Global Hydrogen Gas Turbine Market Size & Overview

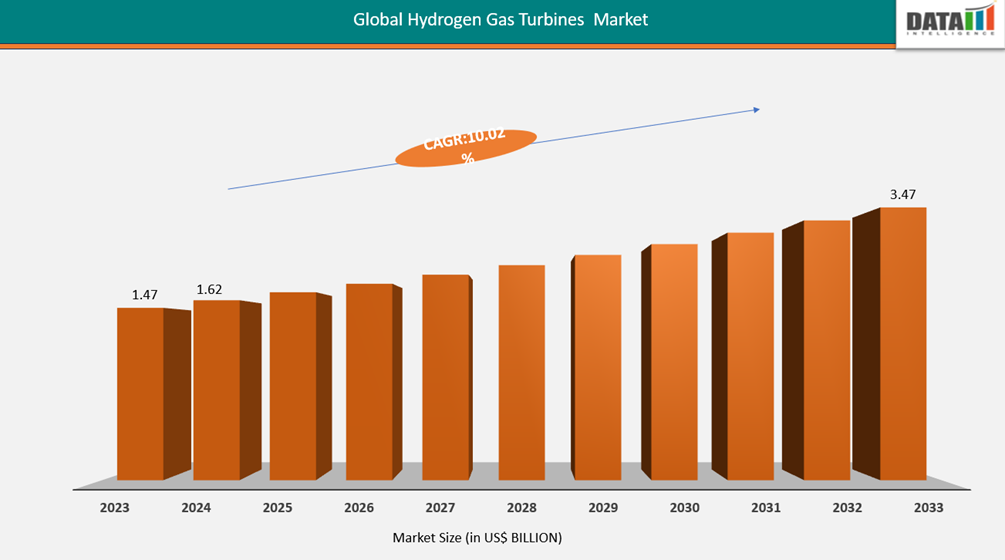

The global hydrogen gas turbine market, valued at approximately US$ 1.62 Billion in 2024, is projected to reach US$ 3.47 Billion by 2032, expanding at a compound annual growth rate of 10.02 % between 2024 and 2032. Th Expansion in the Hydrogen Gas Turbine Market is being driven by the growing emphasis on energy security. As nations seek to reduce dependence on imported fuels and stabilize their power grids, hydrogen-based technologies offer a reliable alternative. Their ability to operate flexibly across various energy systems makes them attractive for long-term infrastructure planning.

At the same time, industries are under increasing pressure to decarbonize operations. Hydrogen turbines provide a pathway to lower emissions without compromising performance, offering high-efficiency power generation with minimal environmental impact. This dual advantage positions them as a key enabler in the shift toward cleaner, more resilient energy systems.

Market Trends and Strategic Insights

- The Europe region dominates the market in the market, capturing the largest revenue share of 36.23% in 2024.

- By end-user, the Industry Sector is projected to experience the largest share in global hydrogen turbine market.

Global Hydrogen Gas Turbine Market Size and Future Outlook

- 2024 Market Size: US$ 1.62 billion

- 2032 Projected Market Size: US$ 3.47 billion

- CAGR (2025-2032): 10.02%

- Largest Market: Europe

- Fastest Market: North America

For More Detailed information Request for Sample

Market Scope

| Metrics | Details |

| By Capacity | Below 100, MW, 100–300 MW, above 300 MW |

| By Type | Pure Hydrogen Gas Turbines, Hybrid Gas Turbines |

| By Application | Power Generation, Industry sector, Oil & Gas, Marine , Others |

| By End User | Utilities, Independent Power Producers, Industry sector, Transportation. |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Hydrogen Strategy Accelerates Turbine Market Transition

Decarbonization targets refer to formal goals set by governments, industries, and international bodies to reduce greenhouse gas emissions within a specific timeframe. These targets are often part of broader climate action plans aimed at limiting global warming and transitioning to low-carbon economies. They typically involve commitments to phase out fossil fuels, increase the share of renewable energy, improve energy efficiency, and invest in clean technologies.

For instance, in 2025 IRENA projects hydrogen could meet 14% of global energy demand by 2050, requiring a fivefold production increase. This supports decarbonization by replacing fossil fuels with clean hydrogen across power, transport, and industry.

High Costs Slow Hydrogen Turbine Gas Deployment

High cost associated with developing and deploying hydrogen-compatible turbines, which includes expenses for specialized materials, combustion systems, and safety infrastructure. Additionally, the availability of green hydrogen remains limited, and its production requires significant energy input, making it less economically viable in many regions

Segmentation Analysis

The global hydrogen gas turbine market is segmented based on capacity, type, application, end user and region

Increasing Use in Power Generation

Power Generation remained the leading application in the hydrogen turbine market, accounting for the largest share of global revenue. Hydrogen turbines are increasingly used in utility scale projects, grid balancing, and backup power, thanks to their ability to deliver clean, dispatchable energy. Their compatibility with hydrogen blends and integration with renewable sources like wind and solar further reinforces their dominance.

For instance, in 2025, Mitsubishi Power and Hygenco Green Energies signed a Memorandum of Understanding (MoU), facilitated by the Japan International Cooperation Agency (JICA), to explore the deployment of green hydrogen and ammonia-fired Gas Turbine Combined Cycle (GTCC) power plants. This collaboration aims to accelerate clean energy adoption in India and beyond, supporting industrial decarbonization and enhancing low-emission power generation capacity.

Industry sector segment of the Hydrogen Gas Turbine Market plays a critical role in decarbonizing sectors that require high-temperature heat and continuous power such as steel, cement, chemicals, and refining. These industries often rely on fossil fuels for process heat, making hydrogen turbines a viable alternative for reducing emissions without compromising operational reliability. In 2024, industrial applications ranked as the second-largest market segment after power generation, driven by pilot projects, government incentives, and the push for cleaner production methods.

For instance, in 2025, the European Union launched a Hydrogen Bank auction valued at €2 billion (approximately USD 2.1 billion), with €200 million (around USD 210 million) dedicated to maritime hydrogen fuels. This funding supports industrial sectors by accelerating hydrogen infrastructure, enabling cleaner energy adoption in shipping, refining, and manufacturing.

Geographical Penetration

Innovation and Expansion in Europe

Europe’s hydrogen market is expanding steadily, driven by decarbonization goals and industrial demand. The region hosts over 500 operational hydrogen production facilities, with refineries and ammonia plants accounting for more than 80% of consumption. Within this landscape, the UK and Germany represent distinct sub-segments.

U.K Hydrogen Gas Turbine Market Insights

The United Kingdom’s approach to hydrogen development is grounded in technology neutrality, allowing various production methods such as electrolysis, methane reforming with carbon capture, and biomass pathways to qualify for support as long as they meet defined carbon intensity thresholds. This framework encourages innovation across the hydrogen value chain without favoring a single technology.

For instance, in 2025 The UK’s HAR2 shortlist of 27 low-carbon hydrogen projects is expected to unlock significant private investment, accelerating deployment of hydrogen-ready turbines across the country (~US$1.22 billion). This strengthens the UK’s hydrogen infrastructure, supports industrial decarbonization, and positions hydrogen turbines as a key technology in the nation’s clean energy transition.

Germany Hydrogen Gas Turbine Market Insights

Germany maintains one of Europe’s most advanced hydrogen ecosystems, shaped by its national hydrogen strategy and alignment with EU renewable energy directives. The country prioritizes green hydrogen produced via electrolysis using renewable electricity, supported by substantial public funding and regulatory frameworks. For instance, in 2025, A joint hydrogen program is entering its application phase, with Germany committing ~$320 million USD from 2032 to 2042, and the Netherlands funding projects between 2028 and 2036. The initiative aims to accelerate cross-border hydrogen innovation and industrial deployment.

North America Leads the Hydrogen Transition

North America’s hydrogen sector is undergoing rapid transformation, driven by climate policy, industrial decarbonization, and clean energy incentives. The region is witnessing increased investment in production, infrastructure, and end-use technologies, with a strong focus on scaling low-carbon hydrogen across transport, power, and heavy industry. Public-private partnerships and regional hydrogen hubs are central to this growth, positioning North America as a key player in the global hydrogen economy.

U.S Hydrogen Gas Turbine Market Insights

The U.S. hydrogen market is expanding swiftly, supported by federal funding mechanisms such as the Inflation Reduction Act and the Department of Energy’s hydrogen hub program. These initiatives aim to establish large-scale production and distribution networks, with emphasis on clean hydrogen for power generation, mobility, and industrial applications. The country is also advancing hydrogen-compatible turbines and fuel cell systems, backed by tax credits and regional deployment strategies.

Canada Hydrogen Gas Turbine Market Insights

Canada’s hydrogen strategy emphasizes low-carbon production and export readiness, with provinces like Alberta and British Columbia leading project development. The national framework supports diverse technologies, including electrolysis and methane reforming with carbon capture. Canada is also investing in hydrogen infrastructure and pilot projects for power generation, positioning itself as a supplier of clean hydrogen to domestic and international markets.

Sustainability Analysis

Hydrogen gas turbines present a compelling sustainability profile, particularly when powered by green hydrogen, which enables near-zero emissions during operation. Their ability to deliver dispatchable energy makes them valuable for balancing renewable sources like wind and solar. Moreover, the limited availability and high energy input required for green hydrogen production reduce overall efficiency and economic viability in many regions. Long-term sustainability will depend on scaling renewable hydrogen supply, reducing turbine costs, and aligning policy incentives to support clean power deployment.

Competitive Landscape

- The global hydrogen gas turbine market is highly competitive, driven by a mix of global and regional players striving for technological efficiency and cost leadership.

- The major global players in the market include, Baker Hughes, Mitsubishi Power, Solar Turbines (Caterpillar), Ansaldo Energia, Doosan Heavy Industries, GE Vernova, MAN Energy Solutions, OPRA Turbines, Siemens Energy

- Companies focus on expanding production capacities, optimizing supply chains, and adopting low-carbon and energy-efficient processes to gain an edge.

Key Developments

- In 2025, P2X Solutions Oy inaugurated Finland’s first industrial-scale green hydrogen plant in Harjavalta. By supplying renewable hydrogen to local industries, the facility supports the deployment of hydrogen-compatible turbines for clean power and heat. This strengthens turbine market viability by ensuring low-emission fuel access and advancing sector-wide decarbonization.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies