Market Overview

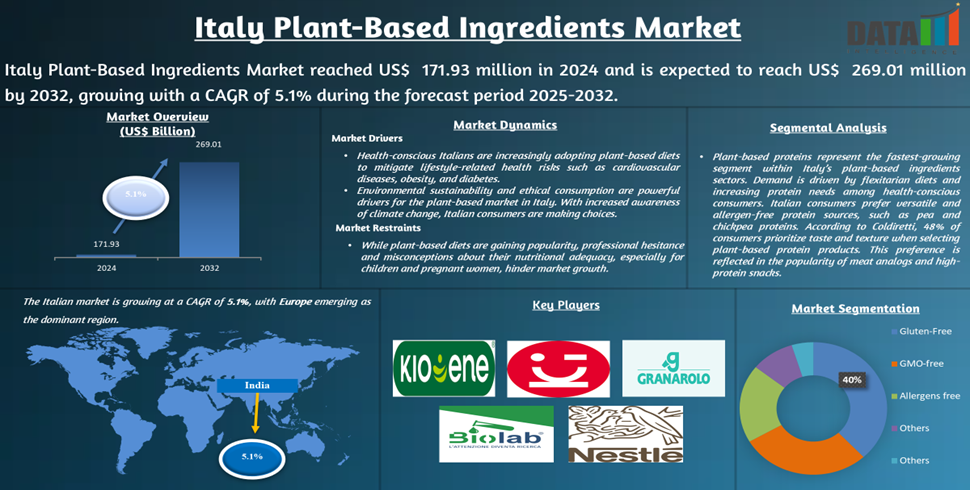

Italy Plant-Based Ingredients Market reached US$ 171.93 million in 2024 and is expected to reach US$ 269.01 million by 2032, growing with a CAGR of 5.1% during the forecast period 2025-2032.

The Italy plant-based ingredients sector is experiencing robust growth, fueled by increasing consumer interest in sustainable and health-conscious diets. This growth is driven by rising awareness of environmental sustainability, ethical consumption and health benefits associated with plant-based diets. The industry includes segments like plant-derived proteins, fats and dairy alternatives, with growing contributions from local and international manufacturers.

Italy has seen increased development of plant-based protein products, including innovations in pea, soy and chickpea proteins. Companies like Granarolo have entered the market with plant-based milk alternatives, offering premium products catering to flexitarians and vegans. Italian consumers are leaning toward clean-label, GMO-free and organic-certified plant-based ingredients. Organic product sales in Italy grew by 8.1% in 2022, driven by consumer preference for transparent labeling and minimal processing.

Executive Summary

To Know More Insights - Download Sample

Market Scope

| Metrics | Details |

| CAGR | 5.1% |

| Size Available for Years | 2023-2032 |

| Forecast Period | 2025-2032 |

| Data Availability | Value (US$) |

| Segments Covered | Ingredient Type, Claims and End-User |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Market Dynamics

Rising Health Awareness Among Consumers

Health-conscious Italians are increasingly adopting plant-based diets to mitigate lifestyle-related health risks such as cardiovascular diseases, obesity and diabetes. This trend is supported by research from the Italian Society of Human Nutrition (SINU), which highlights the benefits of plant-based foods in reducing chronic disease risks and improving overall well-being. In 2022, approximately 1.4% of the Italian population identified as vegan, a number projected to rise to 2.4% by 2023. This aligns with growing health awareness and consumer education about the benefits of plant-based diets. According to the National Institutes of Health (NIH), plant-based diets have been shown to reduce the risk of heart disease by up to 32%.

Brands like Alpro have capitalized on this trend by launching products enriched with vitamins and minerals to support heart health. Alpro’s almond milk, fortified with vitamin E, appeals to health-conscious consumers seeking functional benefits alongside sustainability. Organizations such as the Mediterranean Diet Foundation have introduced campaigns promoting plant-based eating for better heart health. Additionally, regional government efforts in Tuscany have supported plant-based dietary education in schools.

Growing Awareness of Sustainability and Ethical Concerns

Environmental sustainability and ethical consumption are powerful drivers for the plant-based market in Italy. With increased awareness of climate change, Italian consumers are making choices to reduce their carbon footprint by consuming less animal-based food. According to the Food and Agriculture Organization (FAO), animal agriculture accounts for 14.5% of global greenhouse gas emissions. In Italy, reducing meat consumption could lower national emissions by 12%, as reported by the National Institute for Environmental Protection and Research (ISPRA).

The Italian Vegan Association highlights animal welfare as a primary motivator for plant-based adoption. Ethical campaigns, including "Veganok," emphasize cruelty-free and sustainable food production practices. Research indicates that 66% of Italian consumers are willing to pay a premium for sustainably produced organic products. This aligns with the increasing demand for traceability and certifications, such as Fair Trade and EU Organic labels.

Professional Hesitance and Nutritional Misconceptions

While plant-based diets are gaining popularity, professional hesitance and misconceptions about their nutritional adequacy, especially for children and pregnant women, hinder market growth. According to the Italian Pediatric Society, 70% of doctors express concerns about fully plant-based diets for children. Healthcare providers cite risks like inadequate protein, calcium and vitamin B12 intake as potential downsides of plant-based diets. Inadequate knowledge about supplementation and balanced meal planning exacerbates these concerns.

A recent Italian survey showed that 77.4% of vegetarian and vegan parents met opposition from their pediatricians and 45.2% of them found that their pediatricians were unable to provide adequate nutritional information during the weaning period. Many reported challenges in accessing reliable dietary guidance, impacting their confidence in plant-based diets for families. To combat these misconceptions, tools like the "VegPlate," developed by the Italian Society of Human Nutrition, provide evidence-based guidance for balanced vegan and vegetarian diets. The platform offers meal plans, supplementation advice and nutrient tracking to ensure dietary adequacy.

Market Segment Analysis

The Italy plant-based ingredients market is segmented based on ingredient type, claims and end-user.

Growing Demand for Type I due to Skin Elasticity, Reducing Wrinkles and Promoting Bone Health

Plant-based proteins represent the fastest-growing segment within Italy’s plant-based ingredients sectors. Demand is driven by flexitarian diets and increasing protein needs among health-conscious consumers. Italian consumers prefer versatile and allergen-free protein sources, such as pea and chickpea proteins. 48% of consumers prioritize taste and texture when selecting plant-based protein products. This preference is reflected in the popularity of meat analogs and high-protein snacks.Top of Form

Technological advancements, including protein micronization and fermentation, have enhanced product quality. HIFOOD’s Micro Protein, launched in 2024, is a prime example, offering a micronized pea protein with over 70% protein content. This product meets clean-label demands, ensuring smooth integration into food applications without altering taste or texture. Italy’s agricultural sector plays a crucial role in protein ingredient production. The government’s support for crop diversification under the Common Agricultural Policy (CAP) ensures a stable supply of raw materials like soy and peas, fostering growth in the segment.

Major Italy Players

The major Italy players in the market include Granarolo Group, Nestlé, Kioene, Biolab Srl, Ki Group S.p.A., Barilla G. e R. Fratelli S.p.A, Sojasun and Heaven Srl.

Value Chain Analysis

The value chain analysis for the plant-based ingredients market encompasses several stages that contribute to the growth of the sector, starting with raw material sourcing and progressing to end-consumer products. The first critical stage involves the sourcing of plant-based raw materials, such as legumes, grains, seeds and nuts. Suppliers and farmers are increasingly focusing on high-quality, non-GMO and organic sources to meet the rising consumer demand for clean-label products. Sustainability has become a key factor, with growing emphasis on responsible farming practices that reduce environmental impact and ensure consistent raw material availability.

Early-Stage Innovations

Ingredion’s innovation with Vitessence Pea 100 HD is a significant impact for the growth of the plant-based ingredients market. As consumer demand for sustainable, clean-label products rises, pea protein offers a functional solution that meets the need for high-quality, plant-based protein alternatives. The product’s focus on sustainable sourcing and clean labeling aligns with the increasing consumer preference for transparency and environmental responsibility, key drivers for market growth.

The plant-based ingredients market is expected to grow rapidly, with innovations like Vitessence Pea 100 HD addressing the demand for plant-based protein solutions. As food manufacturers seek to improve the texture, flavor and nutritional value of plant-based foods, pea protein will play a central role in expanding market opportunities, particularly in plant-based meat, dairy and snack categories. Sustainability is becoming a critical factor in consumer purchasing decisions and Ingredion’s focus on sustainable sourcing positions it to capture the growing market segment of eco-conscious consumers. As more consumers prioritize products with lower environmental impacts, the plant-based ingredients market will experience accelerated adoption, driven by ingredients like pea protein.

Ingredion’s continued focus on plant-based protein innovations is likely to drive further market growth by enabling food manufacturers to diversify their product offerings. As plant-based ingredients become more functional and accessible, new product categories will emerge, fueling the overall expansion of the plant-based ingredients market.

Why Purchase the Report?

- To visualize the Italy plant-based ingredients market segmentation based on ingredient type, claims and end-user.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points at the plant-based ingredients market level for all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The Italy plant-based ingredients market report would provide approximately 33 tables, 31 figures and 191 pages.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies