Japan Dental Equipment Market Size and Trends

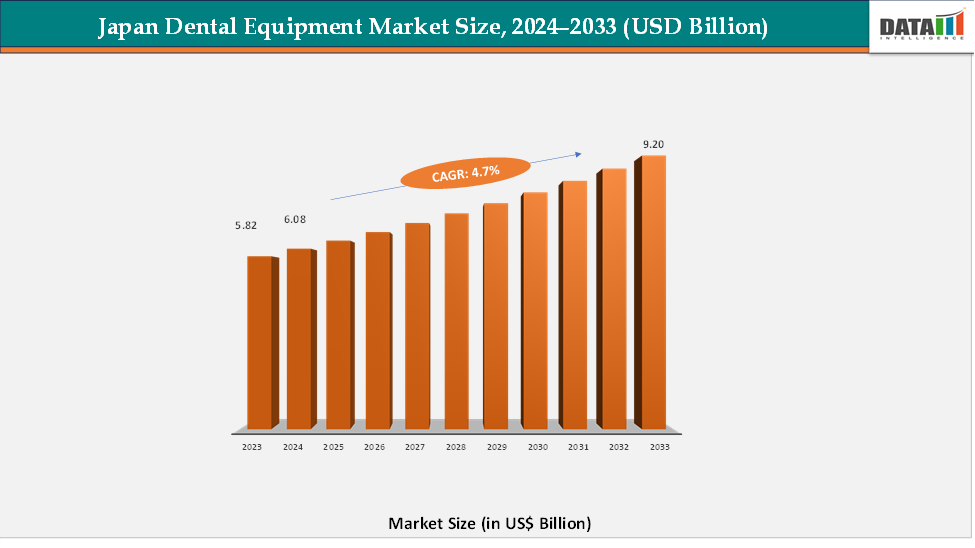

The Japan dental equipment market reached US$ 5.82 billion in 2023, with a rise to US$ 6.08 billion in 2024, and is expected to reach US$ 9.20 billion by 2033, growing at a CAGR of 4.7% during the forecast period 2025–2033. The Japan Dental Equipment Market is witnessing steady growth, driven by the rising prevalence of dental disorders, increasing awareness of oral health, and rapid technological advancements in dental care solutions. Japan’s aging population is contributing significantly to demand for restorative, prosthetic, and cosmetic dental treatments, while the growing emphasis on preventive dentistry is further boosting equipment adoption across clinics and hospitals.

Manufacturers are focusing on developing ergonomic, precise, and energy-efficient devices to meet the evolving needs of modern dental practices. Moreover, supportive government policies, comprehensive insurance coverage, and the expansion of private dental clinics are strengthening Japan’s position as a leading market for advanced dental technologies.

Market Size & Forecast

- 2024 Market Size: US$6.08 billion

- 2033 Projected Market Size: US$9.20 billion

- CAGR (2025–2033): 4.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

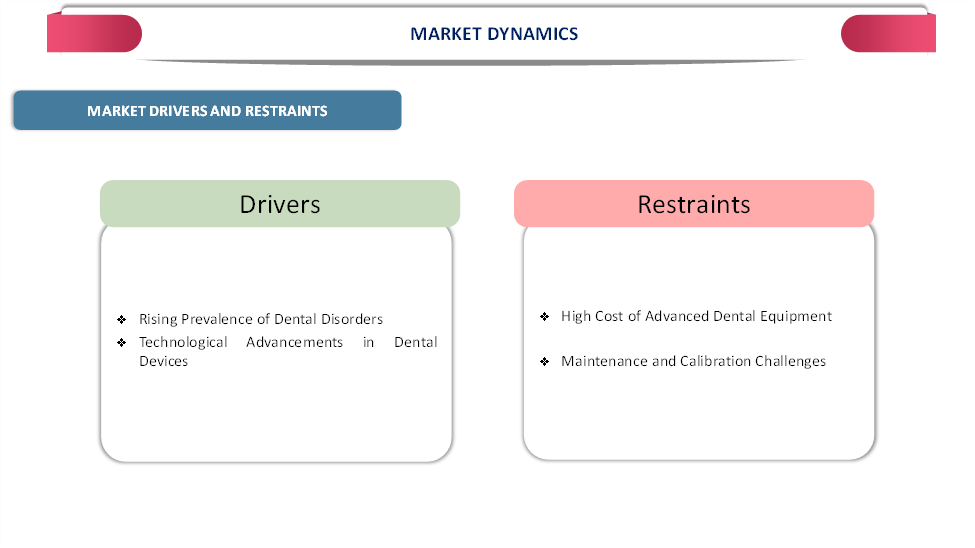

Japan Dental Equipment Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Dental Disorders

The rising prevalence of dental disorders is one of the key factors driving the growth of the Japan Dental Equipment Market, as the country faces an increasing burden of oral health issues linked to its aging population and evolving lifestyle patterns. Conditions such as dental caries, periodontal diseases, tooth loss, and malocclusion are becoming more common among both elderly and younger individuals, creating a continuous need for effective diagnosis, treatment, and preventive care. For instance, in Japan, the prevalence of dental caries was reported to be up to 40% among elementary school children. This surge in dental ailments has significantly boosted demand for modern equipment such as digital imaging systems, intraoral scanners, CAD/CAM devices, and dental lasers, which enhance treatment precision and improve patient comfort.

Furthermore, government initiatives promoting regular dental check-ups, preventive oral care programs, and partial insurance coverage for certain procedures are encouraging more people to seek dental services. The growing emphasis on oral aesthetics and minimally invasive treatments is also increasing patient visits, leading to greater adoption of advanced equipment across clinics and hospitals. As a result, the rising incidence of dental disorders is not only fueling market growth but also accelerating Japan’s transition toward digital and technology-driven dental practices.

Restraint: High Cost of Advanced Dental Equipment

The high cost of advanced dental equipment is expected to hamper the growth of the Japan Dental Equipment Market, as the significant investment required for purchasing, installing, and maintaining modern technologies such as CAD/CAM systems, 3D imaging devices, and laser systems poses a financial challenge for small and mid-sized dental clinics. These high upfront and operational costs often delay technology adoption, particularly among independent practitioners, thereby limiting market expansion despite growing demand for digital and precision-based dental care.

For more details on this report, Request for Sample

Japan Dental Equipment Market Segmentation Analysis

The Japan dental equipment market is segmented by product, treatment, end-user and region.

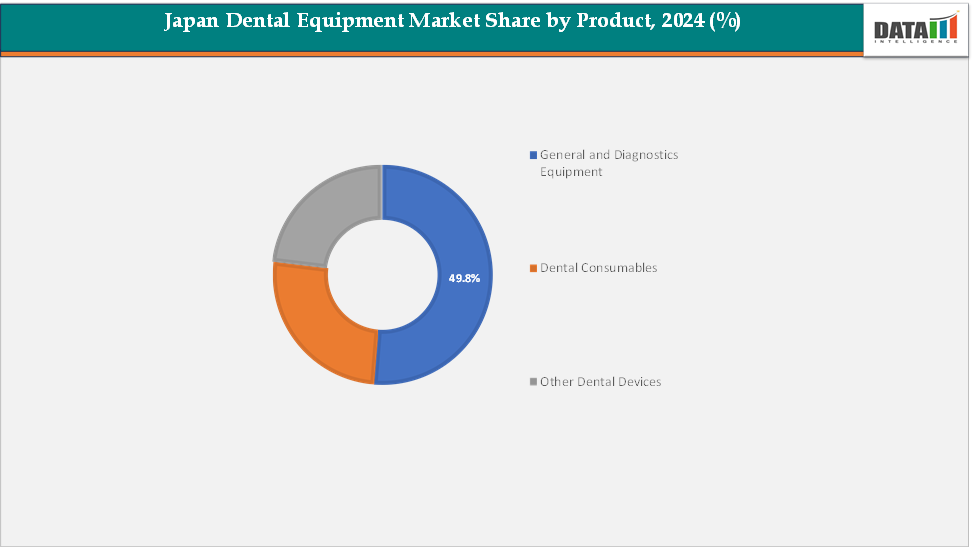

Product: The general and diagnostic equipment segment is estimated to have 49.8% of the dental equipment market share.

The general and diagnostic equipment dominates the dental equipment market, driven by the country’s advanced healthcare infrastructure, high awareness of oral health, and growing emphasis on early detection and precision-based treatment. Japanese dental practices are increasingly equipped with state-of-the-art diagnostic systems such as digital X-ray units, cone-beam computed tomography (CBCT), and intraoral scanners that enable accurate visualization and assessment of dental conditions. The integration of digital imaging and computer-assisted technologies has revolutionized dental diagnosis, allowing clinicians to provide faster, more accurate, and patient-friendly treatments.

Moreover, the rising focus on preventive dentistry and regular dental check-ups, supported by favorable insurance coverage, has increased the adoption of diagnostic tools across clinics and hospitals. The dominance of general equipment is further reinforced by Japan’s strong commitment to safety, hygiene, and workflow efficiency in dental care settings. With continuous advancements in automation, ergonomics, and smart diagnostic systems integrated with artificial intelligence, the general and diagnostic equipment segment is expected to maintain its leadership position in the Japanese market.

The dental consumables segment is estimated to have 26.4% of the dental equipment market share.

Dental consumables are emerging as the fastest-growing segment in the Japan Dental Equipment Market, fueled by rising demand for restorative, preventive, and cosmetic dental procedures. The aging Japanese population, coupled with increasing oral health awareness, has led to higher consumption of dental implants, crowns, bridges, impression materials, and composite resins. The trend toward minimally invasive and aesthetic dentistry is further accelerating the use of consumables for tooth restoration, alignment, and whitening. In addition, the growing preference for high-quality, biocompatible materials and single-use products to ensure patient safety and prevent cross-contamination is driving innovation in this segment.

Furthermore, the expansion of private dental clinics and cosmetic dentistry centers across Japan is increasing the volume of consumable usage. As a result, with technological progress in dental materials and growing patient demand for efficient and aesthetic outcomes, the dental consumables segment is expected to witness significant growth and play a pivotal role in shaping the future of Japan’s dental equipment industry.

Competitive Landscape

The major players in the dental equipment market include Dentsply Sirona, TAKARA BELMONT Corp, KaVo Dental, THE YOSHIDA DENTAL MFG. CO., LTD., J. MORITA MFG. CORP., Paloma, among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | General and Diagnostics Equipment, Dental Consumables, Other Dental Devices |

| Treatment | Orthodontic, Endodontic, Peridontic, Prosthodontic | |

| End-User | Hospitals, Clinics, Other End-Users | |

The Japan dental equipment market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here