Overview

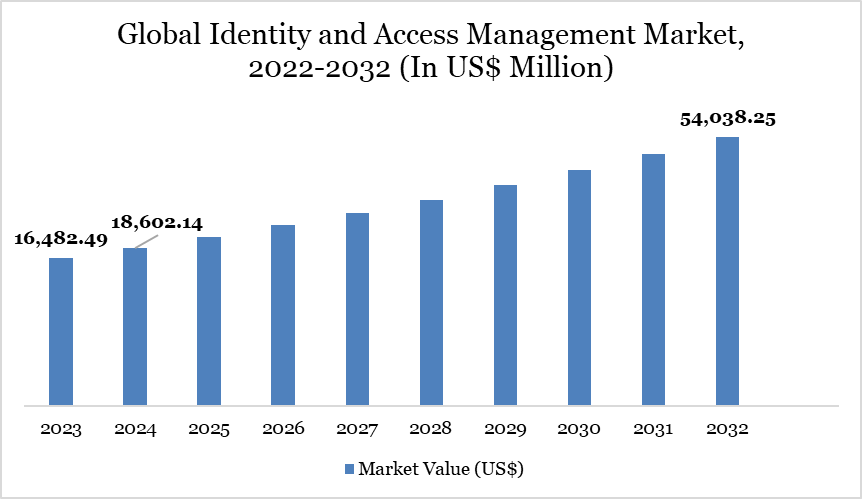

The global identity and access management market was US$18,602.14 million in 2024 and is expected to reach US$54,038.25 million in 2032, growing at a CAGR of 14.4% during the forecast period (2025-2032).

The global identity and access management (IAM) market is experiencing rapid growth, driven by the increasing need for robust security, data privacy and regulatory compliance across industries. IAM encompasses a set of technologies, processes and policies that ensure the right individuals access the right resources at the right times, while also securing digital identities across an organization's infrastructure.

As the frequency and sophistication of cyberattacks, including identity theft, data breaches and phishing schemes, rise, organizations are focusing more on IAM solutions to mitigate these risks. For instance, in 2021, 323,972 internet users reported falling victim to phishing attacks. This means half of the users who suffered a data breach fell for a phishing attack.

During the height of the pandemic, phishing incidents rose by 220%. Ransomware attacks continue to pose a serious threat to individuals and organizations, with more advanced attack methods forcing payouts from victims. Around 236.1 million ransomware attacks were reported worldwide in the first half of 2022.

Additionally, the shift to cloud-based services is a primary driver of the IAM market. As businesses migrate their operations to the cloud, managing identities across a mix of on-premises and cloud environments has become more complex. IAM solutions such as Identity-as-a-Service (IDaaS) enable organizations to secure cloud-based applications and services, thus promoting the growth of IAM systems.

Moreover, stringent regulations like GDPR (General Data Protection Regulation) in Europe, CCPA (California Consumer Privacy Act) and various industry-specific standards require businesses to ensure proper identity verification and data protection. IAM systems are crucial in achieving compliance by enforcing access controls, audit trails and user activity monitoring.

Identity and Access Management Market Trend

The identity and access management (IAM) market is rapidly growing due to rising cyber threats and the shift to remote work. As of 2024, over 80% of data breaches involved compromised credentials, driving IAM adoption. Governments are enforcing stricter compliance, with GDPR and US Executive Order 14028 pushing zero-trust frameworks. Cloud-based IAM solutions now account for over 60% of deployments worldwide.

Market Scope

Metrics | Details |

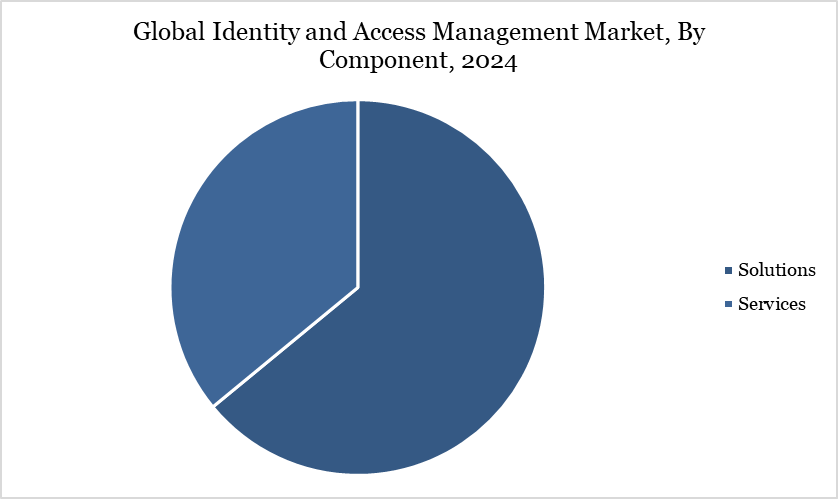

By Component | Solutions, Services |

By Organization Size | Small & Medium Enterprises, Large Enterprises |

By End-User | BFSI, IT and Telecom, Retail and Consumer Goods, Government, Energy and Utilities, Education, Manufacturing, Healthcare and Life Sciences, Others |

By Deployment | Cloud, On-Premise |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Demand for IAM Due To Security Breaches

The growing prevalence of security breaches and identity-related fraud has significantly fueled the demand for Identity and Access Management (IAM) solutions, making it a key driver for market growth. The increasing integration of digital platforms across industries, vast amounts of personal and corporate data are being stored and processed online, rendering them attractive targets for cybercriminals.

The surge in cyberattacks, including unauthorized access, identity theft and fraud, has led to a heightened awareness among organizations regarding the need for robust IAM systems to safeguard sensitive information.

IAM solutions play a pivotal role in securing digital infrastructures by managing and regulating user identities and access rights. These systems ensure that only authorized individuals can access critical data, which is crucial in preventing data breaches and mitigating potential threats.

IAM solutions employ real-time monitoring and behavioral analytics to detect suspicious activities, enhancing the overall security framework and reducing the risk of fraud. The growing instances of cyber threats, particularly identity theft, have accelerated the adoption of IAM solutions as organizations recognize their indispensable role in securing their operations and maintaining regulatory compliance.

Lack of Skilled Workforce

The lack of skilled workforce is one of the major restraining factors for the Global Identity and Access Management (IAM) Market. IAM solutions are highly complex and require specialized knowledge in cybersecurity, identity management and IT infrastructure.

As organizations increasingly adopt IAM solutions to secure their digital ecosystems, they face significant challenges in hiring or training qualified personnel to implement, manage and optimize these systems.

In addition, without proper education, users may not recognize the risks to their accounts. Understanding that hackers can exploit their mistakes encourages adherence to security best practices, such as using strong passwords, enabling multi-factor authentication, avoiding phishing links and reporting suspicious activities. Prompt reporting of compromised accounts is also essential for minimizing risks.

Moreover, in smaller organizations, especially in emerging markets, the lack of skilled IAM professionals restricts adoption. SMEs often cannot afford to hire dedicated experts or invest in training, leading to delays in implementing IAM systems or reliance on outdated, manual access controls, which increases security risks.

For example, an SME in the Asia-Pacific region may struggle to find qualified IAM professionals, hindering the development of secure access management practices. This talent shortage also delays IAM implementation, potentially causing security gaps and compliance issues and ultimately increasing costs and reducing effectiveness. Thus, the lack of skilled workforce remains a significant barrier to IAM market growth.

Segment Analysis

The global identity and access management market is segmented based on component, organization size, deployment, end-user and region.

Solutions Segment Driving Identity and Access Management Market

Global identity and access management market for Solutions was US$11,783.11 million in 2024 and is expected to reach US$35,680.60 million by 2032, growing with a CAGR of 15.0% between 2025 and 2032.

The global demand for Identity and Access Management (IAM) solutions continues to surge as organizations worldwide strive to strengthen security, meet regulatory compliance standards and streamline user access control in an increasingly digitalized landscape.

In January 2024, Cross Identity, a prominent leader in the IAM industry, announced the launch of Privileged Identity and Access Management (PIAM), marking a groundbreaking development in the field. This innovative software offers a unified platform for access management, access governance and administration specifically designed for privileged users. PIAM redefines the management of privileged accounts, addressing the evolving demands of a dynamic cybersecurity environment. The introduction of such a comprehensive solution highlights the industry's focus on tackling sophisticated security challenges associated with managing privileged user identities and access.

Similarly, CloudIBN, a notable player in the IAM space, unveiled its suite of Identity and Access Management solutions on December 28, 2022. These offerings are tailored to ensure data security while simplifying user access management across organizational frameworks. CloudIBN's solutions encompass a wide range of functionalities, including user authentication, authorization, single sign-on (SSO), multi-factor authentication (MFA), role-based access control and audit trails.

Geographical Penetration

North America Drives the Global Identity and Access Management Market

North America’s Identity and Access Management market was valued at US$7,412.95 million in 2024 and is estimated to reach US$20,023.09 million by 2032, growing at a CAGR of 13.3% during the forecast period from 2025-2032. A significant driver within the IAM landscape is the increasing adoption of zero-trust models, which emphasize continuous verification of user identities and access levels. According to the US Cybersecurity and Infrastructure Security Agency (CISA), Zero Trust implementation rose by 35% in 2023, spurred by federal mandates aimed at securing critical infrastructure. IAM solutions serve as the backbone of these frameworks, ensuring a robust defense against unauthorized access.

Multi-factor authentication (MFA) is another area experiencing accelerated growth, driven by regulatory initiatives such as the Cybersecurity Maturity Model Certification (CMMC). MFA’s benefits, including enhanced security, streamlined credential management and compatibility with Single Sign-On (SSO) solutions, make it an essential component of modern IAM systems. Studies suggest that MFA can prevent 80–90% of cyberattacks, a statistic cited by the US national security cyber chief. The growing prevalence of ransomware attacks and the demand for strong authentication mechanisms further bolster MFA adoption.

Sustainability Analysis

Sustainability in the Identity and Access Management (IAM) market focuses on reducing energy use, enhancing cybersecurity resilience, and minimizing IT waste. Cloud-based IAM solutions can cut enterprise IT energy consumption by up to 30% compared to legacy on-premise systems. By reducing unauthorized access and breaches, IAM prevents the average cost of a data breach, promoting long-term financial sustainability. Centralized access controls streamline IT infrastructure, reducing hardware redundancy and carbon footprint. Additionally, organizations adopting zero-trust IAM frameworks report 20–25% lower IT operational overhead, supporting sustainable digital transformation.

Competitive Landscape

The major global players in the market include Okta, Inc., Microsoft Corporation, IBM Corporation, SailPoint Technologies Inc., Ping Identity, CyberArk Software Ltd., Oracle, ForgeRock, Inc., OneLogin, and NEC Corporation.

Key Developments

In July 2024, Okta announced a SaaS Startup Competition to encourage the development of new identity security applications, with finalists pitching at Oktane24 for a chance to win up to US$500,000 and access to Okta’s global network.

In October 2024, Okta announced new Workforce Identity Cloud capabilities to address security challenges like unmanaged SaaS accounts, governance risks and identity verification. These innovations enhance protection before, during and after authentication, offering better control, visibility and a streamlined user experience.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies