India Electric Vehicles (EV) Market Size & Overview

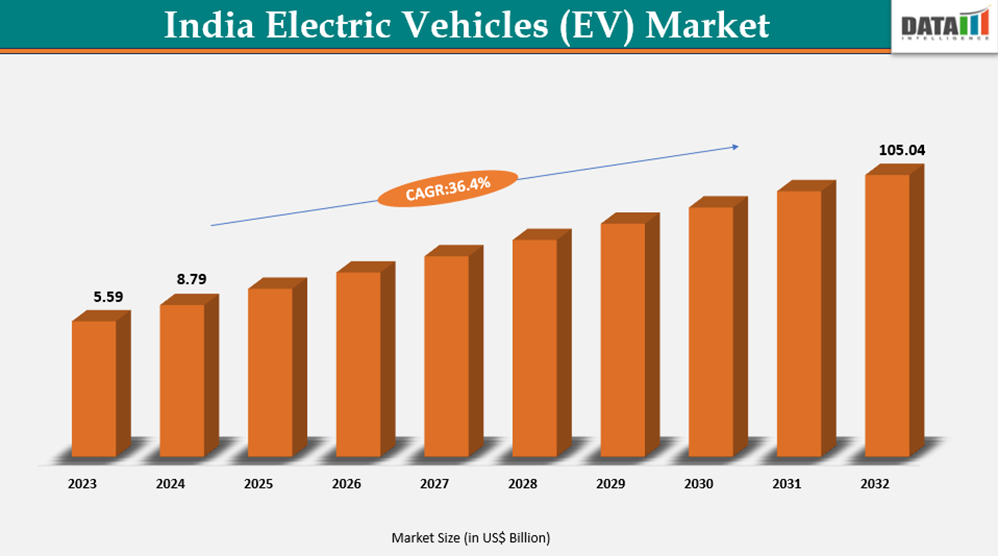

The India electric vehicles (EV) market reached US$ 8.79 billion in 2024 and is expected to reach US$ 105.04 billion by 2032, growing at a CAGR of 36.4% during the forecast period 2025-2032.

This growth is driven by rising disposable incomes, urbanization, government incentives, and increasing environmental awareness among consumers. Supportive policies such as FAME (Faster Adoption and Manufacturing of Hybrid and Electric vehicles (EV)) schemes, emission regulations, and infrastructure development for EV charging are accelerating adoption across personal, commercial, and shared mobility segments. Innovations in battery technologies, vehicle designs, and smart mobility solutions are further enabling access to efficient, durable, and cost-effective electric vehicles (EV), fueling market expansion across metropolitan and tier-2 cities.

Electric vehicles (EV) Industry Trends and Strategic Insights

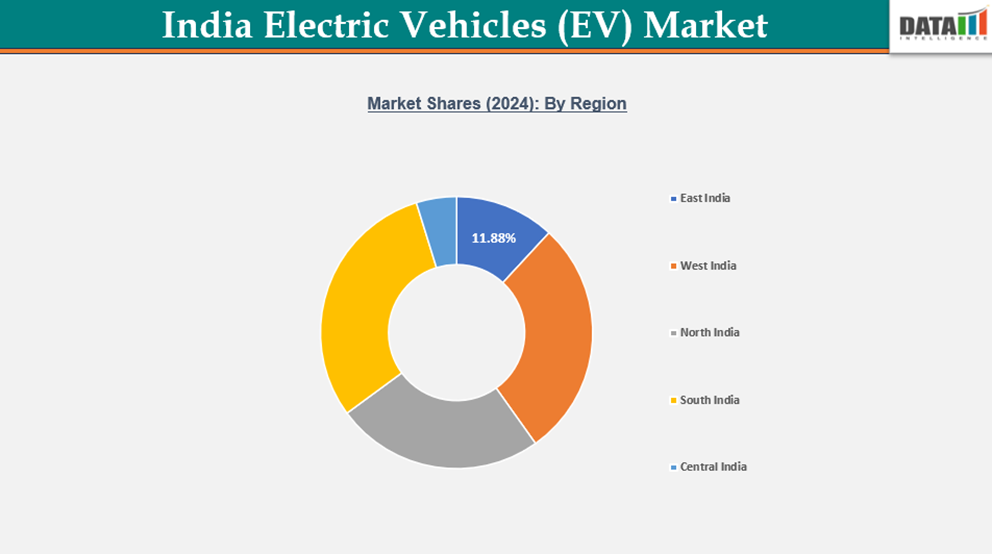

- The North India region leads the electric vehicles (EV) market, capturing the largest revenue share of 24.75% in 2024.

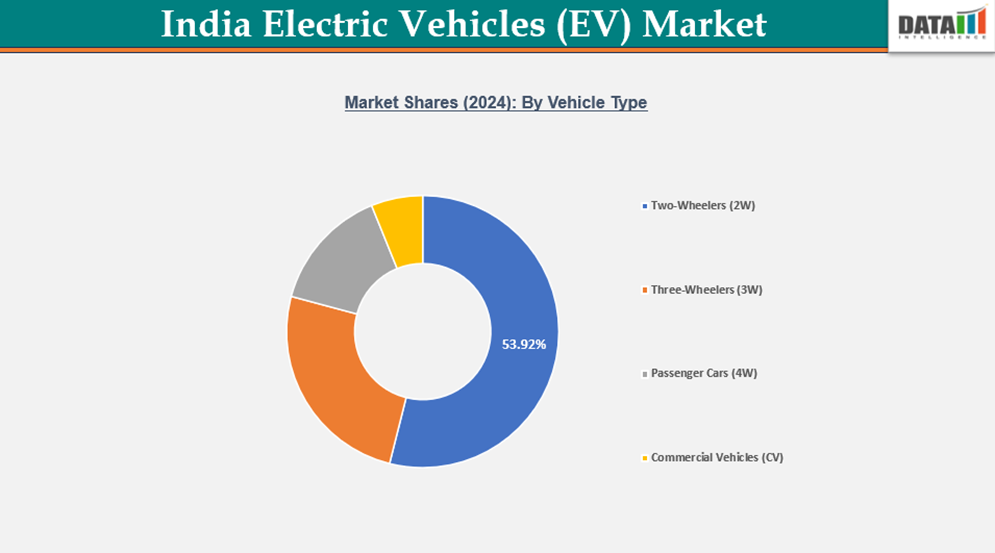

- By vehicle type, two-wheelers (2W) sector dominates the market, capturing the largest revenue share of 53.92% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 8.79 billion

- 2032 Projected Market Size: US$ 105.04 billion

- CAGR (2025-2032): 36.4%

- Largest Market: South India

- Fastest Market: North India

Market Scope

| Metrics | Details |

| By Vehicle Type | Two-Wheelers (2W), Three-Wheelers (3W) (Passenger E-3W, Cargo E-3W), Passenger Cars (4W) (Compact Hatchbacks, Compact SUVs / Crossover BEVs, Sedans / Premium EV, Strong Hybrids / PHEV / BEV), Commercial Vehicles (CV) (Last-mile Delivery Vans / LCVs, Medium/heavy EV Trucks) |

| By Propulsion Type | Battery Electric Vehicle (BEV), Plug-in Hybrid, Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| By Power Source | Lithium-Ion Batteries (Li-ion), Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), Lead-Acid Batteries |

| By Price Range | Economy/Low-Cost, Mid-Range, Premium/Luxury |

| By Region | East India, West India, North India, South India, Central India |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising disposable incomes increase consumer ability to adopt EVs rapidly

Rising disposable incomes are emerging as a pivotal driver in accelerating the adoption of electric vehicles (EV) (EVs) across India. With sustained economic growth, urban households and affluent segments are experiencing enhanced purchasing power, enabling them to consider higher-value mobility options, including EVs. The correlation between disposable income and consumer willingness to invest in EV technology is particularly strong in urban and semi-urban markets, where environmental awareness and access to charging infrastructure are comparatively better.

Higher disposable income not only facilitates the initial purchase of EVs but also supports the total cost of ownership, including home charging installations, maintenance, and potential upgrades. Affluent consumers are increasingly prioritizing sustainability, and EVs align with their preferences for cleaner, technologically advanced mobility solutions.

Segmentation Analysis

The electric vehicles (EV) market is segmented based on the vehicle type, propulsion type, power source, price range and region.

Government incentives and subsidies promote EV adoption across multiple segments

Government incentives and subsidies play a pivotal role in accelerating electric vehicle (EV) adoption across multiple segments, including personal mobility, commercial fleets, and public transportation. By lowering the total cost of ownership, these measures address the critical barrier of upfront price sensitivity that often hinders consumer adoption. For instance, direct purchase subsidies, tax rebates, and exemption from registration fees significantly reduce acquisition costs for individual buyers, enhancing affordability and market penetration.

On the commercial side, fiscal incentives for fleet operators and logistics companies encourage the integration of EVs into last-mile delivery and corporate mobility solutions. Subsidies for charging infrastructure deployment further strengthen this ecosystem, mitigating range anxiety and improving operational efficiency. In the public transport segment, grants and concessional financing enable municipalities to procure electric buses, thereby reducing urban emissions and supporting sustainable city initiatives.

Limited charging infrastructure slows mass adoption of electric vehicles (EV) nationwide

The mass adoption of electric vehicles (EV) (EVs) in India is significantly constrained by insufficient charging infrastructure. Despite increasing consumer awareness and growing government incentives, the availability and accessibility of reliable charging stations remain inadequate to support large-scale EV deployment. A fragmented and unevenly distributed charging network leads to range anxiety among potential buyers, limiting confidence in EV ownership, particularly for long-distance travel across regions.

Most charging infrastructure is concentrated in urban centers and metropolitan areas, leaving semi-urban and rural markets underserved. This urban-rural imbalance restricts market penetration and slows adoption in emerging regions, where the potential for EV growth is substantial. Moreover, the lack of standardized charging protocols and interoperability issues among different EV models and charging networks exacerbate the problem, creating operational inefficiencies and consumer frustration.

From a policy perspective, public-private partnerships are underleveraged, and the pace of infrastructure expansion has not kept up with the projected increase in EV sales. High installation costs, limited grid capacity, and regulatory bottlenecks further challenge the rapid scaling of charging networks.

Geographical Penetration

South India Leads the Indian EV Market Driven by Technology Adoption and Urban Mobility Trends

South India represents one of the most dynamic regional markets in the Indian electric vehicle (EV) sector, driven by progressive consumer behavior, rapid urbanization, and strong government support. States such as Karnataka, Tamil Nadu, Telangana, and Kerala are emerging as early adopters of EVs, particularly in the passenger vehicle and two-wheeler segments, supported by tech-savvy populations and high urban mobility demand.

Karnataka and Tamil Nadu are witnessing significant growth in electric two-wheelers and cars, with consumers attracted to cost savings, environmental benefits, and modern design. The presence of EV manufacturing hubs and technology parks, particularly in Bengaluru and Chennai, facilitates local availability and after-sales services, reinforcing adoption. Increasing awareness of sustainability and rising interest in low-emission transport among urban professionals is also driving demand for electric three-wheelers and shared mobility solutions in tier-1 and tier-2 cities.

The commercial segment, including logistics and ride-hailing services, is accelerating adoption of electric vehicles (EV), with fleet operators increasingly procuring EVs to reduce operating costs and comply with regulatory mandates. Additionally, government initiatives such as state-specific EV policies, subsidies, and infrastructure incentives are expanding charging networks, supporting seamless vehicle operation.

North India Emerging as a Key Growth Hub in the Indian Electric vehicles (EV) Market

North India is rapidly emerging as a critical growth hub in the Indian electric vehicles (EV) (EV) market, fueled by rising urbanization, government incentives, and increasing environmental awareness. States such as Delhi, Uttar Pradesh, Haryana, and Punjab are witnessing accelerated adoption of electric two-wheelers, three-wheelers, and passenger cars. The region benefits from extensive road networks and growing industrial clusters, which support EV usage for both personal mobility and commercial logistics. Strategic policy interventions, including state-level subsidies and EV-friendly regulations, further strengthen North India’s position in the national EV ecosystem.

Delhi EV Market Insights

In Delhi, EV adoption is driven by urban commuters and public transport modernization. Electric two-wheelers dominate last-mile mobility, while electric buses and taxis are increasingly deployed to reduce emissions. Robust government incentives, such as reduced registration fees and charging station subsidies, are encouraging consumers to transition from conventional vehicles. Public-private partnerships in EV infrastructure development are enhancing accessibility and convenience across the metropolitan area.

Uttar Pradesh EV Industry Growth

Uttar Pradesh is witnessing rapid growth in EV manufacturing and adoption, leveraging its industrial base and large urban populations. E-rickshaws and electric three-wheelers are widely adopted in commercial and intra-city transport, while emerging EV startups focus on local assembly and battery manufacturing. Investments in charging infrastructure along highways and urban centers are improving operational efficiency and consumer confidence, positioning the state as a significant contributor to North India’s EV market expansion.

Sustainability Analysis

The Indian electric vehicles (EV) market is increasingly embracing sustainability, driven by rising environmental awareness, government initiatives, and the global push for decarbonization. Companies are investing heavily in battery innovations, energy-efficient drivetrains, and renewable energy integration to meet evolving consumer and regulatory expectations. Sustainable practices, including localized manufacturing, reduced reliance on imported components, and adherence to emission and safety standards, are becoming industry norms. Charging infrastructure development with solar-powered stations, smart grids, and interoperable networks is also contributing to lower environmental impact and improved operational efficiency.

Growing consumer awareness and urbanization are accelerating demand for electric two-wheelers, three-wheelers, and passenger vehicles, while technological advancements in battery chemistry, vehicle design, and fleet management ensure enhanced range, performance, and affordability. The industry is steadily shifting toward a more sustainable and innovation-driven ecosystem, where efficiency, accessibility, and responsible practices align with national energy security and climate objectives.

Competitive Landscape

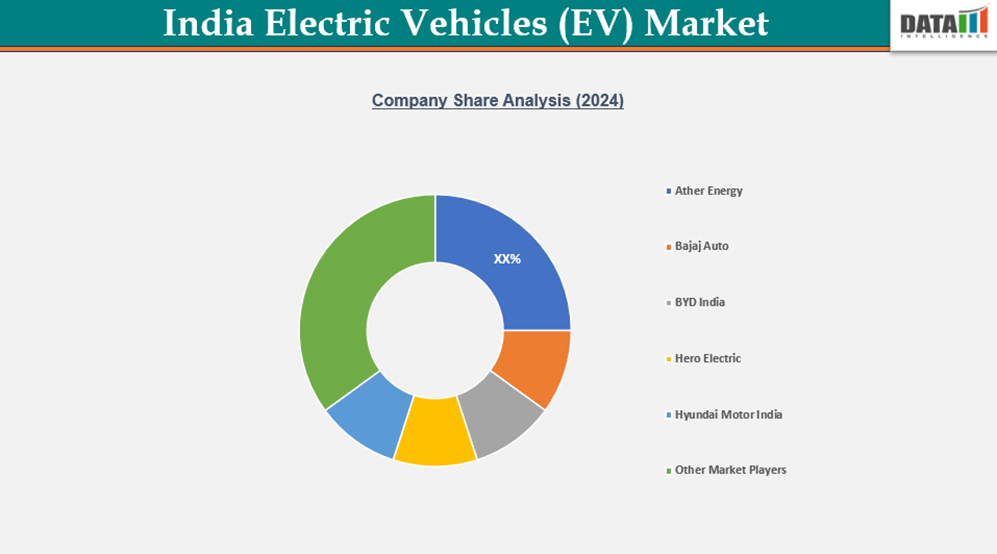

- The Indian EV market is highly competitive, characterized by a dynamic mix of established automotive giants and agile startups. Legacy players like Tata Motors and Mahindra & Mahindra hold a strong initial advantage in the four-wheeler segment, leveraging their brand trust and extensive manufacturing and service networks. However, the two-wheeler sector is fiercely contested, with Ola Electric emerging as a dominant leader, challenging incumbents like Hero Electric and TVS Motor.

- The competitive landscape is intensified by new entrants, including global leader MG Motor and domestic startups like Ather Energy, all vying for market share. Beyond vehicle manufacturers, the battle extends to charging infrastructure, with companies like Tata Power and Statiq building crucial networks. Key competitive factors driving the market include pricing, driving range, battery technology, government subsidies (FAME II), and the rapid expansion of reliable charging solutions, making affordability and infrastructure the central battlegrounds.

Key Developments

- January 2025: Tata Motors expanded its electric vehicle production capacity and launched new EV models across multiple regions in India, targeting both urban commuters and fleet operators.

- January 2025: Mahindra Electric unveiled a state-of-the-art, fully integrated EV manufacturing and battery assembly facility at its Chakan plant. This advanced ecosystem is dedicated to producing Mahindra's Electric Origin SUVs, including the BE 6 and XEV 9e, and is expected to achieve an annual production capacity of 200,000 vehicles as the company expands its EV lineup.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies