HIV Therapeutics Market Size & Industry Outlook

Long-acting (LA) and single-tablet regimens are rapidly becoming the norm in the HIV treatments industry. Through the reduction of pill burden, these improvements enhance patient convenience and adherence. Multiple medications are combined into a single dose with single-tablet regimens, making daily treatment easier. Sustained medication release from long-acting injectables enables monthly or biweekly dosage. This improves patient privacy and lessens stigma. Strong clinical results and pharmaceutical advancements are what propel their uptake. These treatments are increasingly attractive due to their better safety profiles and less adverse effects due to their superior viral suppression and treatment compliance; healthcare providers prefer them. Demand is driven by a growing patient preference for low-maintenance therapy.

Key Highlights

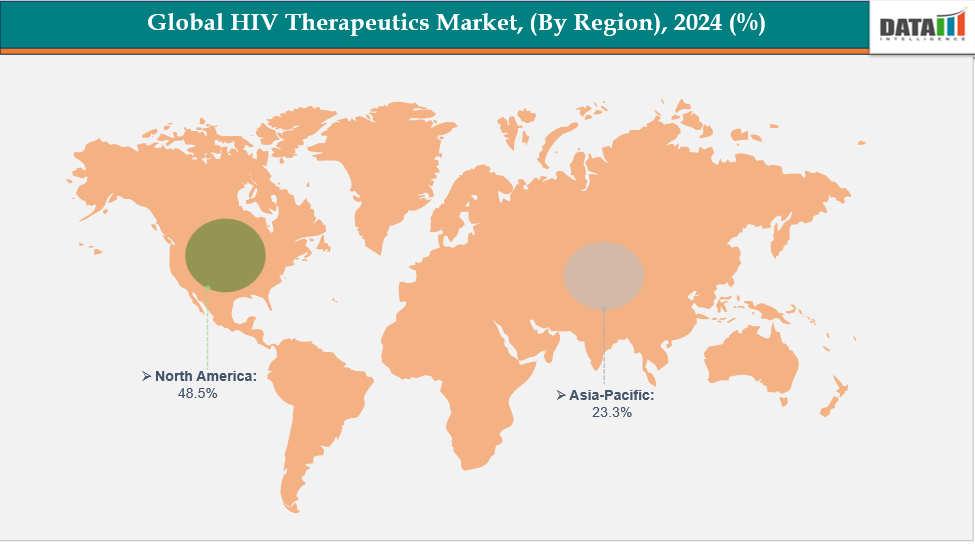

- North America is dominating the global HIV therapeutics market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific region is the fastest-growing region in the global HIV therapeutics market, with a CAGR of 7.7% in 2024.

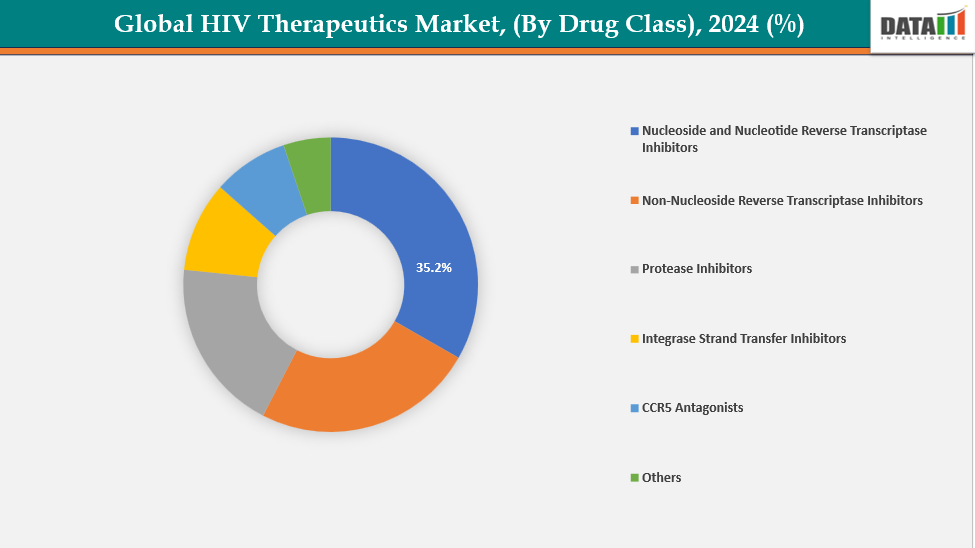

- Nucleoside and nucleotide reverse transcriptase inhibitors are dominating the HIV therapeutics market with a 35.2% share in 2024.

- The oral route of administration segment is dominating the HIV therapeutics market with a 70.3% share in 2024.

- Top companies in the HIV therapeutics market include ViiV Healthcare ULC, Gilead Sciences, Inc., Merck & Co., Inc., Johnson & Johnson, Bristol-Myers Squibb Company, AbbVie Inc., Boehringer Ingelheim International GmbH, Pfizer Inc., Theratechnologies Inc., and Abbott Laboratories, among others.

Market Dynamics

Drivers: Rising global prevalence of HIV is accelerating the growth of the HIV therapeutics market

The market for HIV therapies is expanding rapidly due to the increasing prevalence of HIV worldwide. The need for efficient antiretroviral treatments (ART) has increased as the number of people living with HIV has increased. By enabling earlier treatment commencement, expanding screening and diagnosis programs increases the uptake of ART. To handle the growing patient load, governments and international health organizations are expanding their access initiatives. More undiagnosed people are getting into treatment pipelines as awareness and testing increase. The requirement for ongoing treatment guarantees steady demand for medications and regimen enhancements.

Owing to the factors like HIV prevalence. According to WHO, globally, 40.8 million people were living with HIV at the end of 2024. An estimated 0.7% of adults aged 15-49 years worldwide are living with HIV, although the burden of the epidemic continues to vary considerably between countries and regions.

Restraints: Resistance and clinical uncertainties for some new agents are hampering the growth of the HIV therapeutics market

The market expansion for HIV treatments is being hampered by resistance and clinical uncertainty. The efficacy of medicines is diminished when patients acquire resistance to new medications, particularly when treatment adherence is irregular. Uncertainties about long-term safety, durability, and resistance emergence also affect new agents and long-acting injectables. Clinicians are cautious when transferring patients to newer alternatives due to a lack of real-world data and worries about cross-resistance with current regimens.

For instance, the first injectable HIV medication, Cabenuva, was approved in 2021. However, it has been proven to cause integrase inhibitor resistance in individuals with virologic failure, especially those with pre-existing mutations or HIV subtypes like A6/A1.

For more details on this report, see Request for Sample

HIV Therapeutics Market, Segment Analysis

The global HIV therapeutics market is segmented based on drug class, route of administration, distribution channel, and region

By Drug Class: Nucleoside and nucleotide reverse transcriptase inhibitors are dominating the HIV therapeutics market with a 35.2% share in 2024

The market for HIV treatments is dominated by nucleoside and nucleotide reverse transcriptase inhibitors (NRTIs), which are crucial for antiretroviral therapy (ART). They are part of nearly every routine HIV treatment plan, and for maximum effectiveness, they are frequently taken in combination with other medication types. Strong viral suppression, favorable safety profiles, and widespread accessibility are provided by NRTIs like tenofovir, emtricitabine, and lamivudine. Their widespread clinical experience, affordability, and inclusion in first-line treatments advised by the WHO all contribute to their high demand.

Moreover, regulatory approvals and continuous innovation, such as long-acting and fixed-dose combinations, further strengthen their market position. For instance, in July 2025, Merck announced that the U.S. FDA had accepted its New Drug Application for Doravirine/Islatravir (DOR/ISL), an investigational once-daily, oral two-drug regimen for adults with virologically suppressed HIV-1 infection already stable on antiretroviral therapy.

By Route of Administration: The oral route of administration segment is dominating the HIV therapeutics market with a 70.3% share in 2024

The market for HIV therapies is dominated by the oral method of administration due to its patient adherence, ease of use, and convenience. Dosing is made easier and pill load is decreased by the availability of oral tablets or single-tablet regimens (STRs) for the majority of antiretroviral treatments. In environments with limited resources, oral formulations minimize the requirement for clinical visits by enabling self-administration.

Moreover, continuous research and development, rising FDA approvals, and new product launches make this segment dominant. For instance, in April 2024, ViiV Healthcare received FDA approval for Dovato (dolutegravir/lamivudine) to treat adolescents aged 12 years and older with HIV-1 infection. With this approval, Dovato became the first and only oral, two-drug, single-tablet regimen available for both treatment-naïve and virologically suppressed adolescent patients living with HIV.

HIV Therapeutics Market, Geographical Analysis

North America is dominating the global HIV therapeutics market with 48.5% in 2024

The market for HIV therapies was dominated by North America due to the region's high HIV prevalence, sophisticated healthcare system, and powerful pharmaceutical corporations. The region's dominant position in the market was further reinforced by consistent R&D investment in cutting-edge medicines like long-acting injectables and single-tablet regimens, favorable reimbursement policies, and high treatment awareness.

In the U.S., the HIV therapeutics market grew with new FDA approvals for new indications and product launches, including long-acting injectables and two-drug regimens, convenience, and expanding personalized therapy options. For instance, in July 2025, Gilead Sciences received FDA approval for a new indication of Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide), expanding its use to treatment-experienced people with HIV who were not virologically suppressed and had no known or suspected resistance to INSTIs, emtricitabine, or tenofovir.

Europe is the second region after North America, which is expected to dominate the global HIV therapeutics market with 34.5% in 2024

In Europe, the growing prevalence of HIV, early diagnostic initiatives, and availability to cutting-edge treatments all contributed to the growth of the HIV medicines industry. Supported by robust R&D financing and quick acceptance of creative regimens, the European Commission's (EC) marketing authorizations and new product releases further drove regional market growth.

Owing to factors like new product launches and marketing authorizations.For instance, in August 2025, Gilead Sciences received European Commission (EC) marketing authorization for Yeytuo (lenacapavir), a twice-yearly injectable HIV-1 capsid inhibitor for PrEP. This approval made Yeytuo the first and only HIV PrEP option in Europe, providing six months of protection for adults and adolescents at increased risk of HIV-1.

The Asia Pacific region is the fastest-growing region in the global HIV therapeutics market, with a CAGR of 7.7% in 2024

The Asia-Pacific HIV therapeutics market expanded rapidly as a result of rising HIV prevalence, rising healthcare costs, and government programs that supported early diagnosis and treatment access. Regional market expansion was further boosted by biotechnology breakthroughs and strategic alliances with top pharmaceutical firms in China, Japan, South Korea, and India.

India’s HIV therapeutics market grew rapidly, driven by a high disease burden, government initiatives, and affordable treatment access. Voluntary licensing agreements with global firms enabled domestic manufacturers to produce low-cost antiretrovirals and market expansion across both urban and rural regions. For instance, in October 2024, Gilead Sciences signed non-exclusive, royalty-free voluntary licensing agreements with Dr. Reddy’s Laboratories, Emcure, Eva Pharma, Ferozsons Laboratories, Hetero, and Mylan (Viatris) to manufacture and supply generic lenacapavir for HIV prevention in 120 high-incidence, resource-limited countries, expanding global access to this innovative long-acting therapy.

Competitive Landscape

Top companies in the HIV therapeutics market include ViiV Healthcare ULC, Gilead Sciences, Inc., Merck & Co., Inc., Johnson & Johnson, Bristol-Myers Squibb Company, AbbVie Inc., Boehringer Ingelheim International GmbH., Pfizer Inc., Theratechnologies Inc., and Abbott Laboratories, among others.

ViiV Healthcare ULC : ViiV Healthcare ULC is a global specialist HIV company focused exclusively on developing, manufacturing, and commercializing innovative antiretroviral therapies. Formed through a joint venture between GSK, Pfizer, and Shionogi, it offers leading treatments like Dovato, Triumeq, Juluca, and Cabenuva, emphasizing patient-centric innovation and expanding global HIV treatment access.

Key Developments:

- In October 2025, ViiV Healthcare announced 96-week results from the PASO DOBLE (GeSIDA 11720) study, showing that Dovato (dolutegravir/lamivudine) was as effective as Biktarvy in maintaining virological suppression in adults with HIV-1, with significantly less weight gain and fewer drug-related adverse events over two years.

- In July 2025, ViiV Healthcare extended its voluntary licensing agreement with the Medicines Patent Pool (MPP) to include patents for the long-acting injectable HIV treatment using cabotegravir and rilpivirine, following updated WHO guidance recommending this regimen as an effective HIV treatment option worldwide.

Market Scope

| Metrics | Details | |

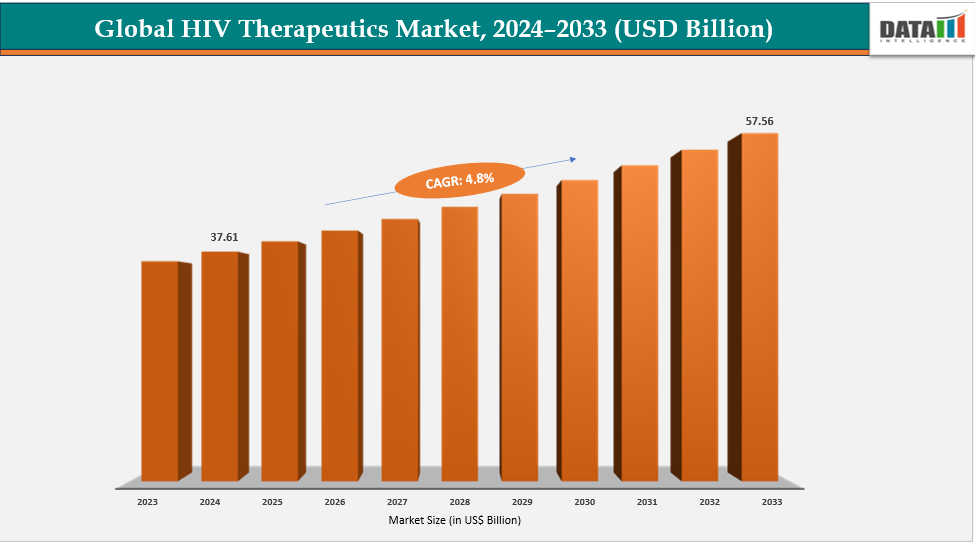

| CAGR | 4.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | Nucleoside and Nucleotide Reverse Transcriptase Inhibitors, Non-Nucleoside Reverse Transcriptase Inhibitors, Protease Inhibitors, Integrase Strand Transfer Inhibitors, CCR5 Antagonists, Others |

| By Route of Administration | Oral, Parenteral | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global HIV therapeutics market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here