Overview

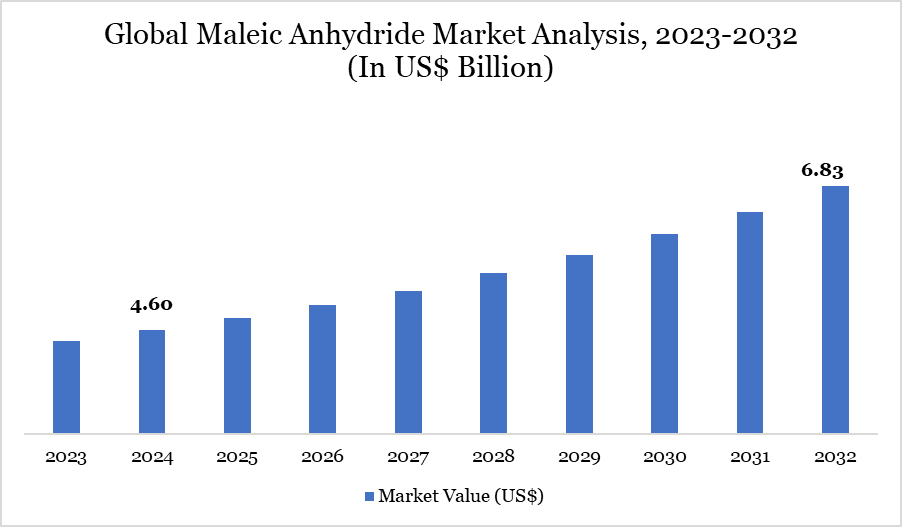

Global Maleic Anhydride market size reached US$ 4.60 billion in 2024 and is expected to reach US$ 6.83 billion by 2032, growing with a CAGR of 5.06% during the forecast period 2025-2032, according to DataM Intelligence report.

The global maleic anhydride market is experiencing significant expansion, principally fueled by the rising demand for unsaturated polyester resins (UPR), particularly in the construction and automotive sectors. UPR is a significant downstream product of maleic anhydride and is widely employed in reinforced fiberglass composites. These composites are extensively utilized in automobile exteriors, maritime components, and domestic infrastructure, such as sinks and countertops.

In 2023, the US represented a substantial 82.9% revenue share in North America, driven by burgeoning building activity and the automobile industry. In 2023, U.S. construction expenditure reached US$1.98 trillion, reflecting a 7.4% increase year-over-year, primarily driven by nonresidential projects. The rise in infrastructure investments, along with the application of UPR in damage repair and body filler, emphasizes the increasing significance of maleic anhydride in essential end-use sectors. The ongoing momentum in the automotive and construction sectors is anticipated to maintain the global demand trajectory for maleic anhydride.

Maleic Anhydride Market Trend

A significant trend influencing the maleic anhydride industry is the rising need for lightweight, high-strength composite materials. UPR is widely utilized in the fabrication of these materials owing to its superior resistance to corrosion, thermal degradation, and mechanical stress. Its application extends across multiple sectors, including wind energy, marine, transportation, and construction, due to these performance advantages.

The market is experiencing an increase in automotive applications, where UPR functions as a putty for vehicle painting, restoring smooth surfaces, and improving paint adhesion. Moreover, UPR plays a crucial role in the fabrication of body panels, headlight reflectors, and bumpers, rendering it essential for both structural integrity and cosmetic restoration in automobiles.

A notable trend is the swift integration of UPR in 1,4-butanediol (BDO) applications, propelled by heightened production of derivatives such as polybutylene terephthalate (PBT) and polyurethane (PU), utilized in electronics, pharmaceuticals, and synthetic leathers, thereby underscoring maleic anhydride’s crucial role in industrial advancement.

Market Scope

Metrics | Details |

By Raw Material | n-butane, Benzene |

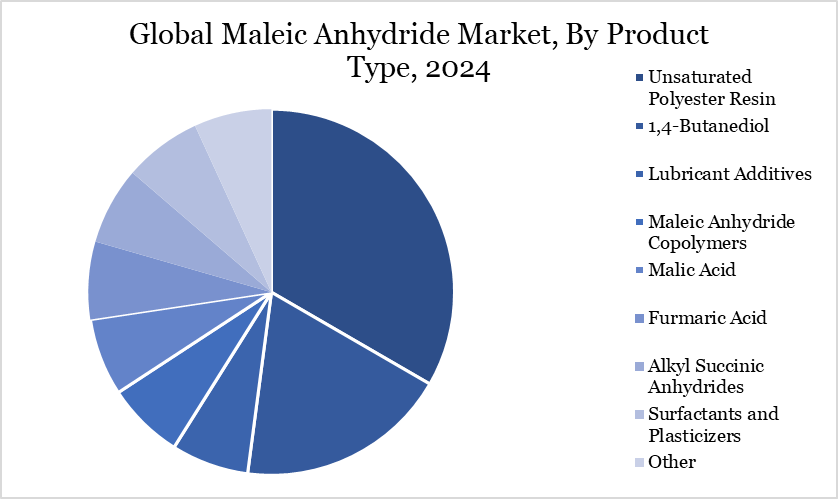

By Product Type | Unsaturated Polyester Resin, 1,4-Butanediol, Lubricant Additives, Maleic Anhydride Copolymers, Malic Acid, Furmaric Acid, Alkyl Succinic Anhydrides, Surfactants and Plasticizers, Other |

By End-user | Construction, Automobile, Food and Beverage, Electronics, Personal Care, Pharmaceutical, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Maleic Anhydride Market Dynamics

Increasing Automotive Production Fuels Demand for Maleic Anhydride

The growth of the automotive industry is substantially propelling the maleic anhydride market, bolstered by a worldwide increase in vehicle sales and manufacturing. Maleic anhydride is an essential component in unsaturated polyester resins (UPR), crucial for the manufacture of automobile composites such as fenders, closing panels, and grille reinforcements. These elements facilitate lightweight vehicle designs, enhancing fuel efficiency and diminishing pollutants.

Maleic anhydride copolymers function as essential components in lubricant additives, improving engine efficiency. The escalating pace of motorization, particularly in developing nations, alongside growing disposable incomes, is driving the need for engine oils, functional fluids, and structural vehicle components.

In 2022, Germany manufactured nearly 4.7 million vehicles, demonstrating the extensive magnitude of the automotive industry in Europe. The continuous progress in composite materials and the rising application of maleic anhydride to improve vehicle aesthetics and mechanical performance position the automotive sector as a crucial growth driver for the maleic anhydride market.

Electric Mobility Disrupts Conventional Maleic Anhydride Demand

The shift to hybrid and electric vehicles poses a significant challenge to the maleic anhydride sector. Hybrid vehicles combine electric motors with compact internal combustion engines, markedly decreasing the usage of lubricants such as engine oils and transmission fluids—key application sectors for maleic anhydride-based additives.

The enhancement of battery parity—characterized by decreasing battery costs and heightened energy density—is expediting the adoption of electric vehicles (EVs), hence reducing lubricant demands. According to industry estimates, lubricant usage per vehicle may decrease by roughly fifty percent using hybrid technology. The aggregate effect of these factors jeopardizes the demand for maleic anhydride in the automotive fluid sector.

The progressive adoption of electric vehicles indicates a long-term limitation on maleic anhydride volumes associated with lubricants and oil-based applications, especially in developed countries. Manufacturers must adjust by diversifying end-use applications or investing in alternate usage such as bio-based maleic anhydride.

Segment Analysis

The global maleic anhydride market is segmented based on raw material, product type, end-user and region.

Diversification of Unsaturated Polyester Resin Products Enhances Market Applications

Unsaturated polyester resins (UPR), synthesized from maleic anhydride, are categorized into many product kinds according to their application properties, including orthophthalic, isophthalic, dicyclopentadiene (DCPD), and specialty resins. Orthophthalic resins prevail in the market owing to their economic efficiency and extensive use in marine, building, and general-purpose sectors.

Isophthalic resins, which provide superior mechanical strength and corrosion resistance, are being progressively utilized in rigorous structural applications, including chemical tanks and pipes. DCPD-based resins are esteemed for their superior cost-effectiveness and thermal resistance, rendering them appropriate for automotive and electrical enclosures.

Specialty UPRs serve specific industries such as aerospace and wind energy, where attributes like heat stability and high tensile strength are critical. The product segments enable the UPR market to cater to a wide range of end-use industries with customized resin solutions, thereby impacting the demand for maleic anhydride due to formulation variability and performance requirements.

Geographical Penetration

In Europe, Germany Drives European Demand through Strong Automotive and Construction Production

Europe is crucial in the worldwide maleic anhydride market, with Germany establishing itself as a regional leader in manufacturing and export. In 2022, Germany exported maleic anhydride valued at US$131 million, positioning it as the world's second-largest exporter. This position is supported by the robustness of its automobile and construction sectors, both primary users of UPR generated from maleic anhydride.

In 2022, the German automotive industry produced over 4.7 million vehicles, as reported by the VDA, highlighting the sector's magnitude and dependence on lightweight composite materials. Moreover, the increasing demand for high-performance construction materials amplifies UPR consumption in applications like panels, tubs, and insulation components.

The European market benefits from legislative focus on sustainability and lightweight materials, fostering potential for maleic anhydride utilization in environmentally friendly composite manufacturing. Germany, with its robust industrial infrastructure and export capabilities, is pivotal to the advancement of Europe’s maleic anhydride sector.

Sustainability Analysis

The ion exchange resins business, historically dependent on petroleum-derived raw chemicals like maleic anhydride, is seeing a transition towards sustainable practices. The rising environmental concerns and the toxicity linked to benzene have expedited the pursuit of renewable feedstock alternatives. A notable invention is bio-based maleic anhydride, which may be produced from fermented renewable resources such as butanol.

Utilizing bio-based feedstock has economic and ecological benefits, decreasing reliance on crude oil while simplifying industrial processes and lowering emissions. Although traditional petroleum-based production prevails due to established supply chains, significant stakeholders are investing in the large-scale commercialization of sustainable alternatives.

This tendency is especially pertinent to the ion exchange resins market, which caters to essential industries including water purification, food processing, and pharmaceuticals. The strategic necessity of sustainability suggests that the effective use of bio-based maleic anhydride will likely improve the environmental credentials of ion exchange resins and facilitate worldwide regulatory compliance.

Competitive Landscape

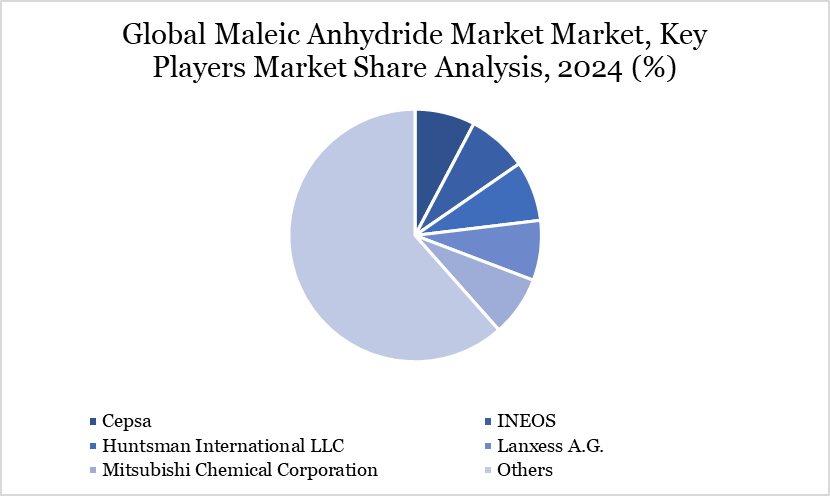

The major global players in the market include Cepsa, INEOS, Huntsman International LLC, Lanxess A.G., Mitsubishi Chemical Corporation, MOL Hungarian Oil & Gas Plc, Nippon Shokubai Co., Ltd., Polynt Group, Thirumalai Chemicals Ltd., Jiangyin Shunfei, Tianjin Bohai Chemicals and among others.

Key Developments

In June 2023, PETRONAS Chemicals Group Berhad (PCG) acquired the 113 kilo-tonnes per annum (ktpa) Maleic Anhydride (MAn) factory located at Gebeng, Kuantan, from BASF PETRONAS Chemicals Sdn. Bhd. (BPCS).

In November 2023, Clariant made an announcement regarding the acquisition of Jiangsu Shenghong Petrochemical Co., Ltd. An agreement has been made to use Clariant's SynDane 3142 LA catalyst for the construction of a new maleic anhydride (MA) manufacturing plant in Lianyungang, Jiangsu province.

In October 2023, Huntsman declared the commencement of maleic anhydride production at its Moers facility in Germany, after an unexpected maintenance closure that had halted operations. The Moers chemical factory is renowned for its substantial yearly output capacity of 105,000 tonnes of maleic anhydride.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies