Hospital Gowns Market Size and Overview

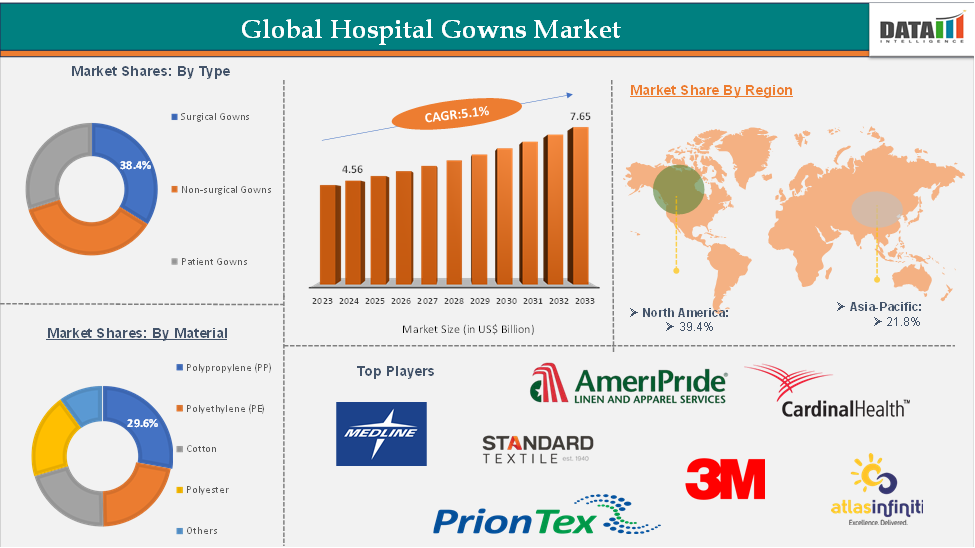

Hospital Gowns Market size reached US$ 4.56 Billion in 2024 and is expected to reach US$ 7.65 Billion by 2033, growing at a CAGR of 5.1% during the forecast period 2025-2033.

The global hospital gowns market is experiencing steady growth, driven by the increasing emphasis on infection prevention in healthcare environments, a rise in hospital admissions, and heightened awareness around the safety of both patients and healthcare professionals. Hospital gowns serve as a critical component of personal protective equipment (PPE), aimed at minimizing the risk of cross-contamination during medical procedures and daily care activities.

Market expansion is primarily fueled by the growing number of surgical procedures, the aging global population, and the rising incidence of infectious diseases such as COVID-19 and hospital-acquired infections (HAIs).

Regulatory guidance from organizations like the FDA and CDC continues to support the widespread use of hospital gowns, reinforcing their importance in clinical settings. Among the types available, disposable gowns hold the largest market share due to their ease of use, cost-effectiveness, and lower risk of infection transmission. However, the reusable gowns segment is gaining attention, particularly in markets focused on sustainability and cost efficiency over time.

Geographically, North America currently dominates the market, supported by a well-established healthcare infrastructure and strict infection control standards. Meanwhile, the Asia-Pacific region is projected to grow at the fastest rate, fueled by increasing investments in healthcare systems, expanding patient populations, and a rise in medical tourism.

Executive Summary

For more details on this report – Request for Sample

Hospital Gowns Market Dynamics: Drivers & Restraints

Rising focus on infection prevention is expected to significantly drive the hospital gowns market

The growing emphasis on infection prevention is a key factor driving the increased adoption of hospital gowns and is expected to significantly contribute to the growth of the hospital gowns market. This heightened focus stems from the rising incidence of healthcare-associated infections (HAIs) globally, which remain among the most common complications in medical settings. HAIs affect approximately one in every ten patients, with even higher rates reported in low- and middle-income countries and among high-risk groups such as intensive care unit patients.

In the European Union/European Economic Area (EU/EEA), an estimated 4.3 million hospital patients experience at least one HAI annually. This data is based on findings from the third point prevalence survey (PPS) of HAIs and antibiotic use in acute care hospitals, coordinated by the European Centre for Disease Prevention and Control (ECDC) during 2022–2023.

To mitigate the risks posed by HAIs, healthcare facilities are increasingly implementing strict infection control protocols, including the routine use of hospital gowns to protect both patients and healthcare personnel. This proactive approach to infection prevention is expected to drive higher demand for hospital gowns, further supporting market expansion in the coming years.

Strict regulatory compliances are expected to hinder the hospital gowns market

Compliance with demanding safety and quality standards results in increased production costs. Manufacturers must spend on quality assurance methods, testing, and certification to meet regulatory standards imposed by bodies such as the FDA and EMA. This can increase the cost of producing gowns, which is especially costly for smaller healthcare providers with limited finances.

Hospital Gowns Market Segment Analysis

The global hospital gowns market is segmented based on type, material, usability, distribution channel, and region.

Type:

The surgical gowns segment is expected to hold 38.4% of the market share in 2024 in the hospital gowns market

The surgical gowns segment is anticipated to capture a substantial share of the hospital gowns market, driven by the rising number of surgical procedures and the growing incidence of hospital-acquired infections. This trend is expected to significantly boost the demand for surgical gowns across healthcare facilities. For example, according to the European Commission, over 1.10 million cesarean sections were performed in the European Union in 2022, underscoring the high volume of surgeries requiring sterile protective apparel.

In addition, ongoing advancements in surgical gown design are further supporting segment growth. In November 2023, Cardinal Health launched the SmartGown EDGE Breathable Surgical Gown featuring ASSIST Instrument Pockets, aimed at enhancing safety and convenience for surgical teams by providing easy access to instruments during procedures. These developments collectively contribute to the increasing adoption of surgical gowns and are expected to drive the continued expansion of this segment.

Hospital Gowns Market Geographical Share

North America is expected to hold 39.4% of the market share in 2024 in the global hospital gowns market with the highest market share

North America currently leads the global hospital gowns market and is projected to grow at the fastest compound annual growth rate (CAGR) during the forecast period. This regional dominance is primarily driven by the rising number of surgical procedures performed across hospitals and clinics, which continues to fuel demand for protective medical apparel, including hospital gowns.

A key factor contributing to this growth is the increasing prevalence of hospital-acquired infections (HAIs). According to 2024 data from the Centers for Disease Control and Prevention (CDC), approximately one in every 31 hospital patients in the U.S. has at least one healthcare-associated infection on any given day, highlighting the critical need for infection control measures such as proper gown usage.

In addition, major companies in the region are actively investing in the enhancement of hospital gown production. For example, on April 29, 2023, Taromed announced the completion of Version 2.1 of its fully automated isolation and surgical gown production line. This development represents a significant advancement in the company's ongoing commitment to delivering high-quality medical gowns. These combined factors are expected to continue driving robust growth in the North American hospital gowns market.

Asia-Pacific is expected to hold 21.8% of the global hospital gowns market share in 2024

The Asia-Pacific region is poised to dominate the hospital gowns market over the forecast period, driven by rapid healthcare infrastructure development, rising healthcare expenditure, and a large, aging population that contributes to increased hospital admissions and surgical procedures. Countries like China, India, and Japan are witnessing a surge in surgeries and heightened awareness of infection control, fueling demand for both disposable and reusable hospital gowns.

Additionally, the growing prevalence of healthcare-associated infections (HAIs) has led to stricter infection prevention protocols across medical facilities. The region also benefits from being a major manufacturing hub for medical textiles, with countries such as China, India, and Bangladesh offering cost-effective production, boosting both regional supply and exports.

Hospital Gowns Market Top Companies

Top companies in the hospital gowns market include Medline Industries Inc., AmeriPride Services Inc., Standard Textile Co. Inc., Cardinal Health, 3M, Atlas Infiniti, Bellcross Industries Pvt. Ltd., Priontex, Sara Health Care, Delta Med SpA, among others.

Market Scope

Metrics | Details | |

CAGR | 5.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Surgical Gowns, Non-surgical Gowns, Patient Gowns |

Material | Polypropylene (PP), Polyethylene (PE), Cotton, Polyester, Others | |

| Usability | Disposable Gowns, Reusable Gowns |

| Distribution Channel | Offline, Online |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global hospital gowns market report delivers a detailed analysis with 68 key tables, more than 61 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.