Kidney Stone Retrieval Devices Market: Industry Outlook

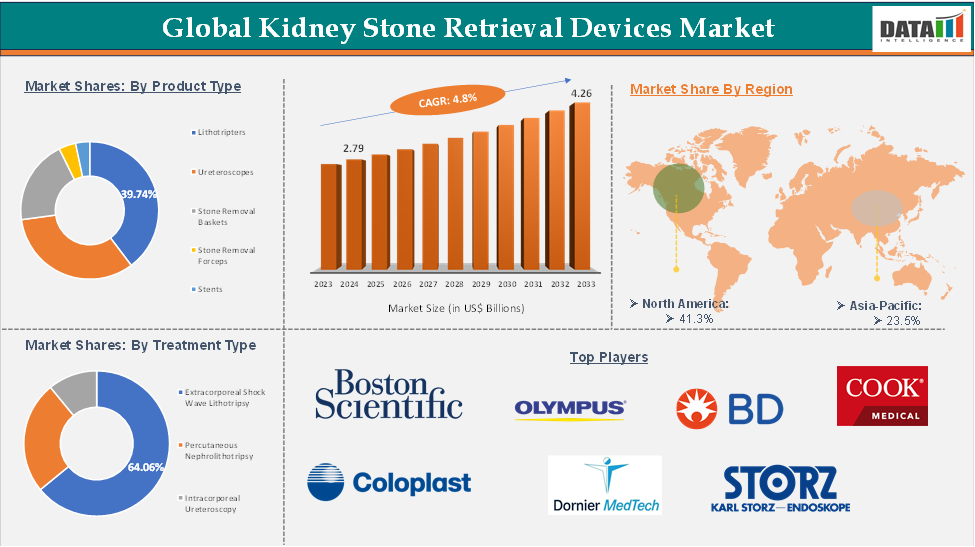

Kidney Stone Retrieval Devices Market reached US$ 2.79 Billion in 2024 and is expected to reach US$ 4.26 Billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033.

The global kidney stone retrieval devices market is growing due to the increasing prevalence of kidney stone disease and the demand for minimally invasive treatment options. Factors such as changing dietary habits, sedentary lifestyles, and climate conditions contribute to higher dehydration risks. Technological advancements, such as improved ureteroscopes and lithotripters, are enhancing safety, precision, and success rates of stone removal procedures. Lithotripters currently dominate the market, while ureterorenoscopes are gaining popularity.

North America leads due to advanced healthcare systems and high awareness, while Asia Pacific is expected to see the fastest growth. Major industry players are focusing on innovation, strategic partnerships, and global expansion.

Executive Summary

For more details on this report, Request for Sample

Kidney Stone Retrieval Devices Market Dynamics: Drivers & Restraints

Driver: Rising prevalence of kidney stones

The global increase in kidney stones is driving the growth of the kidney stone retrieval devices market. Factors like dietary habits, sedentary lifestyles, obesity, and climate change contribute to the prevalence of kidney stones. Technological advancements, such as minimally invasive procedures like lithotripsy and ureteroscopy, offer safer and more efficient treatment options. The aging global population, more susceptible to kidney-related ailments, further increases the need for advanced retrieval devices. The market is experiencing robust growth, with projections for continued expansion in the coming years.

For instance, kidney stones affect one in every 500 US individuals each year, with 1 in 8 men and 1 in 16 women developing the disease over their lifetime. In 2000, nearly $2 billion was spent on managing and caring for patients with stone disease, with the cost increasing annually. Nephrolithiasis is twice as common in the southeastern US due to warmer climates, causing increased sweating, fluid loss, and lowered urine output.

Restraint: Lack of skilled professionals

The global kidney stone retrieval devices market faces a significant challenge due to a shortage of skilled professionals trained in advanced retrieval technologies, particularly in developing regions. This lack of urologists and specialized healthcare providers hinders the adoption of advanced treatment options like ureteroscopy, laser lithotripsy, and robotic-assisted interventions. Addressing this skill gap through targeted training initiatives, international collaborations, and medical education investments could improve market penetration.

Kidney Stone Retrieval Devices Market Segment Analysis

The global kidney stone retrieval devices market is segmented based on product type, treatment type, end user, and region.

The lithotripters segment from the product type is expected to hold 39.74% of the kidney stone retrieval devices market

The lithotripters segment dominates the kidney stone retrieval devices market, treating kidney stones without invasive procedures. They use energy sources like shock waves, ultrasound, or lasers to break down stones into smaller pieces, which can be excreted or removed.

Extracorporeal shock wave lithotripsy (ESWL) is popular due to its non-invasive nature and high success rates. Advanced laser lithotripters, like those used in ureteroscopy, offer precise stone fragmentation for complex or larger stones. Technological advancements like AI for stone targeting and energy optimization are expected to further enhance their market role.

For instance, in September 2024, a clinical trial in The Journal of Urology found that Break Wave lithotripsy (BWL) is a non-invasive ultrasound technology which offers a safe and effective treatment option for urinary stones, The technology, which can be used in various settings without the need for anesthesia, has shown a high treatment success rate in its initial experience.

Kidney Stone Retrieval Devices Market Geographical Analysis

North America dominated the global kidney stone retrieval devices market with the highest share of 41.3% in 2024

North America dominates the kidney stone retrieval devices market due to its increasing prevalence of kidney stones, largely due to lifestyle factors like poor diet, obesity, high salt intake, and sedentary lifestyles. The aging population, particularly in the U.S. and Canada, is more prone to kidney-related issues, driving demand for these devices. The North American healthcare system's advanced infrastructure and high healthcare spending support the adoption of advanced kidney stone retrieval devices, while high health awareness drives the demand for minimally invasive treatments.

For instance, in November 2024, the FDA granted de novo clearance to the Stone Clear device, which uses non-invasive ultrasound pulses to help patients pass residual kidney stone fragments post-lithotripsy. The device is designed to manage kidney stones in clinic settings without requiring anesthesia.

The device is designed to reduce the burden of residual fragment stones in patients who are more likely to have complications, emergency department visits, or repeat procedures. The Stone Clear device provides patients with a reliable, non-invasive option to reduce their burden while being fully awake.

Asia-Pacific is the global kidney stone retrieval devices market with a market share of 23.5% in 2024

The global kidney stone retrieval devices market in the Asia-Pacific region is growing due to factors such as rapid urbanization, changing dietary habits, expanding healthcare infrastructure, government initiatives, and increased awareness about kidney stone prevention and treatment. The middle-class population in countries like China, India, and Southeast Asia is also benefiting from advanced treatments. The availability of skilled medical professionals and minimally invasive surgical techniques is also driving demand for kidney stone retrieval devices in the region.

For instance, in April 2024, Dornier MedTech, a subsidiary of Advanced MedTech Holdings, launched UroGPT, an AI tool designed to assist kidney stone patients. This marks a significant step towards empowering kidney stone sufferers through patient-first healthcare solutions, leveraging digital innovation.

Kidney Stone Retrieval Devices Market Key Players

The major global players in the kidney stone retrieval devices market include Boston Scientific Corporation, Olympus Corporation, Becton, Dickinson and Company, Cook Medical, Coloplast Group, Dornier MedTech, Storz Medical AG, CR Bard Inc., Stryker Corporation, Karl Storz SE & Co. KG, among others.

Key Developments

- In June 2024, Bristol Myers Squibb received accelerated approval from the FDA for KRAZATI (adagrasib) in combination with cetuximab as a targeted treatment option for adult patients with KRASG12C-mutated locally advanced or metastatic colorectal cancer who have received prior chemotherapy. The approval is based on objective response rate and duration of response results, and continued approval may be contingent upon verification and description of a clinical benefit in a confirmatory trial.

- In May 2024, Azurity Pharmaceuticals received FDA approval for Myhibbin, the only ready-to-use mycophenolate mofetil oral suspension. This medication is used to protect donated organs from rejection by the body's immune response. With over 46,000 US transplants in 2023, patients need to take daily medication to fight against rejection, making Myhibbin a valuable solution for these patients.

Market Scope

Metrics | Details | |

CAGR | 4.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Lithotripters, Ureteroscopes, Stone Removal Baskets, Stone Removal Forceps, Stents |

Treatment Type | Extracorporeal Shock Wave Lithotripsy, Percutaneous Nephrolithotripsy, Intracorporeal Ureteroscopy | |

End User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |