Overview

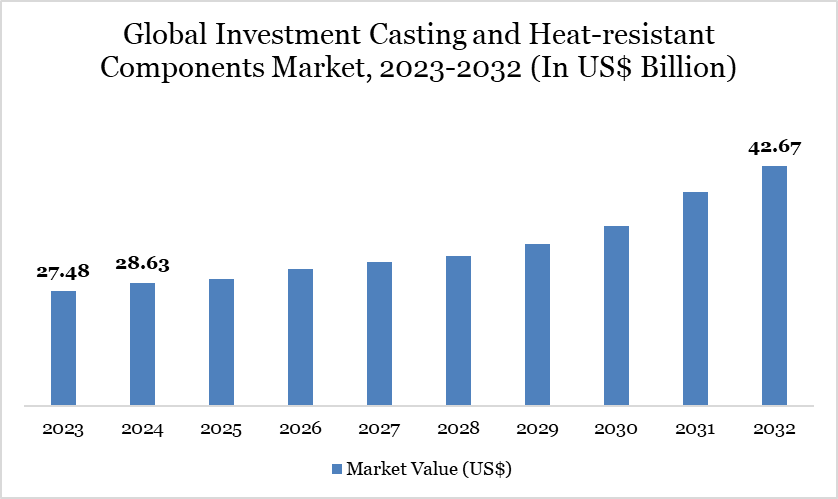

The global market for investment casting and heat-resistant components reached US$28.63 billion in 2024 and is expected to reach US$42.67 billion by 2032, growing at a CAGR of 5.2% during the forecast period 2025-2032.

The global investment casting industry plays a vital role in producing complex, high-precision components for sectors such as aerospace, defense, automotive and biomedical. North America leads the market, accounting for nearly 39% of global sales, with a strong focus on high-value castings. The UK and China follow, with the former also emphasizing advanced applications, while China’s market is more diversified across general engineering and automotive sectors.

Heat-resistant components are increasingly critical in industries that operate in high-temperature environments, including power generation, industrial processing and transportation. Investment casting is well-suited for these applications due to its compatibility with specialized alloys and ability to produce intricate, near-net-shape parts. This reduces material waste, shortens machining time and ensures the durability required for demanding use cases.

India has emerged as a cost-competitive and technically capable player in the global investment casting landscape, contributing around 4% of global output by value. With established hubs like Rajkot home to nearly 30% of the country’s foundries, India is steadily expanding its footprint across key industries such as aerospace, railways and general engineering. Continued adoption of technologies like casting simulation, rapid prototyping and in-house quality control has further strengthened India’s ability to meet global demand for heat-resistant precision components.

Investment Casting and Heat-resistant Components Market Trend

The shift toward lightweight and energy-efficient materials is becoming a key trend in the global investment casting and heat-resistant components market. Industries such as aerospace, automotive and renewable energy are actively seeking materials that offer high strength-to-weight ratios to improve fuel efficiency, reduce emissions and enhance overall system performance.

This trend is driving the adoption of advanced alloys, titanium and aluminum-based components that not only reduce component weight but also maintain high heat resistance and mechanical durability. In sectors like aerospace and defense, lighter components directly contribute to improved payload capacity and fuel savings, making them essential for next-generation designs.

Investment casting is particularly well-suited to support this transition, as it enables the production of complex, thin-walled and lightweight structures with high dimensional accuracy. The combination of material innovation and precision casting processes is helping manufacturers meet stricter environmental regulations while delivering performance-optimized solutions.

Market Scope

Metrics | Details |

By Product Type | Base Trays and Grids, Radiant Tubes and Furnace Rollers/Rolls, Stacking Baskets, Furnace Fans, Sand Casting Fixturing, Furnace Spare Parts, Wrought Fabrications, Forging Trays and Investment Cast Products |

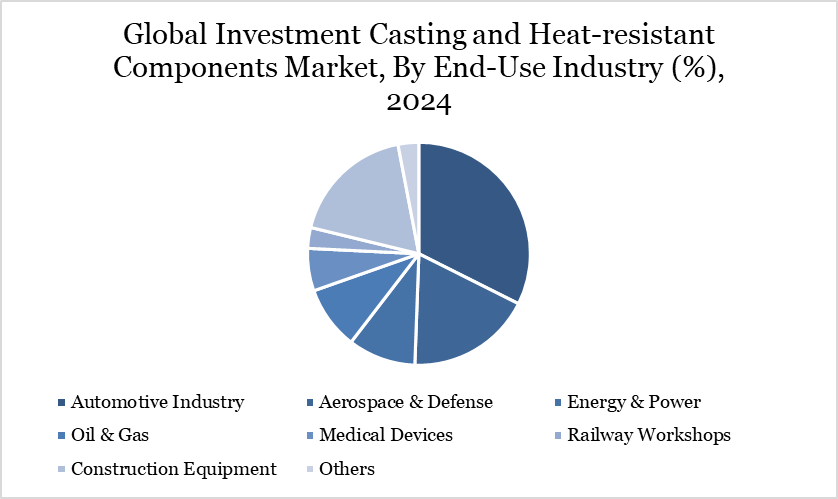

By End-use Industry | Automotive Industry, Aerospace & Defense, Energy & Power , Oil & Gas, Medical Devices, Railway Workshops, Construction Equipment and Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Increasing need for precision components across industries

The aerospace, automotive, energy, defense and medical industries, all reliant on precision-machined components, are increasingly adopting investment casting and heat-resistant components to meet design and performance specifications. These industries require components with near-net shape, fine detailing and minimal post-processing—all of which are enabled by investment casting. Simultaneously, rising demand for heat-resistant alloys and ceramic cores in high-temperature environments such as turbines, engines and reactors is reinforcing market growth.

India’s emergence as a precision machining hub with skilled labor, cost-effective infrastructure and technological integration has created a fertile ground for investment casting expansion. The demand for components such as turbine blades, surgical implants, automotive turbocharger parts and combustion engine segments where heat resistance and precision intersect is steadily rising.

Government-led initiatives such as “Make in India” and Production Linked Incentive (PLI) schemes are accelerating domestic manufacturing, including investment casting capabilities. These programs, aimed at bolstering high-value component production, have led to increased capital investments in precision casting and heat treatment infrastructure.

The Indian precision machining market, valued at US$5 billion in 2023 and projected to grow to US$15 billion by 2030, provides a strong foundation for adjacent markets like investment casting. Moreover, precision component exports exceeding US$18 billion showcase India’s growing influence in the global value chain, with heat-resistant and investment-cast parts forming a significant portion of this output.

High cost of specialty metals

The high cost of specialty metals is a significant challenge impacting the investment casting and heat-resistant components market. Materials such as nickel, cobalt, titanium and chromium-based superalloys are essential for producing components that can withstand extreme temperatures and stress, especially in aerospace, energy and defense applications. However, their limited availability, complex extraction processes and price volatility contribute to elevated production costs.

This cost pressure is particularly impactful in industries with tight margins or high-volume production requirements, such as automotive and general engineering. While these metals are critical for performance in extreme environments, the fluctuating prices of raw materials and limited global supply chains add to the financial risk and procurement complexity for manufacturers.

To manage these challenges, companies are focusing on near-net-shape manufacturing, alloy recycling and process optimization to minimize material waste and reduce overall production costs. Additionally, there is growing interest in developing alternative materials and hybrid alloys that offer a balance between cost, performance and heat resistance.

Segment Analysis

The global investment casting and heat-resistant components market is segmented based on product type, end-use industry and region.

Investment Casting Gains Momentum in Automotive Precision Engineering

The automotive industry is increasingly relying on investment casting and heat-resistant components to meet the demand for complex, high-performance parts. Components such as turbocharger rotors, transmission elements and fuel injection assemblies require exceptional precision and the ability to withstand elevated thermal and mechanical stress. Investment casting offers the dimensional accuracy and material versatility needed to produce these critical parts with minimal machining and high structural integrity, making it a preferred process for modern vehicle platforms.

The rapid adoption of electric vehicles (EVs) is accelerating the need for lightweight and thermally stable components. EV applications such as battery enclosures, inverter housings and power electronics demand heat-resistant materials that can support compact, high-efficiency designs. Investment casting enables manufacturers to deliver near-net-shape, lightweight solutions using advanced alloys, supporting the industry's push for energy efficiency and performance enhancement in next-generation EVs.

India’s automotive sector is becoming a key growth driver for precision casting, supported by strong domestic production, rising exports and strategic policy initiatives like PLI-Auto, FAME-II and EV localization schemes. With a target to increase automotive component production to US$145 billion by 2030, the demand for heat-resistant, high-precision cast parts is set to grow significantly. India's improving technical capabilities, cost competitiveness and government-backed manufacturing incentives position local suppliers to become vital players in the global automotive supply chain.

Geographical Penetration

Rising Demand for Investment Casting and Heat-resistant Components in North America

North America is a key demand center for investment casting and heat-resistant components, driven by its leadership in aerospace, defense and advanced automotive manufacturing. Over 77% of investment casting sales in the region are attributed to high-value applications where components must meet strict tolerance, strength and thermal resistance requirements. From turbochargers and exhaust manifolds in vehicles to turbine blades and structural parts in aircraft, investment casting remains a critical enabler of precision and performance.

The automotive sector in North America, especially in the US and Canada, is actively shifting toward lightweight, high-efficiency vehicles. This transition is fueling demand for components made from nickel- and cobalt-based alloys, which can endure high temperatures while maintaining structural stability. As OEMs invest in hybrid and EV production, the need for heat-resistant castings in battery housings, thermal management units and powertrain systems continues to rise, reinforcing the strategic importance of casting technologies.

Additionally, onshoring initiatives, incentives for advanced manufacturing and growing defense procurement are accelerating the demand for localized, high-integrity casting solutions. North American suppliers are investing in automation, additive manufacturing and high-performance alloys to meet quality, cost and delivery expectations. As the region strengthens its advanced manufacturing footprint, the market for investment casting and heat-resistant components will continue to see steady, high-value growth.

Competitive Landscape

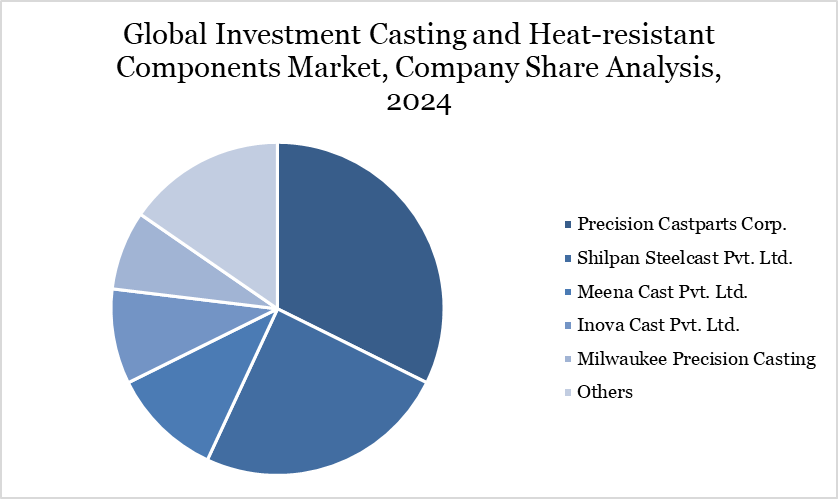

The major global players in the market include Precision Castparts Corp., Shilpan Steelcast Pvt. Ltd., Meena Cast Pvt. Ltd., Inova Cast Pvt. Ltd., Milwaukee Precision Casting, Barron Industries, REDSTONE MANUFACTURING, CIREX, Turbo Cast (India) Pvt. Ltd., IPCL (Investment & Precision Castings Ltd.), LMM GROUP, Cronite-Group, Schunk Carbon Technology, Prakash Metal Industries and Innova Techno Product Pvt. Ltd.

Key Developments

In September 2024, Stratasys, in collaboration with Materialise, introduced the Neo Build Processor to streamline investment casting using Neo SLA 3D printers. The solution delivers up to 50% faster file processing, improved print speeds and seamless integration with Stratasys’ Titanium software and Materialise’s Lattice module. It enables the efficient production of high-precision master patterns with minimal finishing, supporting faster, cost-effective workflows for complex casting applications.

In September 2024, 3D Systems launched QuickCast Air, a new investment casting tool within its 3D Sprint software, enabling up to 50% material savings, faster build times and improved burnout efficiency. Designed for aerospace, defense and energy sectors, it allows the production of large, complex casting patterns at lower cost with optimized resin drainage and minimal internal structures, enhancing overall process efficiency.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies