Liver Cancer Therapeutics Market: Industry Outlook

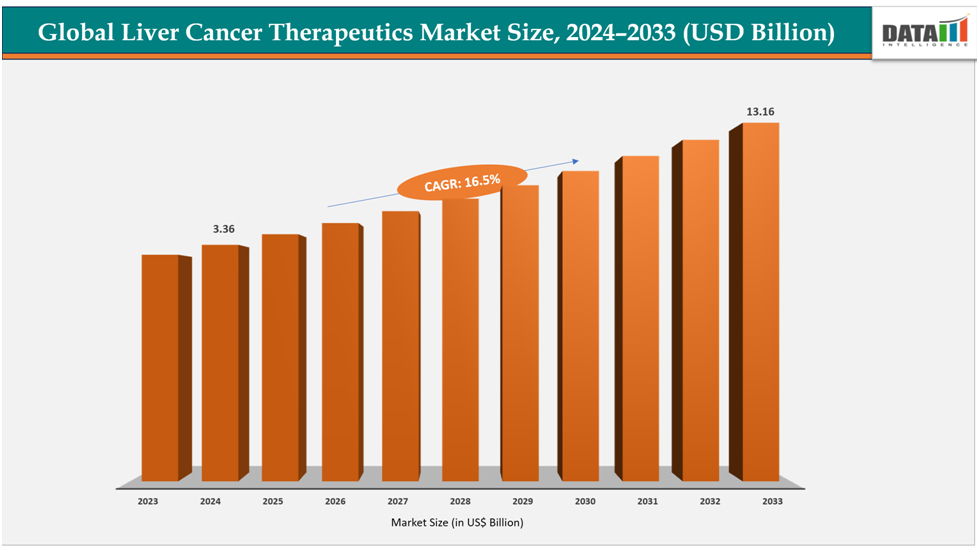

The liver cancer therapeutics market reached US$ 2.92billionin 2023,with a rise of US$3.36billion in 2024, and is expected to reach US$ 13.16billionby 2033, growing at a CAGR of 16.5% during the forecast period 2025-2033.

One major driving factor in the liver cancer therapeutics market is the rising prevalence of hepatocellular carcinoma (HCC) linked to lifestyle and viral factors, particularly chronic hepatitis B and C infections, alcohol-related liver disease, and the growing burden of non-alcoholic fatty liver disease (NAFLD) associated with obesity and diabetes. For instance, in Asiaespecially China and Southeast Asiahepatitis B accounts for the majority of liver cancer cases, while in Western countries NAFLD and alcohol misuse are becoming leading contributors. This rising disease burden is pushing demand for effective therapies and accelerating adoption of both targeted oral agents and novel immunotherapy combinations.

Key Highlights

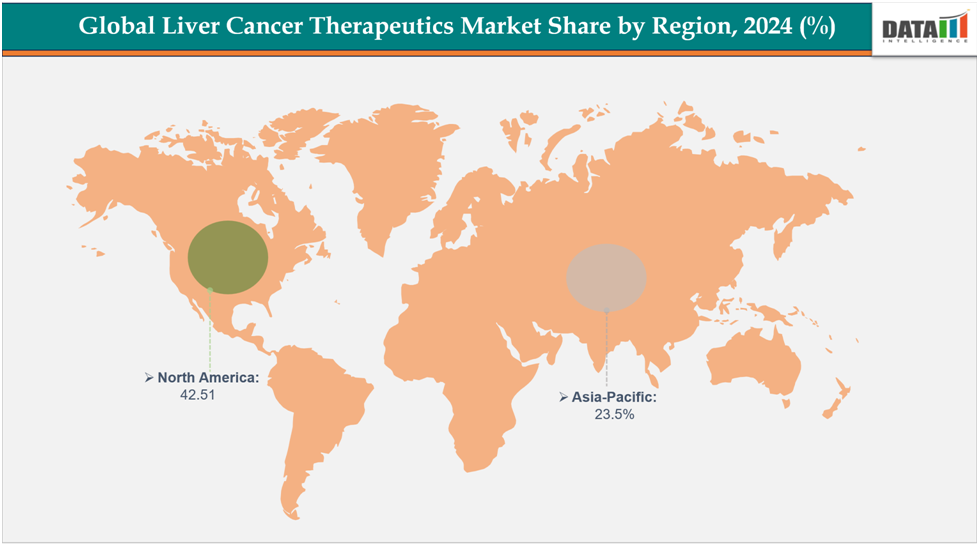

North America dominates the acne therapeutics market with the largest revenue share of 42.1% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the market share of 23.5% over the forecast period.

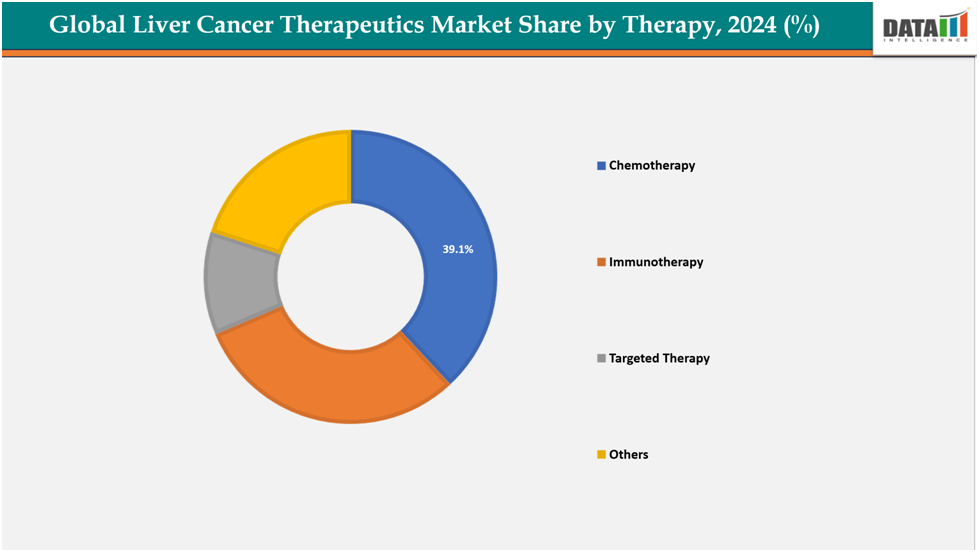

Based on therapy type, chemotherapy segment led the market with the largest revenue share of 39.1% in 2024.

The major market players in the AstraZeneca, Bayer AG, Eli Lilly, Bristol-Myers Squibb Company, Eisai Co., Ltd., Genentech and among others.

Drivers & Restraints

Driver: Rising incidence of liver cancer

The Liver Cancer Therapeutics Market is growing due to the increasing incidence of liver cancer, a condition linked to chronic hepatitis B and C infections, alcohol abuse, obesity, and non-alcoholic fatty liver disease (NAFLD), particularly in developed economies.

For instance, according to the American Cancer Society, in 2025, the US will see 42,240 new cases of primary liver cancer from these diseases. Liver cancer is more prevalent in sub-Saharan Africa and Southeast Asia, with over 800,000 people diagnosed annually worldwide. Cancer is more common in these regions than in the US.

Restraint: High cost of liver cancer treatment

The high cost of liver cancer treatment is a major obstacle to the Liver Cancer Therapeutics Market growth. Advanced therapies like targeted drugs and immunotherapies are expensive, often exceeding thousands of dollars per treatment cycle. This financial burden is particularly pronounced in low- and middle-income countries where access to subsidized care is limited. The lack of reimbursement coverage and high out-of-pocket expenses often leads to delayed or discontinued treatment, negatively impacting patient outcomes.

For instance, a study at UT Southwestern Medical Center found that hepatocellular carcinoma (HCC), the most common type of liver cancer, can significantly burden patients financially. The study found that median Medicare payments for patients with HCC in the first year after diagnosis exceeded $65,000, and out-of-pocket costs were more than $10,000, significantly more than costs for patients with cirrhosis alone.

For more details on this report - Request for Sample

Segmentation Analysis

The liver cancer therapeutics market is segmented based on type, therapy, route of administration, end user, and region.

Therapy Type:

The chemotherapy segment from therapy type is expected to have 39.1% of the liver cancer therapeutics market share.

Chemotherapy remains a vital part of the liver cancer therapeutics market, especially for patients with intermediate-stage hepatocellular carcinoma (HCC) or those ineligible for surgical resection or transplantation. Tran arterial chemoembolization (TACE) is a standard of care used in clinical settings and often combined with targeted therapies. Despite the rise of immunotherapies and precision drugs, chemotherapy remains vital due to its established protocols, lower costs, and widespread availability. Clinical studies are exploring the synergy of chemotherapeutic agents with immunomodulators to prolong survival and delay disease progression.

Route of Administration:

The oral route of administration segment is expected to have 54.1% of the liver cancer therapeutics market share.

The oral segment of the liver cancer therapeutics market is being driven by the rising adoption of targeted therapies and tyrosine kinase inhibitors (TKIs) such as sorafenib, lenvatinib, regorafenib, and cabozantinib, which have become established standards of care in advanced hepatocellular carcinoma. Their oral route of administration offers greater convenience compared to intravenous immunotherapies, supporting long-term outpatient management and better treatment adherence. Growing patient preference for home-based therapy, coupled with expanding availability of generics and favorable reimbursement policies in several regions, further strengthens the growth of this segment. Additionally, ongoing R&D into novel oral targeted agents and combination regimens is expected to enhance therapeutic outcomes and sustain demand.

Geographical Analysis

The North America liver cancer therapeutics market was valued at 42.1% market share in 2024

North America is expected to dominate the liver cancer therapeutics market due to its strong healthcare infrastructure, high awareness, and significant investments in oncology R&D. For instance, in January 2025, Mount Sinai researchers made a significant breakthrough in treating hepatocellular carcinoma (HCC), a type of liver cancer.

Additionally, the rise in liver cancer incidence, driven by NAFLD, obesity, and chronic hepatitis C, has increased early diagnosis rates and demand for advanced therapeutics. The FDA's favorable regulatory pathways, including priority reviews and orphan drug designations, have accelerated drug approval, ensuring rapid market access.

The Europe is second dominating region in the liver cancer therapeutics market was valued at 34.5% market share in 2024

The liver cancer therapeutics market in Europe is driven by the growing prevalence of hepatitis B and C infections, rising alcohol consumption, and increasing cases of non-alcoholic fatty liver disease (NAFLD). Supportive regulatory approvals for novel immunotherapies, coupled with well-established healthcare infrastructure and government-backed cancer screening programs, are boosting adoption of advanced treatment regimens.

In the U.K., a high burden of liver disease linked to obesity, diabetes, and alcohol misuse is accelerating demand for effective HCC treatments. National Health Service (NHS) initiatives to expand early cancer diagnosis, along with faster access schemes for innovative oncology drugs, further drive uptake of immunotherapies and targeted therapies.

The Asia-Pacific region in the Liver Cancer Therapeutics Market was valued at 23.5% market share in 2024

This region is witnessing significant growth due to the very high incidence of hepatitis B and C, particularly in China and Southeast Asia, which are leading causes of HCC. Rising investments in healthcare infrastructure, greater clinical trial activity, and increasing patient access to immuno-oncology drugs are fueling the market.

In Japan, liver cancer remains a leading cause of cancer mortality, primarily associated with hepatitis virus infections and an aging population. Strong government support for oncology research, rapid adoption of cutting-edge immunotherapies, and the presence of domestic pharmaceutical players are key factors driving therapeutic innovation and market expansion.

For instance, in June 2025, Ono Pharmaceutical Co., Ltd. and Bristol-Myers Squibb K.K. have received supplemental approval for their anti-PD-1 antibody, Opdivo, and BMSKK's anti-CTLA-4 antibody, Yervoy, in combination therapy in Japan to expand their use for treating unrespectable hepatocellular carcinoma (HCC), a type of unrespectable hepatocellular carcinoma.

Major Players

The major players in the liver cancer therapeutics market include AstraZeneca, Bayer AG, Eli Lilly, Bristol-Myers Squibb Company, Eisai Co., Ltd., Genentech among others.

AstraZeneca:-AstraZeneca is a leading immunotherapy contender in the liver-cancer (hepatocellular carcinoma, HCC) market: its PD-L1 antibody Imfinzi (durvalumab) combined with CTLA-4 antibody Imjudo (tremelimumab) was approved in the U.S. for unrespectable HCC after the Phase III HIMALAYA program showed a clinically meaningful overall-survival benefit, and updated five-year follow-up reported durable survival for a subset of patients results that solidified the combo as an important alternative to other frontline regimens.

Key Developments

In July 2025, Apollo Proton Cancer Centre (APCC) opened an 'Advanced Liver Cancers Clinic', an integrated facility for primary liver cancers and liver metastases, inaugurated by retired Additional Director-General of Police Radhakrishnan Thiagarajan, with Karan Puri, CEO of Apollo Cancer Centres and APCC, and Sujith Kumar Mullapally, consultant.

In October 2024, Bristol Myers Squibb received a supplemental Biologics License Application (sBLA) from the FDA for Opdivo in combination with Yervoy as a potential first-line treatment for adults with unrespectable hepatocellular carcinoma, based on the Phase 3 CheckMate -9DW trial findings.

Market Scope

Metrics | Details | |

CAGR | 16.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Type | Hepatocellular Carcinoma, Cholangiocarcinoma, Hepatoblastoma, Others |

Therapy | Chemotherapy, Immunotherapy, Targeted Therapy, , Others | |

| Route of Administration | Oral, Intravenous |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The liver cancer therapeutics market report delivers a detailed analysis with 58 key tables, more than 60 visually impactful figures, and 205 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here