Japan Anti–Aging Product Market Size

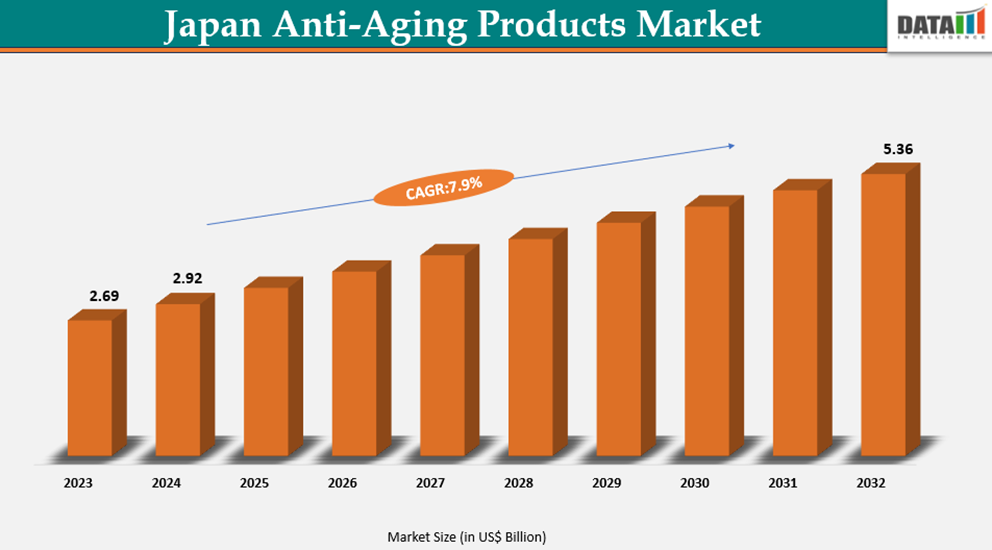

The Japan anti-aging products market reached US$ 2.69 billion in 2023, rising to US$ 2.92 billion in 2024, and is projected to reach US$ 5.36 billion by 2032, growing at a CAGR of 7.6% during 2025–2032.

Japan anti-aging products market is experiencing robust growth, driven by rising consumer awareness of health, wellness, and personal appearance. With increasing life expectancy and shifting demographics, aging populations across developed and emerging economies are fueling demand for advanced skincare, haircare, and nutraceutical solutions designed to delay visible signs of aging and promote overall vitality.

Traditionally focused on cosmetic skincare, the market has evolved into a multidimensional sector that integrates dermatology, biotechnology, and nutrition. Anti-aging creams, serums, and sunscreens remain core categories, while innovations such as collagen supplements, functional foods, and medical-grade formulations are redefining product boundaries. The expansion of minimally invasive procedures and the adoption of high-tech ingredients, including peptides, retinoids, hyaluronic acid, and stem cell extracts, highlight the industry’s ongoing shift toward science-driven, results-oriented solutions.

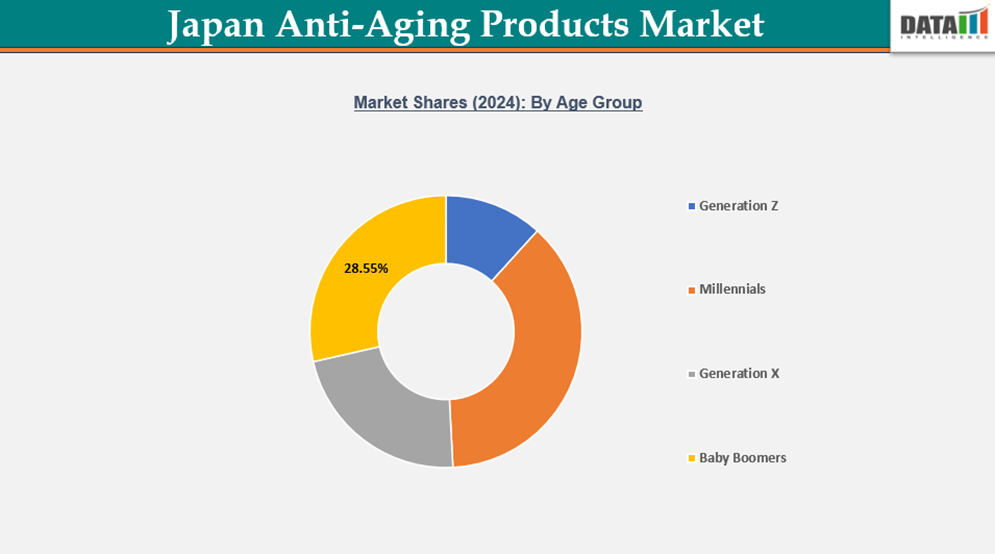

Millennials and Generation X, once considered peripheral to anti-aging, are increasingly adopting preventive skincare and wellness regimens. This trend, coupled with rising disposable incomes, urbanization, and social media influence, is accelerating premiumization and reshaping consumer expectations around product efficacy and safety.

Anti-Aging Products Industry Trends and Strategic Insights

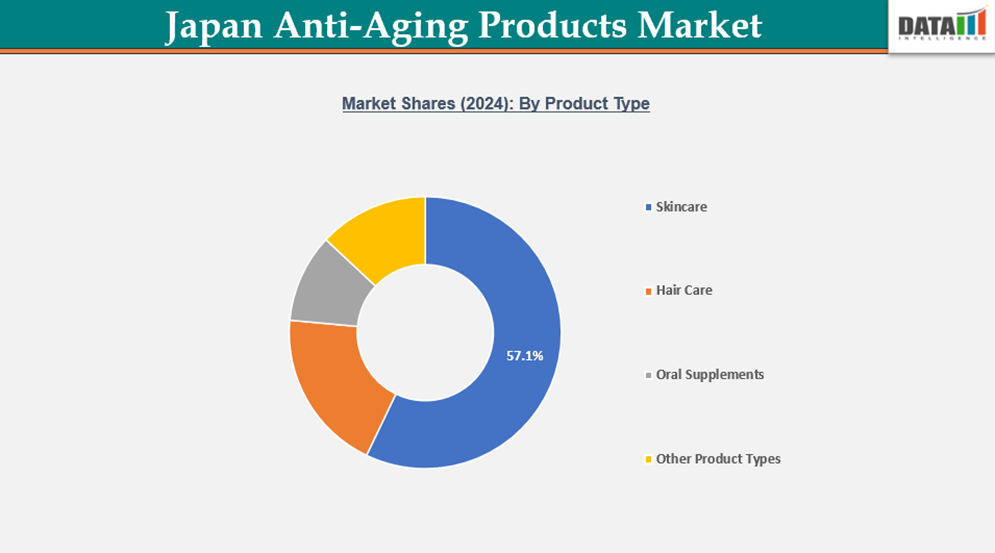

- By product type, the skincare segment dominates, driven by high consumer demand for anti-aging creams, serums, and functional cosmetics, while oral supplements are projected to register the fastest growth due to increasing health awareness and preventive care trends.

- By gender, the women’s segment dominates, fueled by strong adoption of advanced anti-aging products and premium skincare routines, while the men’s segment is expected to register the fastest growth, driven by rising interest in grooming and anti-aging solutions among male consumers in Japan.

Anti-Aging Products Market Size and Future Outlook

- 2024 Market Size: US$ 2.92 billion

- 2032 Projected Market Size: US$ 5.36 billion

- CAGR (2025-2032): 7.6%

- Largest Market: Skincare

- Fastest Market: Oral Supplements

Market Scope

| Metrics | Details |

| By Product Type | Skincare (Moisturizers, Serums & Concentrates, Eye Care, Cleansers & Toners, Sunscreen, Masks), Hair Care (Anti-Gray Hair, Hair Loss Treatments, Scalp Health), Oral Supplements, Other Product Types |

| By Age Group | Generation Z, Millennials, Generation X, Baby Boomers |

| By Gender | Women, Men |

| By Distribution Channel | Offline Retail (Supermarkets/Hypermarkets & Drugstores, Specialty Stores, Department Stores, Direct Sales, Clinics & Medi spas), Online Retail (Brand Websites, E-commerce Marketplaces) |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Health Consciousness and Desire for Youthful Appearance Among Consumers

Japan’s population is aging rapidly, with a significant proportion of individuals over 60 years of age, creating strong demand for anti-aging products. Consumers are increasingly health-conscious, seeking skincare, supplements, and nutraceuticals that improve appearance, prevent aging signs, and enhance overall well-being. Rising awareness of the benefits of natural and functional ingredients such as collagen, retinol, peptides, and antioxidants is driving adoption across skincare, haircare, and oral supplement segments.

The proliferation of social media and beauty influencers has increased visibility of anti-aging solutions, motivating both younger and older demographics to invest in preventative and restorative products.

Advanced technological developments, including novel formulations, bioactive ingredients, and customized solutions, are further attracting consumers willing to pay a premium for efficacy. This trend is amplified by Japan’s strong culture of self-care, longevity, and aesthetic consciousness, making anti-aging products not just cosmetic but integral to lifestyle choices.

High Cost of Anti-aging products Limiting Consumer Accessibility

Premium formulations, advanced bioactive ingredients, and technologically intensive manufacturing processes make anti-aging products relatively expensive, limiting accessibility for middle- and lower-income consumers. Price sensitivity is particularly notable in rural and semi-urban Japan, where many prioritize basic skincare over high-cost anti-aging solutions. Skepticism about product efficacy and the need for regular, prolonged usage can also reduce adoption and repeat purchases.

The import tariffs on international brands and fluctuating raw material costs increase production expenses, indirectly affecting consumer prices. To expand market penetration, companies must balance innovation with affordability, offering effective yet accessible products to capture a broader and more diverse consumer base.

Segmentation Analysis

The anti-aging products market is segmented based on the product type, age group, gender, and distribution channel.

Skincare Leading Anti-Aging Market Demand in Japan

Skincare remains the largest segment in Japan’s anti-aging market due to strong consumer focus on maintaining youthful, healthy skin. Aging population trends and a high prevalence of skincare-conscious consumers contribute to sustained demand for anti-aging creams, serums, masks, and lotions. Japanese consumers highly value product efficacy, safety, and dermatologically tested formulations, which encourages adoption of premium skincare lines containing active ingredients like retinol, hyaluronic acid, peptides, and antioxidants. Skincare products offer visible results, boosting consumer confidence in the segment compared to other anti-aging categories. The segment benefits from extensive distribution channels, including e-commerce, specialty beauty stores, and department stores, enhancing product accessibility nationwide. Cultural factors emphasizing beauty, self-care, and professional grooming further reinforce the prominence of skincare in daily routines.

Japanese consumers prefer multi-functional products that combine anti-aging, UV protection, and hydration, driving product innovation. Leading domestic and international brands continuously introduce technologically advanced solutions tailored to specific skin concerns such as fine lines, pigmentation, and loss of elasticity. Marketing campaigns, celebrity endorsements, and social media influence also support consumer engagement and loyalty. Skincare dominates due to high adoption rates, frequent repurchase cycles, and integration into preventive and corrective beauty regimens, making it the cornerstone of Japan’s anti-aging market.

Oral Supplements Experiencing Rapid Consumer Adoption

Oral supplements are the fastest-growing segment in Japan’s anti-aging market, driven by increasing health awareness and a holistic approach to beauty and longevity. Consumers are seeking solutions beyond topical skincare, opting for ingestible products that target aging from within. Popular supplements include collagen peptides, vitamins, minerals, antioxidants, and herbal extracts, which promote skin elasticity, joint health, and overall vitality. The rise of functional foods and nutraceuticals aligns with Japan’s aging population, as older adults prioritize wellness, immune support, and disease prevention. Convenience and lifestyle compatibility also fuel growth, as oral supplements can be easily incorporated into daily routines. E-commerce platforms and subscription models facilitate accessibility and consistent usage, especially among tech-savvy and urban consumers.

Product innovation, including gummies, powders, and drinkable forms, appeals to diverse consumer preferences. Collaborations between domestic manufacturers and international brands, combined with digital promotion strategies, contribute to rapid market penetration. As awareness of internal wellness grows, oral supplements are expected to maintain robust growth, outperforming other segments in adoption rate, revenue expansion, and long-term market potential.

Japan Aging Population Drives Expanding Anti-Aging Product Demand

Japan’s rapidly aging population is a primary factor driving anti-aging product consumption. With one of the highest proportions of elderly individuals globally, consumers increasingly seek solutions to maintain youthful appearance, skin health, and overall vitality. Rising disposable incomes and a strong culture of beauty and wellness support demand for premium skincare, hair care, and oral supplements. Technologically advanced formulations and functional ingredients, including collagen, peptides, and antioxidants, appeal to health-conscious consumers seeking visible results.

Digital marketing, social media influence, and beauty influences reinforce awareness and adoption, especially among younger and middle-aged demographics interested in preventative care. Urbanization, lifestyle changes, and greater exposure to international beauty trends further accelerate growth. Despite high product costs, the focus on efficacy, quality, and self-care ensures sustained market expansion, making Japan a mature yet innovative hub for anti-aging solutions.

Sustainability Analysis

Sustainability is becoming a key consideration in Japan’s anti-aging products market, driven by consumer preference for environmentally responsible and ethically produced goods. Brands are increasingly adopting eco-friendly packaging, reducing plastic use, and incorporating recyclable or biodegradable materials. Formulation strategies focus on natural, plant-based, and ethically sourced ingredients, minimizing chemical impact on both consumers and the environment.

The rising trend of “clean beauty” encourages innovation in sustainable product development without compromising efficacy. Regulatory frameworks and industry guidelines further reinforce adherence to environmental and social standards. Overall, integrating sustainability into product development, packaging, and marketing not only addresses ecological concerns but also aligns with evolving consumer values, enhancing long-term growth potential and competitiveness in Japan’s anti-aging market.

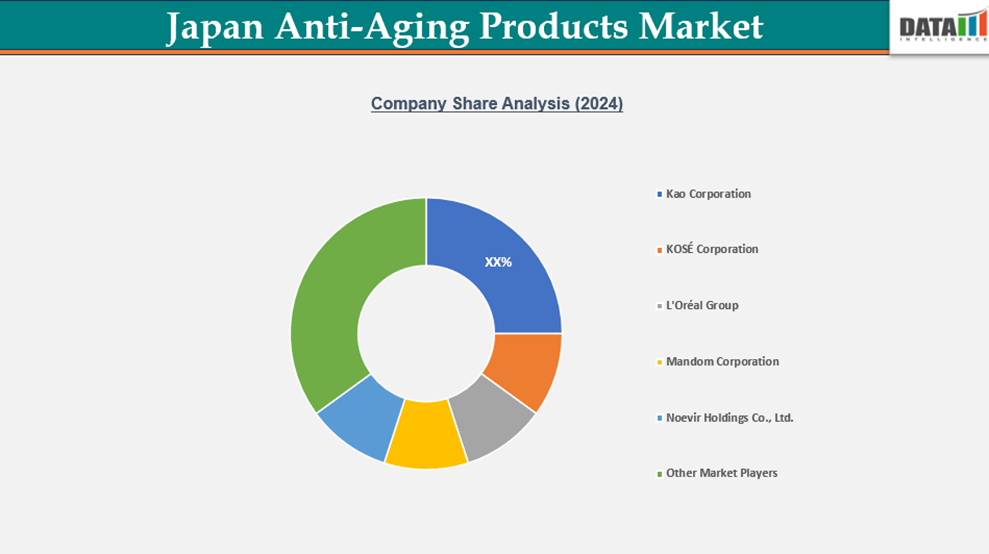

Competitive Landscape

- The anti-aging products market in Japan is dominated by a mix of leading global and domestic players. Kao Corporation, KOSÉ Corporation, L'Oréal Group, Mandom Corporation, Noevir Holdings Co., Ltd., POLA Orbis Holdings Inc., Procter & Gamble (P&G), Rohto Pharmaceutical Co., Ltd., Shiseido Company, Limited, and Unilever Japan collectively hold a significant market share through strong brand equity, extensive distribution networks, and innovative product portfolios.

- A second tier of smaller domestic and regional companies focuses on niche segments, leveraging specialized formulations, targeted marketing strategies, and localized retail presence to capture specific consumer preferences.

- The rest of the market remains fragmented, with numerous boutique brands and emerging startups catering to unique consumer demands, while overall growth is driven by increasing health and wellness awareness, rising disposable incomes, and a strong focus on skincare and anti-aging solutions among Japan’s aging population.

Key Developments

- January 2025: L’Oréal Group in Japan expanded distribution of its anti-aging skincare products through e-commerce and specialty retail channels, strengthening market penetration and accessibility for diverse consumer segments.

- January 2025: POLA Orbis Holdings Inc introduced a new anti-aging supplement range in collaboration with leading dermatologists, aiming to capture growing demand from health-conscious and aging populations in Japan.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies