Gut Health Supplements Market Overview

The global gut health supplements market reached US$12,371.08 million in 2023, rising to US$13,128.19 million in 2024 and is expected to reach US$21,114.60 million by 2032, growing at a CAGR of 6.12% from 2025 to 2032.

The global gut-health supplements market is underpinned by widespread and growing dietary supplement use, as reflected in US government data. According to a national health survey, 57.6 percent of US adults reported using at least one supplement in the past 30 days. This broad base of supplement engagement provides fertile ground for more specialized gut-health formulations. The origins of the regulatory regime trace back to the Dietary Supplement Health and Education Act (DSHEA) of 1994, which defined dietary supplements as a class of food rather than drugs, thereby allowing rapid industry expansion under food law rather than pharmaceutical regulation.

On the research front, government investment is accelerating. The National Institutes of Health reports that in 2023, the Office of Dietary Supplements (ODS) coordinated and supported research into supplement safety and efficacy, leveraging its public-sector role to share strain-and nutrient-level data with researchers, health professionals, and consumers. In that same report, NIH estimated the US dietary supplement market to be USD 63.63 billion, underscoring the economic significance of nutrition research.

Regulatory scrutiny is also building: US Food and Drug Administration documents acknowledge that the dietary-supplement market has grown more than tenfold since DSHEA was enacted, but that agency resources have not scaled at the same pace. As part of its FY 2025 budget proposal, the FDA called for stronger regulatory authority, including a product-registration requirement so it can more rapidly identify dangerous or adulterated products.

Public-sector trends also emphasize safety and transparency: as the number of supplement facilities has expanded, government inspectors are increasingly deploying cGMP (good manufacturing practices) audits to ensure live-microbe product stability, correct labeling, and avoidance of contamination. The convergence of broad consumer usage, evolving public-sector science, and intensifying regulatory scrutiny is steering the gut-health supplements market toward more rigorously tested, strain-verified, and label-transparent products, aligning corporate incentives with public health priorities.

Gut Health Supplements Market Industry Trends and Strategic Insights

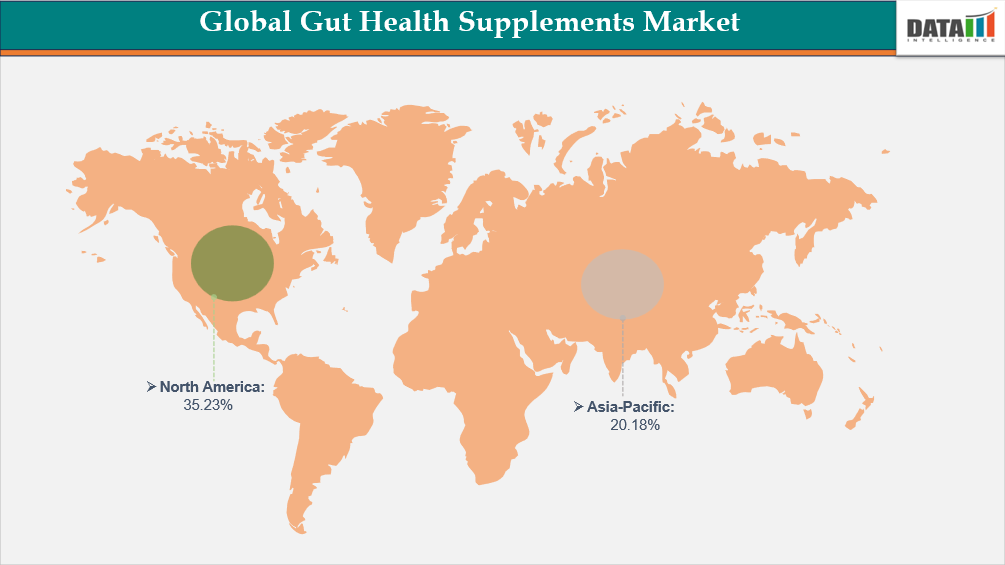

- North America leads the global gut health supplements market, capturing the largest revenue share of 35.23% in 2024.

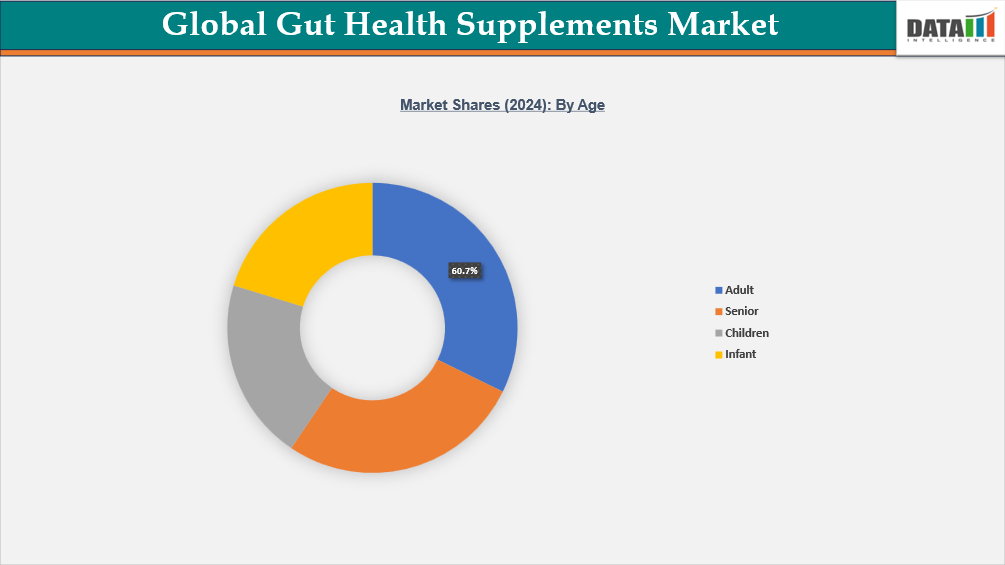

- By age segment, adults lead the global gut health supplements market, capturing the largest revenue share of 60.7% in 2024.

Global Gut Health Supplements Market Size and Future Outlook

- 2024 Market Size: US$13,128.19 million

- 2032 Projected Market Size: US$21,114.60 million

- CAGR (2025–2032): 6.12%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Ingredient | Vitamins, Botanicals, Minerals, Protein & Amino Acids, Omega fatty Acids, Probiotics, Others |

| By Dosage | Tablets, Capsules, Liquid, Powder, Others |

| By Age | Infant, Children, Adults, Seniors |

| By Distribution Channel | Online Retailers, Pharmacies and Drug Stores, Supermarkets/Hypermarkets, Convenience Stores, Other Distribution Channels |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Adoption of Precision Probiotics Enabled by Next-Gen Microbiome Sequencing

Next-generation microbiome sequencing (NGS) is accelerating the shift from generic probiotics to precision probiotics designed at the strain level, enabling tailored gut-health solutions that more accurately target digestive, immune, and metabolic functions. Large publicly funded research initiatives, such as national microbiome sequencing programs, have generated extensive strain-level datasets that companies now use to design targeted formulations. Government health surveys further show a strong consumer base ready for advanced products: in the United States, 57.6% of adults report using at least one dietary supplement in the past 30 days, indicating high adoption potential for next-generation gut-health solutions.

On the manufacturing side, regulatory data indicates that the dietary-supplement ecosystem includes over 10,000 registered facilities, demonstrating a sizeable industrial base capable of scaling precision probiotic and synbiotic production. In addition, recent federal inspection updates show increased oversight, with more than 400 GMP-related inspections conducted in a single year as operations returned to pre-pandemic levels, signaling tighter quality control and the need for more robust, clinically supported formulations.

Industrial classification records also show that the medicinal and botanical manufacturing segment includes over 1,000 establishments, many of which are involved in fermentation, encapsulation, and stabilization technologies essential for live microbial products. These facilities are increasingly adopting advanced processes such as microencapsulation, freeze-drying, controlled-release coatings, and cold-chain optimization to preserve microbial viability.

Together, the rise of NGS-enabled personalization, growing supplement usage among adults, expanding manufacturing capacity, and stricter regulatory oversight are collectively pushing the global market toward precision probiotics. This convergence is driving companies to invest in clinically validated strains, personalized microbiome reports, and high-stability formulations, making precision probiotics a central force propelling growth in gut-health supplements worldwide.

Global Gut Health Supplements Market, Segment Analysis

The global gut health supplements market is segmented based on ingredient, dosage, age, distribution channel, and region.

The global gut health supplements market for the adult age group is leading the market

Government-sourced data shows that dietary supplement use is very common among US adults: according to the CDC’s NHANES survey, 57.6% of Americans aged 20 and over reported using at least one supplement in the past 30 days. This rate increases with age, especially beyond 60, where usage peaks, suggesting a strong foundation for gut-health supplements among adults. Moreover, digestive diseases place a large burden on this population: for example, among US Medicare beneficiaries, the prevalence of digestive disease diagnoses is over 50%, indicating a significant target population for gut health interventions. The rise in preventive health consciousness and the willingness to take daily health supplements further fuel demand in this age group.

Rising demand for gut health supplements in the senior age group

On the demographic side, OECD data shows that the share of people aged 65+ in many developed countries has been rising sharply and is projected to increase further, reaching 26.4% by 2050 in OECD nations. The United Nations estimates the global proportion of those 65 or older is also climbing rapidly, which aligns with growing demand for age-focused health solutions. In terms of supplement usage, CDC data indicates that supplement consumption is highest among older adults, with more than 80% of US women aged 60+ reporting use of at least one supplement. Given age-associated declines in gut microbial diversity and immune strength, this demographic is increasingly interested in gut-health formulations tailored to their needs. The convergence of demographic aging and high supplement uptake makes seniors a critical growth segment in gut health.

Geographical Penetration

DOMINATING MARKET:

North America Leads Dominance in the Market

North America remains the largest gut health supplements market, supported by high consumer awareness, strong purchasing power, and widespread acceptance of probiotics and prebiotics. The US leads with advanced R&D infrastructure, robust clinical trial activity, and dominant brands with scientifically validated strains. The region’s mature retail ecosystem, ranging from pharmacies and supermarkets to Amazon and specialized DTC platforms, ensures strong accessibility and premium product uptake.

High prevalence of digestive issues, metabolic disorders, and immunity concerns continues to fuel demand. Regulatory clarity under FDA dietary supplement guidelines supports rapid product innovation while maintaining safety standards. Strong presence of major ingredient suppliers and fermentation technologies further strengthens market leadership. North America’s scientific ecosystem, market maturity, and consumer readiness make it the largest global region.

FASTEST GROWING MARKET:

Asia-Pacific is the Fastest-Growing Market

Asia-Pacific is experiencing the fastest growth in the gut health supplements market due to rising consumer awareness of digestive wellness, immunity, and microbiome science. Rapid urbanization and lifestyle-induced digestive issues are driving demand for probiotics, synbiotics, and functional beverages. Countries like China, India, Japan, and South Korea are witnessing strong adoption through pharmacies, modern retail, and booming e-commerce platforms.

Increasing disposable incomes and growing interest in preventive healthcare are accelerating category penetration. Regional regulators such as FSSAI, CFDA, and TGA are also strengthening quality standards, boosting consumer trust. The surge in local manufacturing and investments in strain research is further enhancing product availability. Overall, the region’s youthful population, digital health engagement, and expanding nutraceutical industry make it the fastest-growing global market.

Sustainability Analysis

The gut health supplements market is increasingly influenced by sustainability considerations as demand for probiotics, prebiotics, synbiotics, and microbiome-focused formulations grows rapidly. Production of probiotic strains relies on energy-intensive fermentation, freeze-drying, and quality-control processes, which create a measurable carbon footprint and increase water and electricity consumption across the supply chain. As volumes rise, packaging becomes a major sustainability concern because most gut-health products rely on plastic HDPE bottles, blister packs, or multilayer pouches that have low recycling rates, adding to global plastic waste streams and raising compliance pressure from emerging packaging regulations. Cold-chain logistics required for certain live-culture probiotics also raise emissions, making shelf-stable or spore-based strains more attractive as lower-impact alternatives for brands pursuing decarbonization targets.

At the same time, the market is witnessing shifts toward eco-designed packaging, including biodegradable containers, aluminum alternatives, and mono-material formats that improve recyclability and reduce landfill pressures. Companies are increasingly integrating sustainability into sourcing by using plant-based prebiotic fibers such as inulin or FOS derived from regenerative agriculture systems, helping reduce soil degradation and fertilizer dependency. Social sustainability is also emerging as a priority because premium gut-health supplements remain expensive for many consumers, prompting discussions around equitable access, evidence-based formulations, and responsible marketing. Overall, sustainability in the gut-health supplements market is moving beyond packaging to encompass carbon-efficient manufacturing, ethical ingredient sourcing, low-waste logistics, and greater transparency, positioning the sector for more responsible growth over the next decade.

Regulatory Analysis

The regulatory landscape for gut health supplements is shaped by diverse global frameworks governing safety, efficacy, labeling, and the use of microbial strains. In the US, the FDA classifies these products as dietary supplements, requiring GMP compliance while restricting disease-related claims. In contrast, the European Food Safety Authority (EFSA) enforces far stricter standards, often rejecting probiotic health claims unless supported by strong, strain-specific clinical evidence.

India’s FSSAI requires detailed notification of probiotic strains, permissible CFU levels, and stability data for approvals, while Australia’s TGA regulates many microbiome products as complementary medicines, demanding clinical justification and robust quality assurance. Health Canada also mandates pre-market assessment and Natural Product Numbers (NPNs), especially for immunity or digestive health claims.

Additionally, emerging prebiotics and postbiotics may be categorized under “novel food” regulations in regions such as the EU, requiring comprehensive toxicology and efficacy data. Import and export regulations are also tightening, with increased documentation needed on microbial origin, allergen risks, and product stability. As global regulators place greater emphasis on live microorganism viability, companies must adhere to enhanced testing requirements related to survivability, packaging integrity, and storage.

Overall, this tightening regulatory environment is pushing manufacturers toward stronger scientific substantiation, transparent strain labeling, and cleaner formulation standards.Overall, this tightening regulatory environment is pushing manufacturers toward stronger scientific substantiation, transparent strain labeling, and cleaner formulation standards.

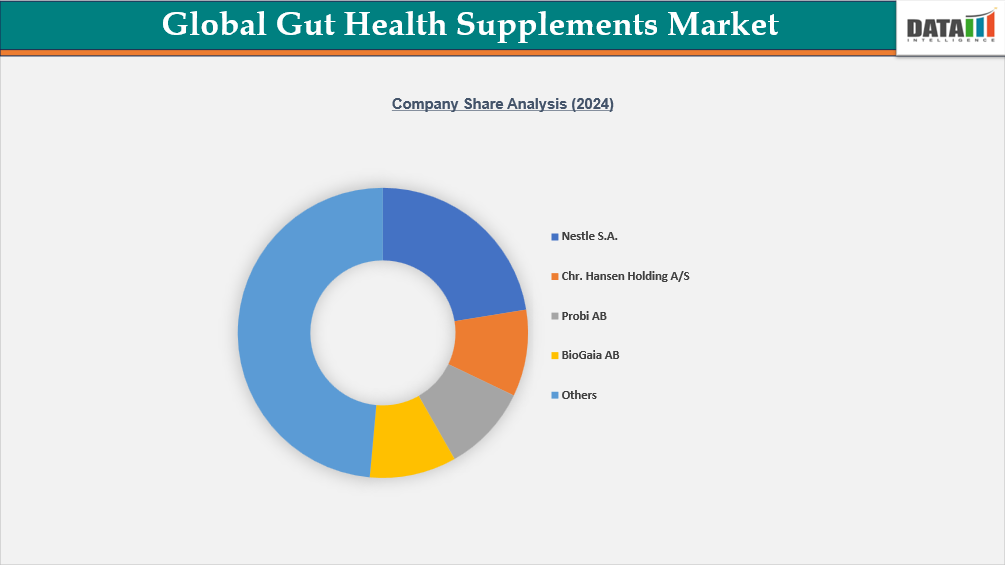

Competitive Landscape

The competitive landscape of the global gut health supplements market is rapidly intensifying as brands shift from traditional digestive aids to scientifically backed microbiome-focused formulations. The market is dominated by established nutraceutical companies such as Nestlé Health Science, ADM, Chr. Hansen, Yakult, and Danone, which leverage strong R&D pipelines, proprietary strains, and global distribution. These players continue to invest heavily in clinical trials to validate strain-specific benefits, enabling premium product positioning and regulatory differentiation in markets with stringent health claim requirements.

Alongside these giants, a growing cohort of specialized microbiome startups, such as Seed Health, Pendulum Therapeutics, Sun Genomics, and Fitbiomics, are reshaping competition by offering precision probiotics, AI-driven personalization, whole-genome strain sequencing, and direct-to-consumer subscription models. Their agility allows faster innovation cycles and targeted formulations addressing niches such as gut–brain axis support, metabolic health, women’s microbiome health, and immune-modulating synbiotics.

Ingredient suppliers, including DuPont (HOWARU), IFF, Nexira, Kerry, and NutriLeads, are also influencing the landscape by developing next-generation prebiotics, postbiotics, and encapsulation systems. These B2B players play a critical role in enabling brand differentiation, especially through heat-stable strains, survivability-enhancing microencapsulation, and clinically substantiated soluble fibers like precision prebiotics.

Competition is further fueled by mass-market FMCG brands and pharmacy chains expanding into the category with affordable probiotics and fiber blends. This pushes premium brands to justify higher pricing through clinical evidence, transparent strain listing, and sustainability claims.

Digital health integration is emerging as a new competitive front. Companies offering microbiome testing kits bundled with supplements gain an edge by creating personalized regimens and boosting consumer loyalty.

Key Developments

- In July 2025, BP Nutriscience launched Enescene Probio 3+ in Malaysia, a synbiotic gut health drink featuring the precision prebiotic Benicaros, HOWARU probiotics, and heat-treated postbiotics. The mixed-berries powder formulation provides a comprehensive daily microbiome solution. Designed for adults, it supports digestive wellness and immune health. Its natural berry flavor enhances convenience and everyday consumption.

What Sets This Global Gut Health Supplements Market Intelligence Report Apart

Granular Market Intelligence

Comprehensive assessment of the global gut health supplements market, including detailed evaluation of market size, ingredient composition, and growth trajectories through 2032. The analysis captures the shift from generic probiotics to targeted microbiome-support solutions such as synbiotics, postbiotics, digestive enzymes, and polyphenol-based formulations. Segment-level intelligence covers product categories (probiotics, prebiotics, postbiotics, enzymes, fibers), delivery formats (capsules, gummies, powders, functional beverages), and end-user groups (adult, pediatric, geriatric, and sports nutrition).

Regulatory Intelligence

In-depth and actionable review of regulatory frameworks influencing the development, formulation, labeling, and global trade of gut health supplements. This includes evolving guidelines from the FDA, EFSA, FSSAI, TGA, and Health Canada related to strain-specific claims, safety evaluations, permissible health claims, and GMP compliance. The analysis also covers import/export policies, novel food approvals, and rising scrutiny around live microbial stability, allergen risks, and substantiation of microbiome-related efficacy claims.

Competitive Benchmarking

Detailed benchmarking of global and regional supplement manufacturers, evaluating product portfolios, strain diversity, R&D capabilities, proprietary fermentation technologies, delivery system innovations (microencapsulation, spore-forming strains), and recent partnerships or acquisitions in the microbiome space. Comparative insights highlight how leading brands differentiate through clinically validated strains, personalized gut health testing, and integration of digital health platforms to strengthen consumer retention.

Investment and Opportunity Mapping

Identification of high-growth segments and emerging profit pools across precision probiotics, women’s digestive health, microbiome-friendly functional foods, and gut–brain axis formulations. Region-specific opportunity mapping covers North America, Europe, Asia-Pacific, and Latin America, emphasizing rising disposable income, preventive healthcare spending, e-commerce penetration, and expanding retail pharmacy networks. Insights also capture opportunities within corporate wellness, pediatric digestive health, athletic performance, and immunity-driven supplement adoption.

Supply Chain Strategy

Critical evaluation of the gut health supplements value chain, from microbial strain sourcing and fermentation to stabilization, encapsulation, distribution, and last-mile retail. The analysis covers raw material cost dynamics (prebiotic fibers, bacterial cultures, enzymes, botanical extracts), cold-chain requirements, shelf-stability challenges, and regulatory documentation demands. Strategic insights address contract manufacturing trends, regional fermentation hubs, packaging innovations, and digital supply chain optimization to ensure product quality and reduce spoilage risks.

Expert, Forward-Looking Insights

Strategic recommendations from microbiome scientists, nutraceutical formulators, and healthcare experts with a deep understanding of gut health innovation cycles and consumer behavior. Forward-looking perspectives include next-generation postbiotics, precision multi-strain formulations, AI-driven personalization, and integration of microbiome testing kits. The insights enable stakeholders to guide investment priorities, strengthen R&D pipelines, pursue strategic collaborations, and capture value in a rapidly evolving gut health supplements ecosystem.