Home Medical Equipment Market - Industry Trends & Overview

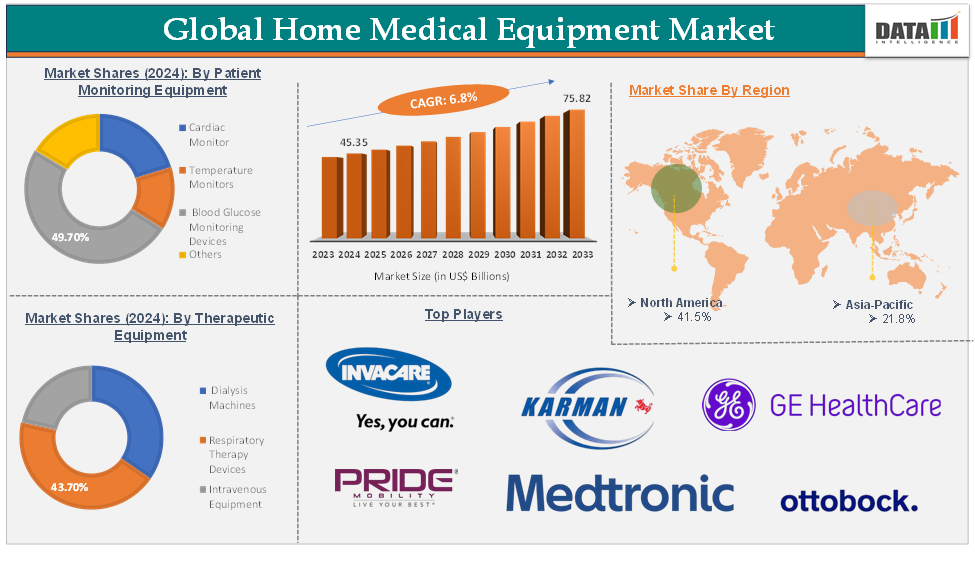

Home Medical Equipment Market reached US$ 45.35 Billion in 2024 and is expected to reach US$ 75.82 Billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025-2033.

The global home medical equipment market encompasses a broad range of medical devices and products designed for use by patients in their homes to manage, monitor, and treat various health conditions, enhancing patient autonomy and reducing the need for frequent hospital visits.

This market is witnessing robust growth, primarily driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular, and respiratory disorders, as well as the significant increase in the global geriatric population. Technological advancements, including the integration of smart technology, telehealth, and remote monitoring, are further propelling market expansion by making devices more user-friendly and effective.

Key opportunities in the market include the growing demand for portable and connected medical devices, especially in emerging economies where healthcare infrastructure is improving and awareness is rising. Current trends shaping the market include the increasing adoption of respiratory therapy equipment due to the rising incidence of respiratory conditions, the development of more compact and portable devices, and the integration of IoT and AI for enhanced patient monitoring and data collection.

Executive Summary

For more details on this report – Request for Sample

Home Medical Equipment Market Dynamics: Drivers & Restraints

Growing geriatric population

The rapidly aging global population is a major driver for the home medical equipment market. According to the World Health Organization, by 2050, 80% of older people will reside in low- and middle-income countries, and the pace of population aging is accelerating faster than ever before.

Notably, in 2020, the number of individuals aged 60 years and older surpassed the number of children under five. The proportion of the world’s population over 60 is projected to nearly double from 12% in 2015 to 22% by 2050. By 2030, one in six people globally will be aged 60 or above, with the population in this age group rising from 1 billion in 2020 to 1.4 billion. By 2050, the number of people aged 60 and older will double to 2.1 billion, and those aged 80 and above are expected to triple to 426 million.

This dramatic demographic shift is expected to significantly boost demand for home medical equipment, as older adults are more likely to experience chronic health conditions and mobility challenges that require ongoing medical care and monitoring. The preference for aging in place and the need for cost-effective, accessible healthcare solutions will further drive the adoption of home-based medical devices and technologies worldwide. As a result, manufacturers and healthcare providers are increasingly focusing on developing innovative, user-friendly, and affordable home medical equipment to meet the evolving needs of the growing elderly population.

Home Medical Equipment Market Dynamics: Restraints

High cost of medical equipment

Factors such as the high cost of medical equipment, including home medical equipment, are expected to hamper the global home medical equipment market. As healthcare systems migrate toward home-based care options, the affordability of medical devices becomes critical. Many people, particularly those with low incomes or limited insurance coverage, struggle to buy required home medical equipment. This financial hardship might cause delayed treatment or insufficient management of chronic diseases, affecting patient health outcomes.

Home Medical Equipment Market Segment Analysis

The global home medical equipment market is segmented based on therapeutic equipment, mobility assist and patient support equipment, patient monitoring equipment, end-users, and region.

The blood glucose monitoring devices patient monitoring equipment segment is expected to hold 49.7% of the global home medical equipment market in 2024

Blood glucose monitoring devices represent a crucial and rapidly evolving segment, primarily driven by the rising prevalence of diabetes and the growing emphasis on self-management of chronic conditions. This segment is broadly categorized into self-monitoring blood glucose (SMBG) devices, which include blood glucose meters, testing strips, and lancets, and continuous glucose monitoring (CGM) systems, which utilize sensors, transmitters, and receivers for real-time glucose tracking.

The self-monitoring devices segment holds the largest market share, attributed to their affordability, ease of use, and the recurring demand for consumables like test strips. Meanwhile, the CGM segment is witnessing robust growth, fueled by technological advancements, increasing awareness of continuous monitoring benefits, and the integration of smart features and connectivity for enhanced diabetes management.

For instance, in August 2024, Dexcom announced the launch of an over-the-counter continuous glucose monitor. Dexcom's Stelo monitors blood glucose levels constantly via a wearable sensor and an application on the user's smartphone or other smart device.

Also, in June 2024, Prevounce Health, a leading provider of remote care management software, devices, and services, announced the launch of its first remote blood glucose monitoring device, Pylo GL1-LTE. The blood glucose meter has been scientifically tested and links to numerous cellular networks to guarantee more dependable data transmission across the United States.

Home Medical Equipment Market Geographical Analysis

North America is expected to hold 41.5% of the global home medical equipment market in 2024

North America will likely dominate the global home medical equipment market, owing to a combination of demographic, economic, and technical factors. The region benefits from a well-established healthcare infrastructure that encourages the use of home healthcare solutions.

As the geriatric population and frequency of chronic diseases increase, so does the demand for home medical equipment that enables patients to properly manage their health conditions from the comfort of their own homes. This trend to home-based treatment not only improves patient comfort but also decreases the pressure on healthcare facilities, making it a popular choice among many individuals and families.

For instance, according to urban.org, the number of Americans aged 65 and older will more than double over the next 40 years, reaching 80 million in 2040. The number of adults ages 85 and older, the group most often needing help with basic personal care, will nearly quadruple between 2000 and 2040. Also, according to America Health Ranking.org, 17.3% of the entire US population is the geriatric population.

There are major players present in this region, which makes this region the most dominant. For instance, in November 2024, Medtronic received U.S. Food and Drug Administration (FDA) approval for its new InPen smartphone software and announced the release of its new Smart MDI system. Smart MDI was created to give users real-time information on multiple daily injection (MDI) therapy.

Asia-Pacific is expected to hold 21.8% of the global home medical equipment market in 2024

The Asia Pacific region is experiencing strong expansion in the worldwide home medical equipment market, owing to several major factors reflecting the changing healthcare landscape. One of the major contributions to this growth is the rising prevalence of chronic diseases in the population and the increasing geriatric population.

Diabetes, cardiovascular diseases, and respiratory ailments are growing increasingly prevalent as people's lifestyles change and urbanization accelerates. The rise in chronic diseases demands continual monitoring and management, making home medical devices crucial for individuals who prefer to manage their health at home rather than visit healthcare facilities.

The increasing geriatric population is one of the driving factors in this region making it the fastest growing region. For instance, according to the UNFPA India, he current elderly population of 153 million (aged 60 and above) is expected to reach a staggering 347 million by 2050.

Home Medical Equipment Market Key Players

The major global players in the global home medical equipment market include Invacare Corporation, Karman Healthcare Inc., Ottobock, Pride Mobility Products Corp., Medtronic, Koninklijke Philips N.V., GE HealthCare, Abbott, Nihon Kohden Corporation, and Danaher Corporation, among others.

Home Medical Equipment Market Emerging Players

The major global players in the global home medical equipment market include Livongo, Tyto Care, and iRhythm Tech, among others.

Key Developments

In May 2025, Medtronic announced plans to spin off its diabetes division into a separate publicly traded company within 18 months. This move aims to allow the diabetes unit, which generated nearly $2.5 billion in fiscal 2024, to expand more rapidly and recover from past regulatory and performance challenges. The division will continue to sell insulin delivery products like the MiniMed insulin pump and smart pens, and is developing a new glucose sensor in partnership with Abbott.

In January 2025, Philips signed an agreement to sell its Emergency Care business to Bridgefield Capital, a US-based investment firm. The Emergency Care business offers products critical in acute care management, including automated external defibrillators. Philips and the Emergency Care business will enter into a brand license agreement to use the Philips brand for manufacturing, sales, and marketing of Emergency Care products globally for up to 15 years.

In November 2024, Invacare sold its North American business to MIGA Holdings LLC. This acquisition aims to optimize Invacare's operations and accelerate growth in North America, enhancing its ability to better satisfy customer needs and expand as a market leader in the healthcare mobility space.

In October 2024, Ottobock invested €22.5 million in ONWARD Medical, a European medical technology company developing therapies to restore movement and independence in people with spinal cord injury. This investment makes Ottobock the largest shareholder of ONWARD® Medical and marks the beginning of a closer partnership.

In August 2024, Hong Kong-based health tech start-up Libpet is into designing smart robot wheelchairs not just for the physically challenged but for everyone. Through innovation, its inclusive device for mobility and productivity helps minimize physical effort, making life so much easier.

Recent Industry Trends 2025

Smart Home Integration: Major players are integrating medical devices with smart home ecosystems (e.g., Amazon Alexa, Google Nest) to enable real-time alerts and improve caregiver connectivity.

Telehealth Synergy: Companies are partnering with telemedicine providers to offer comprehensive remote monitoring + consultation packages.

Subscription Models: There’s a rise in subscription-based home medical equipment rental services, especially for oxygen therapy and mobility devices.

Green & Sustainable Equipment: Increasing focus on eco-friendly, recyclable materials and energy-efficient medical devices.

AI-driven Predictive Health Management: Integration of machine learning to anticipate critical health events using home-based monitors is gaining traction in 2025.

Home Medical Equipment Market Conclusion: Future Outlook

The home medical equipment market is transitioning from basic functional aids to smart, connected, and patient-centric technologies. Companies that invest in innovation, regional customization, and digital transformation are well-positioned to lead this growth curve. By 2033, home-based care is expected to become a mainstream pillar in global healthcare delivery, supporting aging societies and relieving healthcare system burdens.

Market Scope

Metrics | Details | |

CAGR | 6.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Therapeutic Equipment | Dialysis Equipment, Respiratory Therapy Equipment, Intravenous Equipment |

Mobility Assist and Patient Support Equipment | Mobility Assist Equipment, Medical Furniture, and Bathroom Safety Equipment | |

Patient Monitoring Equipment | Cardiac Monitoring Equipment, Temperature Monitoring Equipment, Blood Glucose Monitoring Equipment, Others | |

End-Users | Home Healthcare Providers, Nursing Homes, Rehabilitation Centers | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |