Incontinence Devices Market Size and Trends

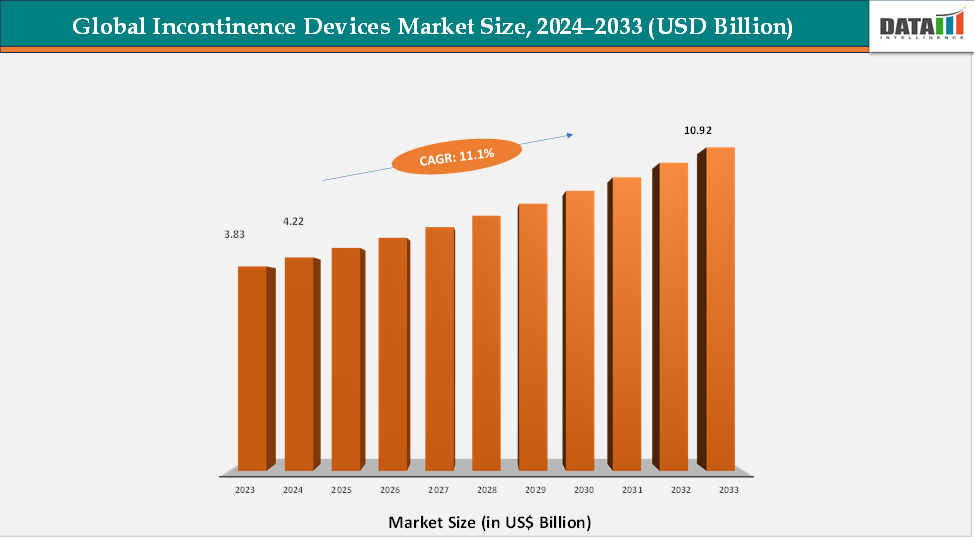

The global incontinence devices market reached US$ 3.83 billion in 2023, with a rise to US$ 4.22 billion in 2024, and is expected to reach US$ 10.92 billion by 2033, growing at a CAGR of 11.1% during the forecast period 2025–2033. The global incontinence devices market is witnessing significant growth, driven primarily by the aging population and the rising prevalence of urinary incontinence worldwide. Increasing awareness of urinary health, coupled with the demand for effective and convenient continence management solutions, is encouraging both patients and healthcare providers to adopt advanced devices such as urinary catheters, urethral slings, electrical stimulation devices, and artificial urinary sphincters. Key applications include management of stress, urge, and mixed incontinence, particularly among elderly populations and individuals with chronic conditions that exacerbate bladder dysfunction.

Key Market highlights

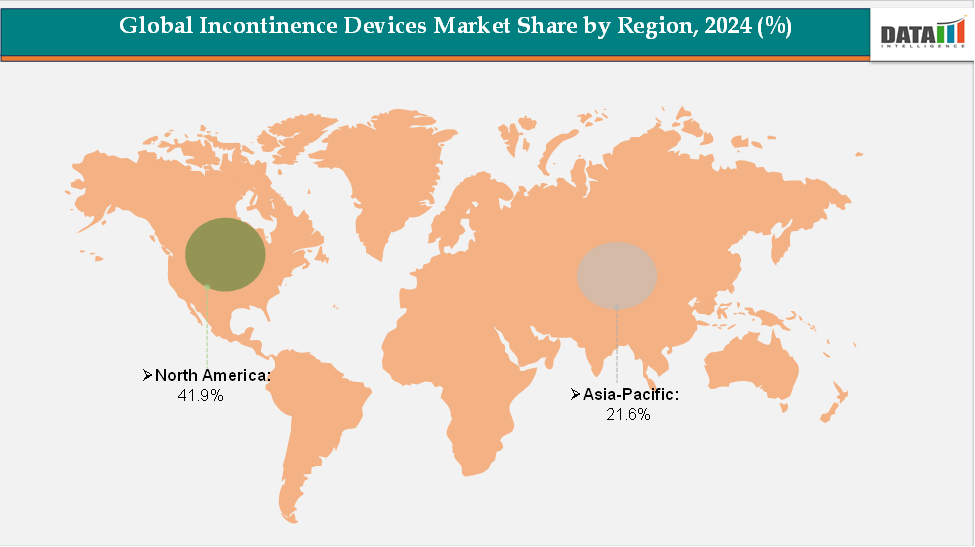

- North America leads the incontinence devices market, accounting for about 41.9% of global revenue. The region’s dominance is driven by advanced healthcare infrastructure, high awareness of urinary health, strong adoption of innovative continence management solutions, and the presence of leading medical device companies continuously investing in research, development, and deployment of advanced incontinence devices.

- Asia–Pacific is the fastest-growing regional market, holding around 21.6% of the share. Growth is supported by the rising prevalence of urinary incontinence among the aging population, expanding healthcare infrastructure, increasing awareness of continence care, and government initiatives to improve access to effective incontinence management solutions across major economies, including China, India, Japan, and South Korea.

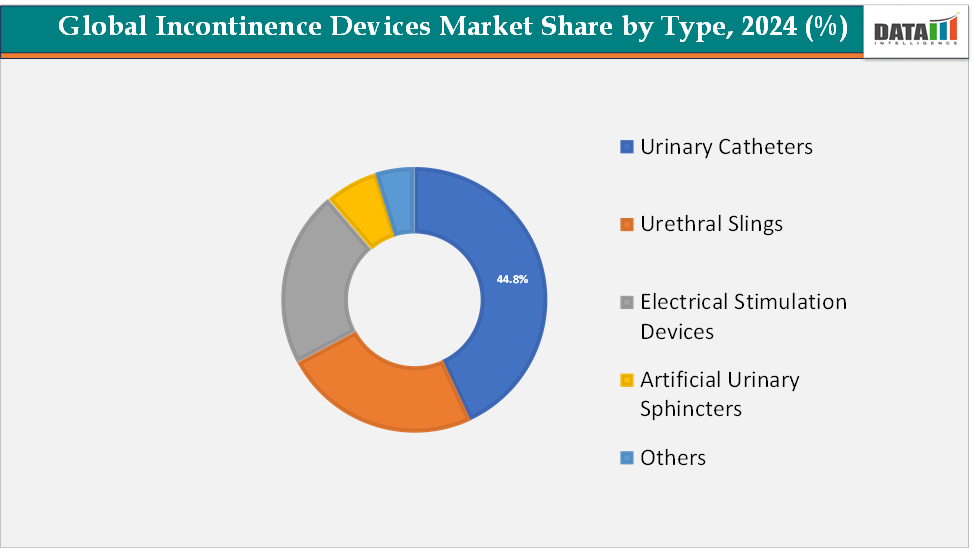

- Urinary catheters remain the dominant product segment, contributing approximately 44.8% of global revenue. Their market leadership is driven by widespread clinical use for urinary retention management, ease of application, availability of advanced and minimally invasive designs, and growing adoption in hospitals, long-term care facilities, and home care settings.

Market Size & Forecast

- 2024 Market Size: US$ 4.22 billion

- 2033 Projected Market Size: US$ 10.92 billion

- CAGR (2025–2033): 11.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Aging Population & Higher Prevalence of Urinary Incontinence

The aging global population and the increasing prevalence of urinary incontinence (UI) are significantly influencing healthcare needs and market dynamics. Globally, approximately 35% of individuals over the age of 60 experience some form of urinary incontinence. In the United States, over half of noninstitutionalized individuals aged 65 and above report urinary leakage or accidental bowel leakage, with women being more affected.

The prevalence of UI increases with age, with over 80% of women over 65 experiencing some form of incontinence. In institutional settings, such as nursing homes, the prevalence is even higher, with more than three-quarters of older adults suffering from some type of urinary loss.

Several factors contribute to the high prevalence of UI among the elderly, including age-related changes in bladder function, hormonal changes in women, and comorbidities like obesity and diabetes. Additionally, UI is associated with increased rates of depression and limited activity levels, further impacting the quality of life for older adults.

The rising prevalence of UI among the aging population underscores the need for effective management strategies and healthcare interventions. Addressing this issue is crucial to improving the quality of life for older adults and reducing the associated healthcare burden.

Restraint: High Device and Treatment Cost

The high cost associated with c and their related treatment procedures poses a significant barrier to widespread adoption, particularly in low- and middle-income economies. Advanced products such as electrical stimulation systems, implantable artificial urinary sphincters, and sacral neuromodulation devices often involve high manufacturing, regulatory, and maintenance costs that translate into elevated retail prices for end users.

For more details on this report, Request for Sample

Segmentation Analysis

The global incontinence devices market is segmented by product type, category, patient type, incontinence type, end-user and region.

Product Type: The urinary catheters segment is estimated to have 44.8% of the incontinence devices market share.

Urinary catheters currently dominate the global incontinence devices market, accounting for the largest share due to their extensive use in hospitals, long-term care centers, and home-care settings. Their dominance stems from their critical role in managing urinary retention and post-surgical incontinence among geriatric and immobile patients. Intermittent, indwelling, and external catheters remain standard care tools across both acute and chronic care environments. The consistent demand is driven by the high prevalence of urinary incontinence in elderly populations and increased incidence of conditions such as spinal cord injury, benign prostatic hyperplasia, and neurogenic bladder disorders.

Moreover, advancements in catheter materials have improved patient comfort and reduced infection risks, strengthening their clinical preference. The availability of disposable, self-lubricated, and gender-specific designs has also expanded adoption in home healthcare. Given their proven clinical efficacy, affordability, and essential role in hospital protocols, urinary catheters are expected to maintain their leadership position in the foreseeable future.

The electrical stimulation devices segment is estimated to have 21.4% of the incontinence devices market share.

Electrical stimulation devices are emerging as the fastest-growing segment in the incontinence devices market, driven by the growing shift toward minimally invasive and non-surgical management of urinary and fecal incontinence. These devices, which deliver mild electrical impulses to strengthen pelvic floor muscles and modulate bladder control, are gaining rapid acceptance among both clinicians and patients seeking alternatives to surgery.

Technological innovation is at the core of this growth. The integration of smartphone connectivity and app-guided therapy programs further enhances user convenience and personalized treatment monitoring. Increasing clinical validation and regulatory approvals in regions such as North America and Europe are boosting confidence among healthcare providers, while reimbursement expansions for neuromodulation therapies are fueling market penetration. Additionally, the rising focus on women’s pelvic health, postpartum rehabilitation, and preventive continence management is broadening the user base. With growing awareness of pelvic-floor therapy and favorable clinical outcomes, electrical stimulation devices are expected to record the highest growth rate over the next decade.

Geographical Analysis

The North America incontinence devices market was valued at 41.9% market share in 2024

North America continues to dominate the global incontinence devices market, supported by a high awareness levels and robust adoption of innovative device-based management solutions. The region’s strong market position is largely attributed to the early acceptance of minimally invasive therapies such as sacral nerve stimulation, urethral slings, and implantable devices that provide sustained relief for both urinary and fecal incontinence. The United States, in particular, benefits from an ecosystem where major medical device manufacturers, such as Boston Scientific, Medtronic, and Becton Dickinson, actively invest in R&D and clinical collaborations with urology centers to refine device efficacy and patient comfort. Growing reimbursement coverage from private insurers and Medicare for advanced incontinence treatments further enhances accessibility for elderly and post-surgical patients, who represent the largest user base. Additionally, the expanding geriatric population—expected to surpass 20% of the total U.S. population by 2030—continues to drive steady demand. The region’s market maturity is also reinforced by technological innovation, including connected catheter systems, wearable pelvic-floor trainers, and AI-assisted monitoring solutions increasingly used in long-term care facilities. North America’s commitment to improving patient dignity and the clinical outcomes of incontinence care ensures it remains the cornerstone of global device innovation and commercialization.

The Europe incontinence devices market was valued at 22.8% market share in 2024

Europe holds a significant position in the global incontinence devices landscape, characterized by a well-regulated market environment, high public health spending, and early adoption of quality-certified products. Countries such as Germany, the U.K., France, and the Nordic nations have developed robust reimbursement structures and specialized continence care programs that support both clinical and community-based management. European consumers exhibit a strong preference for high-quality, eco-friendly, and ergonomically designed devices, driving manufacturers to innovate with biodegradable materials and recyclable absorbent components in compliance with EU sustainability directives.

The region’s hospitals and aged-care networks have integrated digital continence management platforms that allow real-time tracking of leakage episodes, aligning with Europe’s broader push toward digital transformation in eldercare. The aging demographic remains substantial, with over 20% of residents aged 65 or older, sustaining steady market demand. Up to 40% of the population suffers from urinary incontinence (UI), Furthermore, European research institutions and startups are pioneering non-invasive stimulation therapies and precision diagnostics for pelvic floor disorders, positioning the region as a hub for clinical innovation. Europe’s blend of technological expertise, patient-centered healthcare policies, and sustainability focus ensures its enduring relevance in the global incontinence device ecosystem.

The Asia-Pacific incontinence devices market was valued at 21.6% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing incontinence devices market, propelled by a convergence of demographic, economic, and cultural factors reshaping patient care priorities. Rapid population aging has intensified the burden of urinary incontinence, creating strong demand for both disposable and reusable device solutions.

Increasing healthcare expenditure, coupled with the expansion of insurance schemes in countries like China and India, has broadened access to medical-grade continence management products that were once considered premium imports. Local manufacturers are also entering the market with cost-effective innovations tailored to regional needs, such as moisture-sensing pads, compact electrical stimulators, and gender-specific supports that address stigma-driven underreporting among elderly women. Furthermore, the growing presence of multinational device companies establishing R&D and manufacturing bases in countries like Singapore and Malaysia has accelerated technology transfer and reduced cost barriers. The rise of digital health ecosystems in the Asia-Pacific creates fertile ground for app-based pelvic training programs and connected continence devices. As governments increasingly prioritize eldercare and patient-centered home treatment, the Asia-Pacific stands at the forefront of next-generation growth in incontinence device adoption.

Competitive Landscape

The major players in the incontinence devices market include B. Braun SE, Convatec, Coloplast Group, BD, Promedon GmbH, Medtronic, Wellspect HealthCare (Dentsply Sirona Company), Hollister Incorporated, A.M.I. GmbH and Caldera Medical, among others.

Key Developments:

- In September 2025, Medtronic plc announced that it had secured U.S. Food and Drug Administration (FDA) approval for the Altaviva device. This minimally invasive implantable tibial neuromodulation (ITNM) therapy, positioned near the ankle, is specifically designed to provide effective treatment for urge urinary incontinence.

Market Scope

| Metrics | Details | |

| CAGR | 11.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Urinary Catheters, Urethral Slings, Electrical Stimulation Devices, Artificial Urinary Sphincters, Others |

| Category | External Urinary Incontinence Devices, Internal Urinary Incontinence Devices | |

| Patient Type | Male, Female | |

| Incontinence Type | Stress Incontinence, Urge Incontinence, Overflow Incontinence, Functional Incontinence | |

| End-User | Hospitals, Clinics, Homecare | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global incontinence devices market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here