Global Light Fidelity (Li-Fi) Market Size & Overview

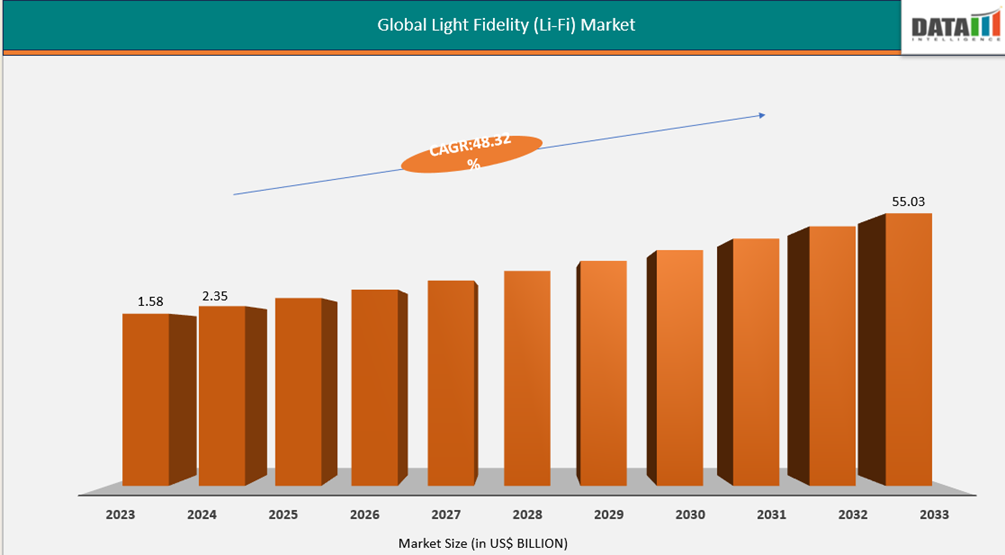

The global Light Fidelity (Li-Fi) market was valued at US$2.35 billion in 2024 and is projected to reach US$55.03 billion by 2032, growing at a CAGR of 48.32%. The market is driven by rising demand for secure, high-speed wireless communication in RF-sensitive environments and the rapid deployment of smart infrastructure across commercial and industrial sectors. Li-Fi’s ability to transmit data through LED lighting systems makes it ideal for hospitals, defense facilities, and manufacturing units where electromagnetic interference and data security are critical.

In parallel, the global shift toward clean energy is intensifying interest in deep-sea mining, particularly for critical minerals like cobalt, nickel, and rare earth elements. These resources are essential for technologies such as batteries, solar panels, and wind turbines. As land-based reserves face geopolitical and environmental constraints, attention is turning to seabed deposits like polymetallic nodules and hydrothermal sulfides. Innovations in subsea robotics and autonomous exploration are making deep-ocean extraction more feasible, positioning the sector as a strategic enabler of global electrification and net-zero goals

Global Light Fidelity (Li-Fi) Market Industry Trends and Strategic Insights

- The Asia-Pacific region leads the global Li-FI Market, capturing the largest revenue share of 36.23 % in 2024.

- By end-user, the Metallurgical sector dominates by largest share in the global Li-FI market

Market Size and Future Outlook

- 2024 Market Size: US$ 2.35 Billion

- 2032 Projected Market Size: US$ 55.03 billion

- CAGR (2025-2032): 48.32%

- Largest Market: Asia-Pacific

- Fastest Market: North America

Market Scope

| Metrics | Details |

| By Component | Residential, Commercial, Industrial |

| By Application | Transmitter, Receiver, Microcontroller, LED Drivers, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More information request for Free sample

Market Dynamics

Li-Fi Delivers Ultra-Fast Connectivity for High-Demand Environment

Li-Fi enables exceptionally fast data transfer by using light waves typically from LEDs to transmit information at speeds far exceeding conventional wireless systems. This rapid transmission is achieved through the modulation of light signals at extremely high frequencies, allowing vast amounts of data to be encoded and decoded almost instantaneously. Its ability to deliver high bandwidth makes it suitable for environments demanding quick and reliable communication, such as smart factories, research labs, and immersive media applications.

In July 2023, IEEE introduced the 802.11bb standard for LiFi, enabling seamless communication between devices from different manufacturers. This move is expected to boost commercial adoption by ensuring greater compatibility and scalability.

Li-Fi Deployment Faces Cost Hurdles Amid Infrastructure Demands

LiFi technology involves higher installation costs due to its reliance on specialized LED transmitters and photodetectors. Unlike WiFi, which uses widely available radio components, LiFi systems must be integrated into lighting infrastructure, often requiring technical upgrades and precise alignment. This makes initial deployment more expensive, especially in large or retrofitted spaces.

Segment Analysis

The global light fidelity (li-fi) market is segmented based on component, application and region

Li-Fi Lights the Way for Secure, Smart Building Connectivity

Commercial adoption of Li-Fi is accelerating in sectors that demand secure, high-speed, and interference-free connectivity. Office buildings, hospitals, and retail environments are integrating Li-Fi-enabled lighting systems that deliver both illumination and data transmission, reducing energy consumption and enhancing network security. These systems are particularly valuable in areas where radio frequency signals pose risks or limitations, such as medical facilities and financial institutions. As smart building technologies evolve, Li-Fi is positioned to play a key role in supporting sustainable, high-performance digital infrastructure.

For instance, in 2025, Intelligent Waves teamed up with Signify to deliver Li-Fi kits to the U.S. Department of Defense, showcasing the technology’s reliability in secure, radio-free environments. This defense-grade validation is boosting commercial confidence, encouraging sectors like healthcare, finance, and real estate to adopt Li-Fi for enhanced data security and interference-free connectivity.

Li-Fi Powers Industrial Connectivity with Speed

Industrial adoption of Li-Fi is expanding rapidly due to its ability to deliver secure, high-speed communication in environments where radio frequency signals are unreliable or restricted. Factories, transportation hubs, and mining operations benefit from Li-Fi’s resistance to electromagnetic interference, making it ideal for precision automation and real-time data exchange. The technology also supports energy-efficient networking through LED-based systems, aligning with sustainability goals in industrial modernization.

For instance, in early 2025, Signify introduced upgraded Trulifi retrofit kits offering speeds up to 250 Mbps, aimed at commercial and defense use. It also joined forces with Intelligent Waves to deliver Li-Fi solutions to the U.S. Department of Defense, strengthening its role in secure, non-RF communications.

Geographical Penetration

Asia-Pacific Powers Li-Fi Growth Through Smart Cities and LED Investment

Asia-Pacific dominates the LiFi market due to its rapid urbanization, large-scale smart city initiatives, and aggressive investment in LED infrastructure. Countries like China, India, and South Korea are leading deployments across sectors such as transportation, healthcare, and education, leveraging LiFi’s secure and high-speed capabilities. The region benefits from strong government support, rising digital literacy, and a growing demand for interference-free wireless communication, positioning it ahead of other global markets in both adoption rate and innovation.

China Li-Fi Market Outlook

China has emerged as a key player in the LiFi market, leveraging its advanced manufacturing capabilities and aggressive smart city rollouts. The country has integrated LiFi into public infrastructure, transportation hubs, and industrial zones, aiming to reduce radio frequency congestion and enhance data security. With strong government backing and rapid LED deployment, China continues to expand its footprint in LiFi innovation and commercialization.

For instance, in 2024, CETC advanced secure optical systems for defense and industrial use, laying technical groundwork for Li-Fi in RF-sensitive zones. Its work in photonics and electromagnetic-safe infrastructure supports China’s broader Li-Fi market by enabling deployment in critical environments aligned with national smart tech goals.

India Li-Fi Market Trends

India, meanwhile, is the fastest-growing LiFi market globally, driven by its Digital India initiative and increasing demand for secure, high-speed connectivity in education, healthcare, and logistics. Pilot projects across smart campuses, railway stations, and rural connectivity programs are accelerating adoption. The country’s focus on cost-effective, scalable solutions makes it a fertile ground for LiFi deployment across diverse sectors.

As per the instance, in 2025, Jabil announced a silicon-photonics plant in Gujarat, India, expanding global fabrication capacity for Li-Fi components and diversifying supply away from single-region concentration. This geographic hedge supports cost reduction and supply-chain resilience.

North America's Growth in Li-Fi

North America holds a significant position in the global LiFi market, driven by strong technological infrastructure, early adoption of emerging wireless systems, and demand for secure communication across enterprise, healthcare, and defense sectors. The region benefits from active research collaborations, favorable regulatory frameworks, and a high concentration of innovation hubs that support LiFi development and deployment.

U.S Li-Fi Market Insights

The United States leads North America in LiFi adoption, particularly in enterprise, defense, and aviation applications. Government agencies and private firms are investing in LiFi for secure, high-speed data transmission in environments where radio frequency interference is a concern. The U.S. market benefits from advanced R&D capabilities, strong venture capital support, and integration of LiFi into smart lighting and building automatic in 2023, Getac integrated Li-Fi into its rugged devices through a collaboration with Signify’s Trulifi platform. This move supports secure, high-speed data transfer in RF-restricted environments like defense, manufacturing, and healthcare. In the U.S. market, it enhances field communication and industrial connectivity, helping expand Li-Fi’s practical use and commercial reach on systems.

Canada Li-Fi Industry Growth

Canada is gradually expanding its presence in the LiFi space, with interest growing in sectors such as education, healthcare, and smart buildings. Universities and research institutions are exploring LiFi for secure campus connectivity, while public infrastructure projects are beginning to incorporate optical wireless technologies. The country’s emphasis on sustainable

Sustainability Analysis

Li-Fi supports sustainable digital infrastructure by using visible light for data transmission, reducing dependence on radio frequencies and lowering electromagnetic interference. Its dual-use LED systems cut energy consumption, while its suitability for RF-restricted zones like hospitals enhances eco-friendly connectivity. As demand for fast, secure networks grows, Li-Fi’s role in smart buildings and industry aligns with carbon reduction and green tech goals.

Competitive Landscape

- The global light fidelity (li-fi) market is highly competitive, driven by a mix of global and regional players striving for technological efficiency and cost leadership.

- Key players include, pureLiFi, Oledcomm, Velmenni, Signify (Philips Lighting), Lucibel, Fraunhofer HHI, Firefly LiFi, VLNComm, Kyocera SLD Laser, Panasonic.

Key Developments

- In 2025, RayNeo’s launch of the X3 Pro spatial-computing glasses marked a significant step for the Li-Fi market. By integrating miniaturized micro-LED engines, the device demonstrated technical readiness for embedding Li-Fi transceivers into wearables—opening a new consumer channel beyond dongles and paving the way for secure, high-speed wireless communication in mobile and augmented reality applications.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies