Hard Seltzer Market Overview

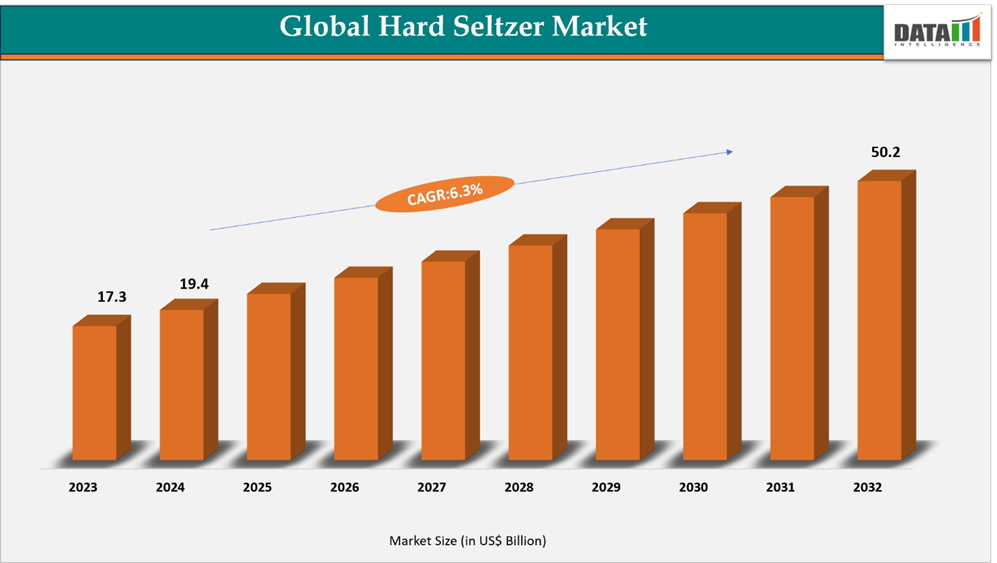

The global hard seltzer market reached US$17.3 billion in 2023, rising to US$19.4 billion in 2024 and is expected to reach US$50.2 billion by 2032, growing at a CAGR of 6.3% from 2025 to 2032.

The global hard seltzer market is experiencing strong growth, fueled by increasing consumer preference for low-calorie, low-sugar, and health-conscious alcoholic beverages. As more consumers adopt wellness-focused lifestyles, hard seltzers are emerging as a popular alternative to traditional beers, wines, and ready-to-drink cocktails.

With a wide variety of flavors, convenient packaging, and lower alcohol content, these beverages appeal especially to millennials and Gen Z, who favor innovative, clean-label, and functional drink options.

Investment in product innovation, marketing, and expanded distribution channels continues to rise, driven by both established beverage giants and emerging craft brands. As hard seltzers become more accessible through supermarkets, convenience stores, e-commerce platforms, and on-premise venues, the segment is rapidly gaining traction within the global alcoholic beverage market.

Hard Seltzer Market Industry Trends and Strategic Insights

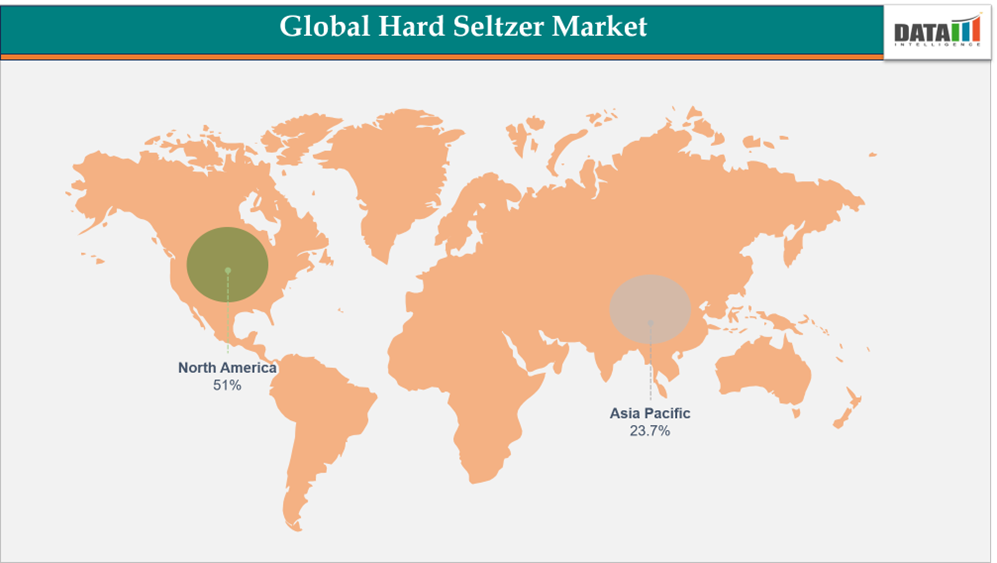

- North America leads the global hard seltzer market, capturing the largest revenue share of 51% in 2024.

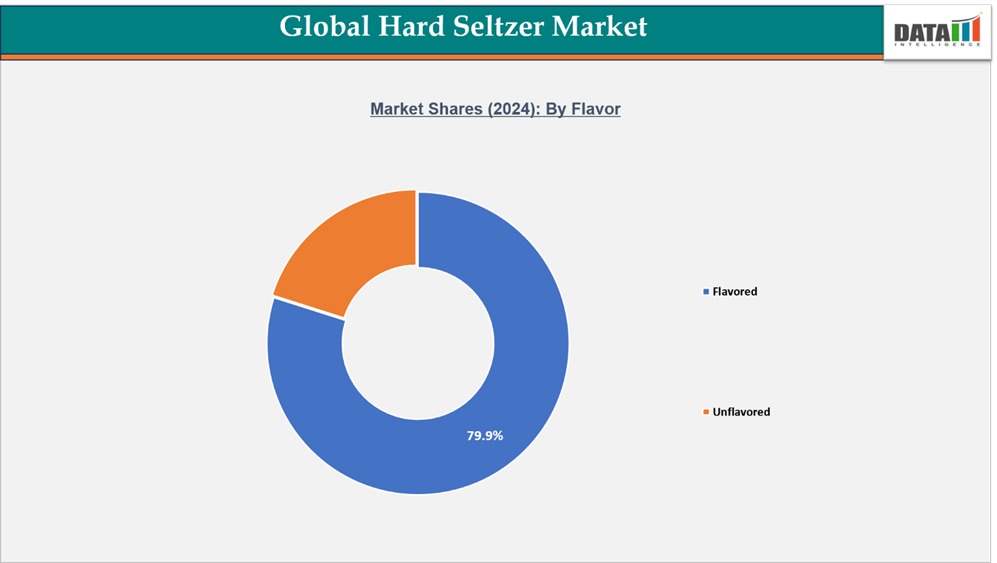

- By Flavor segment, Flavored led the global hard seltzer market, capturing the largest revenue share of 79.9% in 2024.

Global Hard Seltzer Market Size and Future Outlook

- 2024 Market Size: US$19.4 billion

- 2032 Projected Market Size: US$50.2 billion

- CAGR (2025–2032): 6.3%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By ABV (Alcohol by Volume) | ≤4.5%, 4.5%-6%, 6%-8%, >8% |

| By Packaging | Metal Cans, Glass Bottles, Other Packaging |

| By Flavor | Flavored, Unflavored |

| By Distribution Channel | On-Trade, Off-Trade |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand for Low-Calorie & Health-Forward Alcoholic Beverages

One of the key forces driving the global hard seltzer market is the growing consumer preference for healthier alcoholic options. Today’s drinkers are increasingly aware of calorie intake, sugar content, and overall wellness, pushing them to seek alternatives to traditional beers, sweet cocktails, and high-calorie RTD beverages. Hard seltzers meet this demand by offering a refreshing, flavorful, and low-calorie choice that fits well with active, wellness-oriented lifestyles.

Much of the category’s appeal lies in its clean-label positioning, often low in carbs, gluten-free, and made with natural fruit flavors. Consumers, especially millennials and Gen Z, are gravitating toward drinks that feel lighter, more natural, and better aligned with their health values, without giving up flavor or social enjoyment.

This shift is evident even in emerging markets like India. In 2023, Spyk Hard Seltzer became the country’s first brewed hard seltzer brand and expanded from Bengaluru to Hyderabad. Spyk offers a low-calorie, low-carb beverage made with 100% natural fruit flavors and a balanced 5.5% ABV. Unlike carbonated cocktail mixes, it is freshly brewed, resulting in a crisp, clean, and guilt-free drinking experience. This reflects how health-focused alcohol trends are spreading globally, not just in Western markets.

As more consumers prioritize mindful drinking and clean lifestyles, the demand for low-sugar, low-calorie alcoholic beverages will continue to fuel the growth of hard seltzers worldwide. This health-driven shift is expected to remain one of the most powerful growth drivers for the category in the years ahead.

Segmentation Analysis

The global hard seltzer market is segmented based on ABV (Alcohol by Volume), packaging, flavor, distribution channel and region.

Flavored Segment Leads Market Growth

The flavored segment dominates the global hard seltzer market, driven by strong consumer demand for refreshing, fruit-forward beverages with fewer calories and less sugar. Flavor innovation, including tropical, botanical, and cocktail-inspired profiles, helps brands differentiate and engage consumers through variety packs, seasonal releases, and region-specific offerings. In 2024, products like Topo Chico’s Ranch Water Hard Seltzer showcased how regionally inspired flavors boost market growth. Flavored hard seltzers perform well across retail and on-premise channels, making flavor the key driver of ongoing market expansion.

Unflavored Segment Maintains Core Consumer Base

The unflavored segment supports market stability by catering to consumers who prefer a simple, versatile, and mixable beverage option. Unflavored hard seltzers are popular among health-conscious and low-calorie drinkers, as well as for use in cocktails and mixed drinks. Growth is supported by rising adoption in bars, restaurants, and social events, where unflavored options provide flexibility for customization. With consistent demand for clean, minimal-ingredient beverages, the unflavored segment remains essential to the overall hard seltzer market, ensuring accessibility, functionality, and steady revenue streams for brands worldwide.

Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Hard Seltzer Market

The global hard seltzer market is expanding rapidly, driven by increasing consumer demand for low-calorie, flavored alcoholic beverages, rising health and wellness trends, and the popularity of on-the-go, convenient drink options. Major investments in product innovation, marketing, and distribution are enabling brands to reach a wider audience and capture new consumer segments.

US Hard Seltzer Market Outlook

The US remains the largest market for hard seltzers, fueled by strong adoption among millennials and Gen Z, who favor low-calorie, fruit-forward beverages. Flavor innovation, variety packs, and seasonal releases continue to attract consumers, while retail and on-premise channels support widespread availability.

In 2024, Dirty Water, the world’s first session hard seltzer, partnered with Throwing Fits hosts Lawrence Schlossman and James Harris to elevate the brand within NYC’s cultural and lifestyle scene. This reflects a broader trend of brands collaborating with influencers and cultural voices to enhance engagement and differentiate themselves in a highly competitive market.

Canada Hard Seltzer Market Trends

Canada is witnessing steady growth in the hard seltzer segment, supported by increasing health-conscious consumer behavior, expanding retail and e-commerce channels, and growing interest in naturally flavored and clean-label products. Craft and established brands are actively innovating in flavors and packaging, catering to regional preferences and social drinking occasions.

FASTEST GROWING MARKET:

Asia-Pacific Emerges as the Fastest-Growing Region in the Global Hard Seltzer Market

The global hard seltzer market is experiencing rapid growth, driven by increasing consumer adoption of low-calorie, flavored alcoholic beverages, rising health and wellness awareness, and the popularity of convenient, on-the-go drinking options. Expanding retail, e-commerce, and on-premise channels are accelerating accessibility and adoption across key markets.

In 2024, New Zealand hard seltzer brand Everyday Weekend highlighted that APAC consumer demand for affordability, convenience, and novelty is driving the growth of ready-to-drink (RTD) products in the region. This reflects the broader trend of consumers in Asia-Pacific seeking accessible, innovative beverage options that cater to modern lifestyles.

India Hard Seltzer Market Overview

India’s hard seltzer market is witnessing strong growth, supported by urbanization, rising disposable income, and changing consumer lifestyles. Increasing awareness of health-conscious alcoholic beverages, along with product innovation in flavors and packaging, is driving adoption in both retail and on-premise channels. Brands are experimenting with regional and exotic flavors to appeal to local tastes and enhance consumer engagement.

China Hard Seltzer Market Outlook

China is emerging as a key growth market, fueled by rising demand in metropolitan areas, expanding retail and e-commerce penetration, and increasing interest in low-calorie, refreshing alcoholic beverages. Collaboration between international and local beverage brands, coupled with seasonal and culturally inspired product launches, is helping expand market reach and consumer awareness.

Overall, Asia-Pacific is poised to remain the fastest-growing region in the global hard seltzer market, driven by rapid urbanization, evolving consumer preferences, and strategic investments in flavor innovation, distribution, and marketing initiatives.

Sustainability and ESG Analysis

Sustainability is becoming a key focus in the global hard seltzer market, shaping product innovation, corporate responsibility, and consumer choices. Brands are increasingly adopting environmentally friendly production processes, sustainable packaging, and responsible sourcing to reduce their ecological footprint and align with ESG standards.

In 2023, Passion Tree, an eco-conscious hard seltzer brand in Southern California, emerged as a sustainability leader with its award-winning beverages. Through a partnership with Eden Reforestation Projects, the company plants a tree for every case sold, supporting local communities and restoring deforested ecosystems. With more than 50,000 trees planted in Madagascar, Passion Tree sets a benchmark for environmental stewardship, showing how sustainability initiatives can positively impact both communities and the planet while resonating with eco-conscious consumers.

Overall, initiatives such as energy-efficient production, eco-friendly packaging, and reforestation projects enhance environmental accountability, bolster corporate reputation, and position hard seltzer brands to meet the growing expectations of socially and environmentally conscious consumers and investors worldwide.

Competitive Landscape

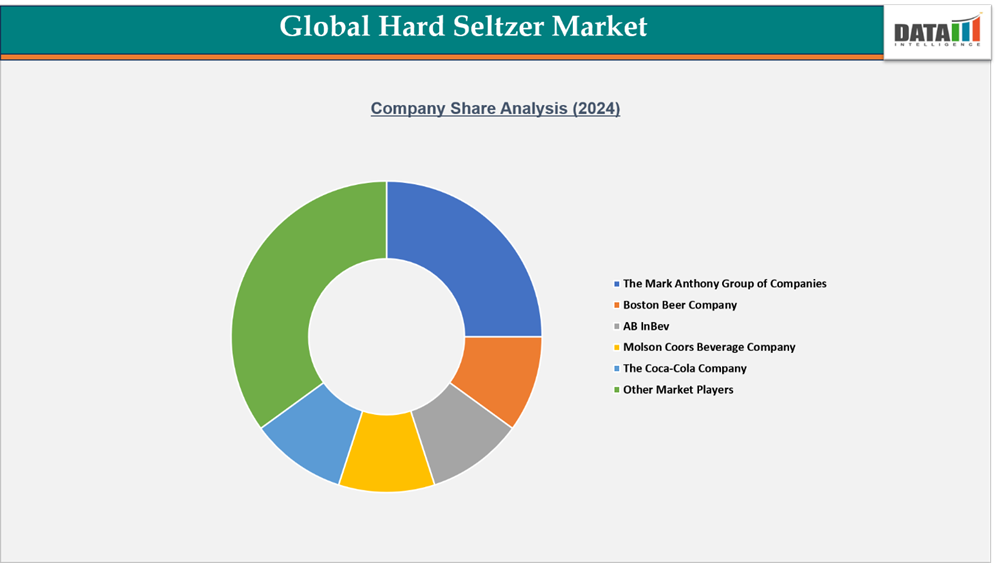

- The global hard seltzer market is intensely competitive, featuring both major multinational beverage companies and dynamic regional players. Top firms such as The Mark Anthony Group, Boston Beer Company, AB InBev, Molson Coors, The Coca‑Cola Company, Heineken N.V., Diageo, Constellation Brands, Carlsberg Breweries, and Kopparberg maintain strong positions through broad product portfolios, innovative flavors, and consistent investment in brand building and marketing.

- Many brands are expanding into emerging markets via strategic partnerships, local collaborations, and acquisitions. These efforts allow companies to scale production, introduce new flavors, and strengthen distribution across retail, e-commerce, and on-premise channels globally.

- Consumer demand for low-calorie, flavored, and health-oriented alcoholic beverages continues to drive market growth. Innovation in flavors, packaging formats, limited-edition releases, and sustainability initiatives, along with effective brand differentiation strategies, remain critical for companies to stay competitive and sustain long-term growth in the global hard seltzer market.

Investment & Funding Landscape

The global hard seltzer market continues to attract significant investor interest, with capital directed toward innovative beverage brands, flavor innovation, and market expansion initiatives.

In 2022, Ojai, California-based hard kombucha and hard seltzer maker Flying Embers closed a $20 million Series C funding round, led by global spirits giant Beam Suntory. This funding supports product innovation, brand growth, and expanded distribution, highlighting investor confidence in premium, health-conscious alcoholic beverages.

In 2025, Kalyan Hospitality, a leading hospitality group, announced a strategic investment in Happy Dad Seltzers, a fast-growing hard seltzer brand recognized for its bold flavors and innovative marketing. This partnership underscores Kalyan Hospitality’s commitment to diversifying its portfolio and aligning with brands that resonate with modern consumer preferences.

Overall, these investments reflect strong market confidence in the growth potential of hard seltzers, driven by consumer demand for flavorful, low-calorie, and lifestyle-oriented beverages, as well as the opportunity for strategic partnerships and brand expansion in global markets.

| Company | Investment/Funding | Year | Details | |

| Kalyan Hospitality | Investment | 2025 | Kalyan Hospitality, a leading hospitality group, announced a strategic investment in Happy Dad Seltzers, a fast-growing hard seltzer brand recognized for its bold flavors and innovative marketing. This partnership underscores Kalyan Hospitality’s commitment to diversifying its portfolio and aligning with brands that resonate with modern consumer preferences. | |

| Ojai | Funding | 2022 | Ojai, California-based hard kombucha and hard seltzer maker Flying Embers closed a $20 million Series C funding round, led by global spirits giant Beam Suntory. This funding supports product innovation, brand growth, and expanded distribution, highlighting investor confidence in premium, health-conscious alcoholic beverages. | |

What Sets This Global Hard Seltzer Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product ABV, packaging, flavor, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw packaging costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks affecting hard seltzer commercialization, including country-specific labeling requirements, permissible alcohol content, import/export regulations, and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading global and regional hard seltzer companies, craft producers, and distribution specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, consumer behavior trends, and market access considerations, with a focus on high-growth or regulatory-uncertain markets

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw Packaging costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry specialists, including beverage innovation experts, regulatory professionals, and leading manufacturers, offering guidance on market dynamics and emerging opportunities.