Global Hepatitis B and C Therapeutics Market Size & Industry Outlook

The global hepatitis B and C therapeutics market size reached US$ 17.02 billion in 2024 is expected to reach US$ 20.83 billion by 2033, growing at a CAGR of 3.4% during the forecast period 2025-2033. Governments and health organizations worldwide are increasingly prioritizing early diagnosis and large-scale screening for Hepatitis B and C, which is significantly driving therapeutic demand. According to the World Health Organization (WHO), more than 350 million people globally live with chronic hepatitis infections, and many remain undiagnosed until advanced stages.

To address this, initiatives such as the WHO Global Health Sector Strategy on Viral Hepatitis (2022–2030) and national programs like India’s National Viral Hepatitis Control Program and the U.S. CDC Hepatitis Elimination Plan aim to identify and treat patients earlier. These initiatives boost demand for antiviral drugs, vaccines, and curative therapies.

Moreover, public-private collaborations for instance partnerships between Gilead Sciences and local governments to expand access to sofosbuvir-based treatments further accelerate market adoption. As awareness and screening improve, more patients are diagnosed and enrolled in treatment programs, directly supporting market growth.

Key Highlights

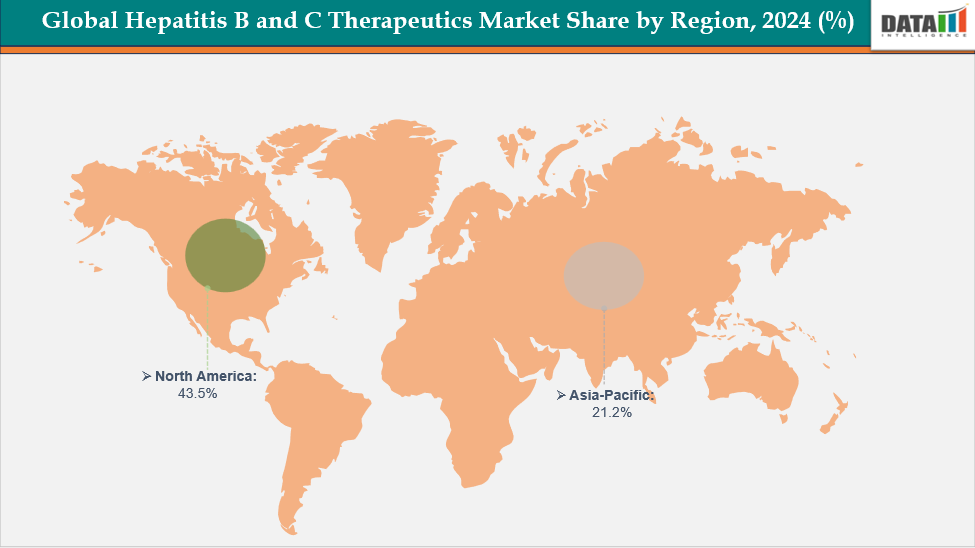

- North America dominates the hepatitis B and C therapeutics market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

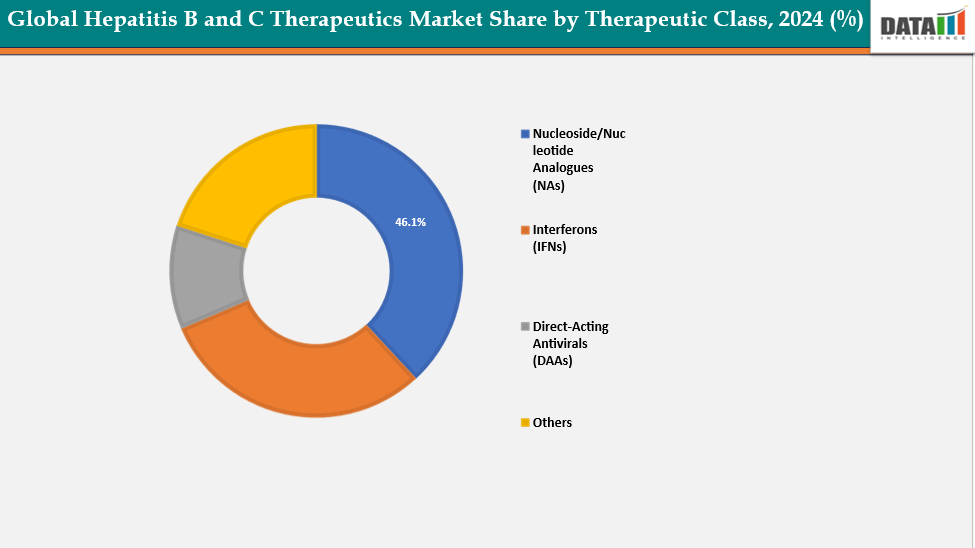

- Based on Therapeutic class Nucleoside/Nucleotide Analogues (NAs) segment led the market with the largest revenue share of 46.1% in 2024.

- The major market players in the Hepatitis B and C Therapeutics Gilead Sciences, Inc, AbbVie Inc., Bristol-Myers Squibb Company, Merck & Co., Inc., Johnson & Johnson, Roche Holding AG, Dynavax Technologies Corporation, VBI Vaccines and among others.

Market Dynamics

Drivers: Rising Global Disease Burden Driving the Global Hepatitis B and C Therapeutics Market Growth

The growing global prevalence of chronic Hepatitis B and C infections is one of the most significant drivers fueling demand in the therapeutics market.

According to the World Health Organization (WHO), approximately 254 million people worldwide are living with chronic Hepatitis B, and nearly 50 million with chronic Hepatitis C, with millions of new infections reported annually. Regions such as Asia-Pacific and Sub-Saharan Africa account for over 70% of global Hepatitis B cases, primarily due to inadequate vaccination coverage, unsafe medical practices, and limited access to screening.

Meanwhile, in countries like the United States and Europe, increasing cases linked to intravenous drug use and blood transfusion-related transmission have sustained the disease burden. This growing patient pool has driven the need for effective antiviral therapies, combination regimens, and curative pipeline candidates. Consequently, pharmaceutical companies and governments are investing heavily in research, treatment infrastructure, and vaccination programs, thereby strengthening the overall growth of the Hepatitis B and C therapeutics market.

Restraints: High Treatment Costs and Limited Access are hampering the growth of the Global Hepatitis B and C Therapeutics market

High treatment costs of branded antiviral therapies for Hepatitis B and C severely limit access in low- and middle-income countries. A 12-week sofosbuvir-based therapy can range from USD 25,000 to USD 90,000 in developed markets, while chronic Hepatitis B treatments cost between USD 300 and USD 1,200 per year. Although generic versions are cheaper in emerging regions, their availability is hindered by regulatory and distribution issues. These factors, coupled with limited healthcare reimbursement and infrastructure, restrict patient access and delay treatment initiation, negatively impacting market growth in Asia and Africa.

For more details on this report – Request for Sample

Global Hepatitis B and C Therapeutics Market, Segment Analysis

The global Hepatitis B and C Therapeutics market is segmented based on therapeutic class, indication, route of administration, distribution channel and region.

Therapeutic Class: The Nucleoside/Nucleotide Analogues (NAs) segment from Therapeutic Class Segment to Dominate the Global Hepatitis B and C Therapeutics market with a 46.1% share in 2024

The Nucleoside/Nucleotide Analogues (NAs) segment holds a significant share of the Hepatitis B therapeutics market and continues to expand due to their high antiviral efficacy and long-term viral suppression capabilities. Drugs such as Tenofovir disoproxil fumarate (TDF), Tenofovir alafenamide (TAF), and Entecavir remain the standard of care for chronic Hepatitis B management, effectively reducing viral replication and preventing liver disease progression. Their proven safety profile, once-daily oral administration, and availability of affordable generic versions in emerging markets further enhance patient adherence.

For instance, in March 2024, Gilead Sciences, Inc. announced FDA approval for the supplemental new drug application for Vemlidy (tenofovir alafenamide) 25 mg tablets, indicating its use as a once-daily treatment for chronic hepatitis B virus infection in pediatric patients aged six years and older, weighing at least 25 kg, with compensated liver disease.

Route of Administration: The oral segment is estimated to have a 54.1% of the Global Hepatitis B and C Therapeutics market share in 2024

The oral segment leads the global Hepatitis B and C therapeutics market due to high patient compliance, ease of administration, and a lower treatment burden compared to injectables. Oral antivirals like sofosbuvir, tenofovir, entecavir, and daclatasvir have transformed hepatitis treatment, achieving over 90% sustained virologic response rates in Hepatitis C patients. The growth of generic manufacturing in countries like India and China has made these therapies more accessible. The transition from injectable interferons to oral direct-acting antivirals aligns with global elimination initiatives and patient preferences, positioning the oral route as the fastest-growing market segment.

Global Hepatitis B and C Therapeutics Market - Geographical Analysis

North America dominates the Global Hepatitis B and C Therapeutics market with a 43.5% in 2024

The North American market is driven by the high prevalence of Hepatitis C infections, strong healthcare infrastructure, and favorable reimbursement systems. Widespread availability of advanced direct-acting antivirals (DAAs) such as sofosbuvir and ledipasvir has significantly improved treatment outcomes and cure rates. In the United States, market growth is primarily fueled by strong government initiatives, insurance coverage, and adoption of curative DAA regimens. The CDC’s National Viral Hepatitis Action Plan and the U.S. Department of Health’s Hepatitis Elimination Strategy emphasize early screening, linkage to care, and universal vaccination for Hepatitis B.

For instance, in August 2025, Precision BioSciences, Inc. announced results from the ELIMINATE-B trial as of July 28, 2025. The trial investigates PBGENE-HBV for chronic hepatitis B patients, featuring completed Cohort 1 at a dose of 0.2 mg/kg and initial safety data from Cohort 2 at 0.4 mg/kg. The study aims to evaluate multiple ascending dose levels with three administrations per level for HBeAg-negative patients currently on nucleos(t)ide analog therapies.

Europe is the second region after North America which is expected to dominate the Global Hepatitis B and C Therapeutics market with a 34.5% in 2024

The European market is supported by government-backed hepatitis elimination programs, universal healthcare systems, and increasing treatment coverage. The European Association for the Study of the Liver (EASL) has set comprehensive guidelines that encourage early antiviral therapy initiation and long-term patient monitoring. Furthermore, pharmaceutical collaborations and public funding across countries like France, Italy, and the U.K. have improved screening rates and expanded patient access to antivirals.

Germany plays a pivotal role in the European hepatitis therapeutics market due to its strong reimbursement policies, early adoption of innovative treatments, and robust pharmaceutical infrastructure. The German government actively supports nationwide screening and vaccination programs, particularly for high-risk populations.

For instance, in July 2025, TherVacB, a new therapeutic vaccine for chronic hepatitis B, has commenced its first clinical trial in patients after a successful phase IA trial in healthy volunteers. Developed by Helmholtz Munich in collaboration with the German Center for Infection Research (DZIF), the vaccine showed a favorable safety profile and triggered immune responses. The multi-center phase Ib/IIa trial began with the enrollment of the first patient in June 2025.

The Asia Pacific region is the fastest-growing region in the Global Hepatitis B and C Therapeutics market, with a CAGR of 8.1% in 2024

The Asia-Pacific region represents the largest patient pool for Hepatitis B and C infections, especially in China, India, and Southeast Asia, making it a major growth driver globally. Rising awareness, expanding vaccination programs, and government-supported hepatitis elimination targets are key growth factors.

In Japan, the market is driven by high healthcare standards, early diagnosis programs, and a strong focus on hepatitis elimination through government policy. Japan’s Ministry of Health has implemented nationwide screening for HBV and HCV and provides reimbursement coverage for antiviral therapies under the national health insurance system. The country has also been a leader in adopting interferon-free DAA regimens, significantly reducing the HCV burden.

For instance, in August 2024, GSK plc announced that the Japanese Ministry of Health has granted SENKU designation for bepirovirsen, an investigational antisense oligonucleotide for chronic hepatitis B treatment. This designation is based on innovation, disease severity, and efficacy, aiming to enhance early patient access to innovative medicines via an expedited review process for serious conditions.

Global Hepatitis B and C Therapeutics Market Competitive Landscape

Top companies in the global hepatitis B and C therapeutics market Gilead Sciences, Inc, AbbVie Inc., Bristol-Myers Squibb Company, Merck & Co., Inc, Johnson & Johnson, Roche Holding AG, Dynavax Technologies Corporation, VBI Vaccines and among others.

Gilead Sciences:- Gilead Sciences, Inc. is a leading player and market pioneer in the global Hepatitis B and C therapeutics segment, holding a dominant position through its innovative antiviral portfolio and extensive global reach. The company revolutionized Hepatitis C treatment with the launch of Sovaldi (sofosbuvir) in 2013, followed by Harvoni (ledipasvir/sofosbuvir), Epclusa (sofosbuvir/velpatasvir), and Vosevi (sofosbuvir/velpatasvir/voxilaprevir) all of which achieved sustained virologic response (SVR) rates above 95%, effectively offering a cure for HCV infection. These therapies not only replaced older interferon-based regimens but also set new standards for short-duration, high-efficacy, and well-tolerated oral treatments.

Market Scope

| Metrics | Details | |

| CAGR | 3.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Therapeutic Class | Nucleoside/Nucleotide Analogues (NAs), Interferons (IFNs), Direct-Acting Antivirals (DAAs), Others |

| Indication | Hepatitis B (HBV), Hepatitis C (HCV) | |

| Route of Administration | Oral, Injectable | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The Global Hepatitis B and C Therapeutics market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

For more pharmaceuticals-related reports, please click here