Medical Polymers Market Size & Industry Outlook

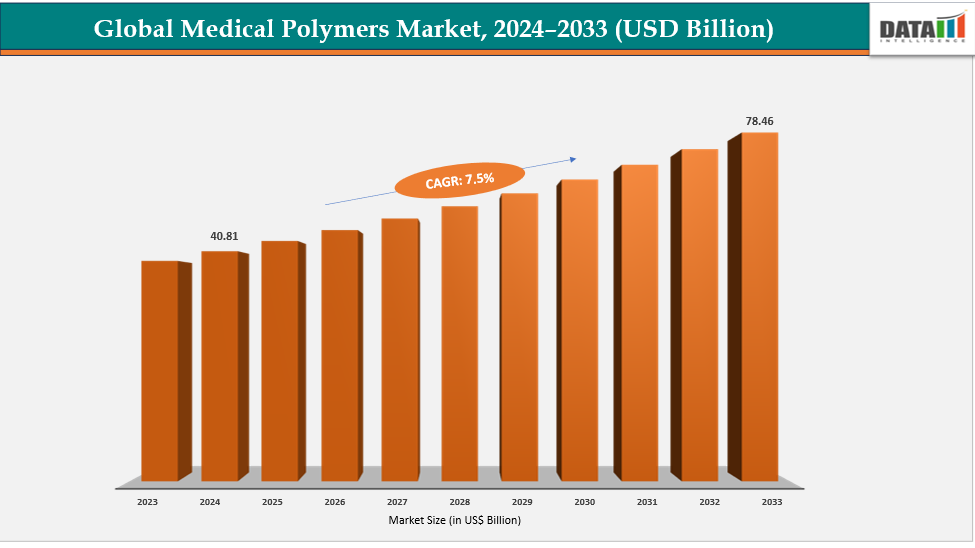

The global medical polymers market size was US$ 40.81 Billion in 2024 and is expected to reach US$ 78.46 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

The market for medical polymers is expanding at a rapidly due to the growing need for biocompatible materials. By reducing immunological reactions and improving patient outcomes, these materials guarantee safe contact with human tissues. Implants, catheters, and medication delivery systems are increasingly using biocompatible polymers like PLA, PEEK, and TPU. They are perfect for contemporary medical devices due to of their adaptability, robustness, and compatibility with sterilizing. The market is expanding due to its increasing application in surgical equipment, wound care, and tissue engineering. Furthermore, the need for high-performance, body-friendly materials is fueled by the move toward minimally invasive procedures and long-term implantable devices.

Key Highlights

- North America is dominating the global medical polymers market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global medical polymers market, with a CAGR of 7.7% in 2024

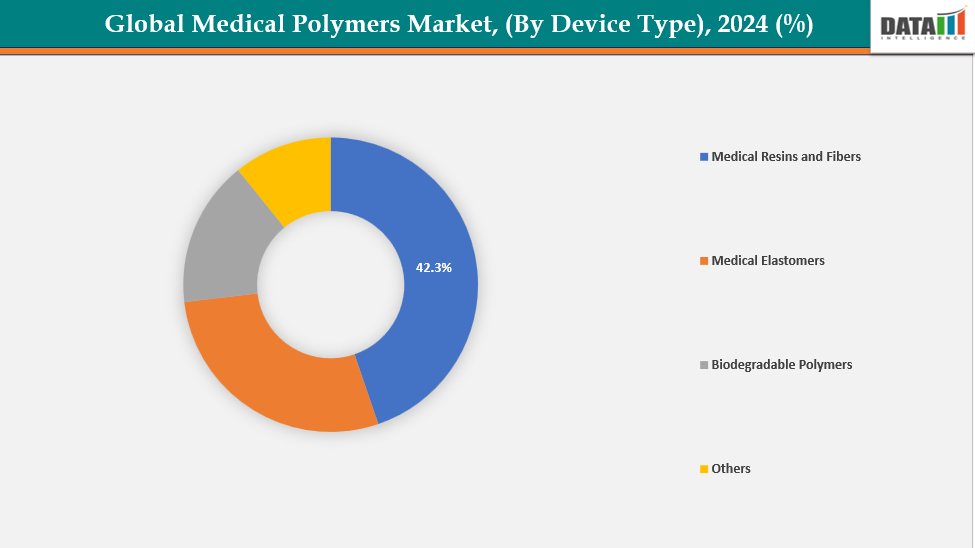

- The medical resins and fibers segment is dominating the medical polymers market with a 42.3% share in 2024

- The medical devices segment is dominating the medical polymers market with a 37.3% share in 2024

- Top companies in the medical polymers market are BASF SE, Covestro AG, Celanese Corporation, DuPont, UL LLC, Evonik, Exxon Mobil Corporation, Foryou Medical, Kraton Corporation, and SABIC, among others.

Market Dynamics

Drivers: Advancements in polymer technology are accelerating the growth of the medical polymers market

The market for medical polymers is expanding rapidly due to advancements in polymer technology, which make it possible to create materials that are extremely robust, sterilizable, and biocompatible. PEEK, TPU, and bioresorbable polymers are examples of innovative polymers that provide greater performance in surgical instruments, implants, and catheters. By offering flexibility, transparency, and chemical resistance, these materials enhance patient safety and the lifespan of devices.

Moreover, ongoing R&D in polymer chemistry and advancements in biodegradable, biocompatible, and sustainable materials address rising environmental concerns and evolving regulatory requirements. For instance, in November 2024, Avient Corporation announced the launch of its Colorant Chromatics Transcend Biocompatible PEEK Pre-Colored Compounds and Colorants at MEDICA 2024. Designed for demanding healthcare applications, these compounds were tested to meet ISO 10993 biocompatibility standards, ensuring safety and compliance for medical use.

Restraints: Environmental sustainability concerns are hampering the growth of the medical polymers market

Environmental sustainability concerns are restraining the growth of the medical polymers market, as most conventional polymers used in healthcare are non-biodegradable and difficult to recycle. Regulatory demand for environmentally acceptable alternatives has increased due to the growing amount of plastic medical waste from disposables including syringes, tubing, and packaging.

Additionally, adoption is being slowed by the increased production costs and restricted scalability associated with the development of biodegradable or bio-based polymers. Global sustainability objectives and growing environmental consciousness are pushing businesses to reinvent their products, but the slow pace of the shift to greener materials is impeding industry growth.

For more details on this report, see Request for Sample

Medical Polymers Market, Segmentation Analysis

The global medical polymers market is segmented based on product type, application, end user and region

By Product Type: The medical resins and fibers segment is dominating the medical polymers market with a 42.3% share in 2024

The market for medical polymers is dominated by the medical resins and fibers segment due toof their extensive use in disposables, packaging, and medical devices. These materials are perfect for syringes, IV bags, tubing, and diagnostic components since they are highly biocompatible, durable, and easily sterilizable. Polymers that are inexpensive and simple to process using injection molding and extrusion include polypropylene, polyethylene, and polyvinyl chloride.

Additionally, advancements in polymer modification, regulatory approval, and launches for medical-grade resins enhance their adoption. For instance, in January 2024, SABIC showcased its versatile and durable ULTEM HU resins at MD&M West, highlighting their ability to support the transition from ethylene oxide sterilization. These resins offered exceptional stability across multiple sterilization methods, addressing regulatory shifts and rising demand for safer, sustainable medical materials.

By Application: The medical devices segment is dominating the medical polymers market with a 37.3% share in 2024

The market for medical polymers is dominated by the medical devices segment due to polymers are widely used in the production of surgical tools, implants, catheters, and diagnostic equipment. Medical applications benefit greatly from the flexibility, chemical resistance, and biocompatibility of polymers including PEEK, PVC, and TPU. The growing use of disposable and minimally invasive medical equipment is driving up the consumption of polymers. 3D printing and technological developments significantly improve the use of polymers in the manufacturing of bespoke devices.

Additionally, the polymer industry offers a diverse range of bioresorbable and biodegradable polymers to medical device manufacturers, driving significant market expansion in the medical device sector. For instance, in June 2025, Ashland expanded its Viatel bioresorbable polymer portfolio with new grades for medical devices and aesthetic medicine. These advanced polymers offered benefits such as eliminating surgical removal, minimizing interventions, reducing foreign body responses, and enabling personalized, localized drug delivery for complex medical applications.

Medical Polymers Market, Geographical Analysis

North America is dominating the global medical polymers market with a 48.5% in 2024

The North American region led the global medical polymers market, driven by advanced healthcare infrastructure, rapid technological innovation, and growing demand for high-performance medical materials. Increasing the number of surgeries, growing the production of medical devices and polymers, and strategically expanding businesses all contributed to the acceleration of regional growth and market domination.

For instance, in October 2025, LyondellBasell expanded its Purell healthcare polymer portfolio in North America, strengthening its presence in the medical-grade polyolefin market. The expansion brought the company’s proven service model, regulatory expertise, and innovation-driven solutions closer to regional healthcare and pharmaceutical customers, enhancing supply reliability and performance.

Europe is the second region after North America which is expected to dominate the global medical polymers market with a 34.5% in 2024

Europe's medical polymer market is expanding as a result of improvements in healthcare infrastructure, population aging, and an increase in surgical and respiratory procedures. Growing demand for sustainable and biocompatible materials, strategic distribution agreements, growing production of medical devices, and significant R&D expenditures are all contributing to innovation and the acceleration of regional market growth in nations like Germany, the UK, France, Denmark, and Italy.

Owing to factors like strategic distribution agreements. For instance, in July 2025, Evonik entered a strategic distribution agreement with IMCD, appointing it as the exclusive European distributor for RESOMER bioresorbable polymers used in implantable medical devices. The partnership expanded IMCD’s medical portfolio and enhanced access to Evonik’s advanced polymer solutions across European Economic Area countries, as well as non-members including the United Kingdom, Switzerland, Turkey, Albania, Andorra, Monaco, Montenegro, San Marino, and Serbia.

Moreover, in May 2023, Americhem expanded its medical-grade materials compounding facility in Denmark, adding a clean compounding unit to meet growing European healthcare demand. The expansion strengthened Americhem’s capacity to deliver high-quality polymer solutions tailored for medical and healthcare applications across the region.

The Asia Pacific region is the fastest-growing region in the global medical polymers market, with a CAGR of 7.7% in 2024

The Asia-Pacific medical polymer market, which includes China, India, South Korea, and Japan, is growing rapidly as a result of increased healthcare spending, technological developments, an increase in surgical and respiratory procedures, better hospital infrastructure, and growing awareness of cutting-edge medical materials for critical and minimally invasive care applications.

China’s medical polymers market is growing rapidly due to expanding healthcare infrastructure, rising demand for advanced medical devices, and increasing investments in biocompatible materials. Strong government support, local manufacturing expansion, and partnerships with global polymer producers are further boosting innovation and accelerating market growth across the healthcare sector.

Owing to factors like manufacturing expansion. For instance, in September 2024, Avient Corporation expanded its healthcare TPU manufacturing in China, enhancing production of NEU Custom Capabilities and NEUSoft Thermoplastic Polyurethane (TPU) solutions for catheter applications. The announcement, made at Medtec China 2024, highlighted Avient’s commitment to advancing medical-grade material innovation and local manufacturing capabilities.

Competitive Landscape

Top companies in the Medical Polymers Market are BASF SE, Covestro AG, Celanese Corporation, DuPont, UL LLC, Evonik, Exxon Mobil Corporation, Foryou Medical, Kraton Corporation, and SABIC, among others.

BASF SE: BASF SE is a leading global chemical company offering a wide range of advanced medical polymers designed for high-performance healthcare applications. Its portfolio includes engineering plastics, biocompatible materials, and specialty polymers used in medical devices, drug delivery systems, and packaging. BASF focuses on innovation, safety, and sustainability to support evolving healthcare and medical technology needs.

Key Developments:

- In April 2025, Peijia Medical Technology (Suzhou) Co., Ltd. and dsm-firmenich established a strategic innovation partnership to advance polymer heart valve materials using ultra-high molecular weight polyethylene (UHMWPE) and thermoplastic polyurethane (TPU). The collaboration marked a major milestone, driving global innovation and transformation in high-end medical device materials and next-generation cardiovascular technologies.

- In January 2025, GEON Performance Solutions Acquires Foster Corporation GEON Performance Solutions, a global leader in the formulation, development and manufacture of performance polymer solutions, today announced it acquired Foster Corporation, a differentiated compounder of biomedical polymers used in the high-growth healthcare and medical device industry.

Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Medical Resins and Fibers, Medical Elastomers, Biodegradable Polymers and Others |

| By Application | Medical Devices, Surgical Consumables and Disposables, Tissue Engineering and Medical Implants, Drug Delivery Systems and Others | |

| By End User | Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Medical Device Manufacturers, Research Laboratories | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global medical polymers market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here