Hereditary Angioedema (HAE) Market Size

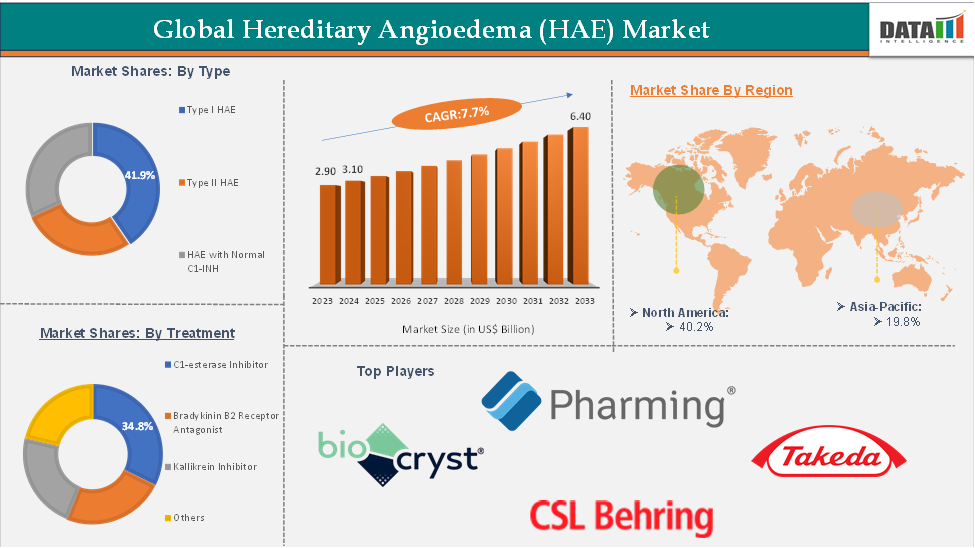

In 2023, the global hereditary angioedema (HAE) market was valued at US$ 3.10 Billion. The global Hereditary Angioedema (HAE) market size reached US$ 3.31 Billion in 2024 and is expected to reach US$ 6.40 Billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

Hereditary Angioedema (HAE) Market Overview

Hereditary angioedema (HAE) is a rare genetic disorder characterized by recurrent episodes of severe swelling in various parts of the body, including the limbs, face, gastrointestinal tract, and airway. The HAE treatment market is being driven by a rise in disease awareness, improved diagnostic rates, and the increasing availability of targeted therapies such as C1-inhibitor replacements, kallikrein inhibitors, and monoclonal antibodies.

The development of long-acting therapies, personalized medicine, and expanded access in underdeveloped markets creates huge opportunities for market growth. North America leads the global market due to its advanced healthcare systems, early diagnosis capabilities, and strong presence of key pharmaceutical players. Meanwhile, the Asia-Pacific region is witnessing the fastest growth, fueled by rising healthcare expenditure, growing awareness among physicians and patients, and increased regulatory support for rare disease treatments.

Hereditary Angioedema (HAE) Market Executive Summary

Hereditary Angioedema (HAE) Market Dynamics: Drivers, Restraints & Opportunities

Drivers:

The rising number of innovative treatment options is significantly driving the hereditary angioedema (HAE) market growth

The rising number of innovative treatment options is playing a pivotal role in driving the Hereditary Angioedema (HAE) market forward, as companies race to develop therapies that are not only more effective but also tailored to meet the evolving needs of patients. The HAE treatment landscape is shifting from traditional intravenous infusions to targeted therapies that address the underlying disease mechanisms with greater precision.

This surge in innovation is expanding both prophylactic and on-demand treatment choices, offering patients and clinicians a wider, more personalized range of options. For instance, in June 2025, CSL announced that the U.S. FDA approved ANDEMBRY (garadacimab-gxii), the first and only prophylactic treatment that targets factor XIIa, a key driver in HAE attacks. By inhibiting the top of the HAE cascade, this therapy marks a major advancement in preventing attacks before they start.

Companies are investing heavily in oral and patient-friendly therapies that can be self-administered, reducing dependence on healthcare facilities and improving the quality of life for those living with HAE. For instance, on June 13, 2025, KalVista Pharmaceuticals revealed that while the FDA has delayed its decision, the pending New Drug Application (NDA) for sebetralstat, an oral on-demand treatment for HAE, highlights the growing momentum toward more accessible and convenient treatment modalities. These developments underscore how therapeutic innovation is unlocking new treatments for market growth by improving patient outcomes and offering greater treatment flexibility.

Currently Approved Treatments

Increasing innovation in medication is significantly driving the hereditary angioedema (HAE) market growth

Increasing investments by pharmaceutical and biopharmaceutical companies are emerging as a key driver for the growth of the Hereditary Angioedema (HAE) market, as companies actively pursue innovative therapies and expand their presence in the rare disease space.

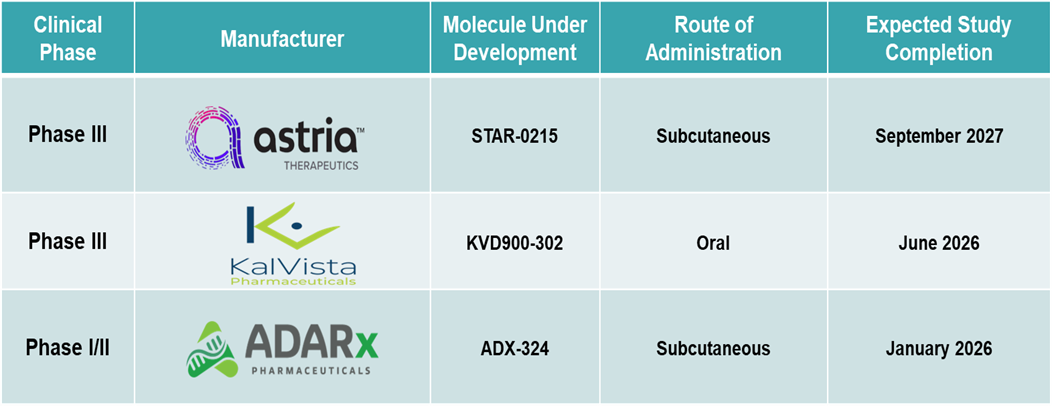

With the rising demand for more effective, convenient, and personalized treatment options, firms are ramping up R&D spending, entering strategic partnerships, and accelerating clinical trials for next-generation therapies. These investments are not only boosting the development pipeline but also improving access to advanced treatments across more regions and patient groups.

For instance, in December 2023, Ionis Pharmaceuticals entered into a licensing agreement with Otsuka Pharmaceutical, granting Otsuka exclusive rights to commercialize donidalorsen, an investigational prophylactic treatment for HAE, in Europe. This collaboration exemplifies how global players are joining forces to fast-track innovative therapies to market.

Similarly, in May 2025, BioCryst Pharmaceuticals announced that the FDA had accepted its New Drug Application for the expanded pediatric use of ORLADEYO, reflecting the company’s continued investment in broadening its treatment’s reach. These instances highlight how focused investment and collaboration are helping reshape the HAE treatment landscape and are expected to play a vital role in driving future market growth..

Restraint:

The high treatment costs are hampering the growth of the hereditary angioedema (HAE) market

The high cost of treatment is expected to significantly hamper the growth of the hereditary angioedema (HAE) market, particularly in low- and middle-income countries where access to advanced therapies remains limited. While newer treatments offer improved efficacy and patient convenience, their premium pricing often places them out of reach for many patients, even in developed markets, especially where reimbursement systems are fragmented or insufficient. This financial burden can lead to delayed treatment, reduced adherence, or complete inaccessibility, ultimately affecting disease outcomes and limiting market expansion.

For instance, according to a report by the Institute for Clinical and Economic Review (ICER), ICER’s updated health-benefit price benchmark (HBPB) range for Takhzyro is $218,900-$219,800 per year, which would require an approximate 53% discount off the treatment’s current US list price. Even after the discount, these high treatment expenses continue to challenge healthcare systems and pose a barrier to widespread adoption, thereby restraining the overall growth potential of the HAE market.

Opportunity:

Emergence of long-acting and more convenient treatment options is expected to create a lucrative opportunity for the growth of the hereditary angioedema (HAE) market

The emergence of long-acting and more convenient treatment options is expected to create a significant opportunity for growth in the hereditary angioedema (HAE) market by addressing one of the most persistent challenges in chronic disease management. Traditional HAE therapies often require frequent intravenous administration or complex dosing schedules, which can interfere with patients’ daily lives and impact adherence.

The introduction of long-acting subcutaneous therapies and oral options is transforming this landscape by offering greater convenience, improved quality of life, and more consistent disease control. These next-generation treatments reduce the frequency of administration and allow patients to manage their condition more independently, which is increasingly valued by both patients and healthcare providers.

As demand shifts toward therapies that are not only effective but also patient-centric, companies developing easy-to-use, long-duration treatments are well-positioned to tap into a growing market segment and drive adoption across global regions.

Pipeline Analysis:

For more details on this report – Request for Sample

Hereditary Angioedema (HAE) Market, Segment Analysis

The global hereditary angioedema (HAE) market is segmented based on type, treatment, route of administration, and region.

The minoxidil from the treatment type segment is expected to hold 27% of the market share in 2024 in the Hereditary Angioedema (HAE) market

The C1-esterase inhibitor segment is currently the dominant segment in the Hereditary Angioedema (HAE) market. This dominance is due to its established efficacy, widespread clinical use for both on-demand and prophylactic treatment, and its early approval history compared to newer therapies.

C1-esterase inhibitors such as Cinryze, Berinert, and Haegarda have long been considered the gold standard in HAE management. Their proven ability to reduce the frequency and severity of HAE attacks, combined with physician familiarity and robust clinical data, has secured their leading position in the market.

Additionally, the availability of both plasma-derived and recombinant forms of C1-esterase inhibitors has improved access and reduced the risk of supply disruptions, further reinforcing their dominance. Products like Cinryze and Haegarda, which are approved for routine prophylaxis, offer the advantage of regular prevention of attacks, while Berinert remains a go-to option for on-demand treatment. These therapies have been in the market longer than most alternatives, giving them the first-mover advantage, which continues to influence physician preference and treatment protocols.

Hereditary Angioedema (HAE) Market, Geographical Analysis

North America is expected to dominate the global Hereditary Angioedema (HAE) market with a 39.5% share in 2024

North America is expected to maintain its dominant position in the Hereditary Angioedema (HAE) market due to its strong regulatory framework, rapid adoption of novel therapies, and robust investment in rare disease research. The region benefits from well-established healthcare infrastructure, favorable reimbursement policies, and a high level of awareness among both healthcare professionals and patients, all of which support early diagnosis and treatment.

Additionally, pharmaceutical companies continue to prioritize the U.S. as a launch market for innovative HAE therapies, further solidifying its leadership in the global landscape. For instance, in February 2023, Takeda received FDA approval for the expanded use of TAKHZYRO (lanadelumab-flyo) for prophylaxis in children under 12, reinforcing the region's commitment to advancing care across age groups.

Also, in December 2023, Ionis Pharmaceuticals licensed donidalorsen to Otsuka for commercialization in Europe, while retaining global development control. These developments highlight that North America continues to lead in HAE treatment, supported by early regulatory approvals and a dynamic biopharmaceutical ecosystem.

Asia-Pacific is growing at the fastest pace in the Hereditary Angioedema (HAE) market, holding 20.8% of the market share

Asia-Pacific is witnessing the fastest growth in the Hereditary Angioedema (HAE) market, driven by increasing awareness of rare genetic conditions, enhanced diagnostic capabilities, and expanding access to specialized treatments. Countries across the region are strengthening their healthcare frameworks, with growing support for rare disease identification and management. Improved availability of genetic testing, particularly in urban centers, is helping clinicians accurately diagnose HAE.

Hereditary Angioedema (HAE) Market Competitive Landscape

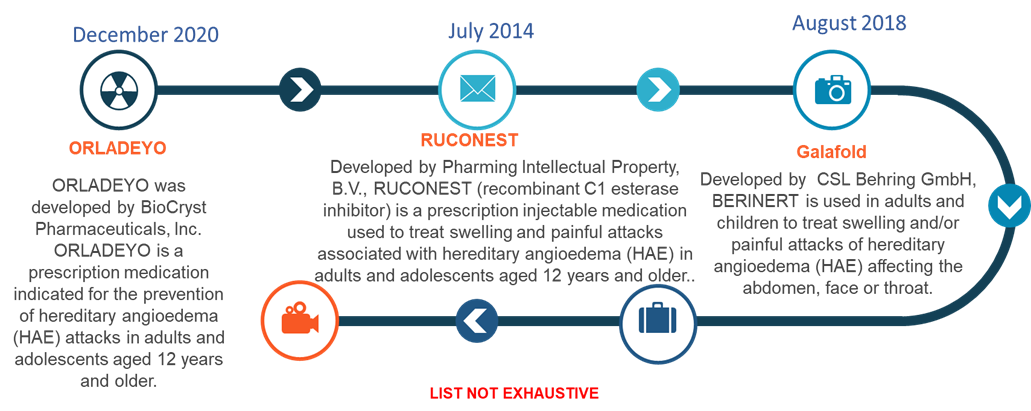

Top companies in the hereditary angioedema (HAE) market include Pharming Intellectual Property, B.V., CSL Behring GmbH, Takeda Pharmaceutical Company Limited, BioCryst Pharmaceuticals, Inc., among others.

Hereditary Angioedema (HAE) Market Key Developments

In June 2025, BioCryst Pharmaceuticals, Inc. announced that Colombia’s National Institute of Drug and Food Surveillance (INVIMA) has approved ORLADEYO (berotralstat), an oral, once-daily treatment, for the prevention of hereditary angioedema (HAE) attacks in both adults and pediatric patients aged 12 years and older.

Hereditary Angioedema (HAE) Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Type I HAE, Type II HAE, HAE with Normal C1-INH |

Treatment | C1-esterase Inhibitor, Bradykinin B2 Receptor Antagonist, Kallikrein Inhibitor, Others | |

Route of Administration | Intravenous, Subcutaneous, Oral | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global hereditary angioedema (HAE) market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.