Global Melatonin Market Size

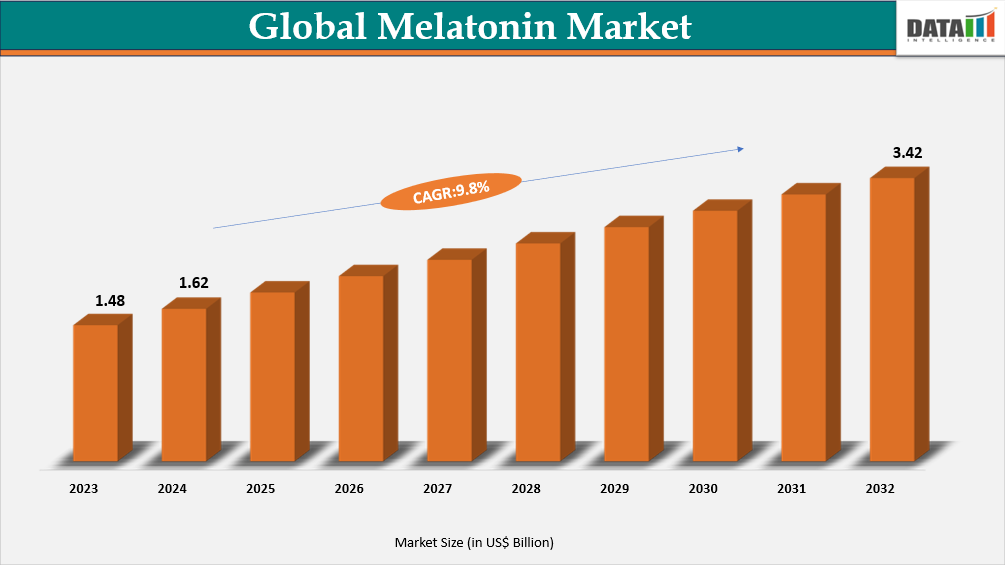

The global melatonin market reached US$ 1.62 billion in 2023, rising to US$ 90.67 billion in 2024 and is expected to reach US$ 3.42 billion by 2032, growing at a CAGR of 9.8% from 2025 to 2032.

The melatonin market has been gradually expanding, driven by increased knowledge of sleep health, the prevalence of sleep disorders and lifestyle-related stress among urban populations. Melatonin is generally used as a dietary supplement in gummies and softgels, with extended-release formulations approved by the regulations of various countries. Market growth is also being fueled by a growing interest in holistic wellbeing, with manufacturers introducing functional ingredients like herbal extracts, vitamins and stress-relief components to improve product distinctiveness and value.

Melatonin Market Industry Trends and Strategic Insights

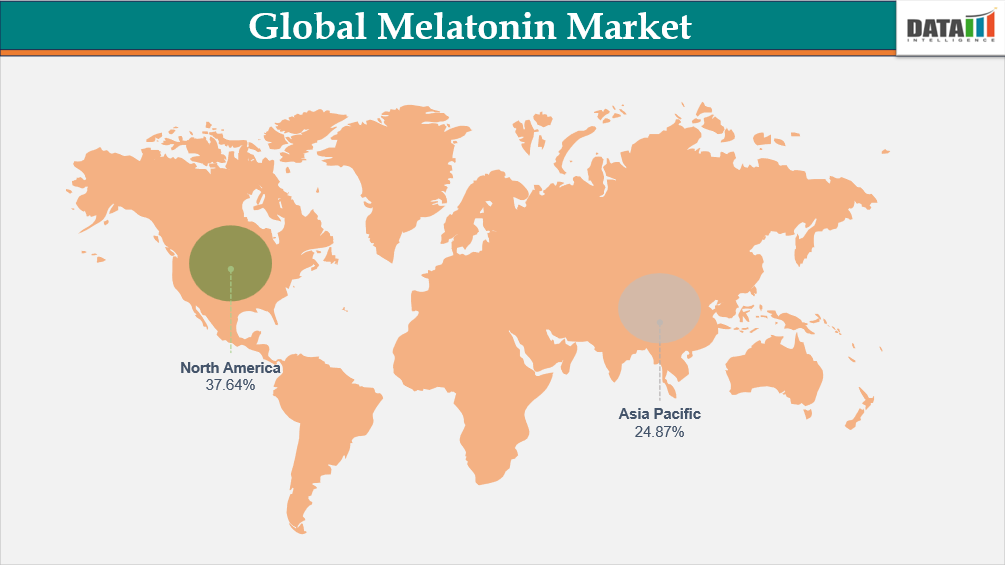

- North America leads the global melatonin market, capturing the largest revenue share of 37.64% in 2024.

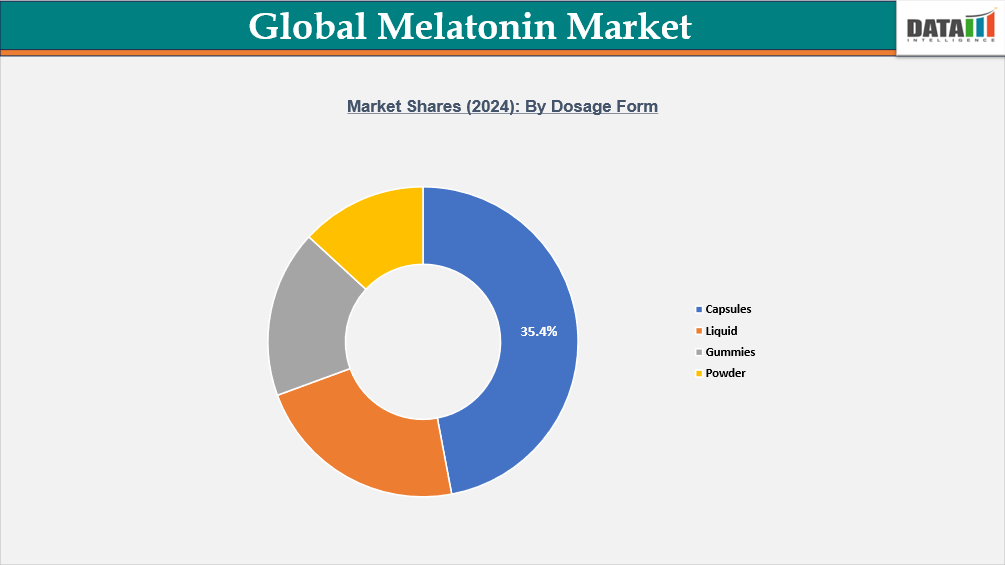

- By dosage form segment, capsules lead the global melatonin market, capturing the largest revenue share of 35.4% in 2024.

Global Melatonin Market Size and Future Outlook

- 2024 Market Size: US$ 1.62 billion

- 2032 Projected Market Size: US$ 3.42 billion

- CAGR (2025–2032): 9.8%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Dosage Form | Capsules, Liquid, Gummies, Powder |

| By Source | Natural Melatonin, Synthetic Melatonin |

| By Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, Online Stores, Pharmacies and Drug Stores, Others |

| By End-User | Kids, Adults |

| By Application | Insomnia Treatment, Jet Lag Management, Stress Relief, Shift Work Disorder, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information, Request for Sample

Market Dynamics

Rising Prevalence of Sleep Disorders and Growing Consumer Awareness Toward Sleep Health

The rising prevalence of sleep disorders, as well as the growing recognition of sleep as a critical component of health, are driving the global melatonin market. Insomnia and insufficient sleep are increasingly seen as serious public health concerns, impacting around one in every three persons worldwide. The American Academy of Sleep Medicine (AASM) states that 30 to 35 percent of adults have transient symptoms of insomnia. 15 to 20 percent experience short-term insomnia that lasts less than three months. 10 percent suffer from chronic insomnia, which occurs at least three times each week for at least three months.

Urbanization, more screen time, shift work and higher stress levels have all altered circadian cycles, resulting in a prolonged requirement for sleep aids such as melatonin. Melatonin is becoming increasingly popular in many developed economies as a safer, natural alternative to sedative-hypnotic pharmaceuticals, resulting in its rapid adoption as both an over-the-counter supplement and a prescribed medicinal agent. Melatonin is increasingly being used to treat jet lag, shift-work exhaustion and sleep disorders linked with age, in addition to classic insomnia.

Segmentation Analysis

The global melatonin market is segmented based on dosage form, source, distribution channel, end-user, application and region.

Capsules Holds the Dominant Share Due to its Convenience and Dosage Accuracy

The capsule segment holds a significant share in the global melatonin market due to its convenience, dosage accuracy and consumer familiarity. Capsules, particularly softgel and firm gelatin forms, enable for exact melatonin dose, which is important given the variety in individual sleep habits and sensitivity to supplements. Melatonin's effectiveness, according to the National Institutes of Health (NIH), is extremely dose-dependent and capsules are an efficient delivery route that assures consistent absorption, especially for immediate-release formulations meant to shorten sleep onset delay. This has become capsules the favored option for both over-the-counter customers and clinicians who prescribe melatonin for sleep disorders.

Capsules also benefit from widespread regulatory acceptance in different areas. Melatonin is frequently classed as a dietary supplement in US, thus capsules can be manufactured under cGMP standards and sold over the counter without a prescription. In Europe, capsule formulations adhere to EFSA-approved rules for sleep-related claims and their uniform dosage forms make it easier to comply with labeling and health claim laws. This combination of regulatory freedom and standardized administration has reinforced the capsule segment's dominance over other forms, particularly in markets with tight dose and labeling requirements.

Gummies have the Fastest Growth Rate Due to the Consumer-Friendly Format and Taste

The gummies segment of the global melatonin market has seen rapid growth due to its consumer-friendly format, taste and convenience, particularly among younger populations and individuals who prefer chewable over traditional capsules. Gummies are an enticing option for those who struggle to take medicines, such as youngsters, the elderly and dysphagia patients. Gummies are more popular among consumers because to the growing emphasis on individualized wellness, functional foods and lifestyle supplementation.

Melatonin is frequently combined with other sleep-promoting substances like magnesium, L-theanine and herbal extracts like chamomile and valerian. According to a 2022 study published in the Nutrients journal, combination compounds increase not only sleep onset but also total sleep quality, meeting consumer need for multifunctional, natural and convenient solutions. This multifunctional positioning has boosted their popularity in North America, Europe and, increasingly, Asia-Pacific markets.

Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Market Due to the Increasing Integration of Sleep Optimization

North America melatonin market leads the global market because to expanding health-conscious consumer behavior and the growing integration of sleep optimization into daily wellness routines. According to a 2024 CDC assessment of dietary supplements for sleep, approximately one-fifth of individuals in US use a sleep aid on a regular basis, whether it be a prescription medicine or an OTC supplement. Consumers are increasingly self-medicating for irregular sleep patterns, driven by work-from-home schedules, prolonged exposure to blue-light devices and lifestyle-induced circadian disruptions, creating strong demand for handy melatonin solutions.

US Melatonin Market Insights

US remains the largest market in North America, owing to rising consumer self-awareness about sleep health and extensive usage of digital sleep tracking devices. According to 2022 data from the CDC's Behavioral Risk Factor Surveillance System (BRFSS), 36.8% of individuals reported insufficient sleep, fueling demand for natural sleep aids. Beyond typical insomnia, consumers are taking melatonin for shift-work adjustment, jet lag and sleep-wake cycle management, especially in urban areas with high stress and irregular schedules.

Canada Melatonin Market Industry Growth

Melatonin is classed as a Natural Health Product (NHP) in Canada and is subject to Health Canada regulations on ingredient supply, dosage and labeling. The NHP framework guarantees excellent product quality and safety, fostering a market environment in which clinically backed, standardized and correctly labeled items are chosen. Melatonin is one of the top five sleep-related items purchased by Canadians, with a larger prevalence among those aged 45 and up who value sleep wellness and preventive health measures.

FASTEST GROWING MARKET:

Asia-Pacific is the Fastest-Growing Region Driven by the Rising Sleep-Related Health Concerns

Asia-Pacific melatonin market is expanding rapidly, driven by rising sleep-related health concerns, increased urbanization and shifting lifestyle patterns. A 2022 study published in the Journal of Clinical Sleep Medicine indicated that youth in Japan are at high risk of Delayed Sleep-Wake Phase Disorder (DSWPD), which is consistent with rising patterns in other Asian nations such as China, South Korea and India. Sleep difficulties are associated with long work hours, digital screen exposure and high stress levels. The growing recognition of sleep as a component of overall wellness creates a favorable environment for melatonin supplementation, particularly among working adults and the elderly.

India Melatonin Market Outlook

India is the fastest growing country in Asia-Pacific melatonin market, primarily driven by rising awareness of sleep disorders among urban populations and increasing adoption of nutraceutical and wellness supplements. According to a 2022 study in the Indian Journal of Sleep Medicine, nearly 30% of Indian adults report poor sleep quality, particularly among IT professionals, shift workers and students. Growing digital device usage, extended work hours and lifestyle stressors are contributing to circadian rhythm disruptions, prompting demand for natural sleep aids like melatonin.

China Melatonin Market Trends

China is the dominant country in Asia-Pacific melatonin market, but it faces unique regulatory and cultural considerations. Melatonin is currently regulated as a prescription drug in China, restricting OTC availability and requiring physician guidance for use. This limits mass-market adoption but positions prescription and clinical formulations as high-value segments. Sleep disorders are rising, particularly among urban white-collar workers and students, with studies from the Chinese Sleep Research Society, more than 60% of Chinese people get less than eight hours of sleep per night, indicating significant latent demand for melatonin.

Sustainability and ESG Analysis

The sustainability landscape in the global melatonin market is emerging as a significant factor influencing consumer perception, brand positioning and operational practices. Melatonin is a naturally occurring substance, but its commercial manufacture is generally based on chemical synthesis or semi-synthetic methods that require energy-intensive processes and the use of solvents and reagents. Companies are investing in green chemistry, solvent recovery systems and process optimization to reduce emissions, waste and energy usage.

To satisfy ESG standards, some businesses are looking into integrating renewable energy and water recycling into their manufacturing plants. As consumers, regulators and investors become more aware of sustainable practices, companies that incorporate environmental stewardship, ethical sourcing and sustainable packaging into their business strategy are likely to enhance brand loyalty, compliance and long-term market resilience in the global melatonin industry.

Consumer Analysis

The global melatonin market is primarily driven by consumers seeking natural and safe alternatives to prescription sleep aids. According to the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC), a significant portion of the adult population in North America, Europe and urban Asia experiences sleep disorders such as insomnia, delayed sleep phase disorder and jet lag. Consumers increasingly prefer melatonin for its non-habit-forming properties and perceived safety, making it a popular choice among health-conscious adults aged 25–55, shift workers, students and aging populations who experience disrupted circadian rhythms.

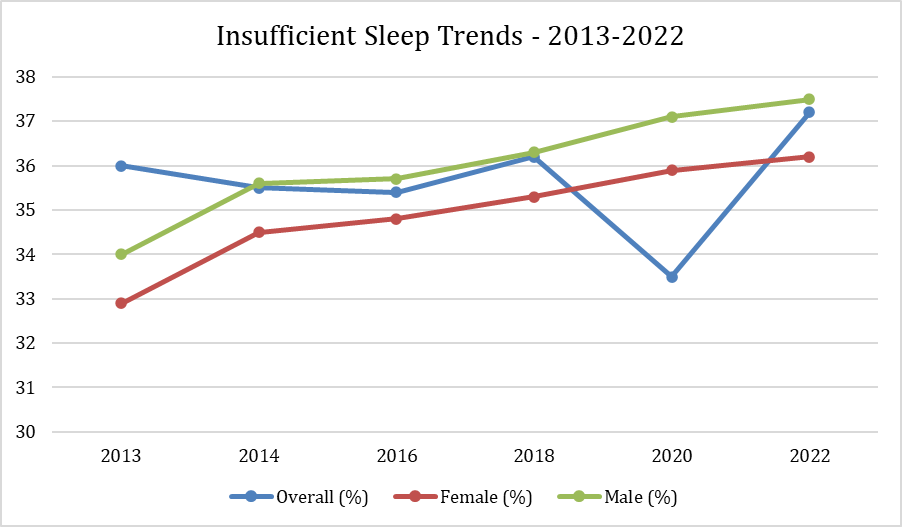

The persistent prevalence of insufficient sleep among adults worldwide is significantly influencing the expansion of the global melatonin market. According to the CDC, approximately 33.2% of US adults reported insufficient sleep in 2020, with variations across demographics such as age, sex and race/ethnicity. This trend has remained relatively stable, with variations across different demographics. Notably, adults aged 45–64 reported the highest percentage of insufficient sleep at 39%, while men exhibited a higher prevalence (37%) compared to women. Consequently, there is a heightened demand for natural sleep aids, including melatonin supplements, as consumers seek non-habit-forming solutions to manage sleep-related issues.

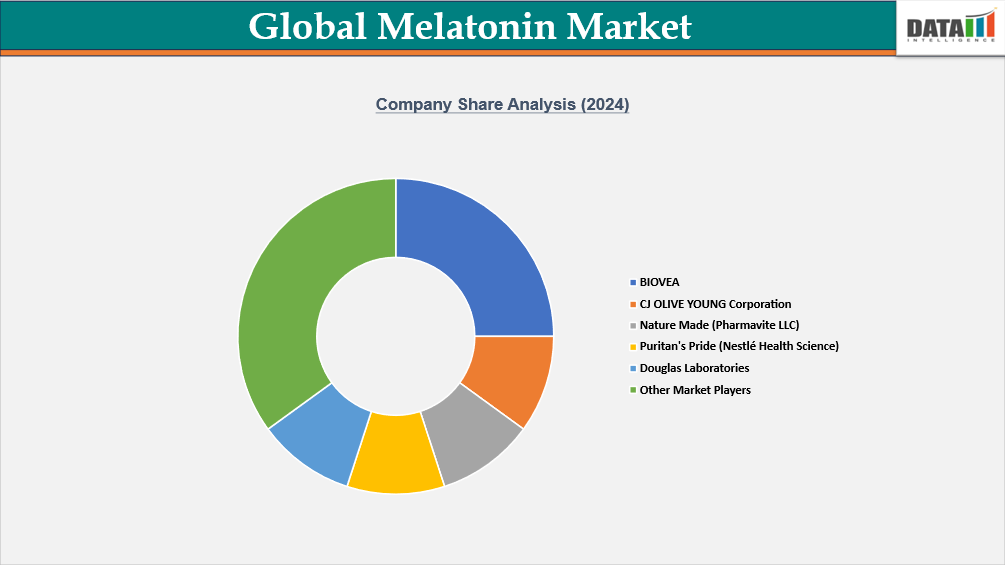

Competitive Landscape

- The global melatonin market is competitive, characterized by the presence of numerous multinational corporations and regional players. Key companies such as BIOVEA, CJ OLIVE YOUNG Corporation, Nature Made (Pharmavite LLC) and Puritan's Pride (Nestlé Health Science) dominate, leveraging their extensive global production footprints, diverse product portfolios and strong R&D capabilities, particularly for high-value sectors like automotive and aerospace.

- International brands have created a strong presence in the import and e-commerce channels. Natrol, a US-based company, for example, is widely available on sites such as Ubuy.kr and Coupang, where it sells melatonin capsules and gummies.

- The market is dynamic, with regulatory adherence, brand credibility, product innovation and distribution strategies determining competitive advantage and development potential.

Key Developments

- On May 2024, Natrol introduced Time Release Melatonin gummies in 3 mg and 10 mg dosages include dual-action administration to help with sleep onset and maintenance.

- On June 2023, Nature's Bounty launched Sleep3 Gummies, a combination of L-theanine, quick-release and time-release melatonin for adults experiencing occasional sleepiness.

Investment & Funding Landscape

The global melatonin market is witnessing a surge in investments and strategic initiatives, driven by increasing consumer demand for natural sleep aids. In 2024, Pharmamel, a biotechnological company having expertise of over 30 years of biomedical research applying melatonin in various disease models, embarked on a pre-IPO capital increase campaign, signaling its intent to go public and attract significant investment in the sector. This move reflects the growing interest in companies specializing in sleep-related products and the potential for high returns in this market segment.

In 2025, Neurim Pharmaceuticals achieved a landmark development with Health Canada granting marketing authorization for Slenyto, an extended-release melatonin minitablet for children and adolescents with ASD or Smith-Magenis Syndrome. As the first pharmacotherapy clinically tested and approved specifically for insomnia in this population, Slenyto addresses a critical unmet medical need, highlighting the market’s shift toward specialized therapeutic applications. Alongside these developments, industry associations like CHPA are advocating for regulatory clarity to ensure product safety and efficacy, further fostering market confidence.

| Company | Investment/Funding | Year | Details | |

| Neurim Pharmaceuticals | Health Canada approval for Slenyto | 2025 | Health Canada granted marketing authorization for Slenyto, an extended-release melatonin minitablet for insomnia in children/adolescents with ASD or Smith-Magenis Syndrome. It is the first and only pharmacotherapy specifically developed, clinically tested and approved for insomnia in this population. | |

| Pharmamel | Pre-IPO capital increase campaign | 2024 | Initiated a capital increase campaign at a pre-money valuation of EUR 37 million, with an expected listing valuation of EUR 45 million on BME Scale, on the CNMV-regulated platform Capital Cell, marking its path toward going public. | |

Partnership Identification Analysis

Strategic partnerships play a pivotal role in scaling operations, expanding product portfolios and accessing new consumer segments within the global melatonin market. We have conducted a comprehensive partnership mapping across the global melatonin value chain, identifying key opportunities for collaboration among manufacturers, contract manufacturing organizations (CMOs), distributors, ingredient suppliers and retail partners. This analysis was developed through secondary research of regulatory filings, company disclosures and verified trade sources, supported by primary validations with industry stakeholders across North America, Europe and Asia-Pacific. The objective was to pinpoint potential partners that can enhance production scalability, regulatory compliance and market access in both established and emerging regions.

| Potential Partners | Strategic Focus | Rationale for Partnership |

| Finished Product Manufacturers | Branded formulation expansion | Collaboration for co-branding, premium product development and regional licensing |

| CMOs / Private Label Manufacturers | Large-scale, GMP-certified production | Ensures flexibility, quality consistency and scalability in global supply |

| Raw Material & Ingredient Suppliers | Secure API and bioactive inputs | Strengthens supply chain reliability and supports innovation in natural/vegan melatonin |

| Regional Distributors & Importers | Multi-channel retail and online reach | Enhances brand visibility, consumer access and cross-border market entry |

| Retail & E-Commerce Partners | Omni-channel distribution | Expands availability and drives consumer adoption in key regions |

What Sets This Global Melatonin Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by dosage form, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect melatonin commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.