Lamination Films Market Size

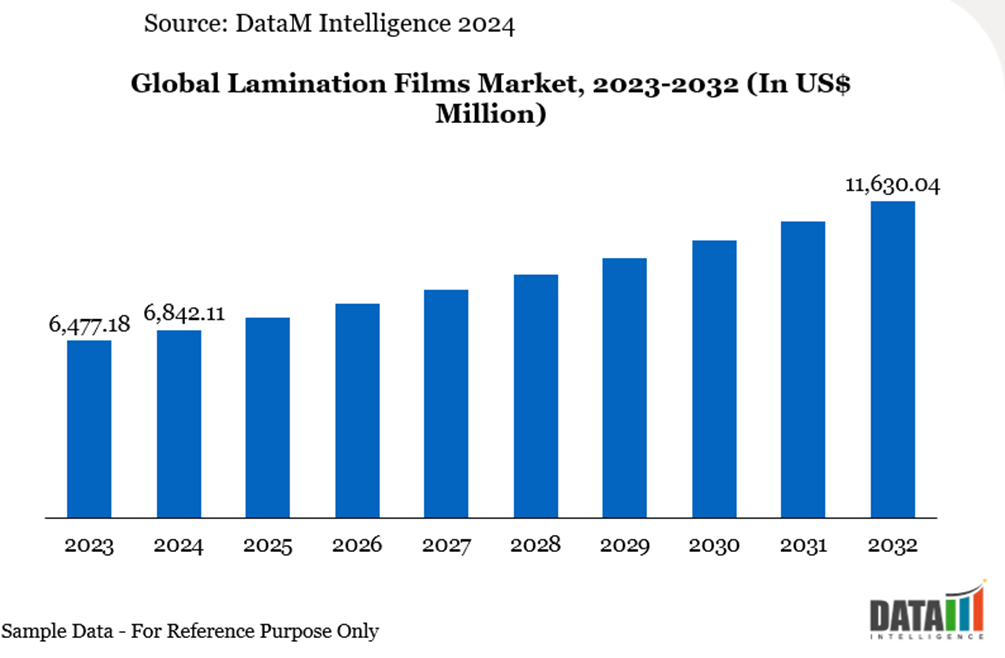

The global lamination films market reached US$6,842.11 million in 2024 and is expected to reach US$11,630.04 million by 2032, growing at a CAGR of 7.0% during the forecast period 2025-2032. The growth is fueled by increasing demand for high-quality, durable, and protective packaging solutions. Additionally, expanding applications across food, electronics, and consumer goods sectors are supporting market expansion.

Lamination Films Industry Trends and Strategic Insights

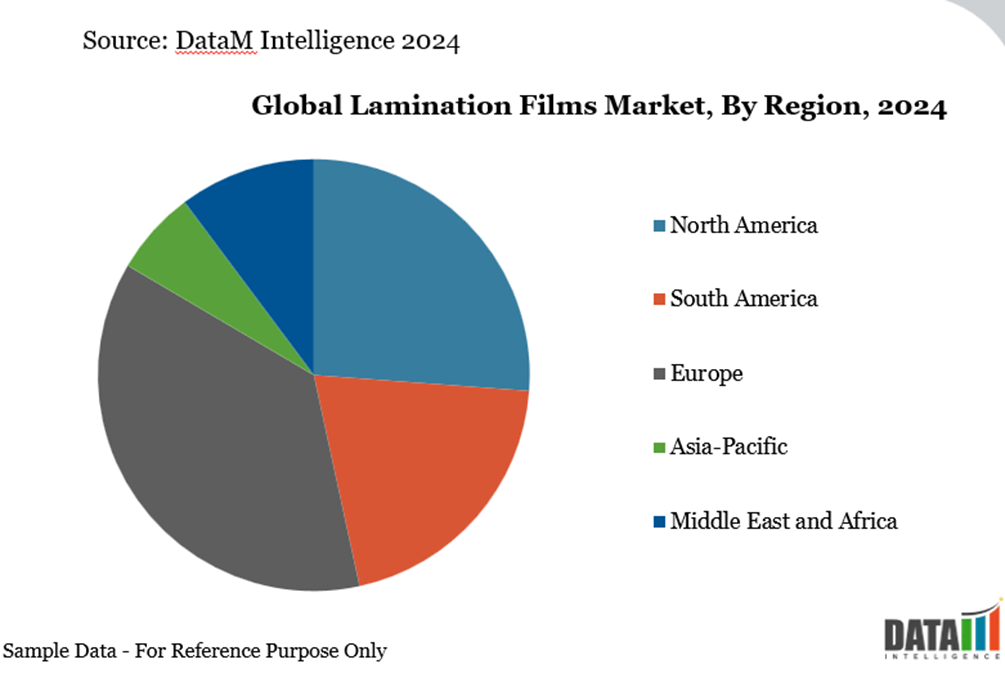

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 36.87% in 2024.

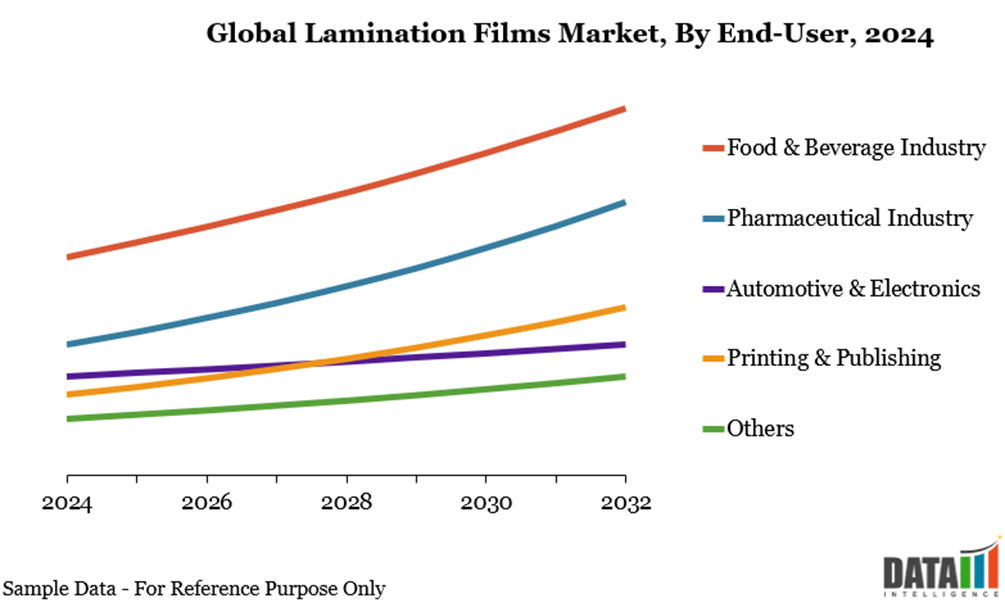

By end-user, the food & beverage industry segment is projected to experience the largest market, registering a significant 6% in0.69 2024.

Global Lamination Films Market Size and Future Outlook

2024 Market Size: US$6,842.11 Million

2032 Projected Market Size: US$11,630.04 Million

CAGR (2025-2032): 7.0%

Largest Market: Asia-Pacific

Fastest Market: Asia-Pacific

Market Scope

Metrics | Details |

By Type | BOPP (Biaxially Oriented Polypropylene), PET (Polyethylene Terephthalate), CPP (Cast Polypropylene), PVC (Polyvinyl Chloride), PE (Polyethylene), Others |

By Thickness | Thin (<25μm), Medium (25-50μm), Thick (>50μm) |

By Material | Plastic-based Lamination Films, Metalized Lamination Films, Composite Lamination Films |

By Application | Packaging, Printing & Labeling, Others |

By End-User | Food & Beverage Industry, Pharmaceutical Industry, Automotive & Electronics, Printing & Publishing, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Driver - Growing Packaged Food & Snack Industry

The global packaged food industry continues to expand, driven by urbanization, changing lifestyles and the growing need for convenience. Ready-to-eat and ready-to-cook products, snacks and processed foods are increasingly preferred by time-conscious consumers, creating substantial opportunities for packaging innovations such as lamination films that preserve product quality and extend shelf life.

India’s packaged convenience food industry is currently valued at ~INR 3,194 billion (FY22) and is projected to reach ~INR 4,883 billion by FY26, reflecting an 11% CAGR. With packaged foods accounting for ~45.9% of India’s overall consumption basket, the country represents a rapidly expanding market for high-performance packaging solutions.

Within the Indian market, snacks (23.5%), Indian sweets (18.6%), biscuits (15%) and ready-to-eat/ready-to-cook meals are among the fastest-growing segments. Rising consumer willingness to pay a premium for quality, taste and convenience fuels demand for packaging that ensures freshness, safety and visual appeal, underscoring the critical role of lamination films.

Consumer preferences are shifting toward innovative and premium food offerings, including artisanal products and international cuisines. Packaged food manufacturers are increasingly adopting advanced lamination technologies to enhance shelf appeal, maintain texture and flavor and provide features such as easy-open pouches or resealable packs, thereby supporting both brand differentiation and consumer satisfaction.

Segmentation Analysis

The global lamination films market is segmented based on type, thickness, material, application, end-user and region.

Food and Beverage Lead the Market Due to Growing Demand for Protective and Sustainable Packaging

The food and beverage sector increasingly relies on lamination films to enhance packaging protection, appearance and sustainability. These films preserve product freshness, maintain color and flavor and safeguard against moisture, oxygen and handling damage, making them vital for both premium and mainstream products.

For instance, in 2023, Novelis introduced laminated aluminium surfaces for beverage can ends, offering superior color stability and high-quality finishes, especially for black and colored cans. BPA- and PFAS-free, these films meet stringent food safety standards while improving production efficiency and reducing carbon footprint, without requiring modifications to existing can lines.

Similarly, Berry Global’s Entour brand unifies its range of high-performance polyethylene lamination films, providing versatile solutions for pouches, bags, stand-up pouches and flow wraps. These films combine excellent product protection, consumer convenience and shelf appeal with recyclable, circular-economy-compliant materials, presenting a sustainable alternative to traditional multi-material laminates.

Pharmaceutical Industry Drives Market Growth Due to Safety and Shelf-Life Packaging

The pharmaceutical industry holds a significant share in the global lamination films market, driven by the need for secure, high-barrier packaging that ensures drug safety and extends shelf life. Lamination films protect sensitive medications from moisture, oxygen, and contamination, making them essential for both prescription and over-the-counter products.

In June 2025, Evertis selected Honeywell's Aclar films for its Evercare pharmaceutical brand, emphasizing the industry’s focus on safety and recyclable packaging solutions. Such innovations highlight the growing demand for sustainable, high-performance films that align with regulatory standards and evolving consumer expectations.

Geographical Penetration

Asia-Pacific Leads Regionally Driven by Manufacturing Strength and Growing Packaging Demand

The Asia-Pacific region holds a substantial share in the global lamination films market, accounting for 36.87% of the revenue in 2024. This dominance is attributed to the region's robust manufacturing capabilities, increasing demand for flexible packaging solutions, and the growing e-commerce sector. The expansion of end-use industries such as food and beverages, pharmaceuticals, and consumer goods further drives the need for high-quality lamination films.

India Lamination Films Market Outlook

India is emerging as a significant player in the lamination films market, with projections indicating the highest compound annual growth rate (CAGR) from 2024 to 2032. The country's rapid industrialization, coupled with a burgeoning middle class, has led to increased demand for packaged goods. In response, companies are investing in advanced lamination technologies to meet the evolving packaging needs.

China Lamination Films Market Trends

China continues to lead the Asia-Pacific region in the lamination films market, driven by its vast manufacturing base and technological advancements. Chinese e-commerce giants like Alibaba are incorporating soft-touch lamination films into their packaging to enhance product appeal and customer experience. In 2024, Alibaba introduced a new line of premium packaging featuring soft-touch lamination films, aiming to attract high-end consumers and differentiate its products in the competitive market.

North America Leads the Market with Advanced and Sustainable Packaging Solutions

North American laminating films market is witnessing steady growth, driven by demand across industries such as packaging, printing and labeling. Laminating films are increasingly used to enhance product protection, durability and visual appeal, particularly in food, pharmaceuticals and consumer goods packaging.

Specialty laminating films with functional features are seeing increased adoption. Anti-scratch, tactile, antimicrobial and anti-graffiti films are used to improve durability, aesthetics and customer experience, especially in premium packaging, POP displays and high-touch products.

For instance, Drytac’s Interlam Eco Anti-Graffiti film, a clear PET laminating film with pressure-sensitive adhesive, protects graphics from vandalism, dirt and spray paint while supporting sustainability goals. Its recognition with the PRINTING United Alliance 2024 Pinnacle Product Award highlights the growing demand for innovative, high-performance laminating solutions in North America.

US Lamination Films Market Insights

The United States maintains a strong position in the lamination films market due to continuous product innovations. In early 2025, Berry Global launched a new line of high-barrier, recyclable lamination films for pharmaceutical pouches, offering improved moisture and oxygen protection. These films also support sustainable packaging goals and enhance shelf appeal, demonstrating the US market’s focus on safety, functionality, and eco-friendly solutions.

Canada Lamination Films Industry Growth

Canada is also making significant strides in the lamination films market, with a focus on sustainable and high-barrier packaging solutions. In 2024, Albéa Tubes began producing its Greenleaf plastic laminate web at its Brampton, Ontario site following the installation of a new blown film line. This initiative boosts North American sourcing of recyclable HDPE tubes, aligning with the industry's efforts to enhance sustainability in pharmaceutical packaging

Regulatory Analysis

The lamination films industry is tightly regulated to ensure consumer safety and environmental compliance, especially in food and beverage applications. Oversight focuses on material composition, migration limits, and proper labeling to prevent contamination. In the US, the FDA requires polymers and adhesives to be GRAS or receive premarket approval under rules such as 21 CFR Parts 175 and 177.

In the EU, Regulation (EC) No. 1935/2004 and Commission Regulation No. 10/2011 govern food contact materials, specifying authorized substances and migration limits. Japan and other countries have similar frameworks to ensure safety and quality. Emerging trends emphasize sustainability, with restrictions on harmful substances like PFAS, requiring manufacturers to adapt to evolving environmental and health regulations.

Competitive Landscape

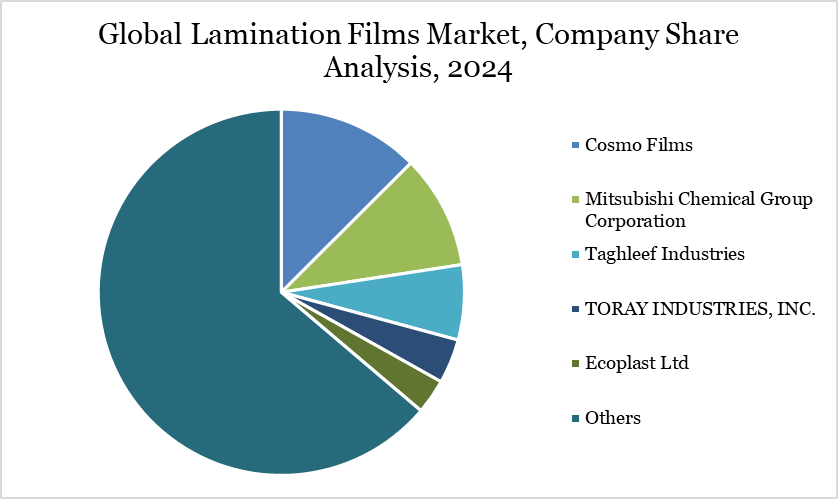

The global lamination films market is highly competitive, driven by a combination of large-scale packaging material manufacturers and specialized film converters.

Key players such as Cosmo Films, Mitsubishi Chemical Group Corporation, Taghleef Industries, TORAY INDUSTRIES, INC., Ecoplast Ltd, Tilak Polypack, Amcor plc, SRF, UFlex Limited and Flex Films command significant market share through their extensive global manufacturing footprint, proprietary technologies and robust R&D pipelines.

The companies compete on performance innovation, pricing strategies and increasingly on sustainability credentials, offering advanced PE and PP grades designed for downgauging, recyclability and food contact compliance.

In recent years, strategic differentiation has shifted toward circular and certified recycled Lamination Films solutions.

Key Developments

In February 2025, Shiva Polymers launched a 3.5-micron PVC lamination film for kela patta printing and dona plate making, offering 175 sqm per kg and strong performance. The company has doubled its production capacity and plans further expansion to meet growing pan-India demand. All products use recycled materials, highlighting a focus on sustainability, while India’s MSME sector presents significant growth potential for printing and packaging.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies