Japan Craft Spirits Market Size Overview

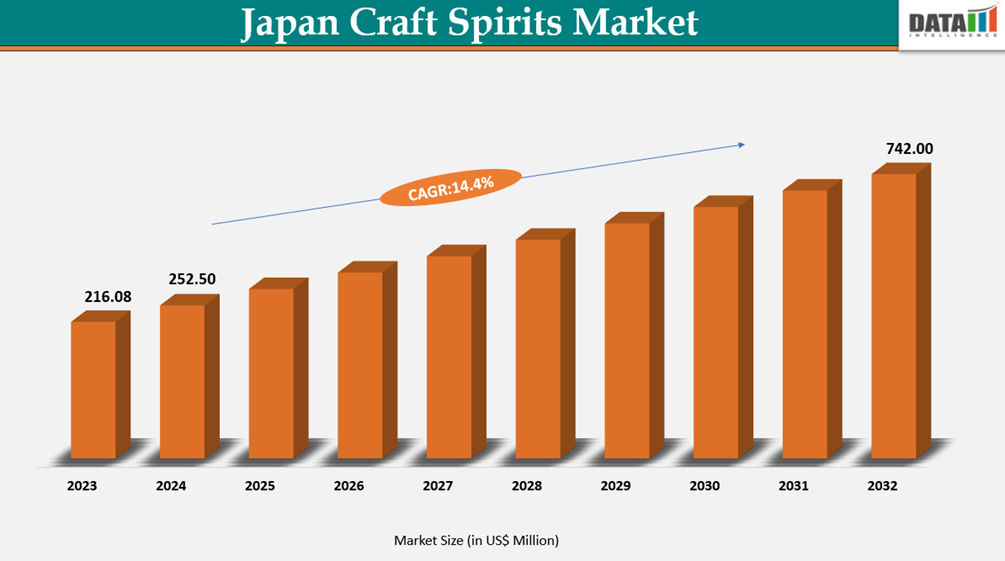

The Japan craft spirits market reached US$ 216.08 million in 2023, with a rise to US$ 252.50 million in 2024, and is expected to reach US$ 742.00 million by 2032, growing at a CAGR of 14.4% during the forecast period 2025–2032.

Japan’s craft spirits market represents a sophisticated fusion of tradition, precision, and innovation, positioning the country as a rising force in the global premium spirits’ landscape. Rooted in centuries-old craftsmanship and guided by meticulous attention to detail, Japanese distillers are redefining the perception of quality and authenticity in distilled beverages. The market encompasses a diverse range of products, including Japanese whisky, shochu, awamori, craft gin, and fruit-based liqueurs such as umeshu each reflecting Japan’s deep cultural heritage and respect for natural ingredients.

Driven by an expanding base of discerning consumers, both domestic and international, the market is witnessing strong growth supported by premiumization trends and evolving consumer preferences toward authenticity and locally inspired flavors. Distillers are increasingly focusing on small-batch production, sustainable sourcing, and innovation through botanicals such as yuzu, sakura, sansho pepper, and green tea to create distinctive sensory experiences.

Craft Spirits Industry Trends and Strategic Insights

- By product type, the Japanese whisky segment dominates, driven by global prestige, refined craftsmanship, and premium positioning. Meanwhile, the craft gin segment grows fastest, fueled by locally inspired botanicals like yuzu and sakura, attracting younger consumers and mixologists. Shochu and Awamori maintain steady domestic demand and cultural significance.

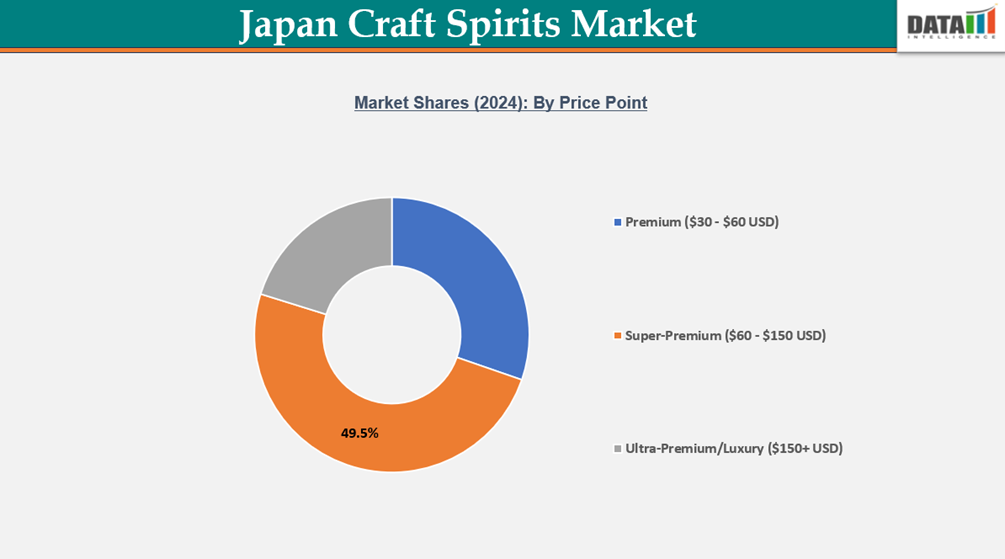

- By price point, the premium segment leads due to rising demand for artisanal, small-batch spirits showcasing regional authenticity. The super-premium and ultra-premium segments expand rapidly, with limited-edition releases and aged whiskies attracting collectors and luxury consumers, strengthening Japan’s image as a global leader in craft spirits.

Market Size and Future Outlook

- 2024 Market Size: US$252.50 million

- 2032 Projected Market Size: US$742.00 million

- CAGR (2025-2032): 14.4%

- Largest Market: Whiskey

- Fastest Market: Gin

Market Scope

| Metrics | Details |

| By Product Type | Whiskey, Gin, Vodka, Rum, Tequila & Mezcal, Liqueurs & Other Spirits |

| By Price Point | Premium ($30 - $60 USD), Super-Premium ($60 - $150 USD), Ultra-Premium/Luxury ($150+ USD) |

| By Distribution Channel | On-Trade Sales (Bars, Restaurants, Hotels, Others), Off-Trade Sales (Liquor Stores, Supermarkets, Online Retailers), Direct-to-Consumer (DTC) |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information, Request for Sample

Market Dynamics

Rising Global Demand for Premium Japanese Whiskey and Artisanal Spirits

The Japan craft spirits market is witnessing robust growth, primarily fueled by rising global demand for premium Japanese whiskey and artisanal spirits. Japan’s long-standing reputation for craftsmanship, precision distillation, and refined aging techniques has positioned its whiskey segment as a global benchmark for quality and authenticity. This reputation, combined with growing consumer interest in premiumization and authentic drinking experiences, is driving strong international exports and domestic consumption.

Evolving consumer preferences toward unique, locally sourced, and small-batch spirits have expanded opportunities beyond whiskey, spurring growth in craft gin, rum, and vodka categories. Japanese distilleries are increasingly experimenting with indigenous ingredients such as yuzu, sakura, and sansho pepper to create distinctive flavor profiles that appeal to both domestic and international palates. This innovation is complemented by rising tourism and experiential marketing, where distillery visits and tasting experiences enhance brand storytelling and consumer engagement.

Expansion of Boutique Distilleries Leveraging Regional Ingredients and Craftsmanship

The Japan craft spirits market is witnessing rapid expansion driven by the emergence of boutique distilleries that emphasize regional authenticity, local sourcing, and artisanal production. These small-scale producers are capitalizing on Japan’s diverse geography, using indigenous ingredients such as yuzu, cherry blossom, shiso, wasabi, and local barley varieties to create distinct flavor profiles that resonate with both domestic and international consumers. This regional differentiation strategy not only enhances product storytelling and brand identity but also aligns with the global trend toward premiumization and experiential consumption.

Government initiatives supporting rural revitalization and tourism, including subsidies for craft production, have encouraged entrepreneurs to establish micro-distilleries in prefectures like Hokkaido, Kyoto, and Okinawa. Collaboration between local farmers and distillers ensures sustainable ingredient sourcing and reinforces community-based economic growth. Japanese craftsmanship rooted in precision, purity, and attention to detail has become a key differentiator in positioning these spirits in global premium markets.

Segment Analysis

The craft spirits market is segmented based on the product type, price point, distribution channel.

Whiskey Tradition, Craftsmanship, and Global Prestige Drive Market Leadership

Whiskey remains the dominant segment in Japan’s craft spirits market, upheld by a legacy of precision distillation, aging mastery, and cultural reverence for craftsmanship. Rooted in decades of expertise, Japanese whiskey has evolved beyond imitation of Scotch styles to establish its own global identity defined by purity, balance, and meticulous blending. Boutique distilleries are reinforcing this legacy by combining traditional copper pot distillation with regionally sourced ingredients and local water profiles, producing limited-edition small batches that emphasize authenticity and terroir.

The growing appreciation for premium and ultra-premium spirits, both domestically and internationally, has positioned Japanese whiskey as a luxury collectible and experiential product. Exports to Europe, the U.S., and Asia-Pacific continue to rise as global connoisseurs seek unique flavor expressions aged in Mizunara oak or sherry casks. Meanwhile, domestic consumers especially millennials are showing renewed interest in homegrown craftsmanship through tasting experiences and distillery tourism.

Gin Innovation and Local Botanicals Fuel Rapid Market Expansion

Gin is the fastest-growing segment in Japan’s craft spirits market, propelled by creativity, botanical diversity, and rising consumer preference for fresh, aromatic profiles. Boutique distilleries are leveraging Japan’s rich natural biodiversity yuzu, sanshō pepper, shiso, green tea, and sakura to craft unique, regionally inspired gins that differentiate themselves from Western counterparts. This localization of botanicals not only enhances the sensory experience but also appeals to younger consumers seeking authenticity and innovation.

Rapid innovation in flavor experimentation, limited-edition collaborations, and small-batch premium offerings are reshaping Japan’s position within the global gin renaissance. Distillers are integrating sustainable production methods, transparent sourcing, and aesthetic branding to attract eco-conscious and design-driven audiences. The versatility of gin in cocktails aligns with the growing mixology culture across Japan’s urban centers, particularly in Tokyo and Osaka.

Export demand is also accelerating, with Japanese gin gaining shelf presence in high-end bars and global duty-free outlets. Lower aging requirements allow faster production cycles compared to whiskey, enabling agile market entry and innovation. While competition among emerging brands is intensifying, the segment’s agility, creative potential, and alignment with global craft trends position Japanese gin as a symbol of modern craftsmanship and the next growth frontier in the nation’s craft spirits evolution.

Japan Innovation, Heritage, and Premiumization Define Craft Spirits Market Growth

Japan’s craft spirits market is rapidly evolving, blending centuries-old craftsmanship with contemporary innovation. Producers are leveraging regional ingredients such as yuzu, sakura, and sanshō pepper to create distinctive flavor profiles that highlight Japan’s terroir. This fusion of tradition and creativity appeals to both domestic consumers and international connoisseurs seeking premium authenticity. Government initiatives supporting rural entrepreneurship and tourism have further fueled the rise of boutique distilleries, particularly in regions like Hokkaido, Kyoto, and Okinawa.

The growing global fascination with Japanese whiskey, gin, and other artisanal spirits underscores the country’s leadership in quality and design precision. However, challenges persist, including high production costs, export complexities, and limited supply due to small-batch operations. Despite these constraints, Japan’s emphasis on craftsmanship, sustainable sourcing, and innovation continues to strengthen its global reputation, positioning the nation as a key driver in the premium craft spirits movement.

Sustainability Analysis

Sustainability has become a critical focus for Japan’s craft spirits industry, encompassing environmental, economic, and social considerations. Environmentally, distilleries are adopting energy-efficient processes, waste reduction strategies, and responsible water usage, while sourcing local, seasonal ingredients minimizes carbon footprint and supports biodiversity. Economically, boutique distilleries stimulate regional growth by collaborating with local farmers and suppliers, fostering rural employment and preserving traditional agricultural practices. Socially, brands emphasize community engagement, cultural heritage, and transparent production methods, which strengthen consumer trust and loyalty.

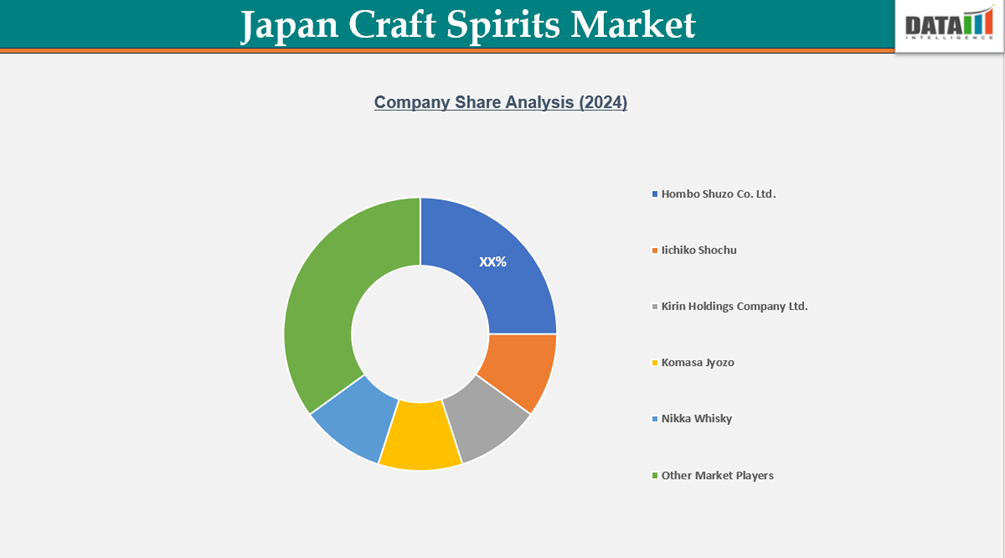

Competitive Landscape

- The craft spirits market in Japan is dominated by a mix of leading domestic producers and heritage distilleries. Eigashima Shuzo, Hombo Shuzo Co. Ltd., Iichiko Shochu, Kirin Holdings Company Ltd., Komasa Jyozo, Nikka Whisky, Nine Leaves Distillery, Suntory Holdings Ltd., The Kyoto Distillery, and Tottori Barley Shochu collectively hold a significant market presence through strong brand recognition, premium product portfolios, and strategic distribution across domestic and international markets.

- A second tier of smaller or niche distilleries focuses on specialized offerings such as limited-edition whiskies, regional shochu, and boutique spirits. These producers leverage traditional craftsmanship, locally sourced ingredients, and targeted product innovation to address gaps in flavor diversity, exclusivity, and premiumization within the market.

- The broader market remains fragmented, with emerging distilleries experimenting in areas like flavored spirits, sustainable production, and artisanal small-batch methods. Market expansion is fueled by rising domestic demand for premium and culturally authentic spirits, international recognition of Japanese whiskies, tourism-driven exposure, and government initiatives supporting local entrepreneurship, making Japan a global leader in craft spirits development.

Key Developments

- 2025 – Komasa Jyozo: Focuses on shochu innovation with small-batch, regionally sourced spirits for both domestic and export markets.

- 2025 – Eigashima Shuzo: Produces traditional craft spirits with emphasis on sustainable ingredient sourcing and regional heritage.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies