High Speed Steel Market Size & Overview

Global High Speed Steel Market reached US$ 3.1 billion in 2024 and is expected to reach US$ 5.1 billion by 2032, growing with a CAGR of 5.76% during the forecast period 2025-2032. The global high-speed steel market is witnessing robust growth, driven by increasing demand from automotive, aerospace and industrial machinery sectors. Rapid industrialization and the expansion of manufacturing capacities in the Asia-Pacific are major contributors to market growth. Governments worldwide are promoting local production of specialty steels to reduce imports, with India’s Production Linked Incentive (PLI) Scheme being a key example, aiming to attract US$ 3.34 billion (Rs. 29,500 crores) of investment and create an additional 25 million tons of capacity. This policy-driven boost is expected to directly enhance high-speed steel manufacturing and adoption.

High Speed Steel Industry Trends and Strategic Insights

Asia-Pacific dominates the high speed steel market, capturing the largest revenue share of 35.23% in 2024.

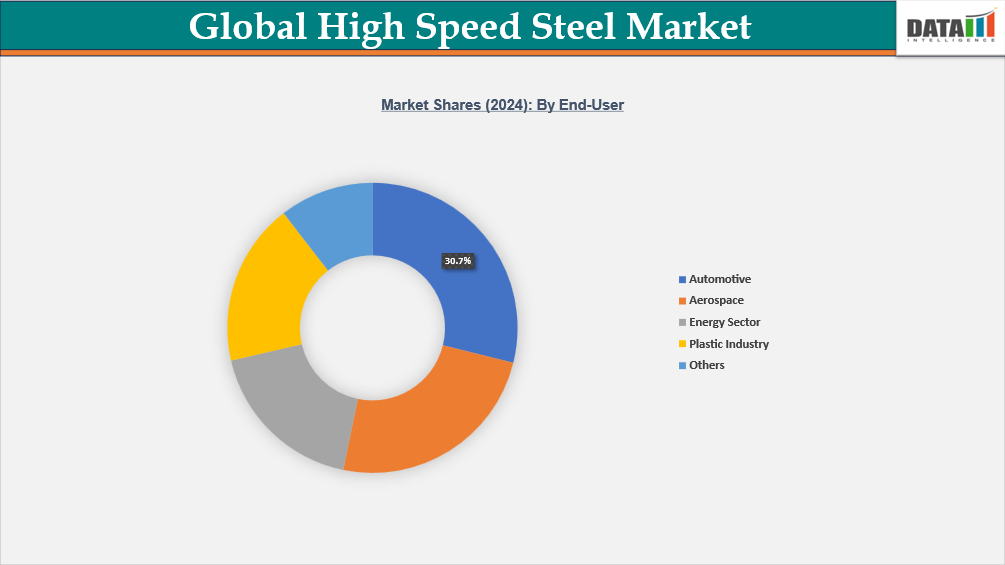

By end-user, the automotive segment is projected to be the largest market, holding a significant share of 30.7% in 2024.

Market Size and Future Outlook

2024 Market Size: US$ 3.1 Billion

2032 Projected Market Size: US$ 5.1 Billion

CAGR (2025-2032): 5.76%

Largest Market: Asia-Pacific

Fastest Market: Asia-Pacific

For More detail information Request for Free Sample

Market Scope

Metrics | Details |

By Product | Metal Cutting Tools, Cold Working Tools, Others |

By Grade | M Grade, T Grade, C Grade, V Grade |

By Production Method | Conventional HSS, Powder Metallurgy (PM) HSS, Spray Forming (SF) HSS |

By End-User | Automotive, Aerospace, Energy Sector, Plastic Industry, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand in Precision Manufacturing

The global high-speed steel market is being strongly driven by the rising demand in precision manufacturing, as industries worldwide seek durable and high-performance cutting tools. In India, the automotive sector exemplifies this trend, producing 28.4 million vehicles in FY 2023-24, up from 25.9 million the previous year, according to SIAM (Society of Indian Automobile Manufactures). Passenger vehicle sales rose to 4.21 million units, utility vehicles to 2.5 million and vans to .14 million units, reflecting robust segmental growth. This surge in vehicle production increases the need for high-quality HSS cutting tools used in machining engine components, gears and other precision parts.

Meanwhile, in the U.S. aerospace and defense sector, 2023 sales surpassed US$ 955 billion, a 7.1% increase from the prior year, according to IEA, underscoring the industry’s reliance on precise machining tools for turbine blades, airframe components and critical assemblies. High-speed steel tools enable manufacturers to maintain accuracy and performance even under high-speed, high-temperature operations. Overall, precision manufacturing acts as a core growth engine for the global high-speed steel market, linking automotive, aerospace, medical and general engineering sectors.

Volatility in Raw Material Prices

One of the key restraints in the global high-speed steel market is the fluctuation in raw material prices, particularly alloying elements such as tungsten, molybdenum, cobalt and vanadium. These elements are critical for imparting hardness, wear resistance and heat resistance to HSS, making them indispensable for cutting tools and industrial applications. However, their availability is limited to a few resource-rich regions and supply is often subject to geopolitical issues, mining regulations and export restrictions. This dependence creates inherent instability in cost structures for HSS manufacturers.

Segmentation Analysis

The global high speed steel market is segmented based on product, grade, production method, end-user and region.

Rising Vehicle Production in Automotive Sector Drives the Segment Growth

Automotive end-user is expected to hold about 30.7% of the global market in 2024. The automobile sector is one of the main end users of high-speed steel (HSS), using it largely for cutting tools, drills, milling cutters, gear production and engine component machining. With global vehicle manufacturing expected to exceed 93.5 million units by 2023 (OICA), there is an increasing demand for precise tooling and long-lasting cutting materials. HSS is still important because of its cost-effectiveness, heat resistance and toughness, especially in processes like gear hobbing, crankshaft machining and fastener manufacturing.

While cemented carbides and ceramics are gaining popularity in high-speed machining, HSS continues to account for a sizable proportion of cutting tools in vehicle manufacturing, particularly in developing economies where price is critical. The competition in the automotive sector is influenced by a combination of global metallurgical corporations and specialized cutting tool manufacturers. Voestalpine, Erasteel and Nachi-Fujikoshi manufacture premium-grade HSS alloys for automotive machining applications, while Kennametal, Sandvik and OSG Corporation specialize in finished HSS tools designed for automotive production lines.

Rising Focus on Efficiency and Safety Driver the Demand in Aerospace End-User

The aerospace industry is a major growth driver for the global high-speed steel market, owing to its reliance on advanced machining tools for producing precision components. High-speed steel is widely used in the manufacturing of drills, taps, reamers and end mills that are essential for cutting and shaping aerospace-grade alloys such as titanium, nickel-based superalloys and stainless steels. With the aerospace sector under constant pressure to enhance efficiency, safety and material performance, demand for durable and cost-effective cutting tools remains strong, positioning HSS as a key enabler despite competition from carbide and ceramics.

Global aerospace production is on the rise, driven by increasing commercial air travel, defense modernization programs and demand for lighter and more fuel-efficient aircraft. According to the International Air Transport Association (IATA), global passenger traffic is expected to double by 2040, fueling large order backlogs for major aircraft manufacturers like Boeing and Airbus. This expansion translates into a steady requirement for machining parts such as engine components, landing gear and structural frames, where HSS tools are favored for their toughness and ability to withstand shock loads in roughing operations.

Geographical Penetration

Rising Demand for Huge Machine Tools and Automotive Sector in Asia-Pacific

Asia-Pacific high-speed steel (HSS) market is the world's largest, accounting for about 35.23% of the global market in 2024, with China alone accounting for the majority of global production due to its huge machine tool and automobile industries. As per the World Steel Association, China will generate more than 1 billion metric tons of crude steel in 2023, providing a strong raw material base for specialty steels such as HSS. Japan and South Korea, despite their smaller volume, dominate the high-value market with superior metallurgy and tool-making skills, providing industries such as aerospace, electronics and high-precision automobile components.

India High Speed Steel Market Outlook

India's high speed steel market is expanding rapidly, fueled by its burgeoning automotive sector and government-led "Make in India" efforts that drive local tool manufacture. The expansion of industries such as automotive and aerospace has increased demand for high-speed steel. Rising construction and infrastructure projects globally increase the need for precision-cut components. Industrial automation and CNC machining adoption also favor high-performance HSS tools in India.

China High Speed Steel Market Trends

China's high speed steel market prognosis remains positive, as it is the dominant country in high speed steel, accounting for more than 40% of the regional market. Chinese companies like as Tiangong International and Baosteel Special Metals are increasing production to meet increased demand for low-cost HSS tools, while Japanese firms such as Nachi-Fujikoshi and Hitachi Metals maintain strong positions in the premium cutting tool category. Global firms such as Voestalpine maintain a significant presence through local subsidiaries and partnerships, particularly in India and China.

Presence of Advance Industrial Infrastructure in North America

North America is expected to be a significant region of the global market holding about 20.18% of the market in 2024. The regional market is supported by strong demand from industries such as automotive, aerospace, oil & gas and general manufacturing. The region benefits from advanced industrial infrastructure and a mature machine tools sector, which ensures steady consumption of HSS cutting tools like drills, taps and end mills.

Despite growing adoption of carbide and ceramic alternatives, HSS continues to hold relevance in applications requiring toughness, shock resistance and cost efficiency. North America also has a notable base of toolmakers and end-user industries that maintain the region’s position as one of the leading consumers of HSS globally.

US High Speed Steel Market Insights

US accounts for the largest share of North America HSS market, driven primarily by its robust aerospace and automotive industries. US aerospace sector, led by manufacturers like Boeing, Lockheed Martin and Raytheon, requires extensive use of HSS tools for machining components from titanium and nickel alloys. Similarly, the automotive sector, with over 10 million vehicles produced annually, relies on HSS for cost-effective and high-volume machining tasks. Furthermore, US defense sector’s investment in advanced manufacturing keeps demand steady for durable and shock-resistant tools. While carbide is gaining traction, HSS maintains a strong foothold due to its lower cost and versatility in small and medium production runs.

Canada High Speed Steel Industry Growth

In Canada, the HSS market is smaller compared to US but remains important due to the country’s resource-driven economy and growing aerospace cluster. Canada is home to major aerospace firms such as Bombardier and Pratt & Whitney Canada, which create consistent demand for machining tools, including HSS-based cutting solutions. Additionally, the mining and oil & gas industries contribute to the use of HSS drills and reamers in equipment manufacturing and maintenance. With Canada’s focus on advanced manufacturing and the expansion of its aerospace supply chain in Quebec and Ontario, HSS demand is projected to grow steadily, albeit at a slower pace than in US.

Sustainability Analysis

The high-speed steel market is increasingly embracing sustainability as a core growth driver, balancing performance with environmental responsibility. Manufacturers are adopting energy-efficient production methods and advanced recycling techniques to reduce carbon emissions and material waste.

For instance, in June 2024, Erasteel became the first global producer of HSS to achieve EPD certification, covering conventional steels and products made from recycled batteries and spent oil catalysts, signaling a new benchmark for transparency and a low carbon footprint. This milestone demonstrates the potential of using over 91% recycled materials, aligning high-performance steels with circular economy principles.

Competitive Landscape

The global high-speed steel market is characterized by a competitive landscape that includes both established steel makers and specialist tool producers.

Key players include Voestalpine AG, NIPPON STEEL CORPORATION, Fushun Special Steel Co., Ltd., Daido Steel Co., Ltd., Graphite Limited, ArcelorMittal S.A., Heye Special Steel Co., Ltd., Hudson Tool Steel Corporation, West Yorkshire Steel Co., Ltd. and Sandvik AB.

The firms emphasize product distinctiveness by providing premium HSS grades with improved wear resistance, toughness and performance in demanding cutting and drilling applications.

Strategic expenditures in R&D, sustainability initiatives and manufacturing efficiency are particularly critical, as the industry faces competition from replacements such as cemented carbides and ceramics.

Key Developments

In July 2023, Syntagma Capital acquired Erasteel, Eramet SA's high-speed steel and recycling operation.

In April 2022, JFE Steel Corporation and ThyssenKrupp Steel Europe developed new high-strength steel sheets (980 and 1180 MPa) for cold forming vehicle frame components.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies