Growth Factors Market Size& Industry Outlook

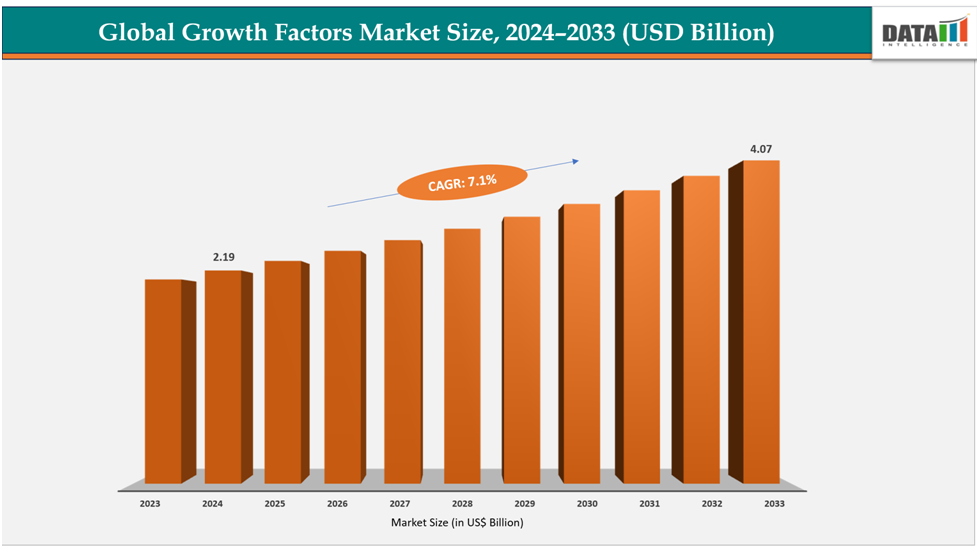

The global growth factors market size reached US$ 2.06 Billion with rise of US$2.19Billion in 2024 is expected to reach US$ 4.07Billion by 2033, growing at a CAGR of 7.1%during the forecast period 2025-2033.

The major key driver of the global growth factors market is the increasing prevalence of cancer and chronic diseases, which has amplified demand for targeted biologics and antibody-drug conjugates that interact with growth factor pathways. For instance, in January 2024, the American Cancer Society reported a continued rise in cancer incidence in the U.S., reinforcing demand for growth factor–targeted therapies such as VEGF and HER2 inhibitors. This trend encourages investment in R&D, accelerates clinical adoption of growth factor–based products, and contributes to sustained market expansion globally.

Key Highlights

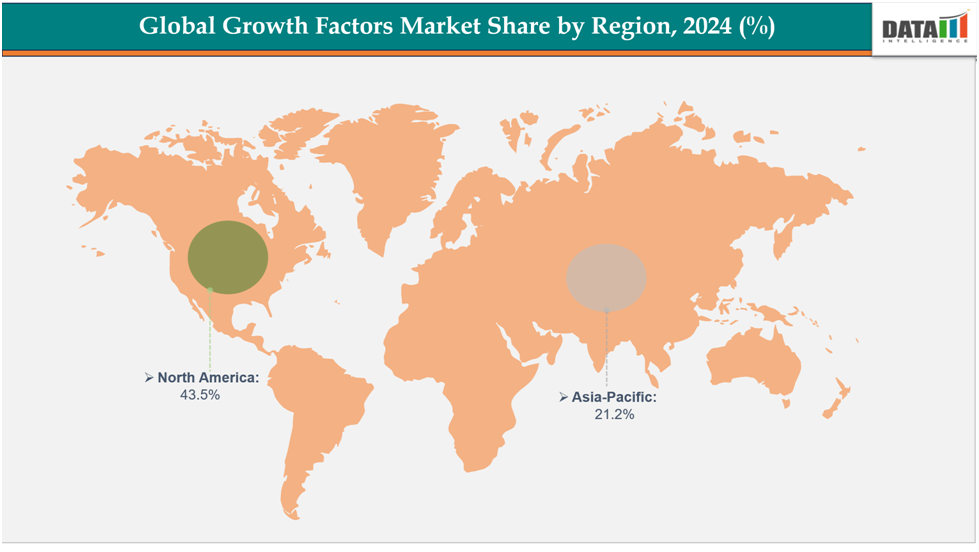

North America dominates the growth factors market with the largest revenue share of 43.5% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of8.1% over the forecast period.

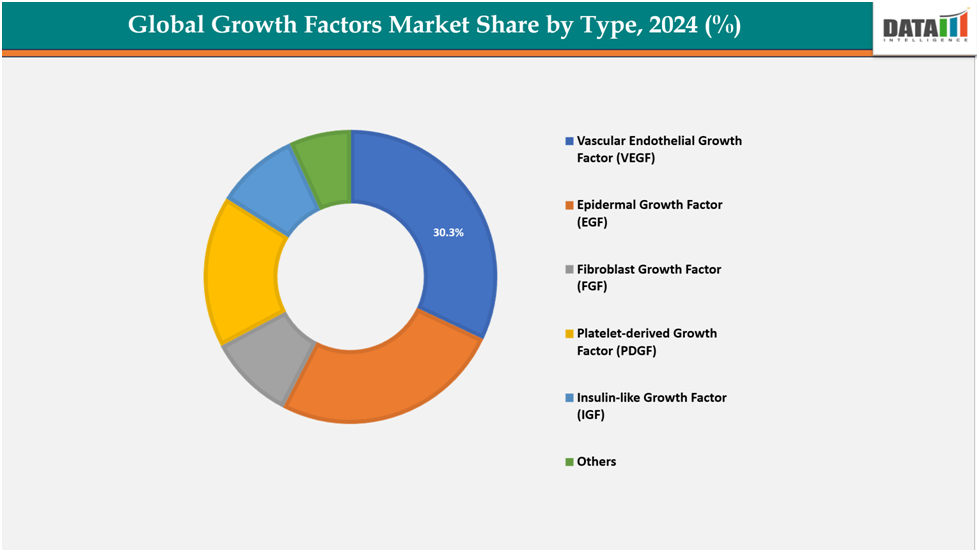

Based on type, vascular endothelial growth factor (VEGF) segmented the market with the largest revenue share of 30.3% in 2024.

The major market players in the F. Hoffmann-La Roche Ltd, Eli Lilly and Company, Novartis AG, Biocon Limited, Thermo Fisher Scientific, Amgen Inc, Merck and among others.

Market Dynamics

Drivers: The rising demand for regenerative medicine and cell therapy is significantly driving the growth factors market growth

The growth factors market is driven by the increasing demand for regenerative medicine and cell therapy, which plays a crucial role in stem cell proliferation, tissue repair, and wound healing. The market is expanding due to clinical adoption, expanding applications in orthopedics, dermatology, and cardiology, and growing regulatory support for regenerative products. Biopharma companies and research institutes are investing heavily in GMP-grade recombinant growth factors.

For instance, in June 2023, CellGenix (a Sartorius company) expanded its GMP-grade portfolio with recombinant growth factors such as FGF-2 and VEGF to support large-scale cell and gene therapy manufacturing, highlighting the growing reliance on high-quality growth factors in regenerative medicine.

Restraints: High cost of growth factor-based therapeutics and production are hampering the growth of the growth factors market

The market faces significant challenges due to the high cost of growth factor-based therapeutics and production. Advanced bioprocessing systems, strict GMP compliance, and costly purification steps increase overall expenses. The average annual treatment cost for patients receiving growth factor-based biologics can range from USD 10,000 to USD 30,000 per year. Research-use recombinant growth factors can cost several hundred to over USD 1,000 per milligram, limiting access for smaller laboratories and limiting adoption in developing regions.

For more details on this report – Request for Sample

Segmentation Analysis

The global growth factors market is segmented based on type, application, end user, and region.

Type:

The vascular endothelial growth factor (VEGF) from type segment to dominate the growth factors market with a 30.3% share in 2024

The vascular endothelial growth factor (VEGF) segment is primarily driven by the rising prevalence of cancer and ophthalmic disorders such as age-related macular degeneration (AMD) and diabetic retinopathy, where anti-VEGF therapies are well established. Also, ongoing trials, increasing demand for targeted biologics and biosimilars, coupled with ongoing R&D in novel VEGF inhibitors and antibody-drug conjugates, further supports market growth.

Additionally, a strong pipeline of next-generation ophthalmology drugs, wider regulatory approvals, and growing adoption in emerging markets continue to accelerate the expansion of the VEGF-focused product segment.

For instance, in November 2024, Merck has secured an exclusive global license to develop, manufacture, and commercialize LM-299, a novel investigational PD-1/VEGF bispecific antibody from LaNova Medicines Ltd., a privately held clinical-stage biotechnology company.

Application: The oncology segment is estimated to have a 31.4% of the growth factors market share in 2024

The oncology segment is driven by the increasing global burden of cancer and the critical role of growth factors in tumor progression, angiogenesis, and metastasis. Rising demand for targeted therapies such as VEGF inhibitors and HER2-directed treatments, along with the rapid adoption of antibody-drug conjugates (ADCs), is fueling market growth. Expanding clinical trials exploring growth factor pathways, favorable regulatory approvals, and the growing use of biosimilars in oncology are further accelerating adoption. Moreover, precision medicine initiatives and combination therapy strategies continue to strengthen the role of growth factors in oncology treatment.

For instance, in September 2025, BioNTech SE and Bristol Myers Squibb announced interim results from a global randomized Phase 2 trial (NCT06449209) evaluating pumitamig (BNT327/BMS-986545), an investigational bispecific antibody targeting PD-L1 and VEGF-A, in combination with chemotherapy for patients with extensive-stage small cell lung cancer (ES-SCLC).

Geographical Analysis

North America is expected to dominate the global growth factors market with a 43.5% in 2024

North America is driven by strong biopharmaceutical R&D investments, a well-established biotechnology industry, and the high adoption of advanced biologics. The presence of leading players such as Amgen, Thermo Fisher, and Bio-Techne, along with a favorable funding ecosystem for regenerative medicine and stem cell research, further accelerates market growth.

For instance, in June 2025, Amgen announced the Phase 3 FORTITUDE-101 clinical trial evaluating first-line bemarituzumab plus chemotherapy (mFOLFOX6) met its primary endpoint of overall survival (OS) at a pre-specified interim analysis.

Moreover, the U.S. specifically leads the growth factor market with FDA approvals for biologics targeting growth factor pathways, large-scale government and private funding for cancer and regenerative medicine, and an increasing patient pool for oncology and chronic diseases. The dominance of companies like Amgen and the rapid uptake of biosimilars also drives expansion.

Europe is the second region after North America which is expected to dominate the global growth factors market with a 34.5% in 2024

Europe benefits from robust academic research networks, strong regulatory frameworks supporting biosimilars, and growing demand for regenerative medicine. The region has an active presence of companies such as Merck KGaA, Lonza, and Roche, which support both research-use growth factors and therapeutic development.

For instance, in September 2025, BioNTech and DualityBio announced that their Phase 3 trial of trastuzumab pamirtecan (BNT323/DB-1303) in HER2-positive breast cancer met its primary endpoint of progression-free survival. The next-generation ADC targets the Human Epidermal Growth Factor Receptor 2 (HER2).

The U.K. contributes to growth through its advanced stem cell research programs, government funding initiatives in life sciences, and the strong presence of biopharma startups. Collaborative research between academia and industry creates favorable opportunities for growth factor applications in cell therapy and oncology.

The Asia Pacific region is the fastest-growing region in the global growth factors market ,with a CAGR of 8.1% in 2024

The Asia-Pacific region is witnessing rapid growth due to increasing healthcare expenditure, expanding biotechnology infrastructure, and government support for regenerative medicine. Rising cancer prevalence and investments by countries like China, South Korea, and India in biosimilar manufacturing also propel market demand.

Japan stands out in Asia-Pacific with its advanced regenerative medicine framework, regulatory support for fast-track approval of cell and gene therapies, and high adoption of growth factor–based products in clinical and research applications. Local companies and collaborations with global biopharma leaders further strengthen Japan’s role in the market.

For instance, in November 2024, Eisai Co., Ltd. has launched a fibroblast growth factor receptor (FGFR) selective tyrosine kinase inhibitor, "TASFYGO Tablets 35mg," in Japan for treating unrespectable biliary tract cancer patients with FGFR2 gene fusions or rearrangements that progressed after chemotherapy.

Competitive Landscape

Top companies in the growth factors market include F. Hoffmann-La Roche Ltd, Eli Lilly and Company, Novartis AG, Biocon Limited, Thermos Fisher Scientific, Amgen Inc, Merck and among others.

F. Hoffmann-La Roche. Hoffmann-La Roche Ltd. plays a significant role in the global growth factors market primarily through its oncology portfolio, where it develops and markets targeted therapies that interact with growth factor pathways. Roche’s blockbuster drug Avastin (Bevacizumab) is a leading VEGF inhibitor used across multiple cancer indications, while other products like Pejeta (Pertuzumab) and Kadcyla (ado-trastuzumab etamine) target the HER2 growth factor pathway in breast cancer. By focusing on angiogenesis and receptor signaling blockade, Roche has established itself as a dominant player in growth factor–targeted therapeutics, strengthening its presence in oncology and maintaining leadership in biologics innovation.

Key Developments:

In May 2025, Xtant Medical Holdings, Inc., a global medical technology company, has launched OsteoFactor Pro, a natural allogeneic growth factor cocktail designed to enhance bone healing and support successful surgical procedures in orthopedic and spine treatments.

In September 2024, Core Biogenesis, a biotech company, has launched two major products to combat aging signs in the beauty industry: Paulita (FGF-2-oleosome) and Peauforia (EGF-oleosome), which offer exceptional stability and efficacy against wrinkles and hyperpigmentation.

Market Scope

Metrics | Details | |

CAGR | 7.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Vascular Endothelial Growth Factor (VEGF), Epidermal Growth Factor (EGF), Fibroblast Growth Factor (FGF), Platelet-derived Growth Factor (PDGF), Insulin-like Growth Factor (IGF), Others |

Application | Oncology, Dermatology & Wound Healing, Cardiovascular Disorders, Neurological Disorders, Orthopedics, Others | |

End User | Hospitals & Clinics, Biopharmaceutical Companies, Research & Academic Institutes, Contract Research Organizations (CROs) | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global growth factors market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.