Global High-Density Polyethylene (HDPE) Containers Market Overview

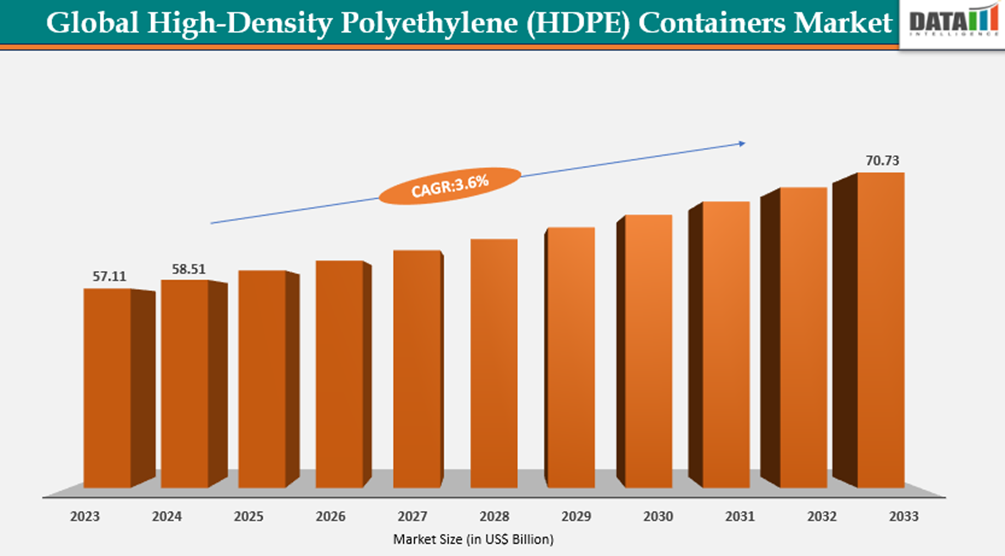

The global High-Density Polyethylene (HDPE) Containers market reached US$58.51 billion in 2024 and is expected to reach US$70.73 billion by 2032, growing at a CAGR of 3.6% during the forecast period 2025-2032.

The global High-Density Polyethylene (HDPE) container market exemplifies a critical segment of the broader plastics industry, characterized by its wide range of applications and versatility in sectors like packaging, automotive, construction, and consumer goods. As the world increasingly focuses on sustainability, efficiency, and performance, HDPE’s unique properties, such as high strength, chemical resistance, and recyclability, position it as a preferred polymer for various industrial and consumer applications. The market operates on a global scale, driven by evolving customer demands, innovative product development, and the transition towards more environmentally-friendly production practices.

High-Density Polyethylene (HDPE) Containers Industry Trends and Strategic Insights

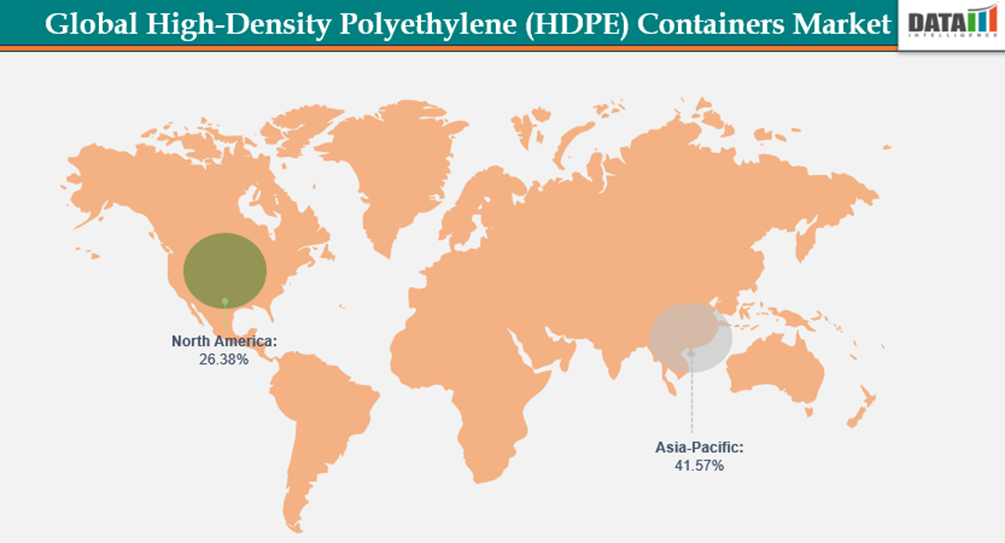

The Asia-Pacific region dominates the market, captured the largest revenue share of 41.57% in 2024.

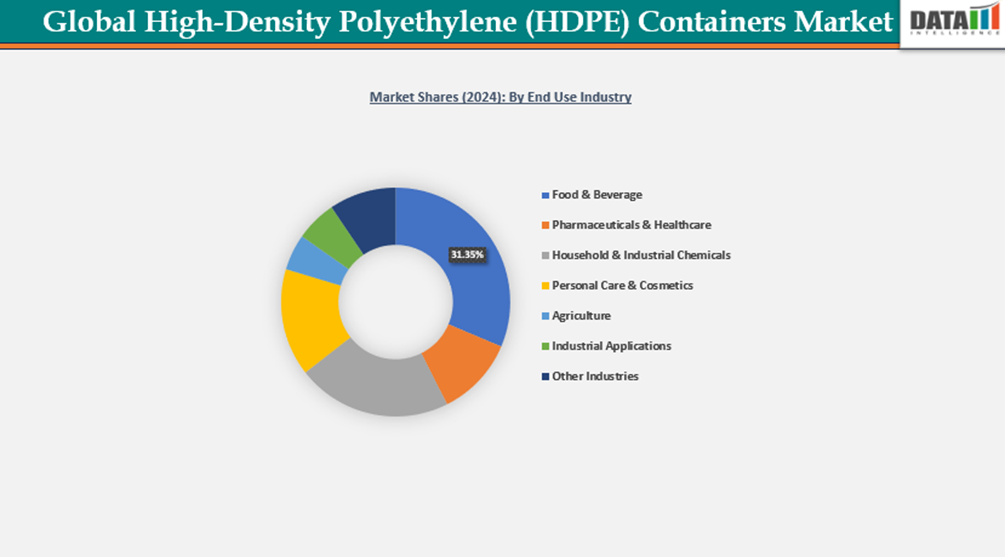

By end-use industry, the food and beverage segment experienced the largest market, registering a significant 31.35% in 2024.

Market Size and Future Outlook

2024 Market Size: US$58.51 Billion

2032 Projected Market Size: US$70.73 Billion

CAGR (2025-2032): 3.6%

Largest Market: Asia-Pacific

Fastest Market: North America

Market Scope

Metrics | Details |

By Container Type | Bottles & Jugs, Pails & Drums, Caps & Closures, Tanks & Intermediate Bulk Containers (IBCs), Other Containers |

By Capacity | Below 1 Litre, 1 Litre - 10 Litres, 10 Litre - 50 Litre, 50 Litre - 100 Litre, Above 100 Litre |

By Manufacturing Process | Blow Molding, Injection Molding, Rotational Molding |

By End-Use Industry | Food & Beverage, Pharmaceuticals & Healthcare, Household & Industrial Chemicals, Personal Care & Cosmetics, Agriculture, Industrial Applications, Other Industries |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Proliferation of Applications Across Diverse Industries

HDPE’s adaptability allows it to serve a broad spectrum of end-use industries, from packaging to infrastructure. The modern industrial landscape is experiencing dynamic shifts, and HDPE is central to solutions such as rigid packaging, pressure pipes, corrosion-resistant tanks, and consumer products. The surge in demand for sustainable packaging, the need for durable and reliable plumbing and gas distribution systems, and robust demand from the automotive and industrial sectors are accelerating HDPE adoption. The material’s excellent properties and processability allow it to seamlessly integrate into blow molding, injection molding, extrusion, and other advanced manufacturing methods, enabling enterprises to meet industry-specific challenges efficiently and cost-effectively.

Widespread Adoption of Sustainable Packaging Solutions

The packaging industry represents the largest consumer of HDPE, primarily driven by the growth of rigid packaging solutions like bottles and containers for milk, water, and detergents. Increasing consumer awareness around packaging sustainability, coupled with stringent government regulations on plastic use and waste management, has catalyzed innovations in recyclable HDPE formulations. Enterprises are transitioning towards circular economy models, emphasizing the use of recycled HDPE materials (rHDPE) and developing energy-efficient processing technologies. These trends enable companies to reduce costs, enhance brand reputation, and meet evolving compliance requirements.

Segmentation Analysis

The global High-Density Polyethylene (HDPE) Containers market is segmented based on container type, capacity, manufacturing process, end-use industry, and region.

Dominating Segment: Blow-Molded Products Driving Packaging Applications

Blow-molded products, particularly bottles and containers, constitute the largest segment of the HDPE market. Their strength, lightness, and excellent moisture barrier properties make them highly suitable for packaging applications in the food & beverage, pharmaceutical, and household chemicals industries. The efficiency of blow molding processes optimizes throughput and reduces operational costs. The consistent global demand for packaged goods and beverages has further reinforced this segment’s dominance.

Geographical Penetration

Asia Pacific's Rapid Industrialization and Infrastructure Demand

Asia Pacific (APAC) is poised to be the fastest-growing region for HDPE demand, driven by significant industrial growth, urbanization, and massive investments in infrastructure. China leads the region with massive investments in construction and packaging industries, with domestic players like Sinopec and PetroChina expanding capacity. India is rapidly adopting HDPE in packaging (for FMCG products), agriculture (irrigation pipes), and water management, fueled by programs like "Make in India" and "Smart Cities Mission." Southeast Asia’s expanding manufacturing and construction base is also propelling regional growth.

India High-Density Polyethylene (HDPE) Containers Market Outlook

India represents one of the fastest-growing markets globally due to its expanding industrial base, significant population growth, and increased consumption of packaged goods. The infrastructure sector is leveraging HDPE pipes for water and gas distribution, while packaging applications continue to expand in the FMCG and dairy industries. Domestic producers and a robust network of distributors further support market momentum, while environmental regulations encourage the shift towards sustainable and recycled HDPE usage.

China High-Density Polyethylene (HDPE) Containers Market Trends

China dominates the APAC HDPE market, with strong policy support for polymer industry advancement and infrastructure development. Government regulations aimed at improving water conservation and reducing plastic waste are reshaping the competitive landscape, pushing innovation towards high-performance and environmentally-friendly HDPE products. Leading domestic producers are advancing R&D to develop specialized HDPE grades, catering to both local and export markets. The focus remains on applications in piping, packaging, and industrial containers.

North America's Market Leadership and Technological Advancements

North America holds a significant market share in the HDPE industry, underpinned by mature industrial applications, high automation levels, and advanced recycling infrastructure. The U.S. is the largest regional contributor, driven by strong demand in packaging, pipe applications, and consumer goods. Technological advancements focus on enhancing material properties and process efficiencies, especially in sustainable product development. Canada contributes through innovations in green polymers and niche applications in the industrial and construction sectors.

United States High-Density Polyethylene (HDPE) Containers Market Insights

The United States is one of the most mature and advanced markets for HDPE, driven by its large-scale industrial base, advanced manufacturing infrastructure, and high consumer demand, particularly in the packaging and construction sectors. Strong demand from the beverage industry for bottles, as well as significant applications in pipe systems for municipal projects, propel market growth. Moreover, increasing regulatory focus on recycling and use of recycled content is driving innovation in rHDPE applications. The U.S. market accounts for a significant share of the North American HDPE market, supported by the presence of key industry players and strategic manufacturing investments.

Canada High-Density Polyethylene (HDPE) Containers Industry Growth

Canada represents a stable segment of the North American HDPE market, supported by rising demand in packaging and construction applications, particularly for pipes and geomembranes. Increasing investments in sustainable infrastructure and environmental protection projects, coupled with technological innovation in recycling, boost market prospects. Canadian manufacturers are focusing on enhanced product differentiation through high-performance HDPE grades, driven by demand from resource industries and packaging applications.

Sustainability Analysis

High-Density Polyethylene (HDPE) plays a dual role in sustainability. It enables reduced material usage and longer-lasting product lifecycles in applications such as rigid packaging, pipes, and consumer goods. Its environmental footprint remains a concern due to challenges in recycling and disposal. Industry leaders are investing in chemical recycling technologies, developing biodegradable formulations, and implementing closed-loop supply chains. Governments globally are enforcing stricter regulations to promote sustainable practices, influencing industry players to accelerate eco-innovation strategies and reduce lifecycle carbon emissions.

Competitive Landscape

The HDPE market is highly competitive and consolidated, driven by leading global petrochemical companies striving for economies of scale, production efficiency, and geographic market expansion.

These players benefit from extensive global production networks, large-scale R&D investments, and strong distribution channels. They focus on developing advanced HDPE grades tailored for specific end-use sectors such as blow-molded containers, pressure pipes, and industrial applications.

Market players are innovating in bio-based HDPE variants and recyclable solutions, thereby enhancing sustainability credentials.

Strategic partnerships, capacity expansions, and technology innovation are core strategies employed to strengthen competitive positioning.

The focus on high-performance and differentiated HDPE products helps market leaders demonstrate superior ROI for industrial and packaging customers while complying with increasingly stringent environmental regulations.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares, and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies