Glycated Albumin Assay Market Size & Industry Outlook

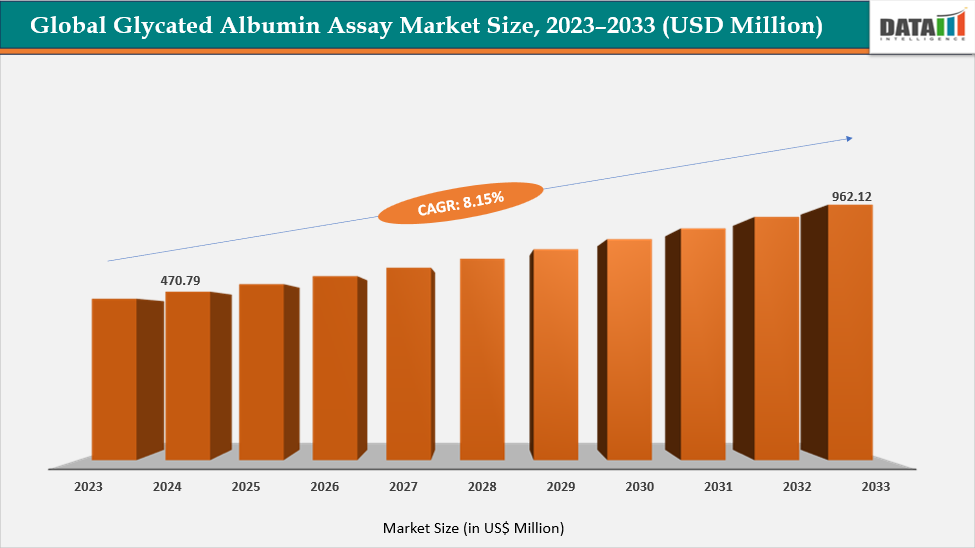

The global Glycated Albumin Assay market size reached US$470.79 Million in 2024 from US$434.85 Million in 2023 and is expected to reach US$962.12 Million by 2033, growing at a CAGR of 8.15% during the forecast period 2025-2033. The global Glycated Albumin Assay market is expanding rapidly, driven by the rising prevalence of diabetes and prediabetes worldwide, which has created a growing demand for accurate and timely glycemic monitoring tools. Glycated albumin assays provide a reliable measure of short-term glycemic control, offering advantages over traditional HbA1c tests, particularly in patients with conditions affecting red blood cell turnover or those requiring rapid monitoring of therapeutic interventions.

Increasing awareness of early detection and preventive healthcare, along with the adoption of routine screening programs, is further fueling market growth. Technological advancements, including automation, point-of-care testing, and integration with digital healthcare platforms, are enhancing assay accessibility, accuracy, and convenience for both clinicians and patients. Additionally, the growing use of glycated albumin assays in clinical trials for evaluating the efficacy of new anti-diabetic therapies is boosting demand from the pharmaceutical and biotechnology sectors, positioning the market for sustained growth over the forecast period.

Key Market Highlights

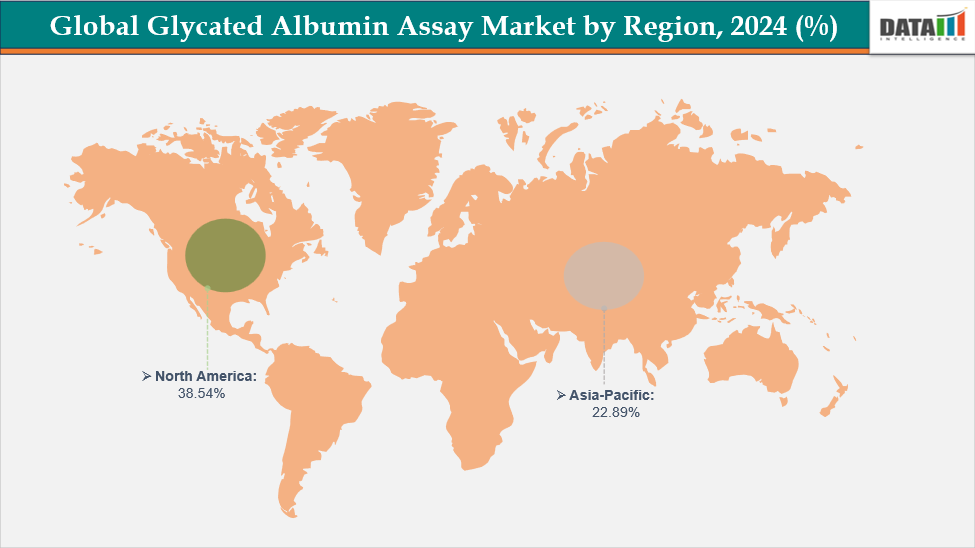

- North America dominates the Glycated Albumin Assay market with the largest revenue share of 38.54% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 10.27% over the forecast period.

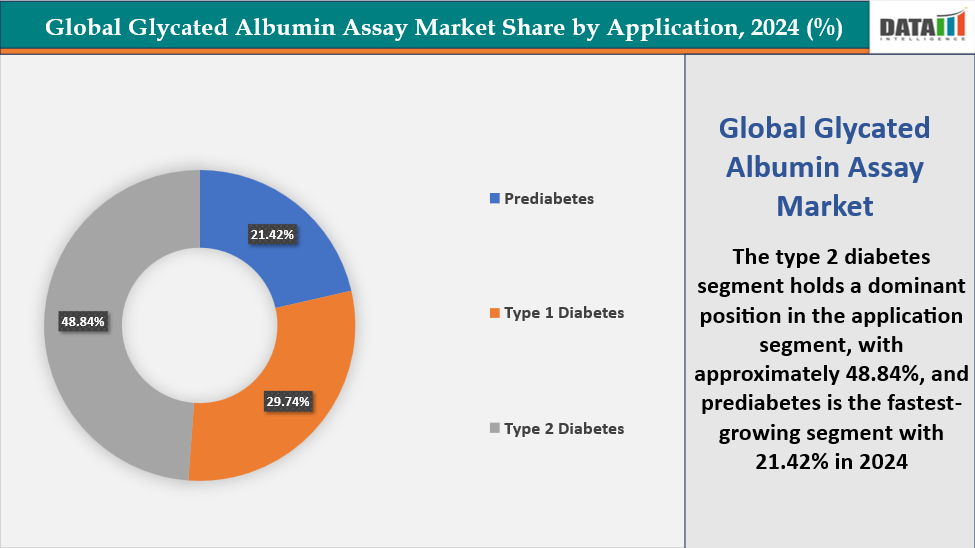

- Based on the application type, the type 2 diabetes segment led the market with the largest revenue share of 48.84% in 2024.

- The major market players in the Glycated Albumin Assay market are Asahi Kasei Pharma Corporation, Hzymes Biotechnology Co., Ltd., DxGen Corp., Abbexa Ltd., Biocompare, EFK Diagnostics, Biomatik, Weldon Biotech India Private Limited, Beijing Strong Biotechnologies Inc., Diazyme Laboratories Inc., among others

Market Dynamics

Drivers: The Rising Prevalence of Diabetes and Prediabetes is significantly driving the Glycated Albumin Assay market growth

The global burden of dysglycemia is expanding rapidly, creating sustained demand for accurate glucose-monitoring and diagnostic tools. Recent estimates show hundreds of millions of adults now living with diabetes: the International Diabetes Federation reports ~589 million adults (age 20–79) with diabetes in 2024, with projections rising to ~853 million by 2050. At the same time, a large share remains undiagnosed (an estimated 252 million adults), representing a significant unmet testing need.

Independent population studies and reviews indicate even larger or alternative estimates depending on methods used (some analyses published in late 2024 put the total adult burden above 800 million), underscoring uncertainty but clearly signalling a much larger testing pool than previously recognised. This widening prevalence includes a disproportionate rise in low- and middle-income countries where routine monitoring infrastructure may be limited.

The rising pool of people with diabetes and prediabetes, a high undiagnosed fraction, and increasing clinical recognition of scenarios where HbA1c is unreliable create a sustained, addressable market opportunity for glycated albumin assays. Adoption drivers include demand for short-term monitoring (therapy optimization, pregnancy, dialysis/CKD), better screening in at-risk populations, and expansion of point-of-care GA technologies. For diagnostic manufacturers and investors, GA represents a strategically attractive product line that addresses unmet clinical needs and scales with the rapidly growing global population affected by dysglycemia.

Restraints: An unfavorable reimbursement scenario is hampering the growth of the market

Despite growing clinical acceptance of glycated albumin (GA) as a complementary biomarker to HbA1c—especially in patients with chronic kidney disease, hemoglobinopathies, or during pregnancy limited reimbursement coverage continues to constrain adoption. In many countries, GA testing is not yet included in standard diabetes management guidelines or payer coverage policies, resulting in out-of-pocket expenses for patients and reduced test ordering by clinicians. Even in regions where reimbursement exists, inconsistent coding and low reimbursement rates hinder test accessibility and discourage laboratories from integrating GA assays into routine diagnostic panels.

Furthermore, compared with HbA1c, which has strong regulatory endorsement and widespread insurance coverage, GA assays are perceived as non-routine specialty tests, creating a financial disincentive for healthcare providers and slowing market penetration. The lack of unified reimbursement frameworks, especially across emerging markets, limits large-scale deployment and delays investments in advanced GA testing platforms.

Until broader guideline inclusion and standardized payer recognition are achieved, reimbursement challenges will remain a significant barrier, restraining market expansion despite strong clinical demand drivers.

For more details on this report – Request for Sample

Glycated Albumin Assay Market, Segmentation Analysis

The global Glycated Albumin Assay market is segmented based on application, by end user, and region.

Application Type: The type 2 diabetes segment is dominating the Glycated Albumin Assay market with a 48.84% share in 2024

The Type 2 diabetes segment holds the largest share of the Glycated Albumin Assay market, accounting for 48.84% in 2024, driven by the overwhelming prevalence of Type 2 diabetes compared to other diabetes forms. Type 2 accounts for 90–95% of all diagnosed diabetes cases globally, making it the primary focus for ongoing glycemic monitoring and treatment evaluation. This large patient population routinely requires periodic assessment of glycemic control, particularly when therapy regimens are adjusted, a scenario where glycated albumin provides superior short-term insights versus HbA1c.

Additionally, Type 2 diabetes is strongly associated with obesity, metabolic syndrome, and aging populations. As these risk factors continue to rise worldwide, the clinical burden of Type 2 diabetes grows proportionally, expanding the addressable market for GA assays. The segment also benefits from the increasing prevalence of comorbidities such as kidney disease, anemia, and hemoglobinopathies — conditions where GA testing is favored because it remains accurate when HbA1c values may be misleading.

With its rapidly expanding patient base and clinical need for more precise short-term glycemic monitoring, Type 2 diabetes will continue to be the dominant revenue-contributing segment for the Glycated Albumin Assay market throughout the forecast period.

The prediabetes segment is the fastest-growing in the Glycated Albumin Assay market, with a 21.42% share in 2024

The prediabetes segment represents the fastest-growing area of the Glycated Albumin Assay market, fueled by the rapid rise in populations with impaired glucose regulation and increased emphasis on early intervention. Globally, hundreds of millions of individuals are estimated to be living with prediabetes, and a significant proportion progress to Type 2 diabetes within a few years if left undiagnosed or unmanaged. This transition risk is driving greater screening uptake and more frequent monitoring in areas where glycated albumin testing provides meaningful clinical value.

Glycated albumin is uniquely suited for prediabetes management because it reflects short-term glycemic fluctuations (2–4 weeks), making it highly useful for monitoring lifestyle interventions, dietary modifications, and responses to early pharmacotherapy. Unlike HbA1c, which may remain within normal or borderline ranges during early dysglycemia, GA can capture subtle changes in glycemic status more sensitively, encouraging its adoption in preventive healthcare models.

Healthcare systems are increasingly shifting focus from reactive diabetes treatment to proactive cardiovascular and metabolic risk reduction. With a large undiagnosed population, expanding screening programs, and a global shift toward early-stage disease management, the prediabetes segment is expected to maintain the strongest growth momentum in the Glycated Albumin Assay market throughout the forecast period.

As early detection becomes a priority in diabetes care pathways and clinical guidelines evolve, prediabetes testing using glycated albumin is emerging as a critical growth engine for the overall market.

Geographical Analysis

North America is expected to dominate the global Glycated Albumin Assay market with a 38.54% in 2024

North America holds the dominant share in the global Glycated Albumin Assay market, supported by a strong healthcare infrastructure, high diabetes prevalence, and extensive adoption of advanced diagnostic technologies. The United States leads the region due to the increasing shift toward more precise glycemic monitoring tools, particularly for patients where HbA1c has limitations, such as those with hemoglobinopathies, chronic kidney disease, or rapid glycemic fluctuations.

Additionally, the presence of major diagnostic companies, strong funding for clinical laboratories, and frequent regulatory approvals accelerate product availability and innovation. Favorable reimbursement frameworks and widespread screening initiatives for prediabetes and diabetes further enhance test utilization. The region also benefits from growing clinician awareness of glycated albumin’s ability to reflect short-term glycemic control (2–3 weeks), supporting personalized treatment adjustments.

Together, these factors ensure that North America continues to serve as the leading market for glycated albumin assays, with sustained demand driven by the rising diabetes burden and a continued push toward improved diagnostic accuracy.

US Glycated Albumin Assay Market Trends

The United States continues to lead the global Glycated Albumin Assay market, driven by the country’s high diabetes burden and strong adoption of innovative glycemic monitoring technologies. The growing prevalence of Type 2 diabetes and obesity is pushing the demand for more accurate short-term glycemic control testing, where Glycated Albumin assays offer a significant advantage over HbA1c, particularly for patients with anemia, kidney disease, or rapidly changing glucose levels. Additionally, extensive research initiatives, improved laboratory infrastructure, and favorable reimbursement coverage are supporting the widespread integration of these assays into clinical practice.

U.S.-based diagnostics companies are continuously investing in new assay platforms and regulatory approvals, advancing accessibility across hospitals and point-of-care settings. Together, these factors position the U.S. as the frontrunner in market expansion, technology innovation, and clinical adoption of Glycated Albumin testing.

The Asia Pacific region is the fastest-growing region in the global Glycated Albumin Assay market, with a CAGR of 10.27% in 2024

The Asia Pacific region is the fastest-growing market for Glycated Albumin Assays, registering a strong CAGR of 10.27% in 2024. This rapid growth is primarily driven by the soaring incidence of diabetes across major countries such as China, India, and Japan. The rising focus on early diagnosis and improved diabetes management has increased the clinical adoption of advanced biomarkers like glycated albumin, especially for patients who are not suitable for HbA1c testing due to anemia or kidney complications, conditions highly prevalent in the region.

Government-led public health initiatives, expanding healthcare access, and increased investment in diagnostic infrastructure further accelerate demand. Additionally, the presence of key regional manufacturers, ongoing product approvals, and collaborations with international diagnostic companies are enhancing assay availability and affordability. Growing awareness among clinicians regarding the advantages of short-term glycemic monitoring also supports wider utilization across hospitals and diagnostic laboratories.

Collectively, these drivers position Asia Pacific as the most dynamic and rapidly expanding market, shaping future innovations and adoption trends in glycated albumin testing worldwide.

Europe Glycated Albumin Assay Market Trends

In Europe, the Glycated Albumin Assay market is experiencing steady growth, supported by a well-established healthcare infrastructure and strong clinical focus on diabetes monitoring and management. The region has a high prevalence of Type 2 diabetes, especially across countries like Germany, Italy, Spain, and the UK, which continues to drive demand for reliable biomarkers beyond HbA1c. Increasing clinical adoption of advanced glycemic monitoring methods for patients with comorbidities such as renal disease or hemoglobinopathies further contributes to the gradual rise in uptake.

In addition, Europe benefits from proactive regulatory frameworks, growing reimbursement support for diagnostic testing, and rising awareness among endocrinologists regarding the value of short-term glycemic indicators. Collaborative research programs and the presence of global diagnostic leaders also facilitate consistent product availability and innovation across the region.

Competitive Landscape

Top companies in the Glycated Albumin Assay market include Asahi Kasei Pharma Corporation, Hzymes Biotechnology Co., Ltd., DxGen Corp., Abbexa Ltd., Biocompare, EFK Diagnostics, Biomatik, Weldon Biotech India Private Limited, Beijing Strong Biotechnologies Inc., Diazyme Laboratories Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 8.15% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Application | Prediabetes, Type 1 Diabetes, Type 2 Diabetes |

| End-User | Hospital and Diabetes Care Centers, Diagnostic Laboratories, Other End Users | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Glycated Albumin Assay market report delivers a detailed analysis with 54 key tables, more than 42 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here