Global Infant Probiotic Supplements Market Overview

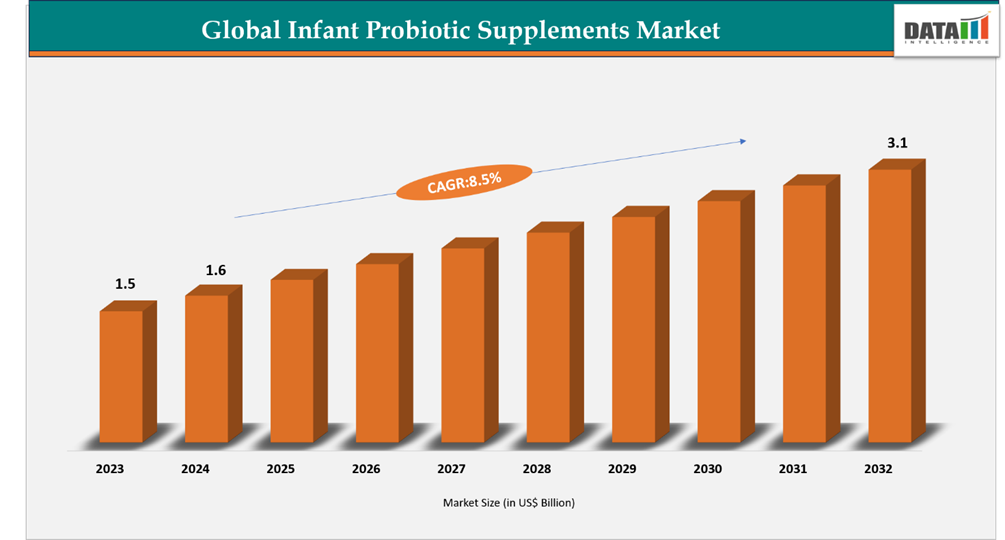

Global Infant probiotic supplements Market reached US$ 1.6 billion in 2024 and is expected to reach US$ 3.1 billion by 2032, growing with a CAGR of 8.5% during the forecast period 2025-2032. The global infant probiotic supplements market is witnessing robust growth, driven by rising awareness of infant gut health and immunity. Increasing demand from health-conscious parents, along with the growing adoption of clinically backed probiotic and HMO formulations, is fueling market expansion. Rapid urbanization and rising disposable incomes in the Asia-Pacific region are major contributors to this growth. Governments and health authorities worldwide are promoting early-life nutrition and maternal-infant health programs, with initiatives such as awareness campaigns and nutrition guidelines encouraging the use of probiotic supplements. This policy-driven focus on infant wellness is expected to directly enhance the production, availability, and adoption of infant probiotic supplements globally.

Infant Probiotic Supplements Industry Trends and Strategic Insights

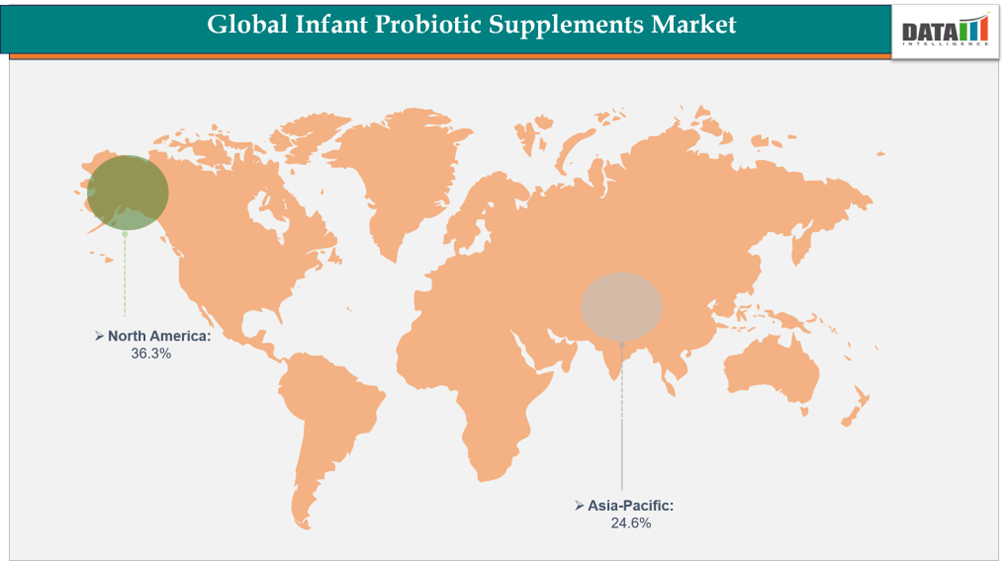

- North America dominates the infant probiotic supplements market, capturing the largest revenue share of 36.3% in 2024.

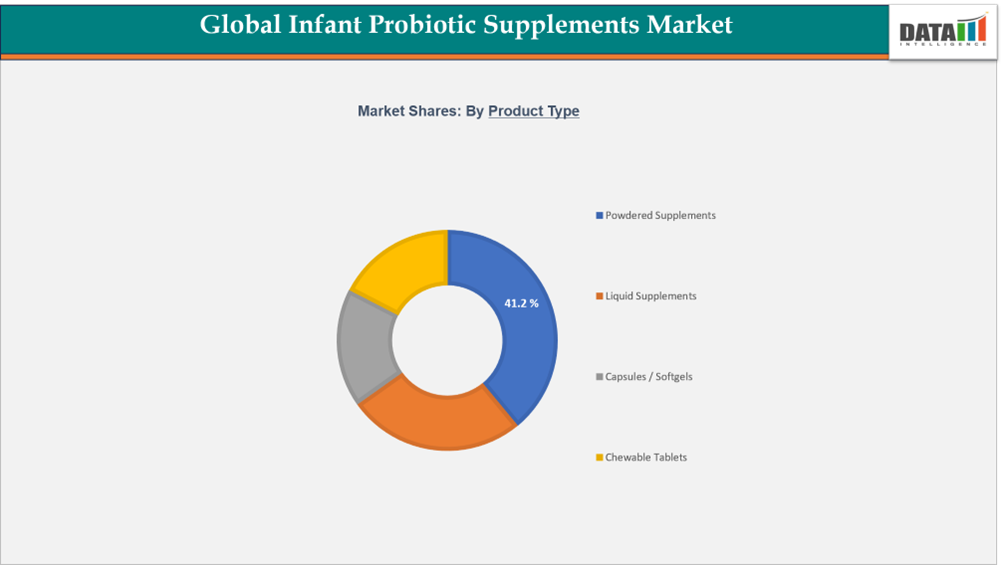

- By product type, the liquid supplements segment is projected to be the largest market, holding a significant share of 41.2% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 1.6 Billion

- 2032 Projected Market Size: US$ 3.1 Billion

- CAGR (2025-2032): 8.5%

- Largest Market: North America

- Fastest Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Product Type | Powdered Supplements, Liquid Supplements, Capsules / Softgels, Chewable Tablets |

| By Application | Digestive Health, Immune Support, Allergy Prevention, Others |

| By Distribution Channel | Online, Offline |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information, Request for Sample

Market Dynamics

Rising Awareness of Infant Gut Health and Immunity

Rising recognition of the vital role the gut microbiome plays in early-life development has heightened parental and healthcare awareness of probiotics for infants. Probiotics are increasingly valued not just for digestive support but also for strengthening immune development during a critical stage when infants are more vulnerable to infections and allergies.

Leading companies are aligning with this growing demand by introducing products that emulate the natural benefits of breastmilk. For instance, In 2023, Nestlé launched a probiotic and human milk oligosaccharide (HMO) blend designed to replicate changes in breastmilk composition across different life stages, supporting both gut health and immune function. HMOs act as prebiotics that feed beneficial gut bacteria, while probiotics enhance intestinal health and immunity.

This trend highlights the rising parental focus on scientifically backed nutrition solutions. As awareness of the gut–immune connection grows, the infant probiotic supplements market continues to expand, fueled by product innovations, pediatric endorsements, and education on early-life health benefits.

High Sensitivity and Regulatory Complexity

The infant probiotic supplements market is constrained by the high sensitivity of its target consumers and the complex regulatory landscape. Infant products must adhere to stringent safety and quality standards, as even minor formulation errors can pose serious health risks. Regulatory requirements vary across regions and cover approval processes, labeling, permissible probiotic strains, and allowable health claims, often necessitating extensive clinical trials and documentation. While these factors can increase operational costs and delay product launches, they also serve as a counterbalance by enhancing consumer trust and brand credibility. Compliance with rigorous regulations encourages investment in scientifically validated formulations, enabling companies to differentiate their products, strengthen reputations, and secure a loyal customer base, ultimately supporting long-term growth in the market.

Segmentation Analysis

The global infant probiotic supplements market is segmented based on product type, application, distribution channel and region.

Rising Demand for Gut Health and Immunity Support Demand for Powdered Supplement Segment

The powdered supplements segment is growing due to increasing awareness of infant gut health and immunity. Powdered probiotics offer precise dosing, longer shelf life, and easy integration into formula or cereals, making them ideal for multi-strain formulations and fortification with HMOs, vitamins, and minerals.

Modern practices like antibiotics and C-sections, combined with industrialized diets, leave many infants lacking essential gut microbes. Stephanie Culler, Ph.D., notes this deficiency affects nearly all US infants, raising the risk of allergies, eczema, and asthma. This drives demand for powdered probiotics that replenish beneficial gut bacteria. Key players such as Nestlé, Danone, and Mead Johnson are expanding their offerings, particularly in Asia-Pacific and Latin America, where awareness and disposable incomes are rising.

Convenience and Early-Life Nutrition Focus Drive Liquid Supplement Segment Growth

The liquid supplements segment is a major contributor to the infant probiotic supplements market, owing to its convenience and suitability for newborns and infants. Liquid probiotics are widely used in early-life nutrition to support digestive health, immunity, and overall development. The format allows for easy administration, accurate dosing, and rapid absorption, which is especially important for infants under 12 months. With increasing launches of clinically backed liquid formulations containing probiotics and HMOs- such as Nestlé’s probiotic and HMO blend that mirrors breastmilk composition-the segment is witnessing robust adoption. Healthcare professionals frequently recommend liquid supplements for infants with feeding challenges or during transition from breastfeeding to formula.

For instance, In July 2023, Danone recently launched a science-based liquid probiotic supplement designed to support breastfeeding experiences, reflecting the growing trend of product innovation targeting early-life gut health and maternal-infant nutrition. Growing awareness of gut health benefits, coupled with rising urbanization and parental preference for ready-to-use, safe, and palatable products, continues to drive the liquid supplements segment globally.

Geographical Penetration

North America Leads the Infant Probiotic Supplement Market Driven by Growing Focus on Gut Health and Early-Life Nutrition

North America is the largest regional market for infant probiotic supplements, representing around 36.3% of the global market in 2024. Growing awareness of infant gut health, immunity, and early-life nutrition is fueling demand. Companies are increasingly launching innovative probiotic products to meet parents’ preference for safe, convenient, and clinically validated formulations.

For instance, in 2024, Bobbie, a mom-founded pediatric nutrition company, announced its first expansion beyond infant formula with two organic supplements: Vitamin D and Probiotic Drops, marking its initial entry into non-formula products and extending its high-quality, simple formula portfolio.

US Infant Probiotic Supplements Market Outlook

The US market is growing rapidly due to heightened parental awareness, higher disposable incomes, and increasing pediatric recommendations for probiotics. Clinically backed formulations in both liquid and powdered forms are becoming popular for infants under 12 months, offering convenience and precise dosing.

Canada Infant Probiotic Supplements Market Trends

Canada’s infant probiotic market is expanding steadily, supported by urban demand for safe, organic, and science-based supplements. International players are entering through partnerships and product launches, while domestic companies emphasize high-quality, clinically supported formulations. Rigorous regulatory standards help maintain consumer confidence and trust in the market.

Advanced Infant Nutrition Infrastructure Supports Asia-Pacific Market Growth

Asia-Pacific is poised to be a key region in the global infant probiotic supplements market, holding a significant share in 2024. Growth is driven by rising parental awareness, increasing disposable incomes, and expanding healthcare and infant nutrition infrastructure. Countries including China, Japan, South Korea, and Singapore are witnessing strong adoption of clinically validated probiotic formulations for both infants and maternal health.Despite the availability of generic probiotics, science-backed formulations remain preferred due to their proven safety and efficacy. The region benefits from a robust network of pediatric nutrition companies and research institutions that foster innovation and product development.

For instance, on Sept. 15, 2025, Supported by six clinical studies and two safety trials, Kerry's LC40 became the first probiotic strain validated for both infant and maternal use, offering a natural, clinically supported approach to early-life and maternal health.

China Infant Probiotic Supplements Market Insights

China leads the Asia-Pacific region in infant probiotic supplement production and consumption, fueled by a large population and a growing urban middle class. Domestic manufacturers are increasing output of high-quality powders and liquids, while international brands target the premium, clinically validated segment. Government initiatives to improve maternal and child nutrition further support market expansion.

India Infant Probiotic Supplements Industry Growth

India’s infant probiotic market is expanding rapidly, driven by increasing awareness of gut health, immunity, and early-life nutrition. Pediatricians and healthcare providers are recommending clinically backed supplements, while urbanization and digital access enable better consumer education. Both startups and established firms are launching innovative products to meet rising demand, supported by regulatory frameworks ensuring safety and quality.

Sustainability Analysis

The infant probiotic supplements market is increasingly integrating sustainability into its core growth strategy, balancing product efficacy with environmental responsibility. Manufacturers are adopting energy-efficient production processes, eco-friendly packaging, and advanced recycling methods to reduce carbon emissions and material waste.

For instance, in Sept. 2025, Kerry’s LC40 probiotic strain, validated for both infant and maternal applications, was produced using sustainable fermentation and formulation practices in Singapore, reflecting a science-backed approach to early-life nutrition while minimizing environmental impact. This initiative highlights the potential for integrating circular economy principles and low-carbon manufacturing into high-quality pediatric nutrition products.

Competitive Landscape

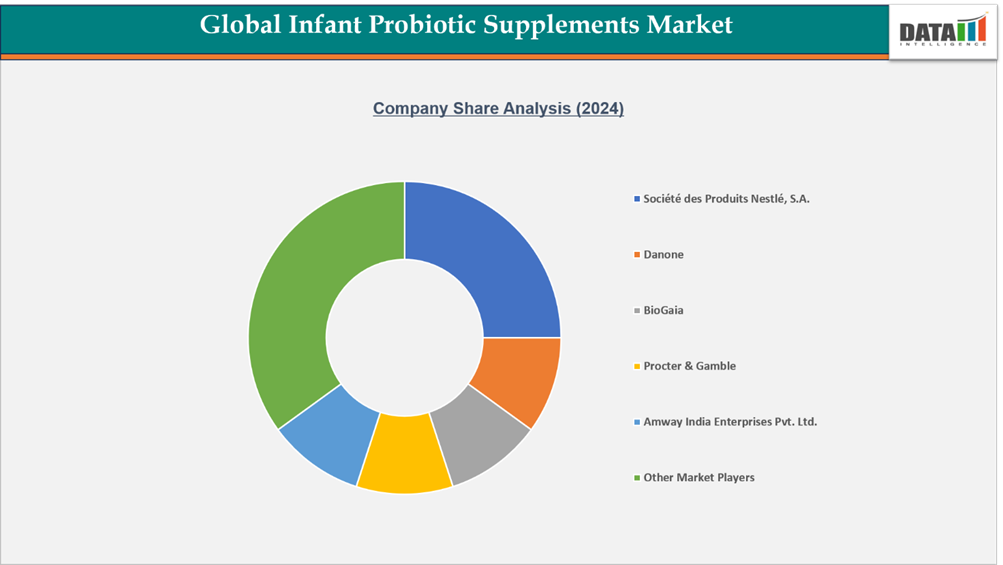

- The global infant probiotic supplements market features a competitive landscape comprising both established pediatric nutrition companies and specialized probiotic producers.

- Key players include Société des Produits Nestlé, S.A., Danone, BioGaia, Procter & Gamble, Amway India Enterprises Pvt. Ltd., Mead Johnson & Company, LL, Lovebug Probiotics, Infinant Health Inc, Lifeway Foods, Inc., and WebMD LLC.

- Companies focus on product differentiation by offering clinically backed, high-quality probiotic formulations in both powdered and liquid forms, targeting infant gut health, immunity, and overall early-life development.

- Strategic investments in R&D, sustainability initiatives, and manufacturing efficiency are crucial, as the market faces competition from alternative nutritional products and generic probiotic supplements.

Key Developments

- In June 2023, AB-BIOTICS collaborates with H&H Group to introduce a new premium infant probiotic under the Biostime brand.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies