IV Tubing Sets and Accessories Market Size and Trends

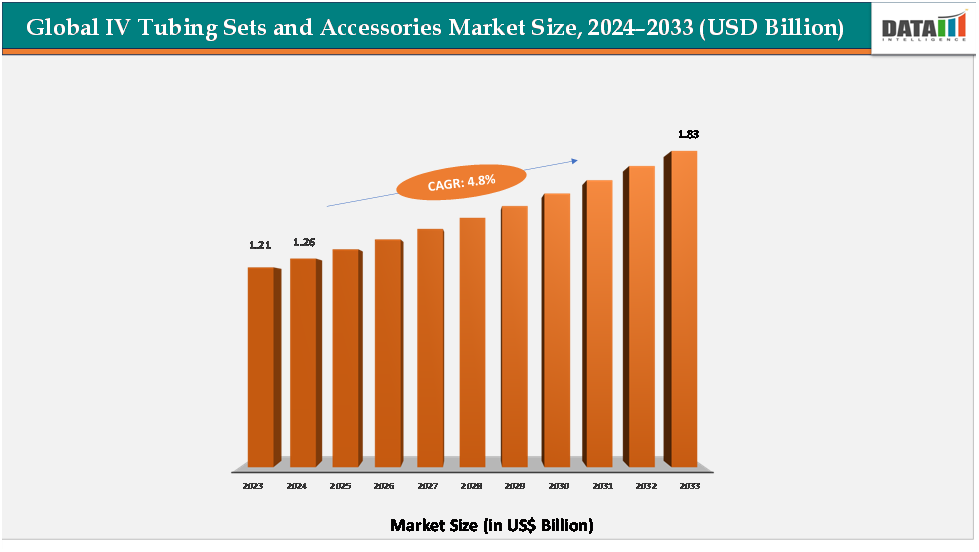

The global IV tubing sets and accessories market reached US$ 1.21billion in 2023, with a rise to US$ 1.26 billion in 2024, and is expected to reach US$ 1.83billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025–2033.

The rapid innovation in healthcare delivery is transforming patient care by enabling safer, more efficient drug administration and precise fluid management through advanced IV tubing sets and accessories. With their ability to ensure accurate dosing, maintain sterility, and minimize the risk of contamination, these devices are helping hospitals and clinics streamline workflows, reduce medication errors, and improve patient outcomes. This growing reliance on high-quality IV tubing solutions is enhancing operational efficiency, supporting critical care initiatives, and reinforcing overall healthcare safety, positioning IV tubing sets and accessories as an indispensable component of modern medical practice worldwide.

Key Market highlights

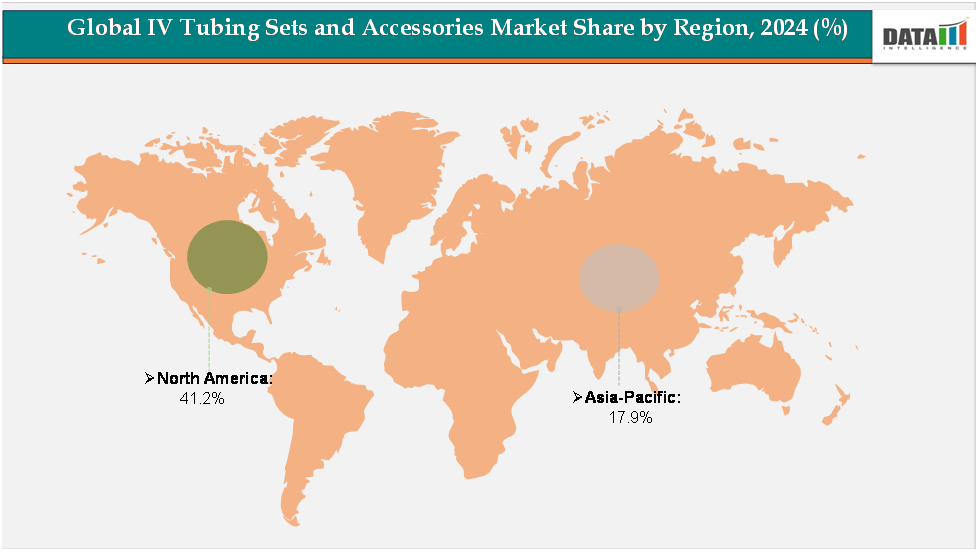

North America dominates the market with over 41.2% revenue share, driven by the presence of high adoption of hospital automation systems, and strong government and private investments in critical care and infusion technologies.

Asia-Pacific is emerging as the fastest-growing region with a 17.9% share, supported by rising healthcare expenditures, expanding hospital networks, and increasing demand for efficient IV delivery systems in countries such as China and India.

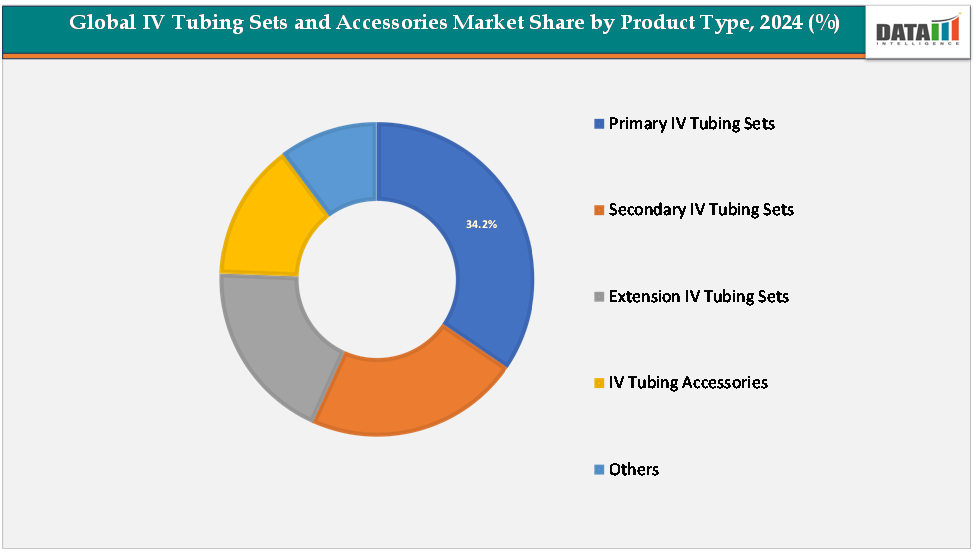

The primary IV tubing sets segment dominates the market, accounting for 34.2% of the overall share, owing to the recurring need for sterile, reliable tubing in hospitals and clinics, which makes it a key revenue contributor in the global IV tubing sets and accessories sector.

Market Size & Forecast

2024 Market Size: US$1.26Billion

2033 Projected Market Size: US$1.83Billion

CAGR (2025–2033): 4.8%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising prevalence of chronic diseases

The rising prevalence of chronic diseases is a major driver of the IV Tubing Sets and Accessories Market, as conditions such as cancer, diabetes, kidney disorders, and cardiovascular diseases often require continuous or long-term intravenous therapies for medication, nutrition, or fluid administration. According to the Centers for Disease Control and Prevention, six in 10 Americans have at least one chronic disease, and 4 in 10 have two or more chronic diseases.

Patients undergoing chemotherapy, dialysis, or insulin infusions rely heavily on IV tubing sets for safe and accurate drug delivery, while the management of comorbidities in aging populations further amplifies demand. This surge in chronic illnesses not only increases hospital admissions but also fuels the adoption of home infusion therapies, where user-friendly and sterile IV tubing accessories play a critical role in reducing infection risks and improving patient outcomes.

Restraint: Stringent regulatory requirements

Stringent regulatory requirements can hamper the IV Tubing Sets and Accessories Market by increasing the time, cost, and complexity of bringing new products to market. Regulatory bodies such as the FDA (U.S.), EMA (Europe), and other national agencies enforce rigorous standards for product safety, sterility, biocompatibility, and material compliance, often requiring extensive testing and documentation. For instance, manufacturers must meet ISO standards for medical devices and demonstrate compliance with Good Manufacturing Practices (GMP), which can significantly lengthen approval timelines. Smaller companies, in particular, face challenges in managing the high costs of regulatory submissions, audits, and quality certifications. Moreover, frequent updates to guidelines on single-use plastics, infection control, and material safety can lead to redesigns or recalls, disrupting supply chains. While these regulations are essential for patient safety, they can limit innovation speed and restrict the entry of new players, thereby slowing overall market growth.

For more details on this report - Request for Sample

Segmentation Analysis

The global IV tubing sets and accessories market is segmented by product type, application, end-user, and region.

Product Type: The primary IV tubing segment is estimated to have 34.2% of the IV tubing sets and accessories market share.

Primary IV tubing sets hold the largest share in the IV tubing sets and accessories market, as they are the standard component for administering fluids, medications, blood, and nutrition directly to patients. Their widespread use across hospitals, clinics, and home care settings for both acute and chronic conditions makes them indispensable in everyday clinical practice.

The rising global prevalence of chronic diseases such as cancer, diabetes, and kidney disorders further fuels the demand for primary IV tubing sets. Additionally, their frequent use in surgical procedures, emergency care, and intensive care units (ICUs) reinforces their dominance in the market..

The secondary IV tubing sets segment is estimated to have 19.7% of the IV tubing sets and accessories market share.

Secondary IV tubing sets are the fastest-growing segment, driven by their increasing adoption in combination therapies, chemotherapy, and situations requiring the sequential administration of multiple medications through a single IV line. The efficiency they offer by minimizing the need for multiple venipunctures enhances patient comfort and reduces infection risks. As the trend of polypharmacy rises, especially among elderly and cancer patients, secondary IV tubing sets are becoming more essential in treatment regimens. Growing hospital demand for streamlined, cost-effective, and safe drug administration solutions positions this segment for rapid growth in the coming years.

Geographical Analysis

The North America IV tubing sets and accessories market was valued at 41.2%market share in 2024

North America holds a dominant position in the global IV tubing sets and accessories market, accounting for a significant revenue share due to its high adoption of modern infusion technologies and strong government and private investments in hospital and critical care systems. The United States, in particular, plays a key role in driving market growth, supported by well-established hospital networks, stringent regulatory standards, and widespread awareness of patient safety and infection control protocols.

The presence of leading manufacturers and distributors of IV tubing solutions, coupled with continuous innovations such as anti-kink tubing, antimicrobial coatings, and integrated safety features, further strengthens the region’s market leadership. Additionally, growing emphasis on outpatient care, home healthcare services, and technological upgrades in infusion devices ensures sustained demand for high-quality IV tubing sets and accessories across North America.

The Europe IV Tubing Sets and Accessories Market was valued at 21.8% market share in 2024

Europe maintains a significant position in the IV tubing sets and accessories market, characterized by steady growth driven by advanced healthcare systems, high regulatory standards, and widespread use of infusion therapies across hospitals and clinics. Countries such as Germany, France, and the United Kingdom lead the market, supported by strong hospital infrastructure, an aging population with increasing healthcare needs, and high awareness of patient safety protocols.

Technological innovations, including precision IV tubing sets, safety-engineered connectors, and integrated monitoring systems, are widely adopted, enhancing patient outcomes and reducing the risk of infections. While the market in Europe is mature compared to North America and Asia-Pacific, ongoing investments in hospital modernization, home healthcare expansion, and preventive care solutions continue to drive demand for IV tubing sets and accessories across the region.

The Asia-Pacific IV tubing sets and accessories market was valued at 17.9% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing market for IV tubing sets and accessories, driven by the increasing hospital capacities and rising government healthcare spending in countries such as China, India, and Japan. The region is witnessing growing demand for safe and efficient infusion systems due to a rising patient population, increasing prevalence of chronic diseases, and growing adoption of advanced therapeutic procedures.

Expansion of modern hospitals, investment in training and certification of healthcare professionals, and increasing awareness of infection control practices are accelerating market adoption. Additionally, multinational manufacturers are expanding their presence and forming partnerships with regional distributors, further fueling growth in the Asia-Pacific. The combination of rising healthcare access, technological adoption, and favorable demographics positions this region as a high-growth market in the coming years.

Competitive Landscape

The major players in the IV tubing sets and accessories market includeB. Braun SE, ICU Medical, Inc., BD, CODAN Companies, and Polymer, among others.

B. Braun SE: B. Braun SE is a major player in the IV tubing sets and accessories space, known for combining safety, material innovation, and user‐friendly design in its product portfolio. Their offerings include IV administration sets, extension sets, stopcocks, needle‐less connectors, filters, and infusion accessories.

Key Developments:

In August 2023, ICU Medical, Inc., a global leader in medical device innovation, announced that it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Plum Duo infusion pump, integrated with Life Shield infusion safety software.

Market Scope

Metrics | Details | |

CAGR | 4.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Product Type | Primary IV Tubing Sets, Secondary IV Tubing Sets, Extension IV Tubing Sets, IV Tubing Accessories, Others |

Application | Hydration, Blood Transfusions, Medication Delivery, Nutritional Support | |

End-User | Hospitals, Clinics, Ambulatory Surgery Centers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global IV tubing sets and accessories market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical disposables-related reports, please click here