Lyophilized Injectables Market Size

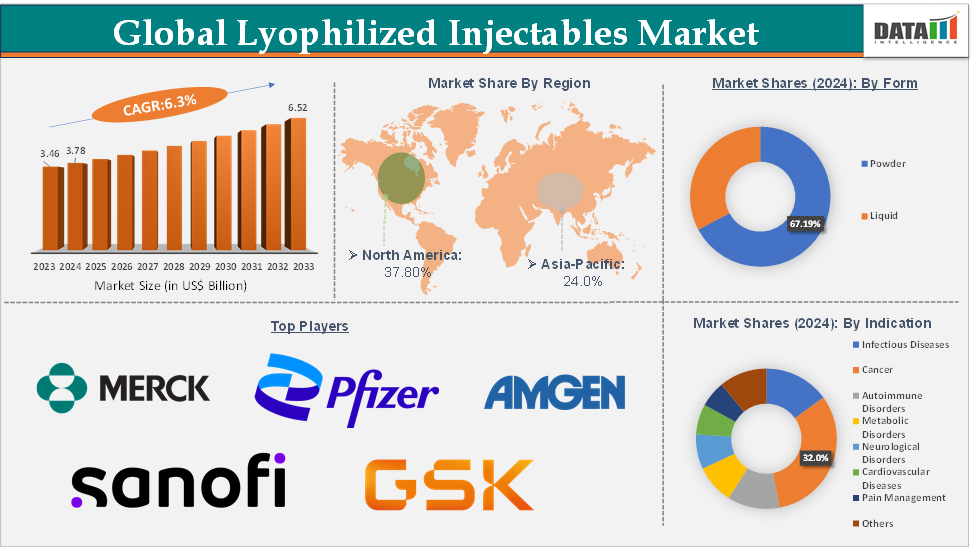

The global lyophilized injectables market size reached US$ 3.78 Billion in 2024 from US$ 3.46 Billion in 2023 and is expected to reach US$ 6.52 Billion by 2033, growing at a CAGR of 6.3% during the forecast period 2025-2033.

Lyophilized Injectables Market Overview

The lyophilized injectables market is experiencing robust global growth, driven by increasing demand for stable and effective injectable formulations in the pharmaceutical and biotechnology sectors. Lyophilization, or freeze-drying, is a critical technology that enhances the shelf life and stability of sensitive drugs, particularly mAbs. In 2024, out of 13 approved mAbs, 4 are lyophilized drug products and 9 are liquid dosage forms. Interestingly, 50% (2 out of 4) of lyophilized products are with bispecific mAbs. Similarly, over 30% of the parenteral medications that have received FDA approval are lyophilized products. These rising approvals for lyophilized mAbs are driving the market growth.

Lyophilized Injectables Market Executive Summary

Lyophilized Injectables Market Dynamics

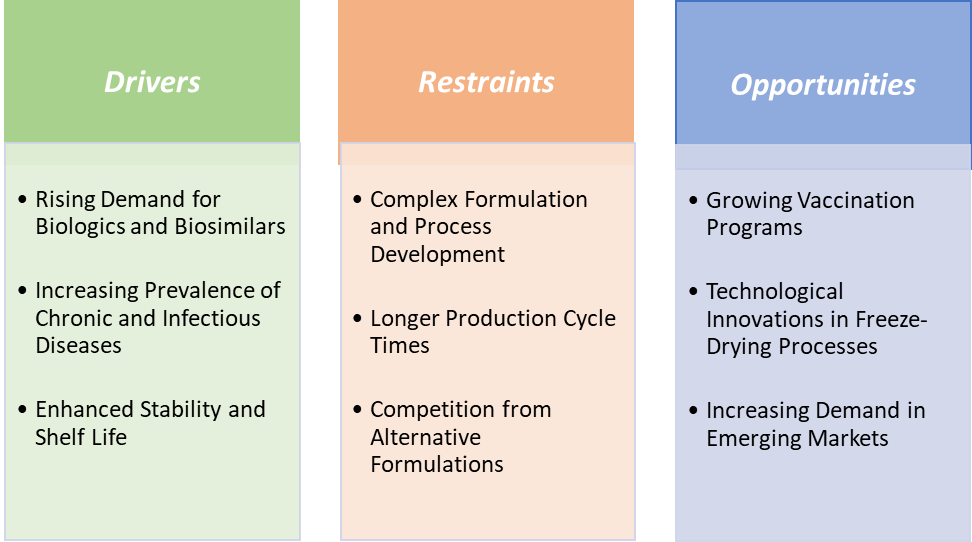

Drivers:

Rising demand for biologics and biosimilars is significantly driving the lyophilized injectables market growth

Biologics, complex molecules like monoclonal antibodies, recombinant proteins, and vaccines, represent one of the fastest-growing segments. However, these biologic drugs are highly sensitive to temperature, moisture, and chemical degradation, which limits their stability in liquid form. Lyophilization is the preferred method to stabilize these sensitive molecules by removing water, thus extending their shelf life, preserving bioactivity, and reducing cold chain dependency. This makes lyophilized injectables critical for the safe and effective delivery of biologics.

As patents expire on blockbuster biologics, biosimilars are entering the market rapidly. By the end of 2024, the FDA approved a total of 71 biosimilars, including six follow-on biologicals that did not undergo the BLA 351K process for use in the US, driving demand for lyophilized formulations to ensure biosimilar stability and regulatory compliance.

Over 70% of monoclonal antibodies in clinical development are formulated as lyophilized injectables to maintain potency. For instance, rituximab (Rituxan) and trastuzumab (Herceptin), leading cancer biologics, are commonly supplied in lyophilized form. Similarly, in 2024, out of 13 approved mAbs, 4 are lyophilized drug products and 9 are liquid dosage forms. Interestingly, 50% (2 out of 4) of lyophilized products are with bispecific mAbs.

Currently, 16 percent of the top 100 pharmaceutical drugs are lyophilized, and 25 percent of the biologics market is expected to be lyophilized in the coming years. More than 30 percent of the FDA-approved parenteral therapies are lyophilized. The market is growing for biologics, and the storage demands are increasing, boosting the market growth.

Restraints:

Competition from alternative formulations is hampering the growth of the lyophilized injectables market

While lyophilized injectables offer enhanced stability and shelf life, they face growing competition from emerging drug delivery technologies and alternative formulations that can bypass some of the challenges of freeze-drying. These alternatives often provide improved patient convenience, faster manufacturing, and lower costs, which limit the adoption of lyophilized products.

Advances in formulation science have enabled some biologics to be developed as stable liquid injectables that do not require freeze-drying. These formulations reduce production time and costs, simplifying supply chains. For instance, adalimumab (Humira) is available as a ready-to-use liquid injectable, which competes with lyophilized versions.

Injectable depot formulations and microspheres that release drugs slowly over time reduce dosing frequency and improve patient compliance, providing an attractive alternative to lyophilized powders that require reconstitution. Products like Lupron Depot use this approach effectively. Although lyophilization remains crucial for many sensitive drugs, the rise of stable liquid injectables, sustained-release formulations, and non-injectable alternatives challenges the lyophilized injectables market by offering more convenient, cost-effective, and patient-friendly options, thereby restraining its growth.

Opportunities:

Growing vaccination programs create a market opportunity for the lyophilized injectables market

Vaccination programs worldwide are expanding rapidly due to increased public health initiatives, emerging infectious diseases, and the need for booster doses. Lyophilized injectables are crucial in these programs because they provide enhanced vaccine stability and longer shelf life, especially important in regions with limited cold chain infrastructure.

Many vaccines, particularly live-attenuated or protein-based vaccines, are unstable in liquid form and require lyophilization to maintain potency during storage and transport. Lyophilized vaccines can be stored at refrigerated or even ambient temperatures for longer periods, reducing reliance on continuous cold chain logistics a significant advantage in developing countries.

The global COVID-19 vaccination drive highlighted the need for stable, easily transportable vaccines. Several COVID-19 vaccines, such as certain mRNA and viral vector vaccines, explored lyophilized formulations to enhance distribution. Governments and organizations like the WHO and GAVI are scaling up immunization programs for diseases like influenza, measles, HPV, and emerging infections, increasing demand for lyophilized vaccine formulations.

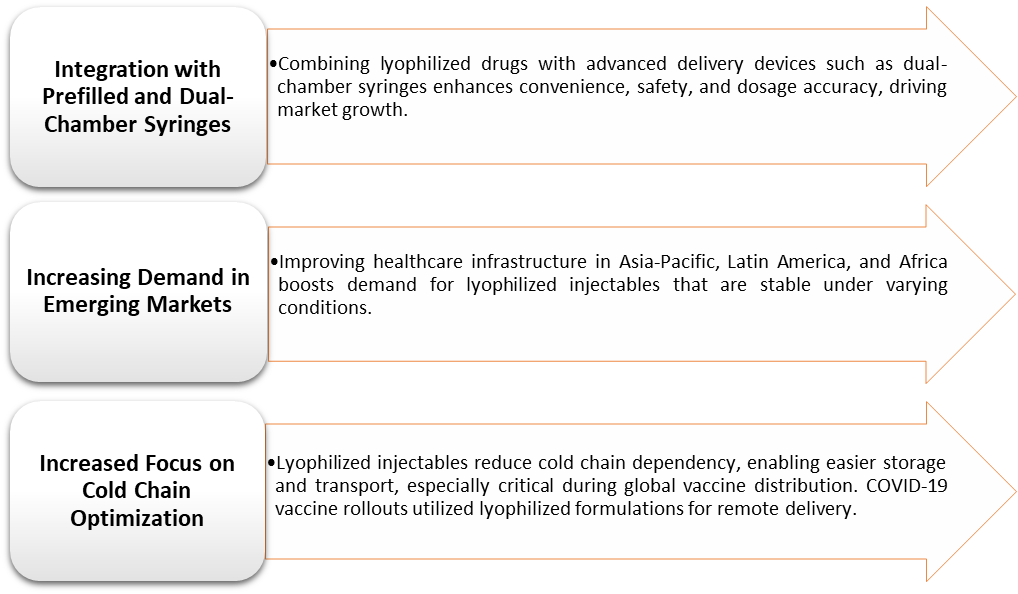

Lyophilized Injectables Market Trends

For more details on this report – Request for Sample

Lyophilized Injectables Market, Segment Analysis

The global lyophilized injectables market is segmented based on form, drug class, packaging type, indication, end-user, and region.

The cancer segment from the indication reached US$ 1.21 Billion in 2024 in the lyophilized injectables market

The cancer segment is a dominant driver of the lyophilized injectables market primarily because many oncology drugs are biologics or complex molecules that require enhanced stability and precise dosing needs ideally met by lyophilization.

For instance, according to the National Institutes of Health, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. According to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million. This growing patient population fuels demand for effective cancer therapies.

Many anticancer drugs, such as monoclonal antibodies (rituximab, trastuzumab) and recombinant proteins, require lyophilization for stability and shelf life. These drugs degrade rapidly in liquid form but remain stable and active after freeze-drying. The oncology pipeline is robust, with over 50% of biologics under development targeting cancer indications, driving innovation and demand for lyophilized injectables. Cancer therapies often require controlled dosing regimens, and lyophilized formulations reduce the risk of degradation during storage and transport, ensuring efficacy at the point of care.

Lyophilized Injectables Market, Geographical Analysis

North America is expected to dominate the global lyophilized injectables market with a US$ 1.43 Billion in 2024

North America, particularly the United States, holds a dominant position in the lyophilized injectables market due to its strong biopharmaceutical industry, advanced healthcare infrastructure, and supportive regulatory environment.

The U.S. FDA provides clear guidance on lyophilized drug products, enabling faster approvals and market access. Additionally, North America has stringent quality and safety standards that lyophilized products easily comply with, reinforcing market trust with the FDA approvals for most of the products. For instance, in February 2025, Medexus Pharmaceuticals announced that GRAFAPEX (treosulfan) for Injection is commercially available in the United States. The dosage form for GRAFAPEX is treosulfan as a lyophilized powder in a single-dose vial for injection.

The high prevalence of chronic diseases like cancer, autoimmune disorders, and infectious diseases increases demand for stable injectable biologics in this region. Additionally, the U.S. is the largest market for biologics globally, driven by high R&D investment and a strong pipeline of novel therapies. Many of these biologics, such as monoclonal antibodies and vaccines, require lyophilization for stability and distribution.

Overall, North America dominates the lyophilized injectables market due to its leadership in biologics development, sophisticated manufacturing and distribution infrastructure, supportive regulatory environment, and high disease burden, all of which create strong demand and supply capabilities for lyophilized injectable products.

Asia-Pacific is growing at the fastest pace in the lyophilized injectables market holding 24.0% of the market share

The Asia-Pacific region is experiencing rapid growth in the lyophilized injectables market due to expanding healthcare infrastructure, rising prevalence of chronic diseases, increasing biopharmaceutical manufacturing capabilities, and growing vaccination programs. Governments in countries like India, China, Japan, and South Korea are heavily investing in healthcare infrastructure, increasing hospital capacity and access to advanced biologics and vaccines that often require lyophilized formulations.

Asia-Pacific is rapidly becoming a global hub for biopharmaceutical production, including lyophilized injectables. India and China are key players expanding manufacturing capacities with cost advantages and skilled labor. Large-scale immunization drives, supported by government policies and global health organizations, promote the use of lyophilized vaccines, which are easier to store and transport in regions with limited cold chain infrastructure.

Lyophilized Injectables Market Competitive Landscape

Top companies in the lyophilized injectables market include Merck & Co., Inc., Pfizer Inc., Novartis AG, Sanofi, Amgen Inc., GSK plc., Novo Nordisk A/S, Aristopharma Ltd., Protech Telelinks, Cirondrugs, among others.

Lyophilized Injectables Market, Key Developments

In February 2025, Medexus Pharmaceuticals announced that GRAFAPEX (treosulfan) for Injection is commercially available in the United States. The dosage form for GRAFAPEX is treosulfan as a lyophilized powder in a single-dose vial for injection.

In October 2024, Sandoz launched a generic paclitaxel formulation in the USA, the first generic of its reference medicine to be approved by the US Food and Drug Administration (FDA). The launch of the lyophilized powder for injection containing 100mg of paclitaxel in a single-dose vial for intravenous use follows approval by the FDA.

Lyophilized Injectables Market Scope

Metrics | Details | |

CAGR | 6.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Form | Powder and Liquid |

Drug Class | Antibiotics, Antineoplastics, Anti-Inflammatory Drugs, Anesthetics, Immunoglobulins, Biologicals, and Others | |

Packaging Type | Single-Use Vials, Multi-Dose Vials, Ampoules, Pre-Filled Syringes, Cartridges, and Specialized Dual-Chamber Systems | |

Indication | Infectious Diseases, Cancer, Autoimmune Disorders, Metabolic Disorders, Neurological Disorders, Cardiovascular Diseases, Pain Management, and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Homecare Settings, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights on Lyophilized Injectables Market

According to DMI analysis, the lyophilized injectables market size reached US$ 3.78 Billion in 2024 and is expected to reach US$ 6.52 Billion by 2033, growing at a CAGR of 6.3% during the forecast period 2025-2033. The lyophilized injectables market is experiencing robust growth globally, driven primarily by the rising adoption of biologics and biosimilars, expanding vaccination programs, and technological advancements in freeze-drying processes. Lyophilization remains a critical formulation technology to enhance the stability, shelf life, and efficacy of sensitive injectable drugs, especially biologics such as monoclonal antibodies, peptides, and vaccines.

Oncology remains the largest therapeutic segment due to the widespread use of monoclonal antibodies and supportive care drugs like pegfilgrastim in lyophilized form. Simultaneously, expanding global vaccination programs, especially in emerging markets, create significant demand for lyophilized vaccines such as measles, BCG, and COVID-19 boosters.

The lyophilized injectables market represents a vital segment within the injectable drug market, with unique advantages in drug stability and patient outcomes. Continued innovations in lyophilization processes, coupled with increasing biologics approvals and vaccination programs, position this market for sustained growth. Companies investing in advanced technologies and expanding into emerging regions are likely to lead the competitive landscape in the coming decade.

The global lyophilized injectables market report delivers a detailed analysis with 78 key tables, more than 85 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.