players offer more apps in the region, thus boosting the market growth in North America.

For instance, in April 2025, the Child Mind Institute, in partnership with the California Department of Health Care Services (DHCS), launched Mirror, a free, intuitive mental health journaling app designed specifically for teens. Backed by Child Mind Institute's clinical expertise and available in English and Spanish, Mirror aims to enhance emotional processing and provide a supportive environment for self-reflection. Through text, voice, image, or video entries, daily mood tracking, guided prompts, and more, Mirror allows users a safe and secure space to self-express and understand patterns.

Additionally, in December 2024, Syra Health Corp. announced that its flagship mental health app, Syrenity, is available for direct download by adults 18 years and older. Syrenity leverages a science-driven approach to address prevalent mental health challenges such as stress, anxiety, and depression, positioning the Company to capture growth opportunities in the expanding digital mental health market while advancing its mission to deliver impactful, scalable solutions for improved health outcomes. The availability of more apps is accelerating the region’s market growth.

Mental Health Apps Market Top Companies

Top companies in the mental health apps market include Sanvello Health, CVS Health, Mindscapes, Squarespace, Headspace Inc., Youper Inc., K Health, Calm, Happify, Inc., and Roble Ridge Software LLC, among others.

Market Scope

Metrics | Details | |

CAGR | 10.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Platform Type | Android, iOS, and Others |

Application | Stress Management, Depression and Anxiety Management, Meditation Management, and Others | |

End-User | Mental Hospitals, Home Care Settings, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global mental health apps market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 157 pages of expert insights, providing a complete view of the market landscape.