India fintech & UPI Payments market Size & Overview

The India fintech & UPI Payments market reached US$ 2.50 Trillion in 2024 and is expected to reach US$ 12.52 Trillion by 2032, growing at a CAGR of 22.3% during the forecast period 2025-2032.

This growth is driven by rising smartphone penetration, urbanization, increasing digital literacy, and expanding demand from consumers, SMEs, and e-commerce platforms. Strong government regulations on data security, financial inclusion programs, and awareness campaigns promoting cashless transactions are supporting adoption of UPI, digital wallets, and contactless payment solutions. Innovations in payment technologies, product offerings, and distribution networks are further enabling access to secure, convenient, and affordable fintech s olutions, fueling market expansion across urban and semi-urban regions.

India Fintech & UPI Payments Industry Trends and Strategic Insights

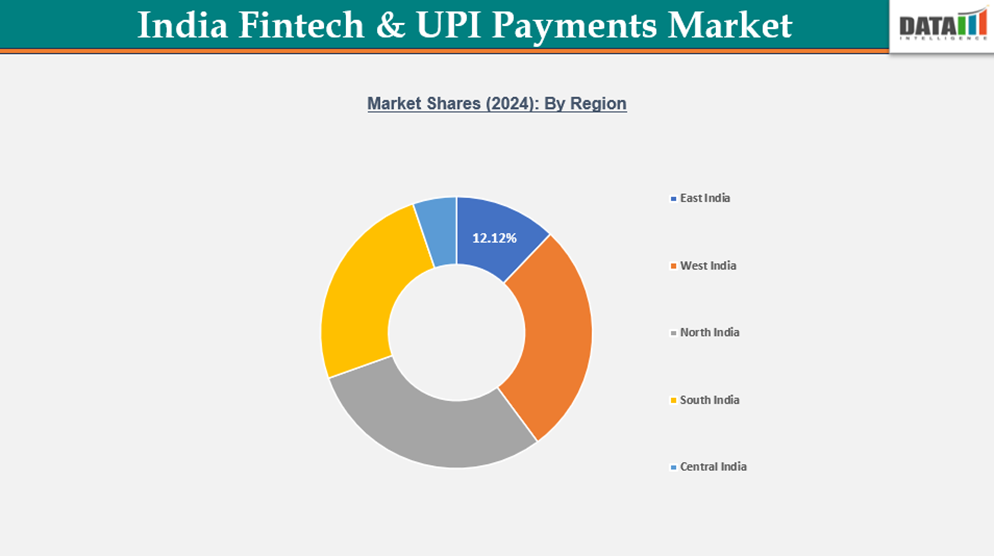

- The North India region leads the India fintech & UPI payments market, capturing the largest revenue share of 29.70% in 2024.

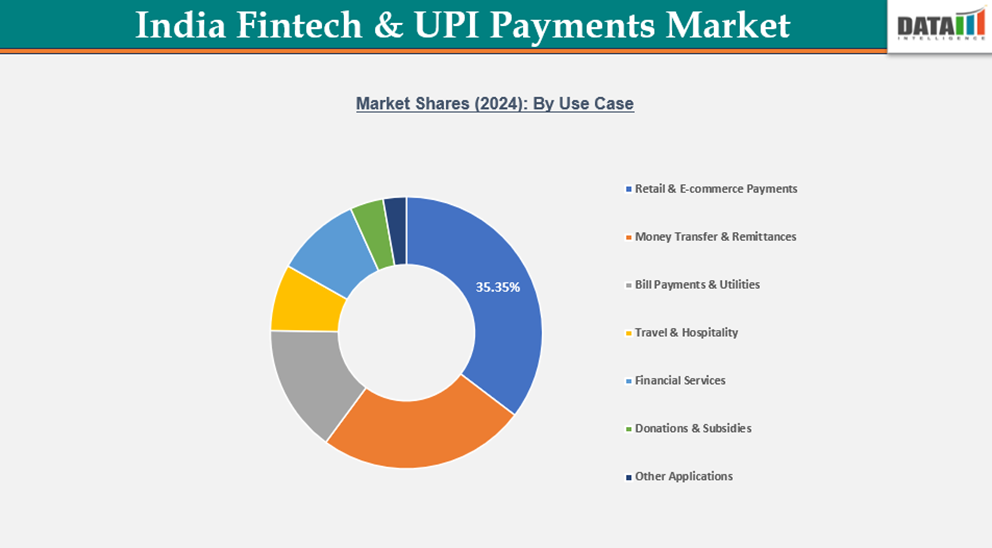

- By use case, the retail & e-commerce payments sector dominates the market, capturing the largest revenue share of 35.35% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 2.50 trillion

- 2032 Projected Market Size: US$ 12.52 trillion

- CAGR (2025-2032): 22.3%

- Largest Market: North India

- Fastest Market: East India

Market Scope

| Metrics | Details |

| By Transaction Type | Peer-to-Peer (P2P), Peer-to-Merchant (P2M) |

| By Use Case | Retail & E-commerce Payments, Money Transfer & Remittances, Bill Payments & Utilities, Travel & Hospitality, Financial Services, Donations & Subsidies, Others |

| By Deployment Mode | QR Code-Based Payments, In-App / Online Payment Gateways, Point-of-Sale Terminals |

| By End-User | Individual Consumers, Small & Medium Enterprises, Large Enterprises, Financial Institutions |

| By Region | East India, West India , North India, South India, Central India |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising smartphone penetration accelerates mobile-based financial services adoption nationwide.

India’s fintech and UPI payments market is undergoing rapid transformation driven by increasing digital literacy and smartphone usage, particularly among urban consumers. As access to digital infrastructure improves, individuals and businesses are increasingly adopting mobile-based payment solutions, reshaping the financial services landscape. This trend is moving the sector beyond basic banking and peer-to-peer transfers toward value-added services such as bill payments, lending, and investment platforms.

Urban consumers, influenced by evolving lifestyles and convenience-driven expectations, are showing a strong preference for seamless, instant, and secure payment solutions. The willingness to adopt UPI and digital wallets reflects a broader shift from cash-dependent transactions to digitally enabled, efficiency-driven financial behavior. Additionally, the rise of dual-income households, growing e-commerce penetration, and government-backed initiatives promoting digital payments are accelerating adoption, driving higher transaction volumes, better financial inclusion, and an expanding ecosystem of fintech innovations.

Segmentation Analysis

The India fintech & UPI payments market is segmented based on transaction type, use case, deployment mode and end-user and region.

Government initiatives promote digital payments, driving fintech and UPI usage.

The Indian fintech ecosystem has witnessed exponential growth over the past decade, underpinned by government initiatives promoting digital financial inclusion. Programs such as the Digital India campaign, Jan Dhan Yojana, and direct benefit transfers have accelerated adoption of digital payments and bolstered UPI (Unified Payments Interface) usage. UPI has emerged as the backbone of the country’s payments infrastructure, enabling seamless, real-time transactions across banks and fintech platforms.

Market growth is being driven by rising smartphone penetration, affordable internet access, and a tech-savvy consumer base increasingly favoring cashless payments. Fintech players are leveraging AI, machine learning, and blockchain to enhance transaction security, streamline onboarding, and deliver personalized financial services. Strategic collaborations between banks, payment service providers, and e-commerce platforms are further expanding UPI adoption across retail, utility payments, and peer-to-peer transfers.

Regulatory frameworks by the Reserve Bank of India and National Payments Corporation of India (NPCI) provide robust compliance standards while encouraging innovation in digital financial services. Additionally, government-backed initiatives such as Bharat BillPay and QR-based merchant payments are expanding UPI’s ecosystem across urban and semi-urban regions.

Cybersecurity risks and fraud concerns limit consumer trust in digital transactions

The India Fintech and UPI payments ecosystem has experienced unprecedented growth, driven by digital adoption, government initiatives like Digital India, and consumer preference for fast, contactless transactions. However, rapid expansion has exposed the sector to significant cybersecurity risks and fraud vulnerabilities, impacting consumer trust and long-term adoption. Phishing attacks, identity theft, malware targeting mobile payment apps, and unauthorized access to bank accounts have become increasingly sophisticated, highlighting the need for robust security frameworks.

Fraud incidents, including UPI transaction scams, SIM swap frauds, and phishing campaigns targeting both retail and SME users, have eroded confidence in digital payment channels. Consumer perception of risk directly influences adoption rates, transaction frequency, and engagement with fintech offerings. Banks, fintech firms, and payment service providers must therefore implement multi-layered security protocols, including two-factor authentication, end-to-end encryption, biometric verification, and AI-driven fraud detection.

Regulatory oversight by the Reserve Bank of India (RBI) and periodic updates to data privacy frameworks, including compliance with the Personal Data Protection Act, are critical enablers for risk mitigation. Collaboration between fintech players, cybersecurity vendors, and government agencies can foster safer payment ecosystems and reinforce trust.

Geographical Penetration

North India Dominates the Indian Fintech & UPI Payments Market Driven by Urban Adoption and Digital Literacy

North India represents one of the largest regional markets in India’s fintech and UPI payments ecosystem, driven by high population density, rapid urbanization, and strong smartphone penetration. States such as Delhi, Uttar Pradesh, Haryana, Punjab, and Rajasthan contribute significantly to transaction volumes, with consumers increasingly favoring instant, contactless payments for retail, bill payments, and peer-to-peer transfers.

The adoption of UPI-enabled apps like Google Pay, PhonePe, and Paytm is reinforced by government initiatives promoting digital financial inclusion and consumer awareness campaigns. Urban centers such as Delhi, Lucknow, and Chandigarh are witnessing growing engagement with value-added fintech services, including microloans, wealth management apps, and integrated digital wallets, reflecting rising tech literacy and comfort with digital banking.

Merchants, SMEs, and the HoReCa (Hotel, Restaurant, Catering) segment further fuel demand for UPI and QR-based payments, facilitating cashless transactions, operational efficiency, and better transaction tracking. Increasing disposable incomes, smartphone penetration, and broadband connectivity are shifting consumer preferences toward secure, branded digital payment platforms, reducing reliance on cash and informal credit networks.

East India Emerging as a Key Growth Hub in the Indian Fintech & UPI Payments Market

East India is rapidly emerging as a critical growth hub in India’s fintech and UPI payments ecosystem, driven by increasing smartphone penetration, rising digital literacy, and expanding merchant acceptance. States such as West Bengal, Odisha, Bihar, and Jharkhand account for significant transaction volumes, supported by both urban adoption and growing rural engagement through digital payment platforms. The region also benefits from strong banking infrastructure and government initiatives promoting financial inclusion, making it a strategic market for fintech expansion.

West Bengal Fintech & UPI Market Insights

In West Bengal, the fintech and UPI payments market is propelled by large-scale urban adoption in Kolkata, Howrah, and Siliguri. Peer-to-peer transfers, utility bill payments, and digital wallet usage dominate consumer behavior, while QR code-based merchant payments are gaining traction in the HoReCa and retail segments. Rising awareness of digital financial services, coupled with increasing smartphone and internet penetration, supports sustained growth in both retail and SME segments.

Bihar & Odisha Fintech Growth

Bihar and Odisha are witnessing accelerated adoption of UPI and mobile banking solutions, fueled by government programs like PMGDISHA and local fintech awareness campaigns. Digital payments are increasingly used for household transactions, small businesses, and government disbursements. Strategic investments by fintech players in user-friendly apps, regional language support, and QR-based merchant solutions are further expanding the market.

Sustainability Analysis

The India fintech and UPI payments market is increasingly embracing sustainability and responsible growth, driven by the demand for secure, efficient, and inclusive digital financial services. Companies and fintech platforms are investing heavily in cybersecurity, robust authentication protocols, and AI-driven fraud detection to strengthen trust and reliability across consumer and merchant segments. Sustainable practices, including interoperable platforms, transparent transaction reporting, and compliance with RBI regulations, are becoming standard across the sector.

Rising digital literacy and government-led financial inclusion initiatives are expanding adoption in both urban and rural areas, while technological advancements in real-time processing, QR-based payments, and mobile wallet integration ensure improved efficiency, user experience, and accessibility. Payment platforms are increasingly focusing on responsible innovation, including low-cost solutions for underserved populations, regional language support, and inclusive product offerings.

Competitive Landscape

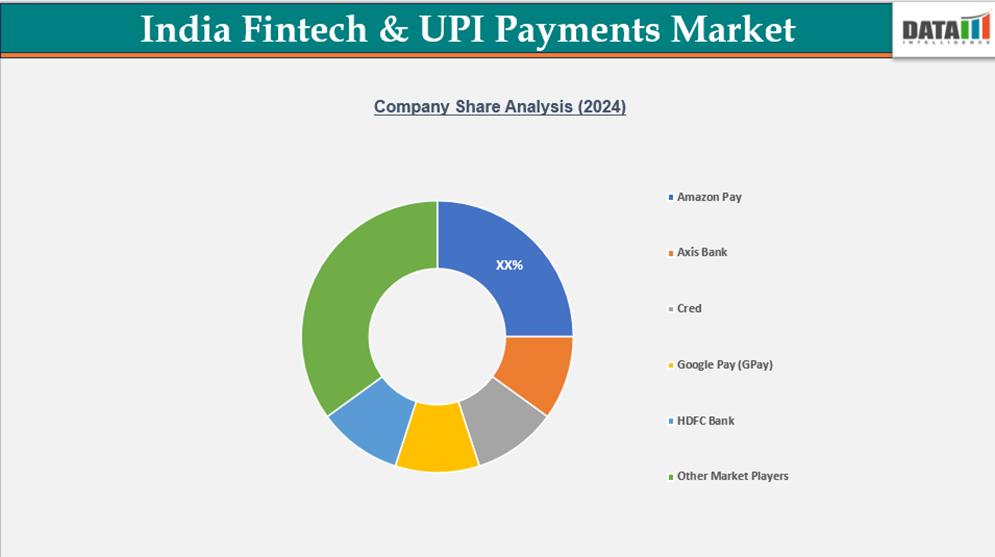

- India's fintech landscape is intensely competitive, driven by the ubiquitous UPI infrastructure. The National Payments Corporation of India (NPCI) governs this ecosystem, where three primary cohorts compete.

- Bank-led platforms like PhonePe and Google Pay dominate transaction volumes, leveraging their user-friendly interfaces. Traditional banks are fortifying their own apps to retain customer relationships.

- New age fintechs like Paytm and CRED offer layered financial services lending, wealth management, and credit—on top of payments, creating differentiated ecosystems. This hyper-competition fuels continuous innovation and deep discounting, with the battle centered on user acquisition, merchant onboarding, and building a comprehensive financial services super-app.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies