Global IoT Security Market: Industry Outlook

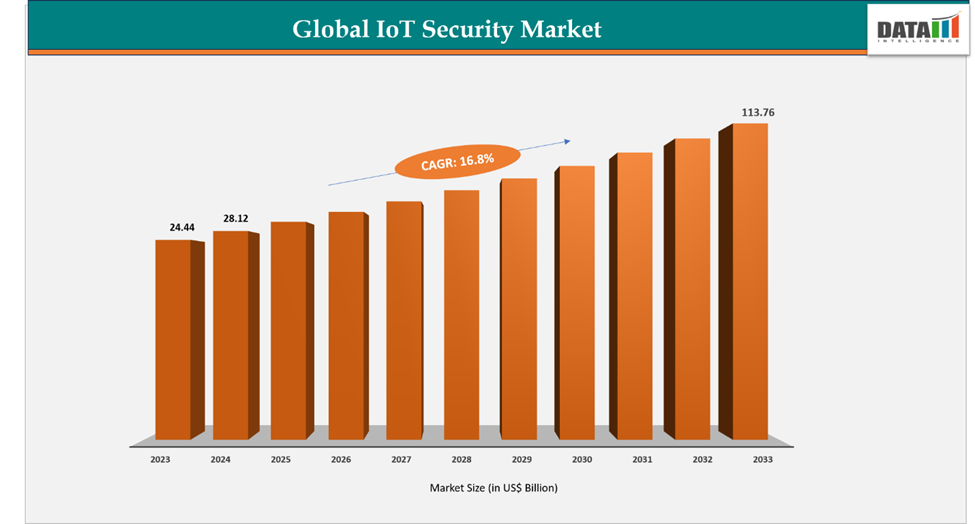

The global IoT security market reached US$24.44 billion in 2023, with a rise to US$28.12 billion in 2024, and is expected to reach US$113.76 billion by 2033, growing at a CAGR of 16.8% during the forecast period 2025–2033. The global IoT security market is growing steadily, driven by increasing deployment of connected devices in defense, smart cities, healthcare, and industrial sectors. Rising cyber threats are pushing the adoption of AI-based threat detection, secure device management, and network protection. Strategic partnerships, government regulations, and awareness of IoT risks are further fueling growth.

The US leads the IoT security market, driven by defense, critical infrastructure, and enterprise demand. The government has been developing a cybersecurity label for IoT devices to make them harder to hack, though the program faces delays. Strong R&D, defense budgets, and collaborations with IoT security providers support continued market growth.

Japan’s smart city initiatives, including Tokyo’s ‘Society 5.0’ and Osaka’s self-driving transport systems, are boosting IoT security demand. Ensuring device safety is critical for urban systems, making cybersecurity a top priority. Partnerships with global firms and AI-based threat monitoring are accelerating adoption.

Key Market Trends & Insights

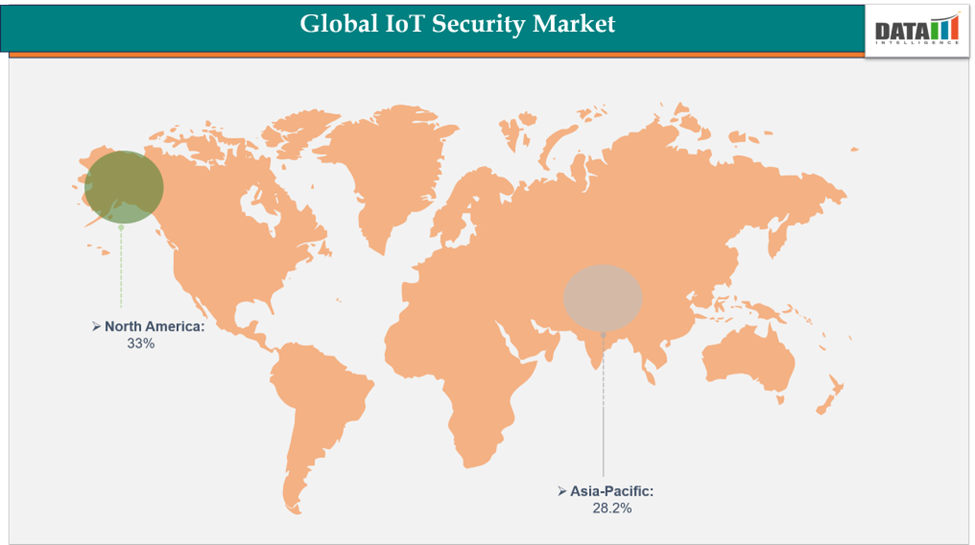

- North America accounted for 33% of the global IoT security market in 2024 and remains dominant, supported by government initiatives and defense investments. For example, the NSA, FBI, and US Cyber Command identified a PRC-linked botnet, highlighting the urgent need for IoT security.

- Asia-Pacific is the fastest-growing region, driven by smart city projects and industrial digitization. Japan’s launch of the IoT Product Security Labeling Scheme (JC-STAR) is enhancing device safety across urban and industrial applications.

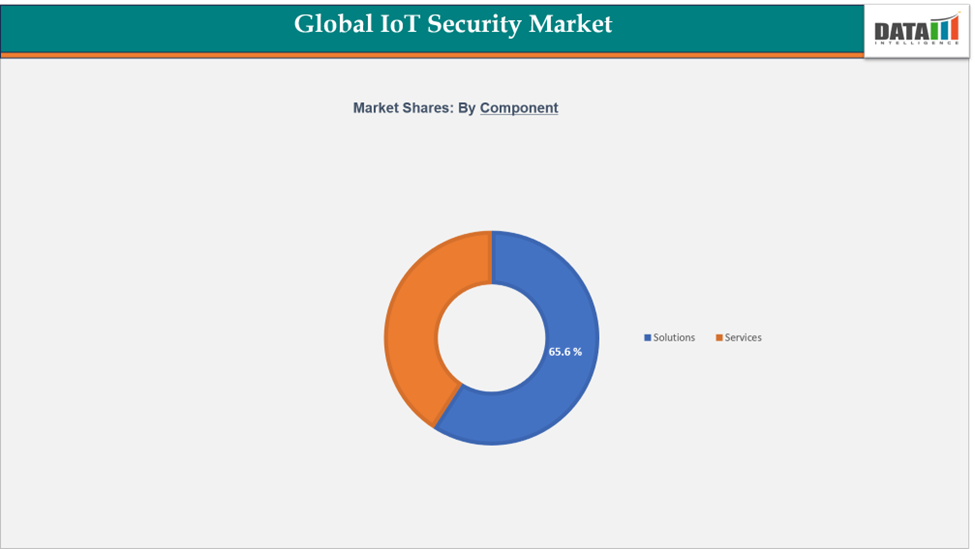

- Solutions dominate the market, protecting devices and networks across public and private sectors and enabling secure IoT adoption.

Market Size & Forecast

- 2024 Market Size: US$ 28.12 Billion

- 2033 Projected Market Size: US$ 113.76 Billion

- CAGR (2025–2033): 16.8%

- North America: Largest market in 2024

- Asia-Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Cyber Threats

The global IoT security market is being strongly propelled by the increasing prevalence of cyber threats targeting connected devices, industrial systems, and enterprise networks. AI-powered attacks, ransomware, and vulnerabilities in hyperconnected IT and IoT environments have made threat exposure one of the most pressing cybersecurity challenges today. Organizations are actively seeking solutions that can detect, prevent, and respond to attacks in real time.

For instance, Check Point® Software Technologies Ltd., a global leader in cybersecurity, announced its acquisition of Veriti Cybersecurity, the first fully automated, multi-vendor pre-emptive threat exposure and mitigation platform. This platform enables enterprises to identify vulnerabilities, anticipate attacks, and implement protective measures proactively, demonstrating how rising cyber threats are driving innovation in IoT security. Growing awareness of cyber risks, regulatory pressures, and the increasing reliance on connected devices in sectors like smart cities, healthcare, industrial automation, and defense are fueling demand for comprehensive IoT security solutions.

Restraint: High Costs

Despite the growing need, the high cost of deploying and managing IoT security solutions continues to hinder market adoption. Advanced platforms require significant investment for initial deployment, integration with existing IT and OT infrastructure, and ongoing operations. Small and medium-sized businesses (SMBs) are particularly affected, as these costs can be prohibitive, restricting adoption in this segment.

Beyond procurement, operational expenses including continuous monitoring, software updates, AI model management, and regulatory compliance add to the financial burden. Consequently, while large enterprises and government agencies are more likely to invest in sophisticated IoT security platforms, smaller organizations may delay adoption or choose less comprehensive solutions, potentially exposing them to risks. Addressing this challenge will require the development of scalable, cost-effective solutions that deliver enterprise-grade security without excessive costs.

For more details on this report, Request for Sample

Segment Analysis

The global IoT security market is segmented based on offering, deployment, security type, organization size, end-user and region.

Offering: The Solutions segment accounts for an estimated 65.6% of the global IoT security market.

The Solutions segment accounts for a significant portion of the global IoT security market, estimated at 65.6%. This segment is essential as organizations increasingly prioritize protection against the growing cyber threats targeting connected devices. For instance, Aeris IoT Watchtower, the world’s first fully integrated security solution for cellular IoT, provides organizations with comprehensive visibility and control, helping prevent security breaches, mitigate risks, enhance operational efficiency, and maintain regulatory compliance.

Market expansion is driven by the widespread use of IoT across sectors such as defense, industrial automation, smart cities, and healthcare. Providers are increasingly adopting AI-driven monitoring, real-time threat detection, and policy-based management to secure IoT networks across both public and private enterprises..

Geographical Analysis

The North America IoT security market was valued at 33% market share in 2024

North America held 33% of the global IoT security market in 2024 and remains the largest regional contributor. Growth is fueled by the rise of AI-powered IoT security services and substantial defense and critical infrastructure investments. For instance, Ontinue, a leading AI-powered managed extended detection and response (MXDR) provider and 2023 Microsoft Security Services Innovator of the Year, has expanded its services to include IoT and OT environments.

The Ontinue ION for IoT Security add-on ensures continuous protection of enterprise IoT networks, safeguarding devices from emerging cyber threats. The region’s leadership is further strengthened by robust R&D, strategic collaborations, extensive defense applications, and government initiatives targeting cyber threats, such as monitoring state-linked botnets and other malicious networks.

The Asia-Pacific IoT security market was valued at 28.2% market share in 2024

Asia-Pacific is set to be the fastest-growing IoT security market, driven by smart city initiatives, industrial digitalization, and enhanced cybersecurity awareness. Leading countries such as Japan, China, and South Korea are fueling regional growth. Japan, for instance, is advancing IoT security through programs like the IoT Product Security Labeling Scheme (JC-STAR) and the acquisition of advanced maritime security technologies, including undersea drones. Companies are also forging global partnerships to strengthen IoT protection.

Aeris Communications, Inc., together with Bridge Alliance, delivers the Aeris IoT Watchtower, an agentless solution that provides full visibility into enterprise IoT devices, proactive threat mitigation, and enhanced risk management. The solution leverages cellular IoT connectivity to enable secure operations across multiple industries. Regional growth is further supported by urbanization, smart transportation, industrial IoT adoption, and government-led cybersecurity initiatives.

Competitive Landscape

The major players in the IoT security market include Microsoft, Amazon Web Services, Inc., Google, IBM, Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Armis Inc, Thales, Allot

Microsoft: Microsoft is a global technology leader providing comprehensive IoT security solutions through its Azure IoT platform. The company focuses on securing connected devices, cloud infrastructures, and edge networks by integrating AI-driven threat detection, device authentication, and real-time monitoring. Microsoft’s solutions enable enterprises to manage and protect IoT ecosystems across industries such as manufacturing, healthcare, smart cities, and energy. With advanced tools like Azure Defender for IoT and strong cloud security capabilities, Microsoft plays a key role in helping organizations mitigate cyber risks and ensure regulatory compliance in increasingly connected environments.

Market Scope

| Metrics | Details | |

| CAGR | 16.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Offering | Solutions, Services |

| Deployment | Cloud-based, On-premises | |

| Security Type | Network Security, Endpoint Security, Application Security, Cloud Security, Others | |

| Organization Size | Large Enterprises, SME's | |

| End-User | Healthcare, Automotive, Manufacturing, Energy & Utilities, Consumer Electronics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global IoT security market report delivers a detailed analysis with 78 key tables, more than 74 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more IoT security-related reports, please click here