HbA1c Testing Device Market Size and Overview

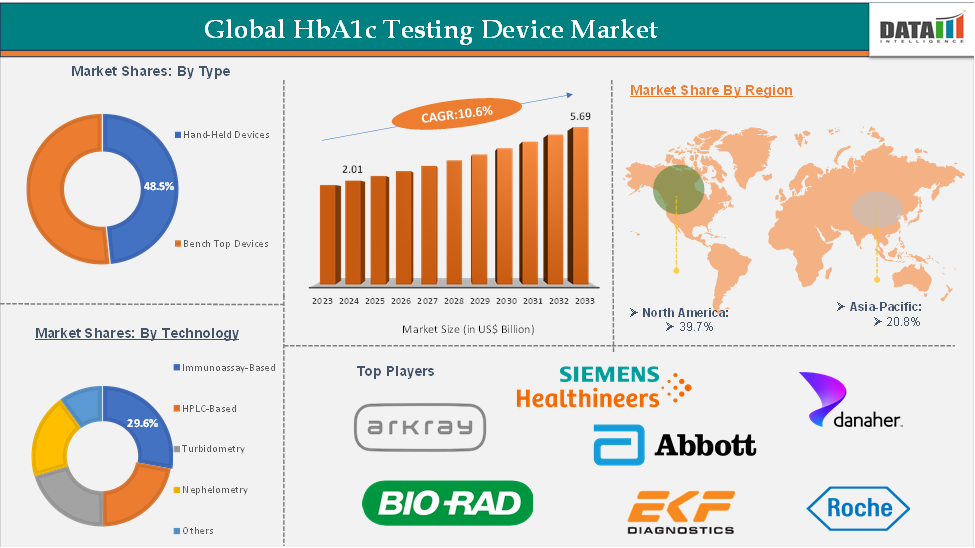

HbA1c Testing Device Market size reached US$ 2.01 Billion in 2024 and is expected to reach US$ 5.69 Billion by 2033, growing at a CAGR of 10.6% during the forecast period 2025-2033.

The HbA1c testing device market is experiencing steady growth driven by the rising global prevalence of diabetes and increasing awareness of the importance of glycemic control in diabetes management. HbA1c testing, which provides a reliable measure of average blood glucose levels over the past two to three months, is critical for diagnosing and monitoring diabetes. The market growth is supported by technological advancements in testing devices, including point-of-care (POC) systems that offer quick, accurate results and improved patient compliance.

Additionally, rising healthcare expenditure, growing geriatric populations, and increasing adoption of home-based testing solutions contribute to market expansion. North America currently dominates the market due to established healthcare infrastructure and high awareness levels, while the Asia-Pacific region is poised for rapid growth due to increasing diabetes prevalence and improving healthcare access.

Executive Summary

For more details on this report – Request for Sample

HbA1c Testing Device Market Dynamics: Drivers & Restraints

Rising prevalence of diabetes is expected to drive the HbA1c testing device market significantly

The rising prevalence of diabetes is expected to be a key driver of the HbA1c testing device market, as it directly increases the demand for reliable and long-term blood glucose monitoring tools. HbA1c testing, which reflects average blood glucose levels over the past 2–3 months, is critical to diabetes management and diagnosis.

By 2050, the International Diabetes Federation (IDF) projects that approximately 1 in 8 adults will be living with diabetes, marking a 46% increase from current levels. About 589 million adults aged 20 to 79 already have diabetes, with over 90% affected by type 2 diabetes, which is primarily influenced by socio-economic, demographic, environmental, and genetic factors.

Notably, more than 81% of adults with diabetes reside in low- and middle-income countries. This rising global burden of diabetes is expected to significantly drive the demand for HbA1c testing devices, which are essential for the long-term monitoring and management of blood glucose levels. As healthcare systems increasingly prioritize early detection and continuous monitoring of diabetes, the market for HbA1c testing devices is poised for substantial growth, particularly in emerging economies where the prevalence is climbing rapidly.

High cost of devices and testing is expected to hinder the HbA1c testing device market

The high cost of HbA1c testing devices and associated consumables is a significant restraint that can hinder the growth of the market, particularly in low- and middle-income countries. Advanced point-of-care (POC) testing devices, while convenient and time-saving, often come with a substantial upfront investment and recurring costs for test cartridges and maintenance. This can limit their accessibility in resource-constrained healthcare settings and among lower-income patient populations. As a result, while the clinical need for HbA1c testing is rising, cost-related barriers remain.

HbA1c Testing Device Market Segment Analysis

The global HbA1c testing device market is segmented based on type, technology, modality, end-user, and region.

Technology:

The immunoassay-based segment is expected to hold 29.6% of the market share in 2024 in the HbA1c testing device market

Immunoassay-based HbA1c testing devices are expected to dominate the HbA1c testing device market due to their high accuracy, widespread clinical adoption, and compatibility with automated laboratory systems. These devices use antigen-antibody reactions to detect glycated hemoglobin and are particularly valued for their specificity, reproducibility, and ability to process high volumes of samples quickly.

Hospitals, diagnostic laboratories, and even some point-of-care (POC) settings rely heavily on immunoassay-based systems because they deliver consistent and reliable results that align with global diabetes management guidelines, including those from the American Diabetes Association (ADA) and International Federation of Clinical Chemistry (IFCC).

Additionally, technological advancements in immunoassay platforms have made them more efficient and user-friendly. Leading global diagnostics manufacturers such as Abbott, Siemens Healthineers, and Roche offer immunoassay-based HbA1c analyzers that are already widely deployed, further reinforcing their market share. These systems are also cost-effective in high-throughput environments, making them a preferred choice for centralized labs and national health screening programs. As demand for diabetes screening rises the immunoassay-based segment is projected to remain the dominant technology in the HbA1c testing device market for the foreseeable future.

HbA1c Testing Device Market Geographical Analysis

North America is expected to hold 39.7% of the market share in 2024 in the global HbA1c testing device market with the highest market share

North America is expected to dominate the HbA1c testing device market due to a combination of high diabetes prevalence, strong healthcare infrastructure, widespread adoption of advanced diagnostic technologies, and supportive regulatory frameworks. According to the Centers for Disease Control and Prevention (CDC), over 38 million people in the United States had diabetes as of 2023, with millions more at risk of developing the condition. This substantial patient base drives continuous demand for effective monitoring tools like HbA1c tests.

The region benefits from early adoption of point-of-care and home-based HbA1c testing devices, particularly in response to rising awareness around proactive diabetes management. Additionally, favorable reimbursement policies from Medicare, Medicaid, and private insurers further encourage regular HbA1c testing, making it more accessible to patients.

North America is also home to major players in the diagnostics industry, such as Abbott, Bio-Rad, and Danaher, who continuously invest in R&D and product innovation. The presence of well-equipped laboratories, trained personnel, and a tech-savvy population supports both centralized and decentralized testing models.

Furthermore, government initiatives like the CDC’s National Diabetes Prevention Program and frequent health screenings in clinical and workplace settings continue to push demand for reliable HbA1c monitoring. As a result, North America is expected to retain a leading share in the global HbA1c testing device market throughout the forecast period.

Asia-Pacific is expected to hold 20.8% of the global HbA1c testing device market share in 2024

The Asia-Pacific region is experiencing the fastest growth in the HbA1c testing device market, driven by a rapid rise in diabetes prevalence, increasing healthcare awareness, and expanding access to diagnostic services. Countries such as China, India, and Southeast Asian nations are witnessing significant lifestyle and dietary shifts, urbanization, and aging populations. According to the World Health Organization (WHO), India is facing a significant public health challenge with an estimated 77 million adults over the age of 18 currently living with type 2 diabetes.

In addition, approximately 25 million individuals are classified as prediabetic, placing them at high risk of developing diabetes shortly. This growing burden is driven by a combination of factors, including sedentary lifestyles, unhealthy dietary habits, urbanization, and genetic predisposition. The WHO emphasizes the urgent need for preventive strategies, early diagnosis, and effective long-term management to curb the diabetes epidemic in India. As a result, there is a rising demand for reliable diagnostic tools like HbA1c testing devices, which are essential for monitoring blood glucose levels and managing the disease more effectively.

HbA1c Testing Device Market Top Companies

Top companies in the HbA1c testing device market include Bio-Rad Laboratories, Inc., Abbott, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Danaher Corporation, EKF Diagnostics Holdings PLC, Arkray, Inc., Trinity Biotech plc, Polymer Technology Systems, Inc., Transasia Biomedicals Ltd, among others.

HbA1c Testing Device Market Scope

Metrics | Details | |

CAGR | 10.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Hand-Held Devices, Bench Top Devices |

Technology | Immunoassay Based, HPLC Based, Turbidometry, Nephelometry, Others | |

| Modality | Laboratory-Based, Point-of-Care |

| End-User | Hospitals, Diagnostic Labs, Homecare, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global HbA1c testing device market report delivers a detailed analysis with 68 key tables, more than 61 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.