Global IgA Nephropathy Treatment Market Overview

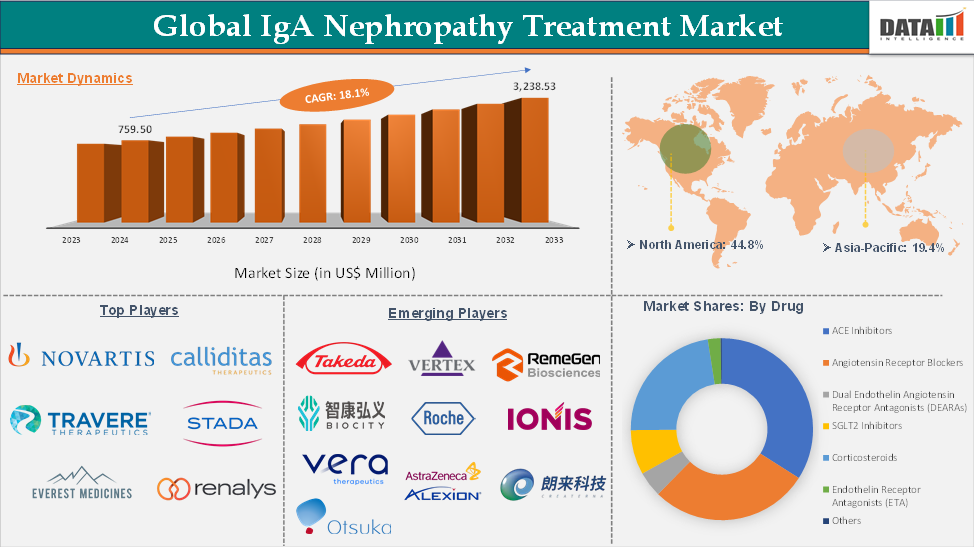

The global IgA nephropathy treatment market reached US$ 759.50 million in 2024 and is expected to reach US$ 3,238.53 million by 2033, growing at a CAGR of 18.1% during the forecast period 2025-2033.

The IgA nephropathy market is significantly driven by factors such as the rising innovation in product development and novel product approvals, the rising prevalence of IgA nephropathy, increasing diagnosis and treatment rate due to improved screening programs, and an aging population with a higher incidence of co-morbid conditions.

With multiple approvals, including Tarpeyo, Filspari, Fabhalta, and Vanrafia, the treatment landscape is shifting from supportive care to targeted approaches. The North America region dominates the IgA nephropathy treatment market due to high diagnosis and treatment rates, whereas the Asia-Pacific region offers significant opportunities for market expansion of newly approved drugs.

Global IgA Nephropathy Treatment Market Definition

IgA nephropathy, also known as Berger’s disease, is a chronic kidney disease caused by the build-up of immunoglobulin A antibodies in the glomeruli. IgA Nephropathy is considered the most common form of glomerulonephritis and is diagnosed at an average age of 30 to 40 years. Currently, the only confirmatory test for IgA Nephropathy includes a kidney biopsy, which is performed among the population with proteinuria levels more than or equal to 0.5 g/d.

The treatment goals include preventing & reducing the IgA immune complex formation and related glomerular injury, and managing the consequences of existing IgA-induced nephron loss. The management of the consequences of IgAN-induced nephron loss includes lifestyle modifications, dietary sodium restrictions, controlling blood pressure, reducing glomerular hyperfiltration, and reducing the risk of cardiovascular events.

The key drugs used in IgA Nephropathy management include Renin-Angiotensin System Antagonists, Dual Endothelin Angiotensin Receptor Antagonists (DEARAs), Sodium-Glucose Cotransporter 2 (SGLT2) Inhibitors, Corticosteroids, Endothelin Receptor Antagonists (ETA), etc.

Global IgA Nephropathy Treatment Market Dynamics: Drivers & Restraints

Innovation in product development and novel product approvals is driving the market growth

IgA nephropathy is a condition with high unmet needs. Patients typically get diagnosed after a significant nephron loss, and they continue progressing to end-stage kidney failure. Up until recently, the standard of care revolved around immunosuppressive drugs and RAS inhibitors. However, the treatment landscape has changed with the recent approvals of innovative therapies.

With these treatments, it is now possible to employ a multi-way approach for preventing further nephron loss and also reducing the complications arising from existing nephron loss. There were several new drugs approved recently, targeting new pathways which are suspected to play a major role in IgAN pathophysiology.

For instance, in August 2024, the U.S. Food and Drug Administration (FDA) approved Fabhalta (iptacopan) developed by Novartis AG for the treatment of adult patients with primary IgA nephropathy, who are at risk of rapid disease progression. Iptacopan is a complement inhibitor and a first-in-class drug that works by reducing proteinuria.

Moreover, in April 2025, the U.S. Food and Drug Administration (FDA) granted accelerated approval for Vanrafia (atrasentan), developed by Novartis AG. Atrasentan is a novel first-in-class drug for IgAN, acting by selective endothelin A (ETA) receptor antagonism and reducing the proteinuria levels among adults with primary IgAN, who are at risk of rapid disease progression.

In April 2025, the European Commission (EC) provided standard marketing approval for FILSPARI (sparsentan) for the treatment of adult patients with primary IgA nephropathy with a urine protein excretion ≥1.0 g/day. With this approval, FILSPARI became the first and only Dual Endothelin Angiotensin Receptor Antagonist (DEARA) in Europe. The brainchild behind this innovative drug is Travere Therapeutics, Inc., and CSL Vifor holds the exclusive commercialization rights for the drug in Europe.

There are several promising drugs in the clinical pipeline, which are expected to make market entry shortly. This is expected to significantly drive the IgA Nephropathy market growth in the forecast period.

High cost of approved drugs may restrain the market growth

The approval of new drugs is promising in the IgA Nephropathy treatment landscape, as they address a specific patient population with high unmet needs. However, these drugs are expensive, as they need to be administered long-term, and in such cases, affordability is a major concern. For instance, Sparsantan, sold under the brand name FILSPARI in the U.S., costs approximately US$ 160,000 per patient per year. Moreover, oral budesonide tablets sold under the brand Tarpeyo in the U.S. can cost up to US$ 19,000 per patient per cycle (~9 months).

This high cost can be a significant economic burden to patients with partial or no insurance coverage. Moreover, several new age therapies, such as monoclonal antibodies, are currently in the clinical pipeline and are expected to make market entry in the near term. These drugs are expected to be costlier than the current standard of care regimens. This affordability issue can significantly impact the adoption of newer drugs and may restrain the market growth in the forecast period.

Global IgA Nephropathy Treatment Market Pipeline Analysis

Global IgA Nephropathy Treatment Market Segment Analysis

The global IgA nephropathy treatment market is segmented based on disease type, drug, gender, and region.

ACE inhibitors in the drug segment accounted for 34.5% of the market share in 2024 in the global IgA nephropathy treatment market

One of the primary treatment goals in IgA nephropathy treatment is to manage the consequences of IgA-induced nephron loss. To manage these consequences, various treatment options are available, of which the renin-angiotensin system (RAS) inhibitors are considered first-line options.

Among the RAS inhibitors, ACE inhibitors are preferred as first-line drugs for managing blood pressure, reducing the glomerular hyperfiltration, and also reducing the overall cardiovascular risk. This drug class includes benazepril, ramipril, lisinopril, enalapril, etc.

Additionally, several clinical studies have shown that ACE inhibitors act as a renal protective agent, reduce proteinuria, and attenuate the progression of chronic kidney disease. For instance, based on various randomized clinical trials conducted in various regions, Kidney Disease Improving Global Outcomes (KDIGO) 2024 clinical practice guidelines for the management of Immunoglobulin A Nephropathy (IgAN), recommended ACE inhibitors in standard clinical management of IgAN, as they have shown potential in reducing annual loss of kidney function and exhibited antiproteinuric effect.

Moreover, a study published in the Kidney International Journal in January 2025 stated that patients who received ACE inhibitor (enalapril) exhibited a significant proteinuria reduction from 2g/d to 0.9g/d at the end of the study period.

ACE inhibitors, although they have long been established in the standard of care for IgA nephropathy, are still the treatment of choice when proteinuria reduction and cessation of CKD progression are a primary treatment goal. This signifies their importance in the management of IgA nephropathy, hence reflecting their dominance in the market.

Global IgA Nephropathy Treatment Market Geographical Analysis

North America dominated the IgA nephropathy treatment market with the highest share of 44.8% in 2024

North American countries, especially the U.S. and Canada, and well known for their advanced healthcare industry. In the IgA nephropathy treatment market, the U.S. accounts for ~87% of the market share. This dominance is attributed to factors like high prevalence of IgA nephropathy, high diagnosis and treatment rate, availability of advanced therapies, and presence of key market players who invest heavily in research and development.

In the U.S., several studies have reported varying prevalence and incidence rates of IgAN. As per dataM estimates, the overall prevalent population in the country is approximately 112k in 2024. Moreover, the rate of diagnosis and treatment is higher in the U.S., as compared to other developing countries. This is due to the country’s advanced healthcare infrastructure.

Moreover, this heavy burden of the disease also reflects the proportion of the population with high unmet needs. To meet the demands, several innovators and manufacturers are investing in developing advanced therapies and obtaining subsequent market approvals. In addition, a supportive yet stringent regulatory body in the country, i.e., the FDA, is favoring the innovations.

Between 2023 and 2025, the FDA approved several new drugs for the treatment of IgA Nephropathy. For instance, in December 2023, TARPEYO (budesonide) delayed-release capsules developed by Calliditas Therapeutics AB received full approval, followed by accelerated approval of Fabhalta (iptacopan) in August 2024, followed by FILSPARI (sparsentan) full approval in September 2024, and Vanrafia approval in April 2025.

This reflects the demand for advanced therapies in the U.S. and why the country is dominating with the highest market share in the global IgA nephropathy treatment market.

Asia-Pacific region in the global IgA nephropathy treatment market is expected to grow with the highest CAGR of 19.1% in the forecast period of 2025 to 2033

The Asia-Pacific region is pacing in the healthcare industry, supported by rising investments and the increasing burden of chronic diseases. In Asia-Pacific, Japan is at the forefront of innovation, with the majority of global players investing in Japan to gain market approval for their products in the country. In the IgA nephropathy treatment market, Japan plays a significant role, as the disease burden is drastically growing, and companies are heavily investing in R&D activities to bring novel therapies to light.

For instance, a study published in the Nephrology Journal in September 2024, the incidence of IgA nephropathy in Japan was 4.2 per 100,000 people per year. The factor of population growth is not suitable to define the growing incidence of IgA nephropathy in Japan, as the population is declining in the country. However, the rising implementation of screening programs and, aging population can significantly contribute to the rising prevalence of the condition.

Moreover, the product development activities in the country are also rising. For instance, in December 2024, the Japanese Ministry of Health, Labour and Welfare granted orphan drug designation to Sparsentan for the treatment of primary IgA nephropathy. Travere Therapeutics, Inc., which is the innovator of Sparsentan, has out-licensed the product to Renalys Pharma, Inc. to develop and commercialise in Japan. In January 2025, Renalys Pharma announced the completion of patient enrollment for phase III trials in Japan. The results are expected by the mid of 2025, post which Renalys Pharma is planning to get approval from the Pharmaceutical and Medical Device Agency (PMDA).

Global IgA Nephropathy Treatment Market Competitive Landscape (Major Players)

The major players in the IgA nephropathy treatment market are Travere Therapeutics, Inc., Calliditas Therapeutics AB, STADA Arzneimittel, Everest Medicines, Viatris Inc., and Novartis AG, among others., Vertex Pharmaceuticals Incorporated.

Global IgA Nephropathy Treatment Market Competitive Landscape (Emerging Players)

The emerging players in the IgA nephropathy treatment market are Vertex Pharmaceuticals Incorporated, RemeGen, Wuxi BioCity, F. Hoffmann-La Roche Ltd/Ionis Pharmaceuticals, Vera Therapeutics, Otsuka Pharmaceutical Co., Ltd., Alexion Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited., and Wuhan Createrna Science and Technology Co.,Ltd. among others.

Global IgA Nephropathy Treatment Market Key Development

- In March 2025, Otsuka Pharmaceutical Development & Commercialization, Inc. filed the Biologics License Application (BLA) for sibeprenlimab to the U.S. Food and Drug Administration (FDA). Siberprenlimab is an investigational biologic that acts by inhibiting a Proliferation-Inducing Ligand (APRIL) in adults with immunoglobulin A nephropathy. The BLA is filed based on positive phase II (ENVISION) and Phase III (VISIONARY) clinical trials.

- In May 2024, RemeGen Co. Ltd. announced the completion of the enrollment of patients to phase III clinical trials evaluating Telitacicept for IgA Nephropathy. The study has enrolled 318 participants to evaluate the safety and efficacy of Telitacicept. The study is expected to be finished by the end of 2025.

Global IgA Nephropathy Treatment Market Scope

| Metrics | Details | |

| CAGR | 18.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Disease Type | Primary IgA Nephropathy and Secondary IgA Nephropathy |

| Drug | ACE Inhibitors, Angiotensin Receptor Blockers, Dual Endothelin Angiotensin Receptor Antagonists (DEARAs), SGLT2 Inhibitors, Corticosteroids, Endothelin Receptor Antagonists (ETA), and Others | |

| Gender | Male and Female | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |