Market Size

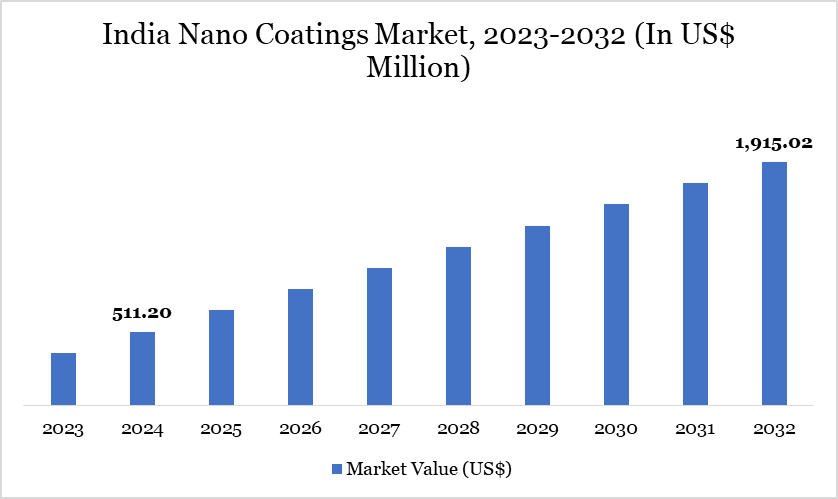

India Nano Coatings Market reached US$ 511.20 million in 2024 and is expected to reach US$ 1,915.02 million by 2032, growing with a CAGR of 17.95% during the forecast period 2025-2032.

The India nano coatings market is witnessing robust growth, driven by increasing demand across the automotive, electronics, construction, healthcare and energy sectors. Enhanced functionalities like anti-corrosion, anti-bacterial, self-cleaning and UV resistance are positioning nano coatings as high-value solutions. Rising infrastructure development, an expanding industrial base and a surge in consumer electronics are fueling adoption. Government initiatives promoting advanced materials and sustainability are further supporting market expansion.

India Nano Coatings Market Trend

A key trend in the India nano coatings market is the rising adoption of functional coatings in renewable energy and infrastructure. Innovations like anti-reflective and self-cleaning coatings enhance solar panel efficiency, while anti-corrosion solutions protect wind turbines and structural assets. This shift supports durability, energy output and long-term cost savings.

For instance, in January 2024, Indian startup Trinano Technologies developed a nano coating for solar modules that reportedly increases power generation by up to 4% and reduces panel temperature by up to 3°C. The coating's light-trapping, anti-reflection and self-cleaning properties contribute to improved energy output and reduced maintenance.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | Self-Cleaning Coatings, Anti-Microbial Coatings, Anti-Fingerprint Coatings, Anti-Corrosion, Conductive, Anti-Fouling Coatings, Thermal Barrier Coatings, Others. | |

| By Substrate | Metal, Glass, Ceramic, Plastic, Textiles, Wood, Others. | |

| By Coating Method | Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), Layer Soft-Gel Process, Electro-Deposition, Others. | |

| By Application | Building & Construction, Food Packaging, Healthcare, Electronics, Automotive, Marine, Others. | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Increasing Demand for Advanced Protective Coatings

Industries such as automotive, aerospace, electronics and construction are adopting nano coatings for their superior properties, like corrosion resistance, UV protection and self-cleaning capabilities. As infrastructure and industrial activities grow, there's a rising need for durable and low-maintenance protective solutions. Nano coatings offer a thin, invisible layer that doesn’t compromise aesthetics while providing robust protection. Their ability to reduce maintenance costs and improve energy efficiency further boosts their appeal.

Several companies are actively investing in the Indian nano coatings market, reflecting the growing demand for advanced protective coatings across various industries. In March 2025, Pellucere Technologies opened its first nano coatings manufacturing facility in Maharashtra, India. This facility will produce 8,500 metric tons of advanced coatings annually, including anti-reflective, anti-soiling, hydrophobic, hydrophilic, photocatalytic self-cleaning and anti-fog technologies, catering to the growing demand in the solar, architectural and automotive glass sectors.

High Costs and Complex Processes

The manufacturing of nano coatings involves costly raw materials like silver, titanium dioxide and zinc oxide, along with advanced polymers and additives. Production processes such as physical vapor deposition (PVD), chemical vapor deposition (CVD) and atomic layer deposition (ALD) require sophisticated equipment and technologies. These processes demand high capital investment and operational costs. The need for precise control at the nanoscale adds further complexity. Additionally, maintaining consistent quality across large-scale production is challenging. As a result, these factors contribute to the overall high cost of manufacturing nano coatings.

Segment Analysis

The India nano coatings market is segmented based on type, substrate, coating method and application.

Self-Cleaning Coatings Dominate Nano Coatings Market Due to Rising Demand for Low-Maintenance Surfaces

Self-cleaning coatings hold a significant share in the nano coatings market due to their growing demand across various industries, including construction, automotive and electronics. These coatings utilize nanotechnology to create surfaces that repel dirt, water and other contaminants, reducing maintenance costs and enhancing durability. The construction sector, in particular, benefits from self-cleaning glass and façades that stay cleaner for longer periods. In the automotive industry, such coatings improve visibility and aesthetics by preventing grime buildup.

Companies are driving the self-cleaning nano coatings market by investing in innovations that enhance durability, efficiency and environmental sustainability. In November 2022, IIT Jodhpur researchers developed a transparent, durable and superhydrophobic self-cleaning coating for solar panels. This innovation reduces dust accumulation and requires minimal water for cleaning, making it suitable for water-scarce regions.

Sustainability Analysis

India's nano coating market is rapidly evolving with advancements in antimicrobial, self-cleaning and energy-efficient coatings, driven by demand in the healthcare, construction and automotive sectors. Eco-friendly, water-based formulations are also on the rise to meet sustainability goals. Government initiatives like Make in India and R&D collaborations are further accelerating growth in this high-potential sector.

On March 17, 2022, Rossari Biotech Ltd launched Dr. Nanoxa, India’s first nanotechnology-based antimicrobial surface coating, offering 30-day protection against bacteria and viruses. Certified by NABL labs, the Made-in-India product is eco-friendly and designed for both home and commercial use. It addresses the need for long-lasting, cost-effective hygiene solutions post-COVID. The coating is ideal for high-traffic areas like hospitals, airports and workplaces.

Major Players

The major players in the market include Harind Chemicals & Pharmaceuticals Pvt. Ltd., Nasiol India Coating, Nanofilm Technologies International Limited, Dura-Coating Technology, Bardiya Corporation Pvt. Ltd., P2i Ltd, TECHExpert Engineering Pvt. Ltd., Nilima Nanotechnologies, Nanoquinn and Advanced NanoTech Lab.

Key Developments

- In August 2020, Tech startup Muse Nanobots, a subsidiary of IIT Madras-incubated Muse Wearables, launched a nanotech coating for textiles that can inactivate 99.99% of the coronavirus within five minutes of contact. The antiviral coating, tested by US-based Situ Biosciences, offers enhanced protection for the public and frontline workers.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies