Implantable Insulin Pumps Market Size

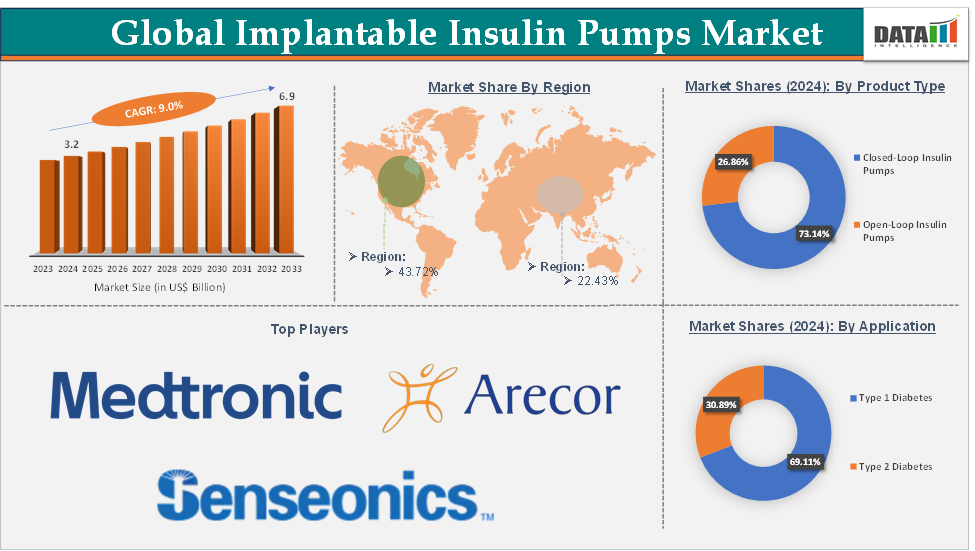

Implantable Insulin Pumps Market Size reached US$ 3.2 Billion in 2024 and is expected to reach US$ 6.9 Billion by 2033, growing at a CAGR of 9.0% during the forecast period 2025-2033.

Implantable Insulin Pumps Market Overview

An implantable insulin pump is a medical device designed for the continuous delivery of insulin to individuals with diabetes. Unlike external insulin pumps that are worn on the body, an implantable insulin pump is surgically placed under the skin, typically in the abdominal area, and functions as a long-term solution for insulin therapy. The primary function of an implantable insulin pump is to deliver insulin in precise doses, mimicking the function of a healthy pancreas. The device uses a small catheter or reservoir to administer insulin into the bloodstream over a specified period, ensuring blood sugar levels remain stable.

The implantable insulin pumps market is experiencing significant growth, driven by technological advancements, increasing diabetes prevalence, and a shift towards personalized medicine. For instance, according to the American Action Forum, about 8.3 million of the United States' increasing diabetic population depend on insulin to control their blood sugar levels, and by 2030, it's predicted that insulin use will rise by 20% globally. This rising insulin use boosts the demand for implantable insulin pumps.

Executive Summary

For more details on this report – Request for Sample

Implantable Insulin Pumps Market Dynamics: Drivers & Restraints

The rising prevalence of diabetes is significantly driving the implantable insulin pumps market growth

According to the International Diabetes Federation, by 2050, IDF projections show that 1 in 8 adults, approximately 853 million, will be living with diabetes, an increase of 46%. Over 90% of people with diabetes have type 2 diabetes, which is driven by socio-economic, demographic, environmental, and genetic factors. This growing diabetic population is a major driver for the implantable insulin pumps market.

Type 1 diabetes, which requires constant insulin administration, is seeing a rise in diagnoses, particularly in children and adolescents. This population is more likely to benefit from advanced insulin delivery solutions like implantable pumps, which provide a more consistent and automated form of treatment compared to traditional injections. For instance, according to the Centers for Disease Control and Prevention (CDC), type 1 diabetes and insulin use were reported by 1.7 million persons aged 20 years or older, or 5.7% of all adults with diabetes in the United States.

Implantable insulin pumps offer continuous and precise insulin delivery, which helps manage blood glucose levels more effectively. As more people with diabetes seek to reduce the burden of managing their condition with multiple daily injections, the demand for more sophisticated devices like implantable pumps increases. Many individuals with diabetes, particularly those with Type 1 diabetes, require frequent insulin injections. Implantable insulin pumps, by providing consistent, 24/7 insulin delivery, offer these patients the opportunity for improved blood sugar control, reduced hypoglycemia, and better overall diabetes management.

Limited clinical data is hampering the implantable insulin pumps market's growth

Although these devices offer advanced diabetes management solutions, the lack of comprehensive, long-term clinical evidence presents challenges in terms of adoption, regulatory approval, and market confidence. While implantable insulin pumps show promise, there is limited clinical data on their long-term effectiveness and safety compared to external pumps. Regulatory bodies like the FDA require extensive data from long-term clinical trials to ensure these devices are safe for sustained use. The absence of such data increases skepticism among healthcare providers and patients, limiting adoption.

For instance, implantable insulin pumps require rigorous clinical trials to prove their efficacy and safety. These trials are lengthy and expensive, and the results can take years to accumulate. This delay in obtaining clinical data slows down the approval process and market entry for new devices.

There are concerns about infections, device malfunctions or complications arising from the implantation of insulin pumps. For instance, while external pumps are known for their ease of replacement and maintenance, implantable pumps require surgery for both implantation and removal. This raises concerns over potential risks like surgical infections, device failures, and the need for re-implantation, all of which need to be substantiated through clinical data.

Implantable Insulin Pumps Market, Segment Analysis

The global implantable insulin pumps market is segmented based on product type, application, end-user, and region.

The closed-loop insulin pumps from the product type segment are expected to hold 73.14% of the market share in 2024 in the implantable insulin pumps market

The closed-loop insulin pumps segment is emerging as a dominant force in the implantable insulin pumps market due to its advanced technology, superior control over blood glucose levels, and patient-centric benefits. Closed-loop insulin pumps, also known as artificial pancreas systems, offer the ability to automatically adjust insulin delivery based on continuous glucose monitoring (CGM) data. This functionality makes them a highly attractive solution for people with diabetes, driving their growing demand by launching advanced next-generation implantable pumps.

For instance, in May 2024, Arecor Therapeutics plc announced a research collaboration with Medtronic plc to develop a novel, high-concentration, thermostable insulin for use by Medtronic’s Diabetes business in a next-generation implantable pump. The collaboration adds to Arecor’s broad program of diabetes-focused activities, led by its two lead proprietary clinical development programs AT278 and AT247, two ultra-rapid acting insulin candidates that offer the potential to simplify and improve blood glucose control for people living with diabetes and could enable the development of next-generation miniaturized insulin delivery systems and a fully closed loop artificial pancreas system.

Closed-loop insulin pumps are integrated with CGM systems that measure blood glucose levels continuously. These pumps use real-time glucose data to automatically adjust insulin delivery, optimizing blood sugar levels without requiring manual intervention from the patient. This automated insulin delivery significantly reduces the risk of both hypoglycemia (low blood sugar) and hyperglycemia (high blood sugar).

Implantable Insulin Pumps Market Geographical Analysis

North America is expected to dominate the global implantable insulin pumps market with a 43.72% share in 2024

North America, particularly the United States, has one of the highest rates of diabetes worldwide. According to the Centers for Disease Control and Prevention (CDC), over 38 million Americans are living with diabetes, i.e., 1 in 10 people, with nearly 90-95% of them having Type 2 diabetes. The rising prevalence of diabetes fuels the demand for advanced insulin delivery solutions, such as implantable insulin pumps.

In addition to Type 2 diabetes, the number of people with Type 1 diabetes is also significant. Type 1 diabetes requires constant insulin delivery, which is a key driver for the adoption of insulin pumps. According to the National Institute of Health (NIH), more than 5 million Americans are predicted to have Type 1 diabetes by 2050, with an estimated 1.6 million now living with the disease and an additional 64,000 being diagnosed annually, which is a major target market for implantable insulin pumps.

North America leads in adopting and integrating advanced medical technologies such as closed-loop systems, continuous glucose monitoring (CGM), and insulin pumps. The region is home to major players like Medtronic, Senseonics, and other emerging players, which are leading the development of implantable insulin pumps and related technologies.

For instance, in April 2024, Senseonics Holdings, Inc. announced that Eversense had been granted an integrated CGM (iCGM) designation by the US Food and Drug Administration (FDA). As the first fully implantable device in the category, Eversense is authorized to be marketed as an iCGM through the FDA’s De Novo pathway, by establishing the special controls that will serve as a predicate device for 510(k) submissions in the future for devices of the same type.

Implantable Insulin Pumps Market Top Companies

Top companies in the implantable insulin pumps market include Medtronic plc, Senseonics Holdings, Inc., and Arecor Therapeutics plc, among others.

Market Scope

Metrics | Details | |

CAGR | 9.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Closed-Loop Insulin Pumps and Open-Loop Insulin Pumps |

Application | Type-1 Diabetes and Type-2 Diabetes | |

End-User | Hospitals, Specialty Clinics, and Homecare Settings | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global implantable insulin pumps market report delivers a detailed analysis with 41 key tables, more than 43 visually impactful figures, and 147 pages of expert insights, providing a complete view of the market landscape.